By Russell Clark of the Capital Flows and Asset Markets Substack

As the saying goes, “short selling is for show, long investing for dough”. What does this mean? Successful short selling can and will raise your profile massively, as it did for me, but the real money almost always comes from long investing. For professional investors who would like to add a net short fund to a portfolio of funds, pay up and read on.

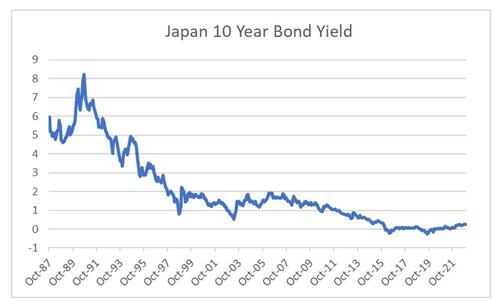

First of all, to run net short, you need to have an idea of how the world works that is different, if not to everyone else, to consensus at least. What I now know, is that my original process was designed for the only world I had ever seen, a pro-capital world. And the consensus I was trading against was the the investor community last memories of a pro-labor world. Perhaps the worst example of investors living in a the past of a pro-labor world was their attitude towards bonds. For my entire investment career, short JGBs was recommended as a trade, despite it being one of the best trades over that period!

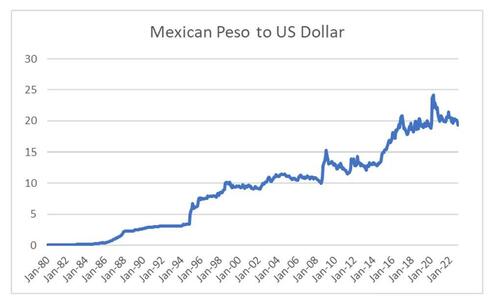

One of the features of a pro-capital world is that countries that try to raise wages, inevitably saw currency weakness, meaning that in global terms wages stayed flat. Mexico is a very good example of this phenomenon. It should be noted, investors are almost always bullish Mexican peso in my experience.

Even countries like Korea, with rising productivity and rising wages would see periodic selloffs in their currency, and have continued to generally weaken against the US dollar. These are pro-capital feature, that keeps global wages and producer inflation weak in US dollar terms.

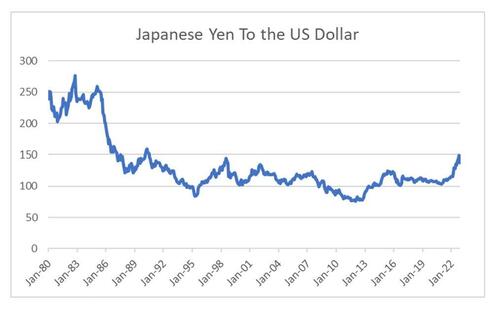

The converse of this feature was that countries that did not see wage growth, like Japan would struggle to keep its currency weak (at least until recently).

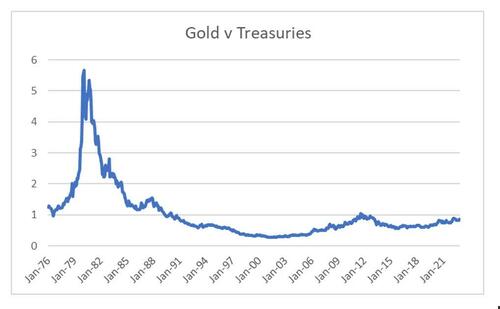

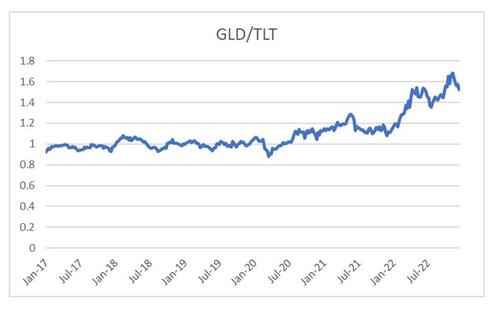

In a pro-capital era you can then expect that at some point countries with low wage inflation to see their currencies appreciate, and countries with high wage inflation see their currencies devalue. Global inflation will constantly surprise to the downside, and financial assets will do well. Using a long term version of my GLD/TLT trade, we can see that from 1980 to 2000 was a pro-capital era, while from 2002 to 2012 was a pro-labour period. The explosion in Chinese growth from 2002 to 2012 and the movement from pro-capital to pro-labour trade is not a coincidence in my mind.

So what caused the turn away from a pro-labor market of 2002 to 2012? You have to remember, pro-capital policies are built around the free movement of capital, free movement of labour, and free market pricing. And in 2012 onwards China began to suffer the negative aspects of pro-capital policy. Japan began to devalue aggressively against the Yuan, Chinese capital began to leave China, factories moved elsewhere. In a pro-capital world, China would have devalued to restore competitiveness, and reduce wages. This would have been massively bullish treasuries and bearish gold. But in 2016, China imposed capital controls, and took control of its financial fate. In essence China rejected free movement of capital, and the free allocation of capital.

