Hot on the heels of last Friday’s US payrolls report will be Thursday’s release of US December CPI inflation data. As previewed by Rabobank, the market is expecting the headline figure to moderate further to 6.5% y/y from 7.1% the previous month, with the core number also expected to ease from 6.0% to 5.7%. Bolstering the disinflation case, moments ago the latest Manheim used car index update came in at 219.3, down 14.9% from a year ago: "This was the largest annualized decline in the series’ history."

Another inflation-related data point will come from the University of Michigan survey on Friday, where the gauge of consumer inflation expectations will be in focus. Other US data releases will include consumer credit (DB forecast +$30.5B vs +$27.1 in October) today and the NFIB small business optimism index on Tuesday.

A smattering of Fed officials is scheduled to speak during the week, which will allow the market to assess the impact of the de-acceleration of earnings growth on policymakers’ respective policy outlooks.

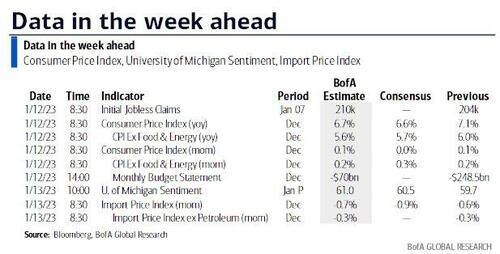

A summary of key US events this week:

Several ECB officials are also speaking during the week. Speculation regarding scope for a less aggressive policy stance has not just been reserved for the Fed. Last week’s softer Eurozone CPI inflation data had already ignited a debate about whether the ECB needs to maintain the ultra-hawkish tone on display at its December policy meeting.

Joining the fray this week will be BoE Governor Bailey. Two of the MPC last month would have favored leaving rates on hold. Insofar as the UK is already in a recession, which the Bank expects to last all year, investors have also started to debate the risks of a smaller than previously expected amount of policy tightening in the UK. The week ahead also brings UK monthly GDP data for November, which is expected to show a -0.3% m/m contraction. Monday is also expected to bring talks aimed at ended rail strikes, while yesterday PM Sunak indicated a willing to discuss pay rises for nurses, who have also been striking. However, press reports suggested that UK junior doctors could be balloted on strike action this week while the doctors’ union could open the possibility of strike action by NHS consultants. Further strikes by ambulance drivers have also been mooted. The news coincides with reports that UK ambulance wait times have hit a new record.

German November production data registered a softer than expected 0.2% m/m, with a downward revision to the previous month’s data. Later today Eurozone unemployment numbers are due for release. Tonight, Tokyo December CPI inflation will be watched in view of the ‘will they, won’t they’ debate leading up to the BoJ’s January 18 policy meeting. At the end of the week, Eurozone production data will be released. Corporate earnings season is due to start this week. This could present a test to the optimism injected by last week’s US jobs data.

Turning to earnings now and some of the largest American banks including JPMorgan, Citi and BofA will kick off the earnings season on Friday. We will also hear from BlackRock and UnitedHealth that day. The day before all eyes will be on results from TSMC as concerns over supply-demand dynamics and US-China tensions continue to weigh on the sector, with the Philadelphia semiconductor index down -35% in 2022.

Courtesy of DB, here is a day-by-day calendar of events

Monday January 9

- Data: US November consumer credit, Japan December Tokyo CPI, November household spending, Italy November unemployment rate, Germany November industrial production, France November trade balance, Eurozone November unemployment rate, Canada November building permits

- Central banks: Fed's Bostic speaks

- Earnings: Jefferies

Tuesday January 10

- Data: US December NFIB small business optimism, November wholesale trade sales, France November industrial and manufacturing production

- Central banks: Fed's Powell speaks, BoE's Bailey speaks, ECB's de Cos and Schnabel speak

- Earnings: Bed Bath & Beyond, Albertsons

Wednesday January 11

- Data: Japan December bank lending, November trade balance BoP basis, leading index, coincident index, Italy November retail sales

