Authored by Matt McGregor via The Epoch Times (emphasis ours),

A former assistant city attorney and police officer in Atlanta has been charged with defrauding the Paycheck Protection Program (PPP) out of $7 million.

The indictment alleges that Shelitha Robertson, 60, and other co-conspirators submitted fraudulent PPP loan applications for several companies they owned, according to the Department of Justice (DOJ).

Robertson allegedly siphoned over $7 million in PPP loan funds and used them to purchase luxury items such as a Rolls-Royce, a motorcycle, and jewelry, as well as to transfer funds to her co-conspirators and family members.

On Dec. 6, Robertson was charged with conspiracy to commit wire fraud, wire fraud, and money laundering.

If convicted, she will face a maximum penalty of 20 years in prison for each wire fraud charge and a maximum of 10 years for the charge of money laundering.

“Robertson allegedly stole millions of dollars in taxpayer money intended to help small businesses stay afloat during the pandemic,” said U.S. Attorney Ryan Buchanan. “CARES Act loans were designed to help sustain small businesses during the pandemic, not to serve as a source of personal enrichment. We will continue to vigorously investigate and prosecute anyone who fraudulently obtains these critical funds.”

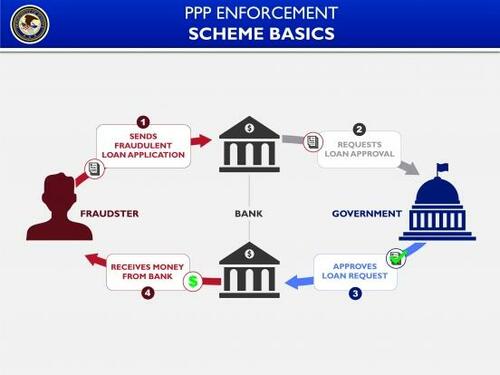

In 2020, Congress passed the largest financial support package in U.S. history: the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act, which authorized $349 billion in PPP loans.

The program provided small businesses with funds to cover up to eight weeks of payroll costs so the businesses could fill in the financial gaps created by the lockdowns.

It was implemented by the Small Business Administration (SBA) through the Treasury Department, and it provided forgivable loans to small businesses for job retention and other expenses.

Since its implementation, the program has been open season for multiple fraud schemes.

The DOJ’s Fraud Section leads its Criminal Division’s prosecution of schemes that target the PPP.

The Fraud Section has prosecuted more than 192 defendants in over 121 criminal cases and has seized more than $78 million in cash proceeds derived from fraudulently obtained PPP funds, as well as several real estate properties and luxury items purchased with those proceeds.

In December, the DOJ indicted defendants in more than 10 cases.

Authored by Matt McGregor via The Epoch Times (emphasis ours),

A former assistant city attorney and police officer in Atlanta has been charged with defrauding the Paycheck Protection Program (PPP) out of $7 million.

The indictment alleges that Shelitha Robertson, 60, and other co-conspirators submitted fraudulent PPP loan applications for several companies they owned, according to the Department of Justice (DOJ).

Robertson allegedly siphoned over $7 million in PPP loan funds and used them to purchase luxury items such as a Rolls-Royce, a motorcycle, and jewelry, as well as to transfer funds to her co-conspirators and family members.

On Dec. 6, Robertson was charged with conspiracy to commit wire fraud, wire fraud, and money laundering.

If convicted, she will face a maximum penalty of 20 years in prison for each wire fraud charge and a maximum of 10 years for the charge of money laundering.

“Robertson allegedly stole millions of dollars in taxpayer money intended to help small businesses stay afloat during the pandemic,” said U.S. Attorney Ryan Buchanan. “CARES Act loans were designed to help sustain small businesses during the pandemic, not to serve as a source of personal enrichment. We will continue to vigorously investigate and prosecute anyone who fraudulently obtains these critical funds.”

In 2020, Congress passed the largest financial support package in U.S. history: the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act, which authorized $349 billion in PPP loans.

The program provided small businesses with funds to cover up to eight weeks of payroll costs so the businesses could fill in the financial gaps created by the lockdowns.

It was implemented by the Small Business Administration (SBA) through the Treasury Department, and it provided forgivable loans to small businesses for job retention and other expenses.

Since its implementation, the program has been open season for multiple fraud schemes.

The DOJ’s Fraud Section leads its Criminal Division’s prosecution of schemes that target the PPP.

The Fraud Section has prosecuted more than 192 defendants in over 121 criminal cases and has seized more than $78 million in cash proceeds derived from fraudulently obtained PPP funds, as well as several real estate properties and luxury items purchased with those proceeds.

In December, the DOJ indicted defendants in more than 10 cases.

Loading…