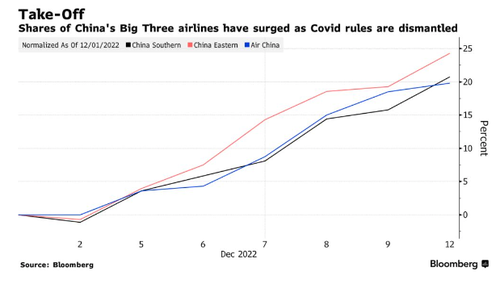

Beijing's abrupt end to zero Covid policies that shuttered factories and cities and crushed economic growth in the world's second-largest economy has produced at least one of the first signs of green shoots: Air travel rebound.

Chinese aviation data company VariFlight reported domestic flight activity soared to 65% of pre-pandemic levels Monday, from only 22% on Nov. 29, according to Bloomberg. Thousands of flights are returning to the skies as air travel demand rebounds ahead of Lunar New Year next month.

Surging air travel demand is expected to increase airfare prices for top travel spots such as major cities from Beijing to Shanghai and the resort island of Hainan. Dialing back strict pandemic control measures that will boost air travel comes ahead Lunar New Year, which before Covid, was the world's biggest mass migration event.

"If you look at around the world, air ticket prices are materially higher than in 2019.

"But when you look at China's domestic air tickets, even into the third quarter of 2022, it's about 15% lower than that of 2019," Parash Jain, head of transport research for Asia Pacific at HSBC Holdings Plc., said in an interview with Bloomberg Television on Monday.

Guo Lechun, an analyst with the online travel website Qunar, expects Lunar New Year bookings to reach the highest levels in three years or about 80% of pre-pandemic levels.

"Ctrip.com said air travel searches jumped 900% on Dec. 7, the day the government announced the dismantling of most Covid restrictions, including mass testing and snap lockdowns," Bloomberg said, adding searches on travel websites exploded hours after Beijing eased zero Covid policies.

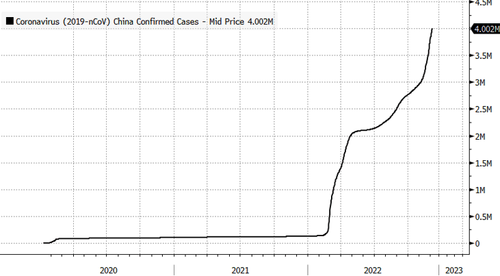

But with the easing of zero Covid, there has been a sharp increase in China's Covid infections. There are risks that at least one million Chinese people are at risk of dying from Covid this winter, according to Financial Times.

S&P Global Commodity Insights expects jet fuel demand to rise as domestic travel flourishes. Reopening China will certainly involve increased crude and refined imports in the coming months (remember what Goldman said ...), perhaps putting a floor in energy prices unless the global economy slides into recession in 2023.

Beijing’s abrupt end to zero Covid policies that shuttered factories and cities and crushed economic growth in the world’s second-largest economy has produced at least one of the first signs of green shoots: Air travel rebound.

Chinese aviation data company VariFlight reported domestic flight activity soared to 65% of pre-pandemic levels Monday, from only 22% on Nov. 29, according to Bloomberg. Thousands of flights are returning to the skies as air travel demand rebounds ahead of Lunar New Year next month.

Surging air travel demand is expected to increase airfare prices for top travel spots such as major cities from Beijing to Shanghai and the resort island of Hainan. Dialing back strict pandemic control measures that will boost air travel comes ahead Lunar New Year, which before Covid, was the world’s biggest mass migration event.

“If you look at around the world, air ticket prices are materially higher than in 2019.

“But when you look at China’s domestic air tickets, even into the third quarter of 2022, it’s about 15% lower than that of 2019,” Parash Jain, head of transport research for Asia Pacific at HSBC Holdings Plc., said in an interview with Bloomberg Television on Monday.

Guo Lechun, an analyst with the online travel website Qunar, expects Lunar New Year bookings to reach the highest levels in three years or about 80% of pre-pandemic levels.

“Ctrip.com said air travel searches jumped 900% on Dec. 7, the day the government announced the dismantling of most Covid restrictions, including mass testing and snap lockdowns,” Bloomberg said, adding searches on travel websites exploded hours after Beijing eased zero Covid policies.

But with the easing of zero Covid, there has been a sharp increase in China’s Covid infections. There are risks that at least one million Chinese people are at risk of dying from Covid this winter, according to Financial Times.

S&P Global Commodity Insights expects jet fuel demand to rise as domestic travel flourishes. Reopening China will certainly involve increased crude and refined imports in the coming months (remember what Goldman said …), perhaps putting a floor in energy prices unless the global economy slides into recession in 2023.

Loading…