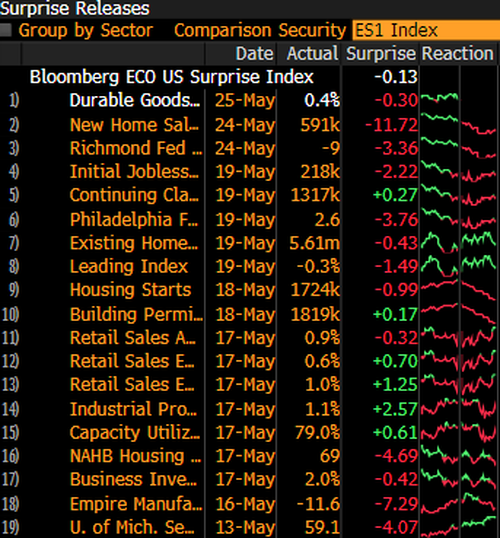

Another missed economic data point this morning (durable goods) just added to the misery of the US Macro Surprise Index which has plunged red to its weakest since Oct 2021...

Source: Bloomberg

And as Nomura's Charlie McElligott notes, this accelerating "miss" is coinciding with a market which was already obsessing on “hard-landing” recession risk due to the shock FCI-tightening of the Fed’s still relatively nascent policy pivot.

Look at the directional turn in categorized sectors of the economy since May 1 to today, particularly “Housing” and “Surveys” while also seeing a sign of a turn in “Labor”...

Of the last 19 major US economic data releases tracked as inputs to Bloomberg’s US Economic Surprise Index dating back to May 13th, 13 have “missed” to the downside versus expectations...

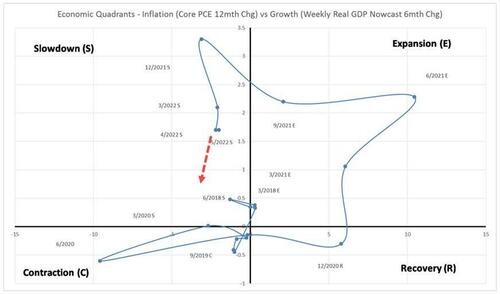

And it is this broad-based US weakening which is adding to the concern that added velocity to the “Recession / Contraction” fears this week, while Nomura's Economic Quadrant work risks a further “impulse” lower towards “Contraction” after this recent string of downside surprises...

Source: Nomura

And while we noted earlier that rate-hike expectations are fading modestly as stocks collapse...

McElligott warns that the market risks being disappointed by believing that there is a “pause” option looming, where instead, he warns:

"I think the Fed is simply biting-off 1 to 2 months of (weak) forward guidance at a time right now - again, remember also from Powell: '…there could be some pain involved in restoring price stability'..."

So perversely, the Nomura strategist thinks that if anything, the Fed is seeing the results of their FCI tightening campaign through these broad measures “slowing” and could actually become incrementally “emboldened” to keep PUSHING on their hiking path until the see the “whites of the eyes” of sustainably lower inflation...as opposed to the notion of “pausing and hoping” for the inflation data to move lower.

Additionally / separately, McElligott believes there is a substantial “head fake” risk into the Fed's preferred inflation measures this week (particularly Core PCE Deflator MoM on Friday), where even our "above Street" hawkish Fed outlook sees this April reading as a downside risk versus expectations... but we then see the next CPI read as an upside surprise potential (Mannheim picking back up, OER / Rent, Services broadening), which could absolutely whipsaw a Rates market where “shorts” are being stopped-out “real time”.

Today’s Fed Minutes could be a big deal on messaging (as the Nomura Econ Team notes):

The May FOMC meeting minutes are likely to indicate a robust discussion about how quickly, and how far, the Fed’s policy normalization should progress considering elevated inflation. While Chair Powell suggested at the press conference that the Committee was not “actively” considering 75bp hikes, his subsequent public comments suggest the Committee did not rule out such action. In addition, more FOMC participants have signaled a greater likelihood of taking rates beyond a 2.25-2.50% range, suggesting an early consensus may be forming for more restrictive policy. We will also be paying attention to comments related to forward guidance after Powell suggested any guidance beyond 60 or 90 days may not be useful.

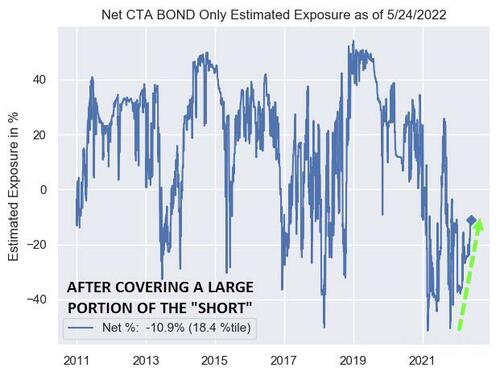

Back to the market, Nomura's cross-asset strategist notes that the grinding “stop-out” in hawkish / bearish UST and STIR trades (i.e. the Nomura QIS model estimating “short covering” of +$44.8B in G10 Bonds over the past 2w alone)...

