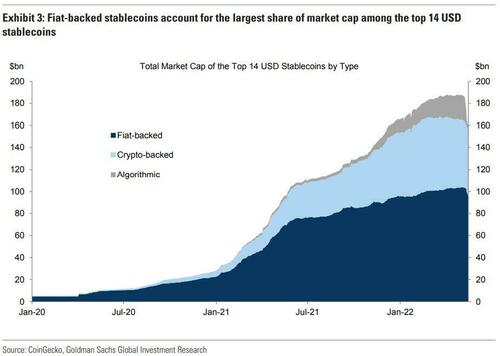

As we detailed previously, the collapse of the Terra USD and the Luna token, within a year of the collapse of Iron Finance and the TITAN token, once again brought out the obituaries for crypto broadly, and raised the FUD over the stabilisation mechanisms of stablecoins (most specifically 'algorithmic' style). As a reminder, we can classify stablecoins into three broad categories: fiat-backed, crypto-backed, and algorithmic.

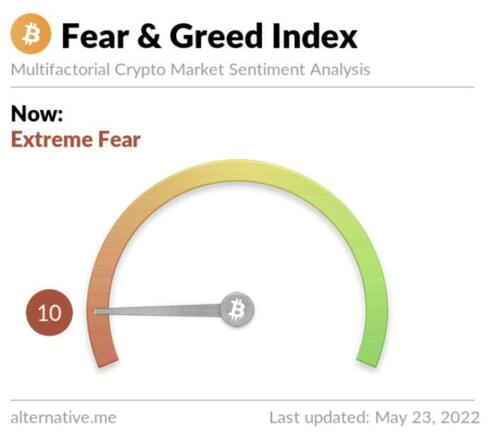

It has also soured sentiment among crypto investors...

As JPMorgan's Nikolaos Panigirtzoglou notes in his latest report, most flow and positioning metrics also turned very negative.

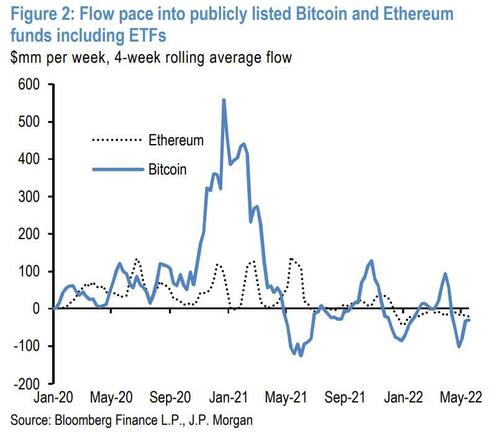

The chart below shows the 4-week rolling flow into bitcoin and ethereum publicly traded funds. These funds capture a significant component of the institutional impulse as many institutional investors are either not willing or not permitted to invest directly in crypto assets via digital wallets.

In the fund space bitcoin funds including ETFs saw the largest outflow since May 2021.

The crypto fund flow impulse has been normalizing over the past year after peaking at the beginning of 2021 and has been mostly negative this year.

In the futures space, JPM's position proxy for CME bitcoin futures is approaching oversold territory. The equivalent indicator for ethereum has also declined to below neutral...

These flow and positioning metrics, Panigirtzoglou suggests, provides a good entry point for long term investors.

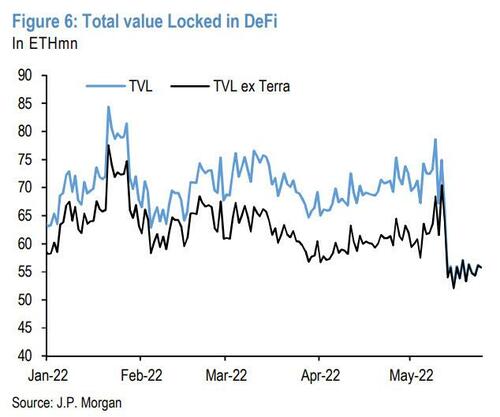

The JPM strategist also notes that, thus far, however, there seems to have been relatively limited spillovers to other stablecoins and the Total Value Locked in DeFi projects beyond Terra appears to have been relatively resilient.

