Oil prices drifted sideways to modestly lower overnight after the notable builds reported by API, as mixed company earnings and weaker business activity spurred concerns about the US economy

While there’s expectation that China’s oil demand will rise after it ditched restrictive Covid rules, there’s still uncertainty about the strength of the rebound.

“After Brent found some resistance just ahead of the $90 mark yesterday, it looks like the market is taking a breather after the rally on Chinese demand optimism,” said Ole Sloth Hansen, head of commodities research at Standard Chartered.

“Products seem to have settled after cracks surged earlier in the week, which had also helped drive crude up. The market will be watching Cushing inventories, due to rising inventories widening the WTI-Brent spread.”

With API drains having stalled, commercial crude stockpiles have swelled by more than 27 million barrels in the prior two weeks. Today's official data

API

-

Crude +3.378mm

-

Cushing +3.928mm - biggest build since April 2020

-

Gasoline +620k

-

Distillates -1.929mm

DOE

-

Crude +533k

-

Cushing +4.267mm - biggest build since April 2020

-

Gasoline +1.763mm

-

Distillates -507k

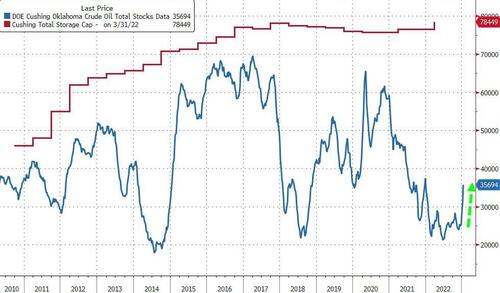

US crude inventories built for a 5th straight week, but only a small 533k barrels (well below API and expectations). However, Cushing stocks soared 4.267mm barrels last week - the biggest build since April 2020 (up 4 weeks in a row). Distillates stocks drew down for the 4th week in a row...

Source: Bloomberg

Total US crude stocks are at their highest since June 2021...

Source: Bloomberg

Cushing stocks are soaring, now at its highest since Dec 2021...

Source: Bloomberg

After a significant drop in the US oil rig count last week, US Crude production remained flat at 12.2mm b/d... we would expect it to fade given the lead from the rig count...

Source: Bloomberg

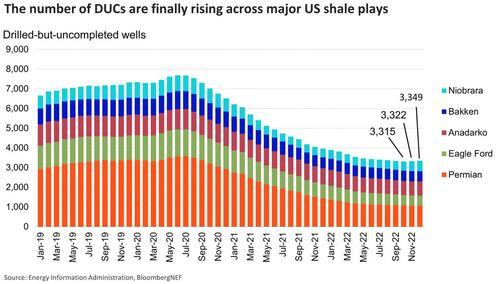

Notably Bloomberg has seen a change in trend? After years of drawing down inventory of drilled-but-uncompleted (DUC) wells, US oil producers have been increasing DUCs in the past two months.

Oil companies require a minimum number of these to optimize their field operations. However, drawing down DUC inventory lets them avoid incurring drilling costs -- which would otherwise push up capital expenditures. If they need to rebuild DUC inventory, it would add to their 2023 capex and weigh on cash flows. However, it would benefit oilfield-service companies by increasing service intensities.

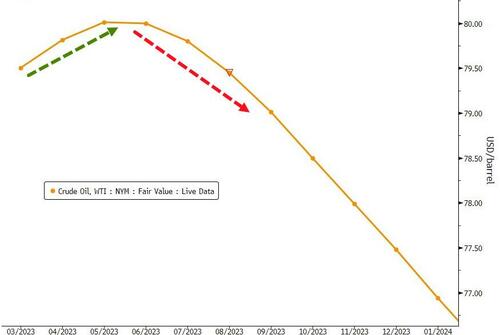

WTI was trading around $79.80 ahead of the official data and rallied on the smaller than expected crude build...

Finally, we note that the unusually large builds we are seeing in Crude (and at Cushing) are due to the contango in the WTI market makes it more attractive to put US crude in storage rather than on the water, and the current pricing structure shows the situation may last until the second half of 2023. As FGE wrote in a note today, contango - where near-term futures are cheaper than those for a later date - combined with the end of SPR releases, has driven down US crude exports in January by about 500k b/d from levels seen in December.

Current pricing shows WTI in contango until mid-2Q, continuing the incentive to store crude rather than export it.

Forward curve shows US crudes returning to backwardation in 3Q, which would remove the incentive to store, but “this is likely a function of the market pricing in higher US crude runs, rather than anticipating a pull on US crudes from outside of the region.”

All of which is leading to higher 'raw material prices'... and that means higher gas prices at the pump...

Get back to work Mr.Biden!

Oil prices drifted sideways to modestly lower overnight after the notable builds reported by API, as mixed company earnings and weaker business activity spurred concerns about the US economy

While there’s expectation that China’s oil demand will rise after it ditched restrictive Covid rules, there’s still uncertainty about the strength of the rebound.

“After Brent found some resistance just ahead of the $90 mark yesterday, it looks like the market is taking a breather after the rally on Chinese demand optimism,” said Ole Sloth Hansen, head of commodities research at Standard Chartered.

“Products seem to have settled after cracks surged earlier in the week, which had also helped drive crude up. The market will be watching Cushing inventories, due to rising inventories widening the WTI-Brent spread.”

With API drains having stalled, commercial crude stockpiles have swelled by more than 27 million barrels in the prior two weeks. Today’s official data

API

DOE

US crude inventories built for a 5th straight week, but only a small 533k barrels (well below API and expectations). However, Cushing stocks soared 4.267mm barrels last week – the biggest build since April 2020 (up 4 weeks in a row). Distillates stocks drew down for the 4th week in a row…

Source: Bloomberg

Total US crude stocks are at their highest since June 2021…

Source: Bloomberg

Cushing stocks are soaring, now at its highest since Dec 2021…

Source: Bloomberg

After a significant drop in the US oil rig count last week, US Crude production remained flat at 12.2mm b/d… we would expect it to fade given the lead from the rig count…

Source: Bloomberg

Notably Bloomberg has seen a change in trend? After years of drawing down inventory of drilled-but-uncompleted (DUC) wells, US oil producers have been increasing DUCs in the past two months.

Oil companies require a minimum number of these to optimize their field operations. However, drawing down DUC inventory lets them avoid incurring drilling costs — which would otherwise push up capital expenditures. If they need to rebuild DUC inventory, it would add to their 2023 capex and weigh on cash flows. However, it would benefit oilfield-service companies by increasing service intensities.

WTI was trading around $79.80 ahead of the official data and rallied on the smaller than expected crude build…

Finally, we note that the unusually large builds we are seeing in Crude (and at Cushing) are due to the contango in the WTI market makes it more attractive to put US crude in storage rather than on the water, and the current pricing structure shows the situation may last until the second half of 2023. As FGE wrote in a note today, contango – where near-term futures are cheaper than those for a later date – combined with the end of SPR releases, has driven down US crude exports in January by about 500k b/d from levels seen in December.

Current pricing shows WTI in contango until mid-2Q, continuing the incentive to store crude rather than export it.

Forward curve shows US crudes returning to backwardation in 3Q, which would remove the incentive to store, but “this is likely a function of the market pricing in higher US crude runs, rather than anticipating a pull on US crudes from outside of the region.”

All of which is leading to higher ‘raw material prices’… and that means higher gas prices at the pump…

Get back to work Mr.Biden!

Loading…