While the yen has reversed all of its post-BOJ losses, following the "unexpected" announcement by Kuroda that the BOJ would not tweak its Yield Curve Control parameters for the 2nd month in a row despite leaking just last week that it would do just that...

... bond yields, both in the US and Japan have remained depressed trading near session, and today's dismal deflationary data, with big misses in PPI, retail sales and industrial production only helping yields slide even further.

So what exactly did the BOJ say to unleash such a dovish move? Well besides what we already noted last night, namely the unabashedly dovish twist in the central bank's decision not to pursue further YCC expansion and therefore to prop up yields, not to mention the BOJ decision to leave the key rate at minus 0.1% and the target for 10-year yields around 0%, the BOJ also announced a technical tweak to its loan program which according to analysts was seen as having a similar impact to policy easing.

But before we dig deeper, here is a recap of everything that happened at last night's Monetary Policy Meeting in which the BOJ decided to maintain the status quo across all key monetary policy parameters, including yield curve control (YCC), asset purchase programs, and forward guidance, courtesy of GS.

Conditions for Stable Achievement of the 2% Inflation Target

One of the key focuses for the latest MPM was reconfirmation of the conditions required to "stably and sustainably" meet the 2% inflation target. As widely expected, the BOJ's core CPI inflation forecasts call for inflation to remain close to 2% with rounding throughout the outlook period, with the risk stronger to the upside. Solely based on these, it would not be surprising if the BOJ judged that achievement of the long-awaited 2% inflation is "coming in sight," if not fully achieved.

At the press conference, Governor Kuroda stressed the need to maintain easing policy until the risks from economic downturn overseas have eased and wages start rising sufficiently, stating that the bulk of inflation in the current phase is cost-push inflation attributable to import prices, not a demand-pull inflation driven by significant wage growth, which Kuroda hopes to see. This basic stance is shared with the government, in our view. We expect some improvement in wages, as the 2023 shunto wage hike is likely to reflect recently high inflation, but we think wage growth will still be some way below the 3% rate that the BOJ believes is consistent with achieving its 2% inflation target.

Accordingly, from the point of view of macro fundamentals, the BOJ likely intends to maintain accommodative monetary conditions for a relatively long time.

* * *

Which brings us to the "technical tweak" discussed above, or as Goldman puts it, the continuation of YCC at least during Kuroda's tenure with the Introduction of "Additional Easing"

As Goldman's Naohiko Baba writes, another key point of the latest MPM is the BOJ's introduction of what can be effectively seen as an additional easing measure—in the form of extended funds-supply operations against pooled collateral—in an attempt to mitigate any yield curve distortions (a side effect of large-scale easing) by encouraging financial institutions to engage in arbitrage with higher-yielding cash bonds and swaps. This measure, as largely expected by Goldman and others, should be seen as a measure to buy time. After all, recall what we said yesterday, namely that "BOJ Is Less Than A Year Away From Running Out Of Bonds To Buy"

Furthermore, with the new BOJ leadership to be decided ahead of the next March MPM, which will be Kuroda's last, Goldman was confident the January MPM was likely to be the last opportunity to make any significant policy changes (the government will likely present nominees to the Diet on February 10, according to a January 17 Reuters report).

Taking all of the above into account, it appears that that Governor Kuroda is strongly committed to maintaining YCC through the end of his tenure. However, there is a problem, namely that...

Sustainability of YCC Still in Question

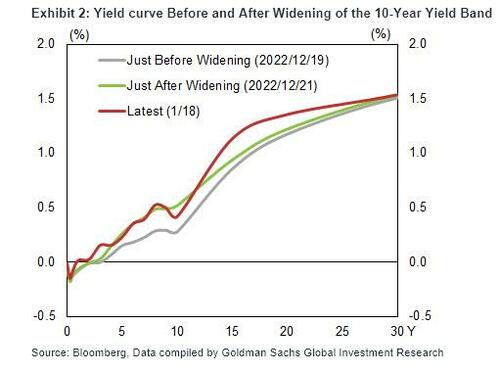

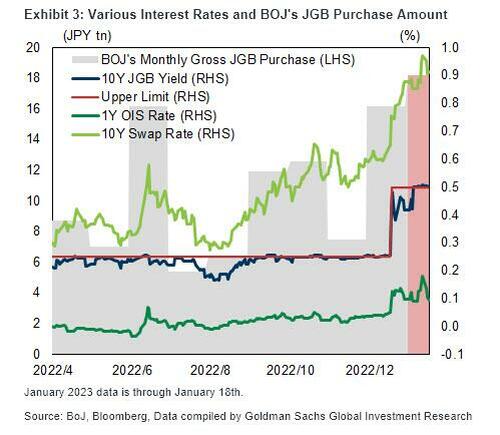

As shown below, the widening of the 10-year yield band in December only served to heighten market expectations for an exit from YCC and resulted in the BOJ having to increase its JGB purchases significantly in order to defend the 10-year yield's upper limit of 0.5%.

And while the 10-year yield moved below 0.5% following the BOJ's decision today to maintain YCC, how long that remains the case is open to question (spoiler alert: not long). Also, the above-mentioned extension, or technical tweak, of funds-supply operations offers no guarantees that market functioning will be meaningfully restored.

With these factors having raised the bar for maintaining YCC over the long term, one of the imminent tasks for the new BOJ leadership from April will be how to strike a proper balance between the desire to prolong YCC from a macro fundamentals standpoint and the sustainability of YCC. Unfortunately, there is no outcome where both outcomes are satisfied.