Panigirtzoglou concludes by noting that the past month’s crypto market correction looks more like capitulation relative to last January/February and going forward JPM sees upside for bitcoin and crypto markets more generally.

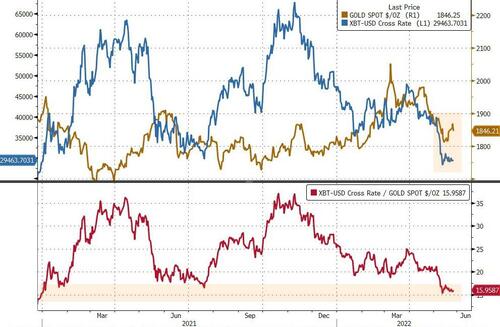

Our previous projection that the bitcoin-to-gold vol ratio will settle to around 4x this year stills holds...

Our fair value for bitcoin based on a volatility-ratio of bitcoin-to-gold of around 4x would be $38k significantly above its current price.

Additionally, JPMorgan's bullish stance is reinforced by Glassnode's MVRZ Z-Score, which assesses when Bitcoin is undervalued/overvalued based on its "fair value", and is nearing the green zone that had preceded the crypto's massive rebound rallies, as shown in the chart below...

JPMorgan reiterates four reasons behind the emergence of crypto as an alternate institutional asset class.

-

First, the pandemic by inducing unconventional monetary policies and by boosting money supply created additional demand for an “alternative” currency. After the Lehman crisis, the role of an “alternative” currency was played by gold. After the virus crisis, this role was played by both bitcoin and gold.

-

Second, the fact that bitcoin and cryptocurrencies survived the long winter of 2018/2019 and their market value did not go down to zero as many crypto critics were predicting at the time, increased confidence among institutional investors that there is enough residual demand ascribing value to cryptocurrencies.

-

Third, the corporate sponsorship of bitcoin that started emerging in the summer of 2020 with Microstrategy, Square, PayPal, Tesla further boosted institutional investors’ confidence into bitcoin and other cryptocurrencies.

-

Fourth, the pandemic accelerated the shift towards digitization and cryptocurrencies are expanding in tandem with the adoption of Distributed Ledger Technology (DLT) as they represent the fuel for powering DLT networks.

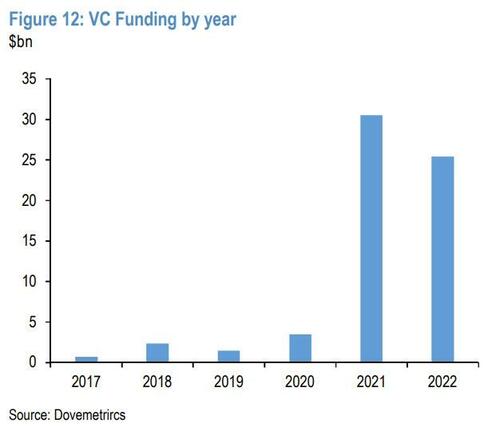

Going forward Panigirtzoglou believes that the trajectory for VC funding would be crucial in helping the crypto market to avoid the long winter of 2018/2019. If VC funding dries up from here as a result of the loss of confidence from the collapse of Terra’s ecosystem, then a return to the long winter of 2018/2019 would look more likely for crypto markets.

Thus far there is little evidence of VC funding drying up post Terra’s collapse.

Of the $25bn VC funding YTD, almost $4bn came after Terra. Panigirtzoglou ends on a positive note, saying that "our best guess is the VC funding will continue and a long winter similar to 2018/2019 would be averted."

On the same day, major venture capitalist Andreessen Horowitz announced the closing of its fourth cryptocurrency fund at $4.5 billion. Also on Wednesday, crypto-focused venture firm NGC Ventures launched its third blockchain fund with $100 million raised from investors that included Babel Finance, Huobi Ventures and Nexo Ventures.

