A relatively quiet (but weak) macro week (Jobs weak, inflation hot, surveys slump) and the pre-Fed blackout meant the combination of pre-holiday low liquidity and headline risk chopped market around intraday with stocks hurting (Small Caps and Big-Tech worst), bond yields higher (in the belly of the curve), and a bloodbath in black gold (as WTI fell to one-year lows).

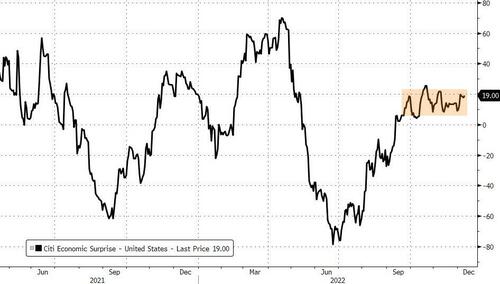

US Macro Surprise data has drifted sideways for almost three months now - Goldilocks-like perhaps...

Source: Bloomberg

But amid the sparse macro data (claims, PPI etc), the market's expectations for The Fed's terminal rate was unchanged and the market's expectations for rate-cuts in H2 2023 also ended unchanged...

Source: Bloomberg

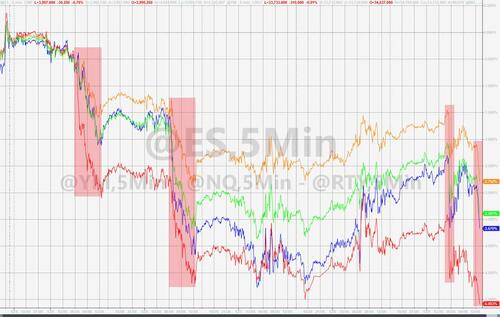

All the majors puked lower on the hotter than expected PPI this morning then the machines levitated things for a few hours until Europe was closed. Then the last 15 mins saw stocks puked to the lows of the day...

Small Caps were the week's worst performers (down 5%), followed by Nasdaq and S&P and The Dow was the prettiest horse in the glue factory...

The S&P 500 held above its 100DMA...

All sectors ended the week in the red with Energy by far the worst. Utes outperformed with a very small loss on the week...

Source: Bloomberg

Tech has been outperforming energy stocks since the start of November...

Source: Bloomberg

US Treasuries were sold hard today, erasing all of the week's gains for the long-bond, and leaving the rest of the curve notably higher in yield (belly underperforming)...

Source: Bloomberg

The yield curve (2s30s) ended flatter (more inverted) on the week, but barely after a big steepening day today post-PPI...

Source: Bloomberg

The dollar ended the week higher, but back in the range from Friday's payrolls pump and dump)...

Source: Bloomberg

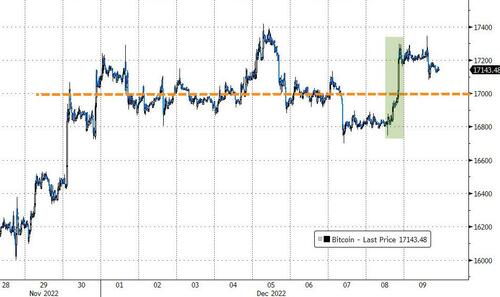

Cryptos were broadly unchanged on the week, despite some intraday volatility (BTC up marginally, ETH down marginally)...

Source: Bloomberg

Bitcoin ended the week back above $17,000...

Source: Bloomberg

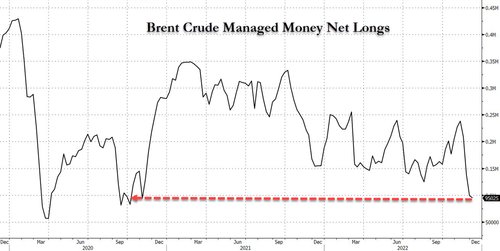

Oil prices are down 6 straight days, with WTI ending the week down over 12% with a $70 handle - its worst week since the first week of April - and back at one-year lows (-2% YoY, first decline since Jan 2021)...

As fund managers abandon black gold...

Source: Bloomberg

Gold ended the week unchanged, above $1800, while silver outperformed modestly...

Finally, will we get a sense of deja vu all over again next week when The Fed hikes?

Source: Bloomberg

Would that kind of downsing be enough to tighten financial conditions and allow Powell to lift his boot from the market's neck?

A relatively quiet (but weak) macro week (Jobs weak, inflation hot, surveys slump) and the pre-Fed blackout meant the combination of pre-holiday low liquidity and headline risk chopped market around intraday with stocks hurting (Small Caps and Big-Tech worst), bond yields higher (in the belly of the curve), and a bloodbath in black gold (as WTI fell to one-year lows).

US Macro Surprise data has drifted sideways for almost three months now – Goldilocks-like perhaps…

Source: Bloomberg

But amid the sparse macro data (claims, PPI etc), the market’s expectations for The Fed’s terminal rate was unchanged and the market’s expectations for rate-cuts in H2 2023 also ended unchanged…

Source: Bloomberg

All the majors puked lower on the hotter than expected PPI this morning then the machines levitated things for a few hours until Europe was closed. Then the last 15 mins saw stocks puked to the lows of the day…

Small Caps were the week’s worst performers (down 5%), followed by Nasdaq and S&P and The Dow was the prettiest horse in the glue factory…

The S&P 500 held above its 100DMA…

All sectors ended the week in the red with Energy by far the worst. Utes outperformed with a very small loss on the week…

Source: Bloomberg

Tech has been outperforming energy stocks since the start of November…

Source: Bloomberg

US Treasuries were sold hard today, erasing all of the week’s gains for the long-bond, and leaving the rest of the curve notably higher in yield (belly underperforming)…

Source: Bloomberg

The yield curve (2s30s) ended flatter (more inverted) on the week, but barely after a big steepening day today post-PPI…

Source: Bloomberg

The dollar ended the week higher, but back in the range from Friday’s payrolls pump and dump)…

Source: Bloomberg

Cryptos were broadly unchanged on the week, despite some intraday volatility (BTC up marginally, ETH down marginally)…

Source: Bloomberg

Bitcoin ended the week back above $17,000…

Source: Bloomberg

Oil prices are down 6 straight days, with WTI ending the week down over 12% with a $70 handle – its worst week since the first week of April – and back at one-year lows (-2% YoY, first decline since Jan 2021)…

As fund managers abandon black gold…

Source: Bloomberg

Gold ended the week unchanged, above $1800, while silver outperformed modestly…

Finally, will we get a sense of deja vu all over again next week when The Fed hikes?

Source: Bloomberg

Would that kind of downsing be enough to tighten financial conditions and allow Powell to lift his boot from the market’s neck?

Loading…