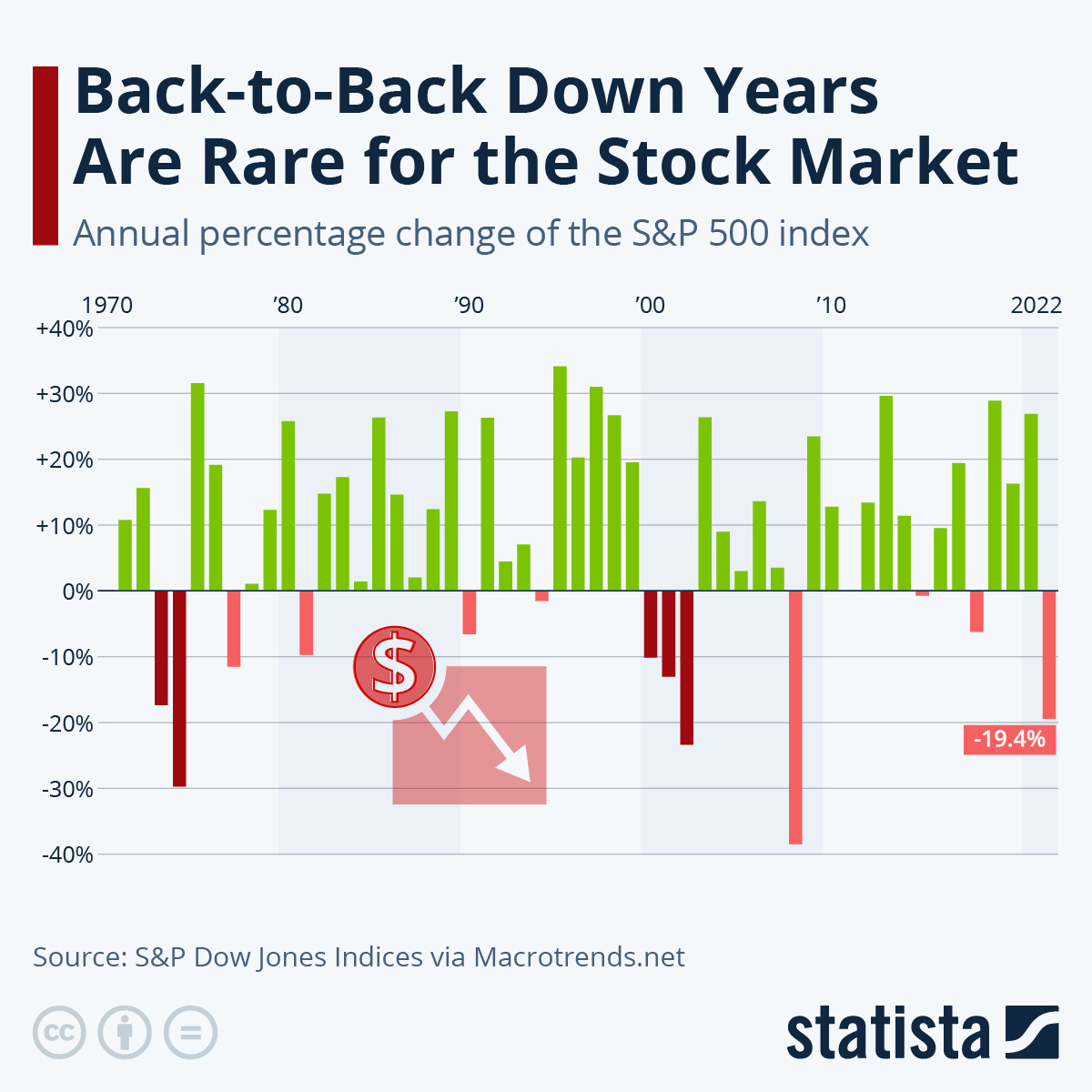

After a year of ups and downs, the S&P 500 ended 2022 on a downbeat note. The index closed at 3,839.50 on Friday, down 0.25 percent for the day and 19.44 percent for the year.

That makes 2022 the worst year for the S&P 500 since 2008 and the fourth-worst year since the index was expanded to 500 companies in 1957.

While positive returns in 2020 and 2021 despite Covid-19 made it seem like the only way for the stock market was up, 2022 served as a good reminder that that is not the case. In fact, as Statista's Felix Richter reports, investors are now worried that lightning might strike a second time in 2023, as most of the crises that led to the market decline last year remain unsolved with the specter of a global recession looming large over markets around the world.

Historically, back-to-back down years are a very rare occurrence, as Statista's chart shows.

You will find more infographics at Statista

According to Macrotrends.net, the S&P 500 has only seen consecutive years of negative returns three times since 1957, in 1973/1974 and in 2001/2002/2003 with returns getting worse in the second (and third) down year on each of those occasions. Since 1957, the S&P 500 has ended the year in the red 18 times including 2022. On 14 occasions, the index returned to growth the next year.

And while history might point to an upbeat 2023 – on average the S&P 500 gained 15 percent in years following a negative year – the odds are stacked against investors this time. As the war in Ukraine drags on, Covid-19 continues to disrupt the Chinese economy and the Fed is all but certain to keep raising interest rates in the face of red-hot inflation, consumer spending and corporate earnings may well buckle, which could send stock prices even further down.

After a year of ups and downs, the S&P 500 ended 2022 on a downbeat note. The index closed at 3,839.50 on Friday, down 0.25 percent for the day and 19.44 percent for the year.

That makes 2022 the worst year for the S&P 500 since 2008 and the fourth-worst year since the index was expanded to 500 companies in 1957.

While positive returns in 2020 and 2021 despite Covid-19 made it seem like the only way for the stock market was up, 2022 served as a good reminder that that is not the case. In fact, as Statista’s Felix Richter reports, investors are now worried that lightning might strike a second time in 2023, as most of the crises that led to the market decline last year remain unsolved with the specter of a global recession looming large over markets around the world.

Historically, back-to-back down years are a very rare occurrence, as Statista’s chart shows.

You will find more infographics at Statista

According to Macrotrends.net, the S&P 500 has only seen consecutive years of negative returns three times since 1957, in 1973/1974 and in 2001/2002/2003 with returns getting worse in the second (and third) down year on each of those occasions. Since 1957, the S&P 500 has ended the year in the red 18 times including 2022. On 14 occasions, the index returned to growth the next year.

And while history might point to an upbeat 2023 – on average the S&P 500 gained 15 percent in years following a negative year – the odds are stacked against investors this time. As the war in Ukraine drags on, Covid-19 continues to disrupt the Chinese economy and the Fed is all but certain to keep raising interest rates in the face of red-hot inflation, consumer spending and corporate earnings may well buckle, which could send stock prices even further down.

Loading…