As we detailed previously, the collapse of the Terra USD and the Luna token, within a year of the collapse of Iron Finance and the TITAN token, once again brought out the obituaries for crypto broadly, and raised the FUD over the stabilisation mechanisms of stablecoins (most specifically ‘algorithmic’ style). As a reminder, we can classify stablecoins into three broad categories: fiat-backed, crypto-backed, and algorithmic.

It has also soured sentiment among crypto investors…

As JPMorgan’s Nikolaos Panigirtzoglou notes in his latest report, most flow and positioning metrics also turned very negative.

The chart below shows the 4-week rolling flow into bitcoin and ethereum publicly traded funds. These funds capture a significant component of the institutional impulse as many institutional investors are either not willing or not permitted to invest directly in crypto assets via digital wallets.

In the fund space bitcoin funds including ETFs saw the largest outflow since May 2021.

The crypto fund flow impulse has been normalizing over the past year after peaking at the beginning of 2021 and has been mostly negative this year.

In the futures space, JPM’s position proxy for CME bitcoin futures is approaching oversold territory. The equivalent indicator for ethereum has also declined to below neutral…

These flow and positioning metrics, Panigirtzoglou suggests, provides a good entry point for long term investors.

The JPM strategist also notes that, thus far, however, there seems to have been relatively limited spillovers to other stablecoins and the Total Value Locked in DeFi projects beyond Terra appears to have been relatively resilient.

Panigirtzoglou concludes by noting that the past month’s crypto market correction looks more like capitulation relative to last January/February and going forward JPM sees upside for bitcoin and crypto markets more generally.

Our previous projection that the bitcoin-to-gold vol ratio will settle to around 4x this year stills holds…

Our fair value for bitcoin based on a volatility-ratio of bitcoin-to-gold of around 4x would be $38k significantly above its current price.

Additionally, JPMorgan’s bullish stance is reinforced by Glassnode’s MVRZ Z-Score, which assesses when Bitcoin is undervalued/overvalued based on its “fair value”, and is nearing the green zone that had preceded the crypto’s massive rebound rallies, as shown in the chart below…

JPMorgan reiterates four reasons behind the emergence of crypto as an alternate institutional asset class.

-

First, the pandemic by inducing unconventional monetary policies and by boosting money supply created additional demand for an “alternative” currency. After the Lehman crisis, the role of an “alternative” currency was played by gold. After the virus crisis, this role was played by both bitcoin and gold.

-

Second, the fact that bitcoin and cryptocurrencies survived the long winter of 2018/2019 and their market value did not go down to zero as many crypto critics were predicting at the time, increased confidence among institutional investors that there is enough residual demand ascribing value to cryptocurrencies.

-

Third, the corporate sponsorship of bitcoin that started emerging in the summer of 2020 with Microstrategy, Square, PayPal, Tesla further boosted institutional investors’ confidence into bitcoin and other cryptocurrencies.

-

Fourth, the pandemic accelerated the shift towards digitization and cryptocurrencies are expanding in tandem with the adoption of Distributed Ledger Technology (DLT) as they represent the fuel for powering DLT networks.

Going forward Panigirtzoglou believes that the trajectory for VC funding would be crucial in helping the crypto market to avoid the long winter of 2018/2019. If VC funding dries up from here as a result of the loss of confidence from the collapse of Terra’s ecosystem, then a return to the long winter of 2018/2019 would look more likely for crypto markets.

Thus far there is little evidence of VC funding drying up post Terra’s collapse.

Of the $25bn VC funding YTD, almost $4bn came after Terra. Panigirtzoglou ends on a positive note, saying that “our best guess is the VC funding will continue and a long winter similar to 2018/2019 would be averted.”

On the same day, major venture capitalist Andreessen Horowitz announced the closing of its fourth cryptocurrency fund at $4.5 billion. Also on Wednesday, crypto-focused venture firm NGC Ventures launched its third blockchain fund with $100 million raised from investors that included Babel Finance, Huobi Ventures and Nexo Ventures.