- Central banks: ECB's Holzmann and Vujcic speak

Thursday January 12

- Data: US December CPI, monthly budget statement, initial jobless claims, China December CPI, PPI, Japan December Economy Watchers survey, M2, M3, Germany November current account balance

- Central banks: Fed's Harker and Bullard speak, ECB's economic bulletin, consumer expectations survey

- Earnings: TSMC, Infosys

Friday January 13

- Data: US January University of Michigan consumer sentiment, December import price index, export price index, China December trade balance, UK November monthly GDP, trade balance, manufacturing production, industrial production, index of services, construction output, Italy November industrial production, Eurozone November trade balance, industrial production, Canada December existing home sales

- Earnings: JPMorgan Chase, Citi, Bank of America, Wells Fargo, BlackRock, UnitedHealth, Delta Air Lines

* * *

Finally, looking at just the US, Goldman notes that the main events are the CPI report on Thursday and the University of Michigan report on Friday. There are several speaking engagements from Fed officials, including remarks from Chair Powell, as well as presidents Bostic, Daly, Harker, and Bullard

Monday, January 9

- 12:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated discussion hosted by the Rotary Club of Atlanta. A Q&A with audience and media is expected. On January 6, Bostic said he would “be comfortable with either a 50 or a 25, and if I start to hear signs that the labor market is starting to ease a bit in terms of its tightness, then I might lean more in the 25 basis-point position.” He added that his 5.00-5.25% terminal rate projection is “the range I think we need to move to if the economy proceeds as I expect which is continual gradual slowdown” and that “we’re not going to be bouncing policy back and forth. We’re really going to let the restrictiveness hold.”

- 12:30 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a live interview with the Wall Street Journal. On December 16, Daly said, “We still have a long way to go. We are far away from our price stability goal.” She added that a 5% terminal rate is “a good starting point” and that “everybody has rates holding for 2023...I think 11 months...is a reasonable starting point. But I’m prepared to do more if more is required.”

Tuesday, January 10

- 06:00 AM NFIB small business optimism, December (consensus 91.5, last 91.9)

- 09:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will participate in a panel discussion on central bank independence at an event hosted by the Sveriges Riksbank in Stockholm, which will also be attended by Bank of England Governor Andrew Bailey, ECB Executive Board Member Isabel Schnabel, and others. The precise speaking time is still to be determined. Text and a moderated Q&A with the audience are expected. Last week, the December FOMC minutes noted that the committee would “continue to make decisions meeting by meeting,” leaving the FOMC’s options open for the size of rate hikes at coming meetings. We continue to expect the FOMC to slow the hiking pace to 25bp at the February meeting. “No” participants anticipated that it would be appropriate to reduce the funds rate this year, and participants welcomed the recent softening in inflation but stressed that “substantially more evidence” was required. At his December FOMC press conference, we saw Powell’s intention to “feel our way”to the appropriate policy rate as most consistent with our forecast of a stepdown in the pace to 25bp. Asked about the possibility of rate cuts next year, Chair Powell said that the FOMC will only cut when it is confident that inflation is moving down in a sustained way. We are doubtful that the inflation path that we forecast for next year would be enough to provide that confidence.

- 10:00 AM Wholesale inventories, November final (consensus +1.0%, last +1.0%)

Wednesday, January 11

- No major data releases scheduled.

Thursday, January 12

- 07:30 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook at an event hosted by the Main Line Chamber of Commerce. Text and a Q&A with the audience are expected. On November 15, Harker said, “In the upcoming months, in light of the cumulative tightening we have achieved, I expect we will slow the pace of our rate hikes as we approach a sufficiently restrictive stance...I expect we will hold at a restrictive rate for a while to let monetary policy do its work.” He added that he expects “core PCE inflation to come in around 4.8% in 2022, around 3.5% [in 2023], and 2.5% in 2024.”

