The high oil prices that roiled the U.S. economy in 2022, helping send inflation rates to levels not seen since the 1980s, also caused ripple effects by raising materials costs used to produce consumer goods across nearly every major American industry.

Energy costs are a major driver of inflation, which currently sits at 7.1%, according to the latest update to the consumer price index from the Bureau of Labor Statistics.

The price of oil is closely tied to fuel costs and transportation prices, which in turn feed into the prices of all goods and services that involve shipping or traveling. When oil and diesel prices skyrocketed in the months following Russia’s invasion of Ukraine, consumers also saw a parallel increase in prices for goods delivered by trucks, ships, or railroads.

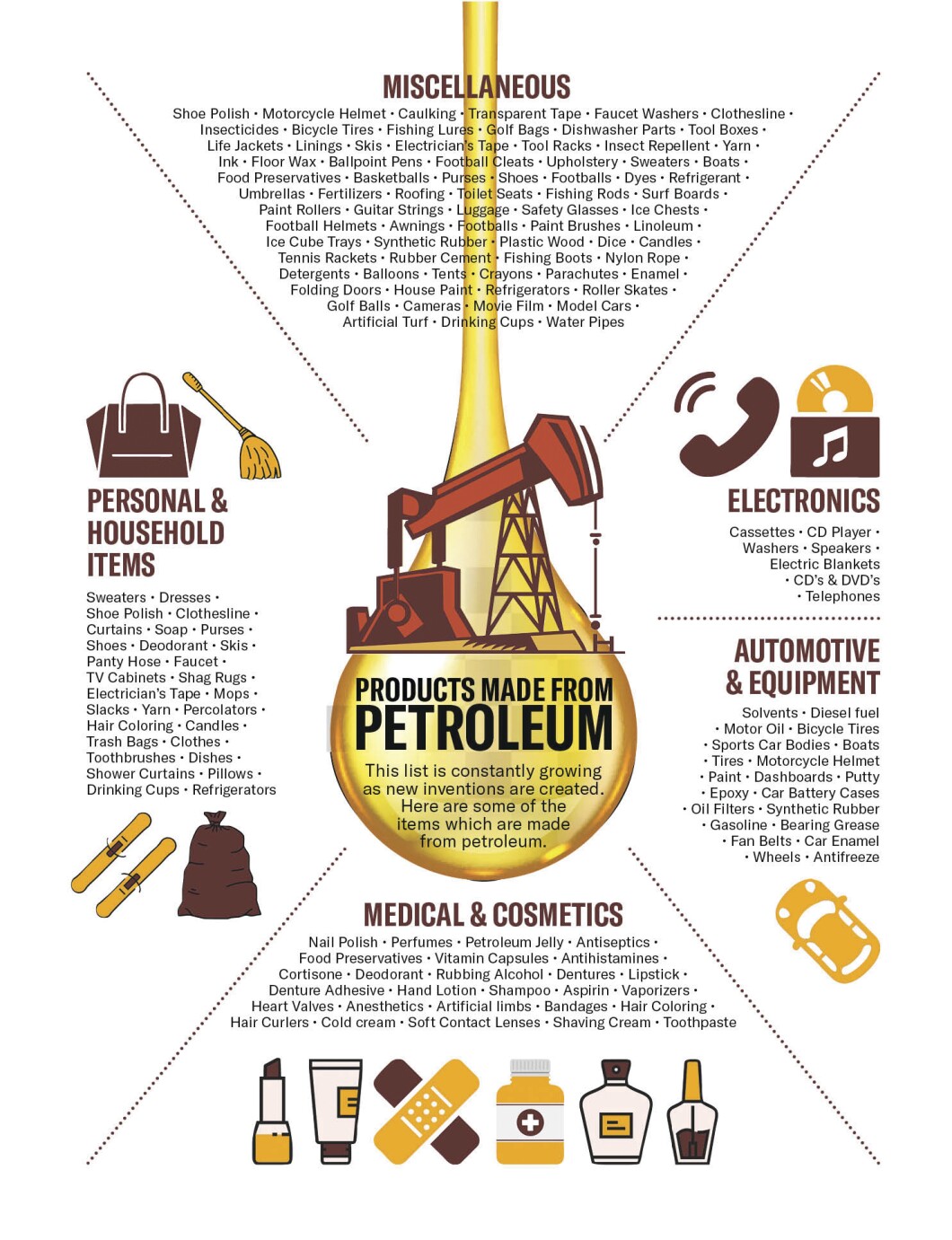

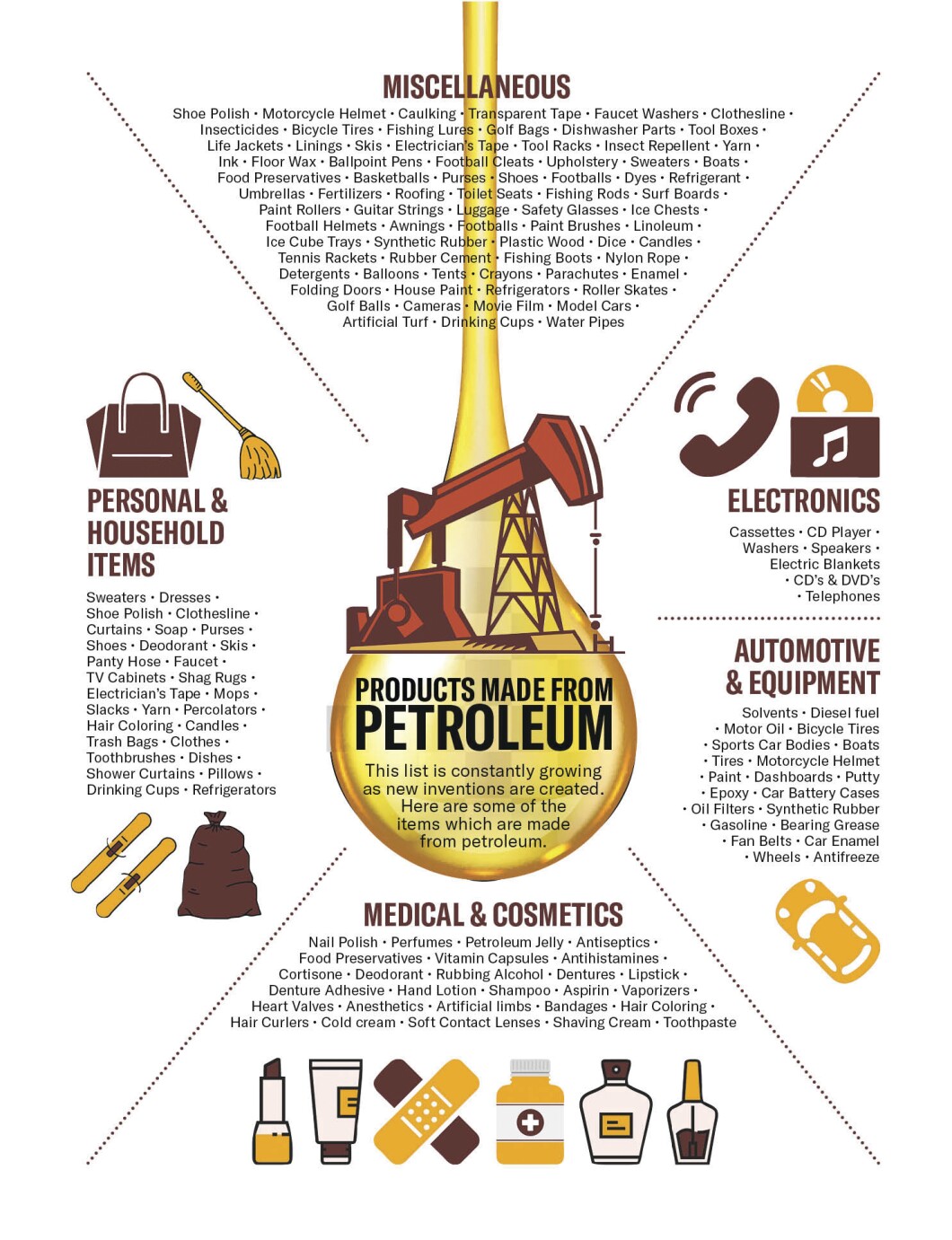

But petroleum derivatives also are used as material for many products in everyday use, including plastics, chemicals, and rubber products — colloquially referred to as the “Big 3” because of their high dependence on oil.

Therefore, any increase in oil prices is also reflected in the production costs of these products — price hikes that companies can then pass on to consumers to protect their own profit margins.

“When we think about our house, things like roofing shingles, heat, or any of those adhesives and pastes that you use have a hydrocarbon base,” said Andy Lipow, the chief strategist at Lipow Oil Associates. “Then we think about other consumer goods — nylon, polyester clothing, carpets … plastic bottles that you buy your water or soft drinks in.”

“All those things will go up in price” alongside another increase in petroleum costs, Lipow said.