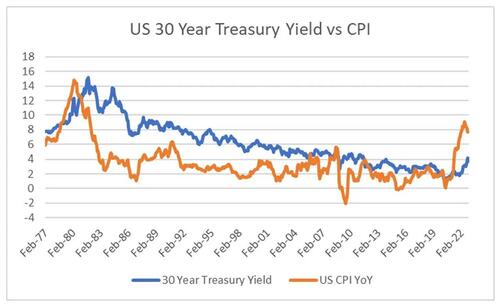

My argument is where China leads, the rest of the world is likely to follow. Why does the rest of the world follow? Two reasons - one is the demonstration effect. If China can make pro-labour policies work, then why not here? The second is that pro-labour policies in China is pushing up food prices globally, which makes weak wage growth intolerable, forcing change. We are looking at political change, but the signs in the bond market are already there. In 1980, we changed to pro-capital and inflation duly fell, but the bond market lagged, leaving yields much higher than inflation for many many years. Conversely, a change to pro-labour has left bond yields lagging behind inflation this year. The implication is that bonds are a short, just as they were a buy in 1980.

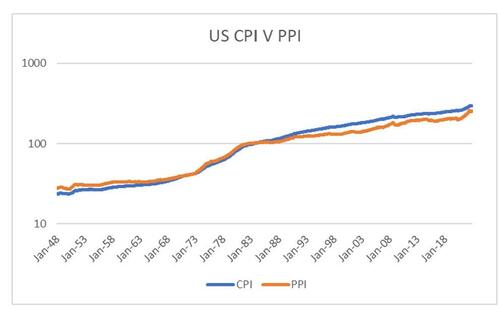

Another way to visualize the political change is to look at PPI vs CPI. In grossly simplified terms, PPI are costs to businesses, while CPI is cost to consumers. In a pro-capital world, policy is all about getting PPI down, while in a pro-labor world it about getting PPI up. Or shifting from pro-consumer to pro-worker. It should not be surprising that markets prefer CPI to be rising above PPI (it implies rising profits).

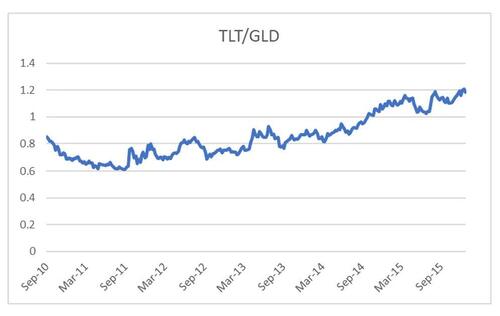

So how can we run net short? In 2012/3 as the world was inflecting back to pro capital, we could be sure of two things. One was that commodities were going lower, and that bond yields would also go lower. So it was possible to be short gold, and long bonds, or variations of that theme, such as short cyclicals/long defensive, short emerging markets/long S&P 500, short miners/long tech. When I first put this trade on in 2011, I expected the end game would be obvious - a dramatic devaluation and/or financial crisis in China. For me, a lead indicator of the market beginning to think about such an outcome would be the weakening of Asian currencies. Asian currencies began to weaken in 2011.

At the point, the market was exclusively focused on the Federal Reserve and QE. When markets thought policy would be inflationary, we saw GLD rally, and treasuries be weak, but with a pro-capital view, you could guess with reasonable confidence that this relationship would reverse, or have a “correlation break” at some point, which is what we saw in 2015, when treasuries were strong, but gold was also weak.

So a portfolio that was long bonds, short gold, (or one of the more exotic options listed above) would have eked out small gains with some carry from 2011 to 2013, and then realized large gains in 2014 and 2015. This understates the gains on offer, as higher beta versions of long TLT and short GLD did much better than this.

What I am seeing at the moment, is the exact reverse of what we saw in 2011 and 2012. Inflation trades such as gold are suffering as TLT sells off. But gaining when TLT rallies. This confirms my view that if central banks ease, inflation will return as PPI pressures are now cyclical, but political.

A long GLD/short TLT has performed well, but ultimately I am looking for rising commodities at the same time as rising bond yields for the end trade.

So this offers a chance to run net short equities highly correlated to TLT, such as defensives, private equity, REITS, while hedging with inflationary assets such as gold, short dollar trades or short bonds.

By Russell Clark of the Capital Flows and Asset Markets Substack

As the saying goes, “short selling is for show, long investing for dough”. What does this mean? Successful short selling can and will raise your profile massively, as it did for me, but the real money almost always comes from long investing. For professional investors who would like to add a net short fund to a portfolio of funds, pay up and read on.