- 08:30 AM CPI (mom), December (GS -0.06%, consensus +0.0%, last +0.1%); Core CPI (mom), December (GS +0.25%, consensus +0.3%, last +0.2%); CPI (yoy), December (GS +6.43%, consensus +6.5%, last +7.1%); Core CPI (yoy), December (GS +5.63%, consensus +5.7%, last +6.0%): We estimate a 0.25% increase in December core CPI (mom sa), which would lower the year-on-year rate by four tenths to 5.6%. Our forecast reflects a 1.6% decline in the used car category on the back of falling auction prices and a 0.5% decline in new car prices on rebounding incentives. We also assume a decline in apparel prices reflecting increased holiday promotionality and a 2% pullback in airfares on lower oil prices. We forecast a sequentially slower pace of shelter inflation (we estimate rent +0.67% and OER +0.64%) as weakness in new rental pricing begins to offset continued upward pressure on renewing leases. On the positive side, we assume another gain in the car insurance category, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.06% drop in headline CPI, reflecting lower gasoline but higher food prices.

- 08:30 AM Initial jobless claims, week ended January 7 (GS 210k, consensus 215k, last 204k); Continuing jobless claims, week ended December 31 (consensus 1,718k, last 1,694k): We estimate initial jobless claims increased to 210k in the week ended January 7.

- 11:30 AM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the economic outlook and monetary policy at a virtual event hosted by the Wisconsin Bankers Association. A Q&A with audience is expected. On January 5, Bullard said, “The policy rate is not yet in a zone that may be considered sufficiently restrictive, but it is getting closer.” In response to whether Bullard preferred a 50bp increase at the February FOMC meeting, he said, “The policy rate is still a little bit below the sufficiently restrictive zone, but I think it would behoove the committee to get into that zone as soon as we can without ignoring the data.”

Friday, January 13:

- 08:30 AM Import price index, December (consensus -0.9%, last -0.6%); Export price index, December (consensus -0.7%, last -0.3%)

- 10:00 AM University of Michigan consumer sentiment, January preliminary (GS 61.5, consensus 60.5, last 59.7); University of Michigan 5-10-year inflation expectations, January preliminary (GS 2.9%, consensus 2.9%, last 2.9%): We expect that the University of Michigan consumer sentiment index increased to 61.5 in the preliminary January report

Source: Rabobank, DB, Goldman, BofA

Hot on the heels of last Friday’s US payrolls report will be Thursday’s release of US December CPI inflation data. As previewed by Rabobank, the market is expecting the headline figure to moderate further to 6.5% y/y from 7.1% the previous month, with the core number also expected to ease from 6.0% to 5.7%. Bolstering the disinflation case, moments ago the latest Manheim used car index update came in at 219.3, down 14.9% from a year ago: “This was the largest annualized decline in the series’ history.”

Another inflation-related data point will come from the University of Michigan survey on Friday, where the gauge of consumer inflation expectations will be in focus. Other US data releases will include consumer credit (DB forecast +$30.5B vs +$27.1 in October) today and the NFIB small business optimism index on Tuesday.

A smattering of Fed officials is scheduled to speak during the week, which will allow the market to assess the impact of the de-acceleration of earnings growth on policymakers’ respective policy outlooks.

A summary of key US events this week:

Several ECB officials are also speaking during the week. Speculation regarding scope for a less aggressive policy stance has not just been reserved for the Fed. Last week’s softer Eurozone CPI inflation data had already ignited a debate about whether the ECB needs to maintain the ultra-hawkish tone on display at its December policy meeting.

Joining the fray this week will be BoE Governor Bailey. Two of the MPC last month would have favored leaving rates on hold. Insofar as the UK is already in a recession, which the Bank expects to last all year, investors have also started to debate the risks of a smaller than previously expected amount of policy tightening in the UK. The week ahead also brings UK monthly GDP data for November, which is expected to show a -0.3% m/m contraction. Monday is also expected to bring talks aimed at ended rail strikes, while yesterday PM Sunak indicated a willing to discuss pay rises for nurses, who have also been striking. However, press reports suggested that UK junior doctors could be balloted on strike action this week while the doctors’ union could open the possibility of strike action by NHS consultants. Further strikes by ambulance drivers have also been mooted. The news coincides with reports that UK ambulance wait times have hit a new record.