As the oil industry likes to point out, its products are used in the creation of thousands of consumer products used every day.

These items include cosmetics, tires, and plastics — including the plastic packaging for nearly every product lining store shelves.

During the first five months of 2022, plastics prices increased between 10% to 15%, said Michael Greenberg, CEO of The Plastics Exchange, a market intelligence firm.

Though plastics prices have since abated compared to late 2021-early 2022 levels due to an increase in U.S. production as well as a slowdown in exports to China, Greenberg said he expects another supply-demand imbalance similar to last year by mid-2023.

Other items made with petroleum derivatives range from aspirin and artificial limbs to most clothes, cleaning products, and household construction materials.

The near ubiquity of such items put many companies in an unfortunate position last year as oil prices soared: Either shoulder the costs themselves and risk threatening their own bottom lines or pass the higher prices along to cash-strapped consumers. In the end, many opted for the latter.

For example, Procter & Gamble instructed retailers in late February to raise prices on Tide laundry detergent and Downy dryer sheets. It later added some personal healthcare products to the list in order to help protect its portfolio amid higher commodity and freight costs.

Lululemon, the high-end athleisure company, increased prices across 10% of its product line in June, citing high materials costs. (Lululemon is estimated to use petroleum-based materials in up to 75% of its clothing line.)

And Clorox raised consumer prices four separate times in 2022, an effort to offset higher materials prices and account for the higher costs of shipping and manufacturing.

