Just weeks after the BOJ shocked markets by expanding the permitted trading band under its Yield Curve Control policy, in the process unleashing a historic repricing of the JGB bond curve and forcing the BOJ to spend 16.2 trillion yen (to date) in ad hoc unlimited bond buys to defend the central bank's new cap...

Oh. My. God. BoJ lifted the ceiling for 10-year JGB yield from 0.25 to 0.50% last month and here's the result: it had to buy 16.2 trillion Yen in JGBs to defend the new cap. Exiting any peg - in this case a yield cap - is extremely costly. A warning for any yield cap proponents. pic.twitter.com/3HwjfBIKp3

— Robin Brooks (@RobinBrooksIIF) January 4, 2023

... the Bank of Japan is preparing for more surprise and overnight Reuters reported that the central bank is putting more emphasis on an inflation gauge that excludes fuel costs, and will likely raise its projections for the index's growth in quarterly forecasts due this month, according to three sources familiar with its thinking.

The upgrade - which sparked a rally in JGBs overnight amid expectations that while the BOJ will tweak policy but avoid further YCC adjustments in its January meeting - would underscore the central bank's growing conviction that robust domestic demand will allow firms to raise prices, and keep inflation sustainably around its 2% target in coming years, a critical level of Japan which has been mired in deflation for the past 40 years, and where the administration's goal has long been to engineer rising wages, even if means unleashing a wage-price spiral (one of those "we will worry about it when we get it" things).

That said, the upward revision alone is unlikely to trigger an immediate interest rate rise, because many BOJ officials saw a need to scrutinize annual spring wage negotiations and the fallout from U.S. interest rate hikes.

"Price rises are broadening more than initially expected, a trend that could continue if wages rise enough," one source said; while another added that "when stripping away one-off factors like government subsidies, trend inflation appears to be gaining momentum."

Traditionally, the BOJ has used core consumer inflation, which excludes the effect of fresh food but includes energy costs, as a key gauge in producing forecasts and guiding policy. But in April it also began issuing forecasts for "core-core" consumer inflation, which strips away the effect of both fresh food and energy costs, to better grasp the broad price trend driven by domestic demand.

With government fuel subsidies and scheduled utility bill hikes muddling this year's price outlook, the BOJ was now focusing more on the core-core index in determining whether Japan could achieve sustained price rises. And in fresh quarterly projections due this month, the BOJ would probably raise its core-core inflation forecasts for the current fiscal year ending in March and fiscal 2023, Reuters said. It might also slightly upgrade the forecast for fiscal 2024, depending on how the board viewed prospects for wage growth, the sources said.

But ultimately, it will be all about whether Japan can created sustained wage growth.

The upgrades, which would push the outlook for core-core inflation closer to the BOJ's target, will likely keep alive market expectations the central bank will phase out its ultra-loose policy when Governor Haruhiko Kuroda's second five-year term ends in April. In current forecasts, made in October, the board projected the average level of the core-core consumer price index this fiscal year will be 1.8% higher than in fiscal 2021. It expects fiscal 2023 and fiscal 2024 each to show rises in the index of 1.6%.

The BOJ will issue the quarterly forecasts after a two-day policy meeting that ends on Jan. 18.

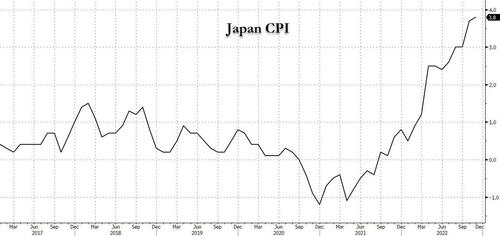

Of course, surging raw material import costs have pushed headline inflation well above the BOJ's 2% target in recent months, achieving what Kuroda's decade-long stimulus efforts had failed to accomplish. At the same time, Kuroda has dismissed the chance of a near-term interest rate hike on the view the BOJ must keep supporting the economy until the current cost-push inflation turns into a demand-driven one accompanied by higher wages.

But Japan's long-term interest rates have crept up since the BOJ stunned markets last month by widening the band around its 10-year bond yield target, a move investors saw as a prelude to a future rate hike. Core consumer prices in November rose 3.7% from a year earlier and analysts expect inflation to remain above the BOJ's 2% in coming months, as companies continue to pass on higher costs to households.

Bottom line, analyst agree that wage growth will be key to whether Japan's fragile economy can withstand the hit from rising prices, and allow the BOJ to begin normalizing monetary policy.