German November production data registered a softer than expected 0.2% m/m, with a downward revision to the previous month’s data. Later today Eurozone unemployment numbers are due for release. Tonight, Tokyo December CPI inflation will be watched in view of the ‘will they, won’t they’ debate leading up to the BoJ’s January 18 policy meeting. At the end of the week, Eurozone production data will be released. Corporate earnings season is due to start this week. This could present a test to the optimism injected by last week’s US jobs data.

Turning to earnings now and some of the largest American banks including JPMorgan, Citi and BofA will kick off the earnings season on Friday. We will also hear from BlackRock and UnitedHealth that day. The day before all eyes will be on results from TSMC as concerns over supply-demand dynamics and US-China tensions continue to weigh on the sector, with the Philadelphia semiconductor index down -35% in 2022.

Courtesy of DB, here is a day-by-day calendar of events

Monday January 9

- Data: US November consumer credit, Japan December Tokyo CPI, November household spending, Italy November unemployment rate, Germany November industrial production, France November trade balance, Eurozone November unemployment rate, Canada November building permits

- Central banks: Fed’s Bostic speaks

- Earnings: Jefferies

Tuesday January 10

- Data: US December NFIB small business optimism, November wholesale trade sales, France November industrial and manufacturing production

- Central banks: Fed’s Powell speaks, BoE’s Bailey speaks, ECB’s de Cos and Schnabel speak

- Earnings: Bed Bath & Beyond, Albertsons

Wednesday January 11

- Data: Japan December bank lending, November trade balance BoP basis, leading index, coincident index, Italy November retail sales

- Central banks: ECB’s Holzmann and Vujcic speak

Thursday January 12

- Data: US December CPI, monthly budget statement, initial jobless claims, China December CPI, PPI, Japan December Economy Watchers survey, M2, M3, Germany November current account balance

- Central banks: Fed’s Harker and Bullard speak, ECB’s economic bulletin, consumer expectations survey

- Earnings: TSMC, Infosys

Friday January 13

- Data: US January University of Michigan consumer sentiment, December import price index, export price index, China December trade balance, UK November monthly GDP, trade balance, manufacturing production, industrial production, index of services, construction output, Italy November industrial production, Eurozone November trade balance, industrial production, Canada December existing home sales

- Earnings: JPMorgan Chase, Citi, Bank of America, Wells Fargo, BlackRock, UnitedHealth, Delta Air Lines

* * *

Finally, looking at just the US, Goldman notes that the main events are the CPI report on Thursday and the University of Michigan report on Friday. There are several speaking engagements from Fed officials, including remarks from Chair Powell, as well as presidents Bostic, Daly, Harker, and Bullard

Monday, January 9

- 12:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated discussion hosted by the Rotary Club of Atlanta. A Q&A with audience and media is expected. On January 6, Bostic said he would “be comfortable with either a 50 or a 25, and if I start to hear signs that the labor market is starting to ease a bit in terms of its tightness, then I might lean more in the 25 basis-point position.” He added that his 5.00-5.25% terminal rate projection is “the range I think we need to move to if the economy proceeds as I expect which is continual gradual slowdown” and that “we’re not going to be bouncing policy back and forth. We’re really going to let the restrictiveness hold.”

- 12:30 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a live interview with the Wall Street Journal. On December 16, Daly said, “We still have a long way to go. We are far away from our price stability goal.” She added that a 5% terminal rate is “a good starting point” and that “everybody has rates holding for 2023…I think 11 months…is a reasonable starting point. But I’m prepared to do more if more is required.”

