So it seems China re-opening is now 'bad' news, like Zero-COVID was 'bad' news?

China's offshore yuan tumbled back to more than 7/USD...

Source: Bloomberg

And US equities tumbled, bounced, then re-tumbled on the headlines about US requiring negative COVID tests for Chinese visitors late on. Small Caps were the biggest losers followed closely by Nasdaq, then S&P and The Dow - all followed the same trajectories as hopes for a Sant Claus rally evaporate...

"The stronger the positive impact on growth from Chinese reopening, the faster the global inflation, and the faster the global inflation the more aggressive the central bank actions will be,” Swissquote Bank analyst Ipek Ozkardeskaya wrote in a note.

Fears that interest rates might rise further than expected are adding pressure on technology stocks which typically suffer during monetary tightening cycles and are among the biggest stock-market losers of 2022.

That makes 2022 the most 1%-Plus down-days since 2008...

Another 1%+ down day for $SPY today. That makes 65 1%+ down days so far in 2022. https://t.co/H4p1RcpfIn pic.twitter.com/nTnD7APsn6

— Bespoke (@bespokeinvest) December 28, 2022

TSLA shares rallied today (after 7 straight down days)...

AAPL briefly dropped below $2 trillion market cap today (for the first time since March 2021)...

Source: Bloomberg

Treasuries were mixed today with the short-end outperforming (2Y -2bps on a roll, 30Y +4bps)...

Source: Bloomberg

The market's expectations for The Fed's rate actions continues to drift hawkishly...

Source: Bloomberg

The 30Y Yield pushed up towards 4.00% - its highest in six weeks...

Source: Bloomberg

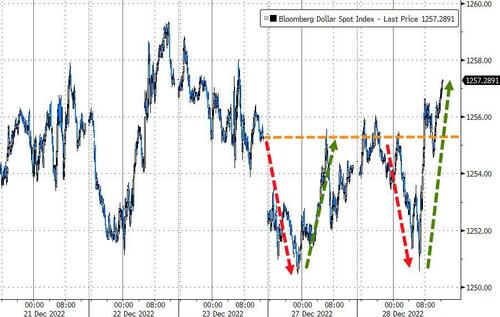

The dollar dumped and pumped today, turning green for the week...

Source: Bloomberg

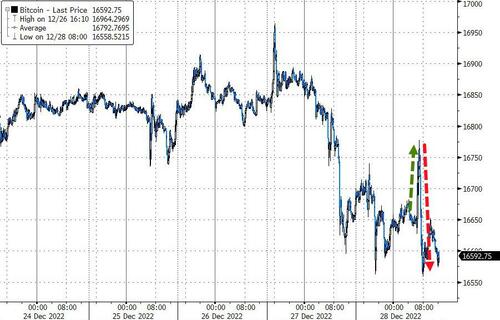

Bitcoin was volatile but extended yesterday's losses...

Source: Bloomberg

Gold ended the day lower but held above $1800...

Oil prices slipped lower today as the surge in China COVID cases raised anxiety again with WTI back below $80...

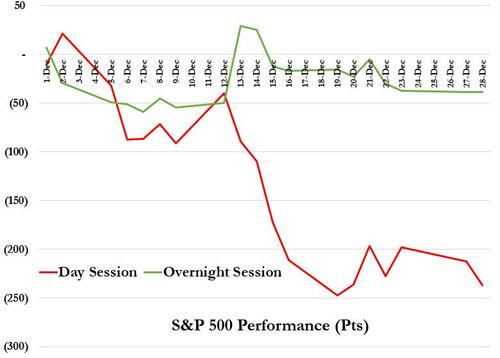

Finally, December has been an 'odd' month with the S&P 500 basically cumulatively unchanged during the overnight session, but down a dramatic 240 points cumulatively from the close to the open...

Will that continue in 2023?

So it seems China re-opening is now ‘bad’ news, like Zero-COVID was ‘bad’ news?

China’s offshore yuan tumbled back to more than 7/USD…

Source: Bloomberg

And US equities tumbled, bounced, then re-tumbled on the headlines about US requiring negative COVID tests for Chinese visitors late on. Small Caps were the biggest losers followed closely by Nasdaq, then S&P and The Dow – all followed the same trajectories as hopes for a Sant Claus rally evaporate…

“The stronger the positive impact on growth from Chinese reopening, the faster the global inflation, and the faster the global inflation the more aggressive the central bank actions will be,” Swissquote Bank analyst Ipek Ozkardeskaya wrote in a note.

Fears that interest rates might rise further than expected are adding pressure on technology stocks which typically suffer during monetary tightening cycles and are among the biggest stock-market losers of 2022.

That makes 2022 the most 1%-Plus down-days since 2008…

Another 1%+ down day for $SPY today. That makes 65 1%+ down days so far in 2022. https://t.co/H4p1RcpfIn pic.twitter.com/nTnD7APsn6

— Bespoke (@bespokeinvest) December 28, 2022

TSLA shares rallied today (after 7 straight down days)…

AAPL briefly dropped below $2 trillion market cap today (for the first time since March 2021)…

Source: Bloomberg

Treasuries were mixed today with the short-end outperforming (2Y -2bps on a roll, 30Y +4bps)…

Source: Bloomberg

The market’s expectations for The Fed’s rate actions continues to drift hawkishly…

Source: Bloomberg

The 30Y Yield pushed up towards 4.00% – its highest in six weeks…

Source: Bloomberg

The dollar dumped and pumped today, turning green for the week…

Source: Bloomberg

Bitcoin was volatile but extended yesterday’s losses…

Source: Bloomberg

Gold ended the day lower but held above $1800…

Oil prices slipped lower today as the surge in China COVID cases raised anxiety again with WTI back below $80…

Finally, December has been an ‘odd’ month with the S&P 500 basically cumulatively unchanged during the overnight session, but down a dramatic 240 points cumulatively from the close to the open…

Will that continue in 2023?

Loading…