Net CTA Bond Exposure at 18.4%ile

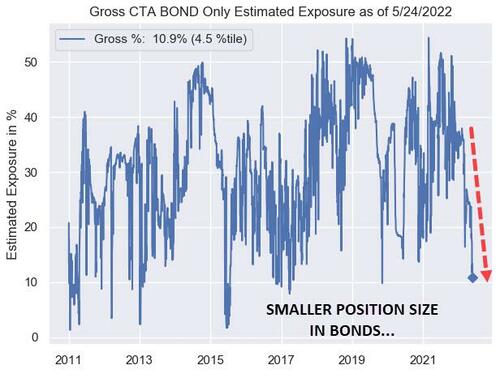

...has further contributed to deteriorating market liquidity now, as funds have reduced to low grosses- / nets- in the trade...

Gross CTA Bond Exposure at 4.5%ile since 2011

Simply put, the bond market is still significantly short, becoming drastically less liquid, and the growing perception that the (negative) economic response to Fed hawkishness is going to dictate an FOMC "downshift" is misplaced.

Another missed economic data point this morning (durable goods) just added to the misery of the US Macro Surprise Index which has plunged red to its weakest since Oct 2021…

Source: Bloomberg

And as Nomura’s Charlie McElligott notes, this accelerating “miss” is coinciding with a market which was already obsessing on “hard-landing” recession risk due to the shock FCI-tightening of the Fed’s still relatively nascent policy pivot.

Look at the directional turn in categorized sectors of the economy since May 1 to today, particularly “Housing” and “Surveys” while also seeing a sign of a turn in “Labor”…

Of the last 19 major US economic data releases tracked as inputs to Bloomberg’s US Economic Surprise Index dating back to May 13th, 13 have “missed” to the downside versus expectations…

And it is this broad-based US weakening which is adding to the concern that added velocity to the “Recession / Contraction” fears this week, while Nomura’s Economic Quadrant work risks a further “impulse” lower towards “Contraction” after this recent string of downside surprises…

Source: Nomura

And while we noted earlier that rate-hike expectations are fading modestly as stocks collapse…

McElligott warns that the market risks being disappointed by believing that there is a “pause” option looming, where instead, he warns:

“I think the Fed is simply biting-off 1 to 2 months of (weak) forward guidance at a time right now – again, remember also from Powell: ‘…there could be some pain involved in restoring price stability’…”

So perversely, the Nomura strategist thinks that if anything, the Fed is seeing the results of their FCI tightening campaign through these broad measures “slowing” and could actually become incrementally “emboldened” to keep PUSHING on their hiking path until the see the “whites of the eyes” of sustainably lower inflation…as opposed to the notion of “pausing and hoping” for the inflation data to move lower.

Additionally / separately, McElligott believes there is a substantial “head fake” risk into the Fed’s preferred inflation measures this week (particularly Core PCE Deflator MoM on Friday), where even our “above Street” hawkish Fed outlook sees this April reading as a downside risk versus expectations… but we then see the next CPI read as an upside surprise potential (Mannheim picking back up, OER / Rent, Services broadening), which could absolutely whipsaw a Rates market where “shorts” are being stopped-out “real time”.

Today’s Fed Minutes could be a big deal on messaging (as the Nomura Econ Team notes):

The May FOMC meeting minutes are likely to indicate a robust discussion about how quickly, and how far, the Fed’s policy normalization should progress considering elevated inflation. While Chair Powell suggested at the press conference that the Committee was not “actively” considering 75bp hikes, his subsequent public comments suggest the Committee did not rule out such action. In addition, more FOMC participants have signaled a greater likelihood of taking rates beyond a 2.25-2.50% range, suggesting an early consensus may be forming for more restrictive policy. We will also be paying attention to comments related to forward guidance after Powell suggested any guidance beyond 60 or 90 days may not be useful.

Back to the market, Nomura’s cross-asset strategist notes that the grinding “stop-out” in hawkish / bearish UST and STIR trades (i.e. the Nomura QIS model estimating “short covering” of +$44.8B in G10 Bonds over the past 2w alone)…

Net CTA Bond Exposure at 18.4%ile

…has further contributed to deteriorating market liquidity now, as funds have reduced to low grosses- / nets- in the trade…

Gross CTA Bond Exposure at 4.5%ile since 2011

Simply put, the bond market is still significantly short, becoming drastically less liquid, and the growing perception that the (negative) economic response to Fed hawkishness is going to dictate an FOMC “downshift” is misplaced.