Clorox raised prices on many of its products that relied most heavily on petroleum materials for production, including trash bags, bleach, and cleaning supplies.

During a third-quarter earnings call in May, Clorox CEO Linda Rendle acknowledged that its price hikes were steeper than originally anticipated but were ultimately necessary to protect its profit margins amid soaring commodities costs and inflation caused by the war in Ukraine.

There’s no specific rule of thumb as to how much of these add production costs companies pass on to consumers, analysts said — and some companies may opt not to raise prices at all.

And the price hikes from added materials costs only add to the other forms of cost pressures driven by higher oil prices and higher energy prices in general. Over the last 12 months, energy costs for U.S. consumers — a category that includes, for instance, home heating oil — increased by more than 33%, according to the Bureau of Labor Statistics.

These price hikes threaten to get even worse in the months ahead as analysts brace for another year of potential uncertainty and market volatility.

Though crude prices have eased slightly in recent weeks, some analysts expect this to be a short-lived trend, all but canceled out by looming geopolitical events — including a rebound in Chinese demand, as well as long-term volatility from Russia as it prepares to ban oil sales to all countries abiding by the oil price cap.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

By midyear, analysts expect oil prices for Brent crude, the international benchmark, to hit upward of $98-$100 per barrel. That’s not as high as last year, but it is expected to hurt nonetheless.