Tuesday, January 10

- 06:00 AM NFIB small business optimism, December (consensus 91.5, last 91.9)

- 09:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will participate in a panel discussion on central bank independence at an event hosted by the Sveriges Riksbank in Stockholm, which will also be attended by Bank of England Governor Andrew Bailey, ECB Executive Board Member Isabel Schnabel, and others. The precise speaking time is still to be determined. Text and a moderated Q&A with the audience are expected. Last week, the December FOMC minutes noted that the committee would “continue to make decisions meeting by meeting,” leaving the FOMC’s options open for the size of rate hikes at coming meetings. We continue to expect the FOMC to slow the hiking pace to 25bp at the February meeting. “No” participants anticipated that it would be appropriate to reduce the funds rate this year, and participants welcomed the recent softening in inflation but stressed that “substantially more evidence” was required. At his December FOMC press conference, we saw Powell’s intention to “feel our way”to the appropriate policy rate as most consistent with our forecast of a stepdown in the pace to 25bp. Asked about the possibility of rate cuts next year, Chair Powell said that the FOMC will only cut when it is confident that inflation is moving down in a sustained way. We are doubtful that the inflation path that we forecast for next year would be enough to provide that confidence.

- 10:00 AM Wholesale inventories, November final (consensus +1.0%, last +1.0%)

Wednesday, January 11

- No major data releases scheduled.

Thursday, January 12

- 07:30 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook at an event hosted by the Main Line Chamber of Commerce. Text and a Q&A with the audience are expected. On November 15, Harker said, “In the upcoming months, in light of the cumulative tightening we have achieved, I expect we will slow the pace of our rate hikes as we approach a sufficiently restrictive stance…I expect we will hold at a restrictive rate for a while to let monetary policy do its work.” He added that he expects “core PCE inflation to come in around 4.8% in 2022, around 3.5% [in 2023], and 2.5% in 2024.”

- 08:30 AM CPI (mom), December (GS -0.06%, consensus +0.0%, last +0.1%); Core CPI (mom), December (GS +0.25%, consensus +0.3%, last +0.2%); CPI (yoy), December (GS +6.43%, consensus +6.5%, last +7.1%); Core CPI (yoy), December (GS +5.63%, consensus +5.7%, last +6.0%): We estimate a 0.25% increase in December core CPI (mom sa), which would lower the year-on-year rate by four tenths to 5.6%. Our forecast reflects a 1.6% decline in the used car category on the back of falling auction prices and a 0.5% decline in new car prices on rebounding incentives. We also assume a decline in apparel prices reflecting increased holiday promotionality and a 2% pullback in airfares on lower oil prices. We forecast a sequentially slower pace of shelter inflation (we estimate rent +0.67% and OER +0.64%) as weakness in new rental pricing begins to offset continued upward pressure on renewing leases. On the positive side, we assume another gain in the car insurance category, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.06% drop in headline CPI, reflecting lower gasoline but higher food prices.

- 08:30 AM Initial jobless claims, week ended January 7 (GS 210k, consensus 215k, last 204k); Continuing jobless claims, week ended December 31 (consensus 1,718k, last 1,694k): We estimate initial jobless claims increased to 210k in the week ended January 7.

- 11:30 AM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the economic outlook and monetary policy at a virtual event hosted by the Wisconsin Bankers Association. A Q&A with audience is expected. On January 5, Bullard said, “The policy rate is not yet in a zone that may be considered sufficiently restrictive, but it is getting closer.” In response to whether Bullard preferred a 50bp increase at the February FOMC meeting, he said, “The policy rate is still a little bit below the sufficiently restrictive zone, but I think it would behoove the committee to get into that zone as soon as we can without ignoring the data.”

Friday, January 13:

- 08:30 AM Import price index, December (consensus -0.9%, last -0.6%); Export price index, December (consensus -0.7%, last -0.3%)

- 10:00 AM University of Michigan consumer sentiment, January preliminary (GS 61.5, consensus 60.5, last 59.7); University of Michigan 5-10-year inflation expectations, January preliminary (GS 2.9%, consensus 2.9%, last 2.9%): We expect that the University of Michigan consumer sentiment index increased to 61.5 in the preliminary January report

Source: Rabobank, DB, Goldman, BofA

Loading…