* * *

Finally, turning attention again to the altered loan program, we should point out that the BOJ altered a clause about its loan program, saying it will determine interest rates to encourage the formation of a yield curve that’s consistent with the guideline for market operations. And while the loan program was fixed at 0% previously, Kuroda said at the press briefing that a lending rate below zero isn’t ruled out.

Specifically, the BOJ can lead bond yields to desired levels by offering loans at these rates and letting financial companies buy bonds or enter swap contracts. BOJ said it will separately offer 5-year loans to financial companies, the longest term ever

According to Naka Matsuzawa, chief strategist at Nomura, this tweak to the loan program is so important that it’s equivalent to a policy change. The move "can be almost interpreted as strengthening policy easing", according to Nomura, and is why yields have stayed near session lows even as the yen rebounded hard.

While the yen has reversed all of its post-BOJ losses, following the “unexpected” announcement by Kuroda that the BOJ would not tweak its Yield Curve Control parameters for the 2nd month in a row despite leaking just last week that it would do just that…

… bond yields, both in the US and Japan have remained depressed trading near session, and today’s dismal deflationary data, with big misses in PPI, retail sales and industrial production only helping yields slide even further.

So what exactly did the BOJ say to unleash such a dovish move? Well besides what we already noted last night, namely the unabashedly dovish twist in the central bank’s decision not to pursue further YCC expansion and therefore to prop up yields, not to mention the BOJ decision to leave the key rate at minus 0.1% and the target for 10-year yields around 0%, the BOJ also announced a technical tweak to its loan program which according to analysts was seen as having a similar impact to policy easing.

But before we dig deeper, here is a recap of everything that happened at last night’s Monetary Policy Meeting in which the BOJ decided to maintain the status quo across all key monetary policy parameters, including yield curve control (YCC), asset purchase programs, and forward guidance, courtesy of GS.

Conditions for Stable Achievement of the 2% Inflation Target

One of the key focuses for the latest MPM was reconfirmation of the conditions required to “stably and sustainably” meet the 2% inflation target. As widely expected, the BOJ’s core CPI inflation forecasts call for inflation to remain close to 2% with rounding throughout the outlook period, with the risk stronger to the upside. Solely based on these, it would not be surprising if the BOJ judged that achievement of the long-awaited 2% inflation is “coming in sight,” if not fully achieved.

At the press conference, Governor Kuroda stressed the need to maintain easing policy until the risks from economic downturn overseas have eased and wages start rising sufficiently, stating that the bulk of inflation in the current phase is cost-push inflation attributable to import prices, not a demand-pull inflation driven by significant wage growth, which Kuroda hopes to see. This basic stance is shared with the government, in our view. We expect some improvement in wages, as the 2023 shunto wage hike is likely to reflect recently high inflation, but we think wage growth will still be some way below the 3% rate that the BOJ believes is consistent with achieving its 2% inflation target.

Accordingly, from the point of view of macro fundamentals, the BOJ likely intends to maintain accommodative monetary conditions for a relatively long time.

* * *

Which brings us to the “technical tweak” discussed above, or as Goldman puts it, the continuation of YCC at least during Kuroda’s tenure with the Introduction of “Additional Easing”

As Goldman’s Naohiko Baba writes, another key point of the latest MPM is the BOJ’s introduction of what can be effectively seen as an additional easing measure—in the form of extended funds-supply operations against pooled collateral—in an attempt to mitigate any yield curve distortions (a side effect of large-scale easing) by encouraging financial institutions to engage in arbitrage with higher-yielding cash bonds and swaps. This measure, as largely expected by Goldman and others, should be seen as a measure to buy time. After all, recall what we said yesterday, namely that “BOJ Is Less Than A Year Away From Running Out Of Bonds To Buy”

Furthermore, with the new BOJ leadership to be decided ahead of the next March MPM, which will be Kuroda’s last, Goldman was confident the January MPM was likely to be the last opportunity to make any significant policy changes (the government will likely present nominees to the Diet on February 10, according to a January 17 Reuters report).

Taking all of the above into account, it appears that that Governor Kuroda is strongly committed to maintaining YCC through the end of his tenure. However, there is a problem, namely that…

Sustainability of YCC Still in Question

As shown below, the widening of the 10-year yield band in December only served to heighten market expectations for an exit from YCC and resulted in the BOJ having to increase its JGB purchases significantly in order to defend the 10-year yield’s upper limit of 0.5%.

And while the 10-year yield moved below 0.5% following the BOJ’s decision today to maintain YCC, how long that remains the case is open to question (spoiler alert: not long). Also, the above-mentioned extension, or technical tweak, of funds-supply operations offers no guarantees that market functioning will be meaningfully restored.

With these factors having raised the bar for maintaining YCC over the long term, one of the imminent tasks for the new BOJ leadership from April will be how to strike a proper balance between the desire to prolong YCC from a macro fundamentals standpoint and the sustainability of YCC. Unfortunately, there is no outcome where both outcomes are satisfied.

* * *

Finally, turning attention again to the altered loan program, we should point out that the BOJ altered a clause about its loan program, saying it will determine interest rates to encourage the formation of a yield curve that’s consistent with the guideline for market operations. And while the loan program was fixed at 0% previously, Kuroda said at the press briefing that a lending rate below zero isn’t ruled out.

Specifically, the BOJ can lead bond yields to desired levels by offering loans at these rates and letting financial companies buy bonds or enter swap contracts. BOJ said it will separately offer 5-year loans to financial companies, the longest term ever

According to Naka Matsuzawa, chief strategist at Nomura, this tweak to the loan program is so important that it’s equivalent to a policy change. The move “can be almost interpreted as strengthening policy easing”, according to Nomura, and is why yields have stayed near session lows even as the yen rebounded hard.

Loading…