There had been a quiet at first, and then increasingly louder chorus of disapproval among Tesla bulls at the relentless decline in the TSLA stock price, which someone was aggressively selling in recent days and slashing nearly a quarter of its value since the start of the month (and more than 60% from its all time high just over a year ago).

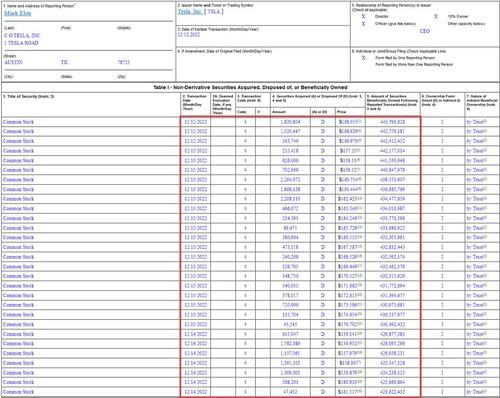

It turns out that at least one of the whale sellers was none other than Elon Musk himself who - just days after losing the world's richest man rank to French luxury titan Bernard Arnault - late on Wednesday filed a Form 4 showing he sold nearly 22 million shares, or some $3.6 billion worth, of TSLA stock between Nov 12 and Nov 14.

The sales, which took place at a price between $176.702 and $156.14, brought Musk's total TSLA holdings down from 445.617 million to 423.622 million, a decline of 21.995 million shares.

The week's sale, which follows a similar dump one month ago when during a 4 day period from November 4-8, Elon Musk sold 19.5 million shares or roughly $4 billion in TSLA stock, means that the Tesla - and now Twitter - chief executive has sold more than $39 billion in Tesla shares since the company’s stock peaked in November 2021. Tesla, still the world’s largest auto maker by value, has lost more than $700 billion in market value since that all-time high.

It wasn’t clear what prompted Musk to sell additional Tesla stock, and the company didn’t respond to a request for comment from the WSJ, but on Tuesday, in what may have been a foreshadowing of what's to come, Musk tweeted, “At risk of stating obvious, beware of debt in turbulent macroeconomic conditions, especially when Fed keeps raising rates.”

Musk, of course, has lots of debt from his completed acquisition of Twitter in October. While Musk provided $33.5 billion in equity financing to pay for the deal, Twitter also took on around $13 billion in debt as part of the takeover, in which the company went private. According to reports from Bloomberg, the banks which are stuck with the debt and unable to syndicate it to willing buyers, offered to lower the interest on some of the more expensive tranches if Musk is willing to exchange the Twitter debt with a personal margin loan (backed by far more valuable Twitter stock).

Musk tried for months to get out of the Twitter deal but failed. To raise enough cash for the purchase, he offloaded more than $15 billion in Tesla shares — about $8.5 billion in April, then another $6.9 billion in August. In November, after vowing he was done selling, he unloaded another $3.95 billion of his stake.

Besides Musk's sales, TSLA stock has been hit by concerns that rising interest rates will make the cars more expensive for consumers while demand issues in China, Tesla’s largest market after the US, have reportedly depressed local production.

Twitter now faces annual interest payments approaching $1.2 billion, which could get even more expensive given that the interest rates on about half of that debt aren’t locked in and will rise with the market. To cut costs, Twitter not only fired more than half of its employees, but according to the NYT has not paid rent for its San Francisco headquarters or any of its global offices for weeks; Twitter has also refused to pay a $197,725 bill for private charter flights made the week of Musk’s takeover, and has also discussed the consequences of denying severance payments to thousands of people who have been laid off since the takeover.

Musk’s recent sales will bring his stake in the company to roughly 13%; he remains the company's largest shareholder by a wide margin. Musk's net worth was $160.9 billion as of Wednesday's close, ranking No. 2 on the Bloomberg Billionaires Index after France’s Bernard Arnault. His fortune has dropped by $109.4 billion this year.

There had been a quiet at first, and then increasingly louder chorus of disapproval among Tesla bulls at the relentless decline in the TSLA stock price, which someone was aggressively selling in recent days and slashing nearly a quarter of its value since the start of the month (and more than 60% from its all time high just over a year ago).

It turns out that at least one of the whale sellers was none other than Elon Musk himself who – just days after losing the world’s richest man rank to French luxury titan Bernard Arnault – late on Wednesday filed a Form 4 showing he sold nearly 22 million shares, or some $3.6 billion worth, of TSLA stock between Nov 12 and Nov 14.

The sales, which took place at a price between $176.702 and $156.14, brought Musk’s total TSLA holdings down from 445.617 million to 423.622 million, a decline of 21.995 million shares.

The week’s sale, which follows a similar dump one month ago when during a 4 day period from November 4-8, Elon Musk sold 19.5 million shares or roughly $4 billion in TSLA stock, means that the Tesla – and now Twitter – chief executive has sold more than $39 billion in Tesla shares since the company’s stock peaked in November 2021. Tesla, still the world’s largest auto maker by value, has lost more than $700 billion in market value since that all-time high.

It wasn’t clear what prompted Musk to sell additional Tesla stock, and the company didn’t respond to a request for comment from the WSJ, but on Tuesday, in what may have been a foreshadowing of what’s to come, Musk tweeted, “At risk of stating obvious, beware of debt in turbulent macroeconomic conditions, especially when Fed keeps raising rates.”

Musk, of course, has lots of debt from his completed acquisition of Twitter in October. While Musk provided $33.5 billion in equity financing to pay for the deal, Twitter also took on around $13 billion in debt as part of the takeover, in which the company went private. According to reports from Bloomberg, the banks which are stuck with the debt and unable to syndicate it to willing buyers, offered to lower the interest on some of the more expensive tranches if Musk is willing to exchange the Twitter debt with a personal margin loan (backed by far more valuable Twitter stock).

Musk tried for months to get out of the Twitter deal but failed. To raise enough cash for the purchase, he offloaded more than $15 billion in Tesla shares — about $8.5 billion in April, then another $6.9 billion in August. In November, after vowing he was done selling, he unloaded another $3.95 billion of his stake.

Besides Musk’s sales, TSLA stock has been hit by concerns that rising interest rates will make the cars more expensive for consumers while demand issues in China, Tesla’s largest market after the US, have reportedly depressed local production.

Twitter now faces annual interest payments approaching $1.2 billion, which could get even more expensive given that the interest rates on about half of that debt aren’t locked in and will rise with the market. To cut costs, Twitter not only fired more than half of its employees, but according to the NYT has not paid rent for its San Francisco headquarters or any of its global offices for weeks; Twitter has also refused to pay a $197,725 bill for private charter flights made the week of Musk’s takeover, and has also discussed the consequences of denying severance payments to thousands of people who have been laid off since the takeover.

Musk’s recent sales will bring his stake in the company to roughly 13%; he remains the company’s largest shareholder by a wide margin. Musk’s net worth was $160.9 billion as of Wednesday’s close, ranking No. 2 on the Bloomberg Billionaires Index after France’s Bernard Arnault. His fortune has dropped by $109.4 billion this year.

Loading…