First of all, to run net short, you need to have an idea of how the world works that is different, if not to everyone else, to consensus at least. What I now know, is that my original process was designed for the only world I had ever seen, a pro-capital world. And the consensus I was trading against was the the investor community last memories of a pro-labor world. Perhaps the worst example of investors living in a the past of a pro-labor world was their attitude towards bonds. For my entire investment career, short JGBs was recommended as a trade, despite it being one of the best trades over that period!

One of the features of a pro-capital world is that countries that try to raise wages, inevitably saw currency weakness, meaning that in global terms wages stayed flat. Mexico is a very good example of this phenomenon. It should be noted, investors are almost always bullish Mexican peso in my experience.

Even countries like Korea, with rising productivity and rising wages would see periodic selloffs in their currency, and have continued to generally weaken against the US dollar. These are pro-capital feature, that keeps global wages and producer inflation weak in US dollar terms.

The converse of this feature was that countries that did not see wage growth, like Japan would struggle to keep its currency weak (at least until recently).

In a pro-capital era you can then expect that at some point countries with low wage inflation to see their currencies appreciate, and countries with high wage inflation see their currencies devalue. Global inflation will constantly surprise to the downside, and financial assets will do well. Using a long term version of my GLD/TLT trade, we can see that from 1980 to 2000 was a pro-capital era, while from 2002 to 2012 was a pro-labour period. The explosion in Chinese growth from 2002 to 2012 and the movement from pro-capital to pro-labour trade is not a coincidence in my mind.

So what caused the turn away from a pro-labor market of 2002 to 2012? You have to remember, pro-capital policies are built around the free movement of capital, free movement of labour, and free market pricing. And in 2012 onwards China began to suffer the negative aspects of pro-capital policy. Japan began to devalue aggressively against the Yuan, Chinese capital began to leave China, factories moved elsewhere. In a pro-capital world, China would have devalued to restore competitiveness, and reduce wages. This would have been massively bullish treasuries and bearish gold. But in 2016, China imposed capital controls, and took control of its financial fate. In essence China rejected free movement of capital, and the free allocation of capital.

My argument is where China leads, the rest of the world is likely to follow. Why does the rest of the world follow? Two reasons – one is the demonstration effect. If China can make pro-labour policies work, then why not here? The second is that pro-labour policies in China is pushing up food prices globally, which makes weak wage growth intolerable, forcing change. We are looking at political change, but the signs in the bond market are already there. In 1980, we changed to pro-capital and inflation duly fell, but the bond market lagged, leaving yields much higher than inflation for many many years. Conversely, a change to pro-labour has left bond yields lagging behind inflation this year. The implication is that bonds are a short, just as they were a buy in 1980.

Another way to visualize the political change is to look at PPI vs CPI. In grossly simplified terms, PPI are costs to businesses, while CPI is cost to consumers. In a pro-capital world, policy is all about getting PPI down, while in a pro-labor world it about getting PPI up. Or shifting from pro-consumer to pro-worker. It should not be surprising that markets prefer CPI to be rising above PPI (it implies rising profits).

So how can we run net short? In 2012/3 as the world was inflecting back to pro capital, we could be sure of two things. One was that commodities were going lower, and that bond yields would also go lower. So it was possible to be short gold, and long bonds, or variations of that theme, such as short cyclicals/long defensive, short emerging markets/long S&P 500, short miners/long tech. When I first put this trade on in 2011, I expected the end game would be obvious – a dramatic devaluation and/or financial crisis in China. For me, a lead indicator of the market beginning to think about such an outcome would be the weakening of Asian currencies. Asian currencies began to weaken in 2011.

At the point, the market was exclusively focused on the Federal Reserve and QE. When markets thought policy would be inflationary, we saw GLD rally, and treasuries be weak, but with a pro-capital view, you could guess with reasonable confidence that this relationship would reverse, or have a “correlation break” at some point, which is what we saw in 2015, when treasuries were strong, but gold was also weak.

So a portfolio that was long bonds, short gold, (or one of the more exotic options listed above) would have eked out small gains with some carry from 2011 to 2013, and then realized large gains in 2014 and 2015. This understates the gains on offer, as higher beta versions of long TLT and short GLD did much better than this.

What I am seeing at the moment, is the exact reverse of what we saw in 2011 and 2012. Inflation trades such as gold are suffering as TLT sells off. But gaining when TLT rallies. This confirms my view that if central banks ease, inflation will return as PPI pressures are now cyclical, but political.

A long GLD/short TLT has performed well, but ultimately I am looking for rising commodities at the same time as rising bond yields for the end trade.

So this offers a chance to run net short equities highly correlated to TLT, such as defensives, private equity, REITS, while hedging with inflationary assets such as gold, short dollar trades or short bonds.

Loading…