With public discontent over rising prices hurting approval ratings, Prime Minister Fumio Kishida on Wednesday urged firms to offer wage hikes exceeding the rate of inflation. Then again, every Japanese prime minister had been urging firms to do just that for the past decade. They have yet to do so.

Just weeks after the BOJ shocked markets by expanding the permitted trading band under its Yield Curve Control policy, in the process unleashing a historic repricing of the JGB bond curve and forcing the BOJ to spend 16.2 trillion yen (to date) in ad hoc unlimited bond buys to defend the central bank’s new cap…

Oh. My. God. BoJ lifted the ceiling for 10-year JGB yield from 0.25 to 0.50% last month and here’s the result: it had to buy 16.2 trillion Yen in JGBs to defend the new cap. Exiting any peg – in this case a yield cap – is extremely costly. A warning for any yield cap proponents. pic.twitter.com/3HwjfBIKp3

— Robin Brooks (@RobinBrooksIIF) January 4, 2023

… the Bank of Japan is preparing for more surprise and overnight Reuters reported that the central bank is putting more emphasis on an inflation gauge that excludes fuel costs, and will likely raise its projections for the index’s growth in quarterly forecasts due this month, according to three sources familiar with its thinking.

The upgrade – which sparked a rally in JGBs overnight amid expectations that while the BOJ will tweak policy but avoid further YCC adjustments in its January meeting – would underscore the central bank’s growing conviction that robust domestic demand will allow firms to raise prices, and keep inflation sustainably around its 2% target in coming years, a critical level of Japan which has been mired in deflation for the past 40 years, and where the administration’s goal has long been to engineer rising wages, even if means unleashing a wage-price spiral (one of those “we will worry about it when we get it” things).

That said, the upward revision alone is unlikely to trigger an immediate interest rate rise, because many BOJ officials saw a need to scrutinize annual spring wage negotiations and the fallout from U.S. interest rate hikes.

“Price rises are broadening more than initially expected, a trend that could continue if wages rise enough,” one source said; while another added that “when stripping away one-off factors like government subsidies, trend inflation appears to be gaining momentum.”

Traditionally, the BOJ has used core consumer inflation, which excludes the effect of fresh food but includes energy costs, as a key gauge in producing forecasts and guiding policy. But in April it also began issuing forecasts for “core-core” consumer inflation, which strips away the effect of both fresh food and energy costs, to better grasp the broad price trend driven by domestic demand.

With government fuel subsidies and scheduled utility bill hikes muddling this year’s price outlook, the BOJ was now focusing more on the core-core index in determining whether Japan could achieve sustained price rises. And in fresh quarterly projections due this month, the BOJ would probably raise its core-core inflation forecasts for the current fiscal year ending in March and fiscal 2023, Reuters said. It might also slightly upgrade the forecast for fiscal 2024, depending on how the board viewed prospects for wage growth, the sources said.

But ultimately, it will be all about whether Japan can created sustained wage growth.

The upgrades, which would push the outlook for core-core inflation closer to the BOJ’s target, will likely keep alive market expectations the central bank will phase out its ultra-loose policy when Governor Haruhiko Kuroda’s second five-year term ends in April. In current forecasts, made in October, the board projected the average level of the core-core consumer price index this fiscal year will be 1.8% higher than in fiscal 2021. It expects fiscal 2023 and fiscal 2024 each to show rises in the index of 1.6%.

The BOJ will issue the quarterly forecasts after a two-day policy meeting that ends on Jan. 18.

Of course, surging raw material import costs have pushed headline inflation well above the BOJ’s 2% target in recent months, achieving what Kuroda’s decade-long stimulus efforts had failed to accomplish. At the same time, Kuroda has dismissed the chance of a near-term interest rate hike on the view the BOJ must keep supporting the economy until the current cost-push inflation turns into a demand-driven one accompanied by higher wages.

But Japan’s long-term interest rates have crept up since the BOJ stunned markets last month by widening the band around its 10-year bond yield target, a move investors saw as a prelude to a future rate hike. Core consumer prices in November rose 3.7% from a year earlier and analysts expect inflation to remain above the BOJ’s 2% in coming months, as companies continue to pass on higher costs to households.

Bottom line, analyst agree that wage growth will be key to whether Japan’s fragile economy can withstand the hit from rising prices, and allow the BOJ to begin normalizing monetary policy.

With public discontent over rising prices hurting approval ratings, Prime Minister Fumio Kishida on Wednesday urged firms to offer wage hikes exceeding the rate of inflation. Then again, every Japanese prime minister had been urging firms to do just that for the past decade. They have yet to do so.

Loading…