By Ryan Fitzmaurice of Marex

As many traders would agree, sometimes it’s not the data that is important but rather the price reaction to the data. We believe this is the case with oil prices recently. Looking at US inventory statistics, crude oil stocks have built by an incredible +27mb over the past two reports, yet oil prices have rallied more than 10% over the same timeframe in a classic case of sell the rumor, buy the fact. As for the sharp rise in US crude inventories, it’s not as if oil fundamentals have shifted on a dime, but rather it’s the result of the extreme cold weather that ravaged the US energy corridor in late December. The cold forced several major US refineries to shut down due to operational issues related to the freezing temperatures. Additionally, end of year tax on inventory in Texas and Louisiana caused oil imports to come onshore in early January.

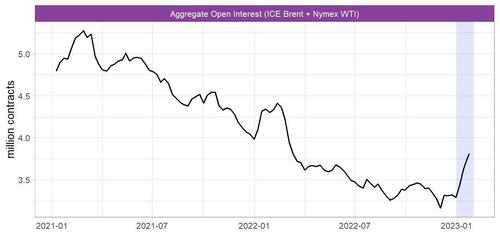

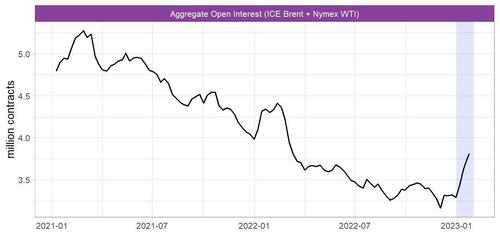

So, despite what seems to be very bearish data points, the oil market appears focused on China’s abrupt reopening plans and the improving macro backdrop as opposed to backward looking inventory that was impacted by weather. In fact, the spot Brent contract is now trading in the mid to high $80s and above many moving averages. The oil rally has also coincided with a notable increase in futures open interest and managed money buying. The combined aggregate futures open interest for ICE Brent and Nymex WTI has climbed by +440mb since the start of the year while the net managed money position has increased by +68mb since last Tuesday, the latest reporting period for the CFTC positioning data. Also, about half of the net buying has come from “short”covering due to the big shift in momentum the past two weeks.

Mixed Signals

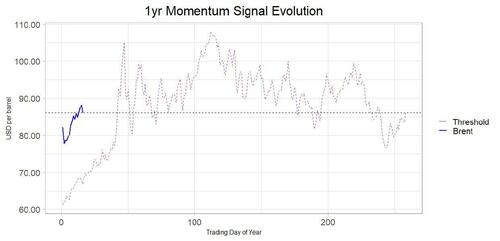

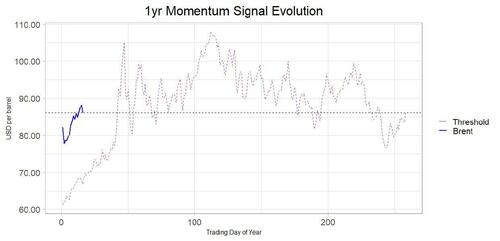

Last week we discussed momentum traders, and how their herd-like behavior can impact oil prices at times. Today we want to expand on that topic while discussing the impact the war in Ukraine has had on the momentum factor. To reiterate our point from last week, momentum is a very simple and straight forward trading strategy, buying commodities or assets with positive returns and selling those with negative returns over a pre-defined timeframe. For example, the one-year momentum signal tends to be a popular long-term indicator that measures the roll-adjusted return of the past year. Given we are dealing with historical prices, it is possible to look at the price development of the prior year to formulate a roadmap of how this key hurdle will change with time. It is worth noting that roll-adjustments will alter the momentum indicator somewhat, with contango increasing the signal threshold over time while backwardation decreases it.

With that in mind, we are all aware of how erratic oil prices were last year, and particularly in the early stages of the Russian invasion of Ukraine in late February. In fact, spot Brent prices spiked from below $80 at the start of 2022 to more than $135 by early March. This is important to remember because the huge spike in oil prices is going to make for an increasingly higher bar with respect to the one-year momentum signal as we approach the anniversary of the start of the war. Importantly, the forward curves shifted into a strong state of backwardation for several months after the price spike, which has worked to lower this key hurdle, but the current contango could work to offset that in the coming months should it hold. On the flip side, the weak price action more recently could make for a low bar with respect to shorter-term signals. As a result, mixed oil momentum signals are likely to persist until the impact from the war fades.

Thinking Ahead

Oil prices are now higher on the year after a very sharp decline the first week of January and despite some sizable US inventory builds. Notably, open interest has also increased alongside prices as new money enters the fray. So far, there has been little in the way of commodity index inflows this year, however, one would assume “long-only” investor dollars are likely to be chasing oil prices given the past two years of stellar returns. This group of institutional investors should gain more influence as the war-inspired volatility begins to filter out of risk models, allowing for increased position sizes. This dynamic should become more apparent in 2H23 though.

Fundamentally, all eyes remain on the Chinese reopening and its potential demand implications for this year. As we have been highlighting recently, Chinese crude imports already climbed to more than 11mb/d in November and December, even before the abrupt pandemic policy reversal took place. This supports the notion that China will likely need record oil imports this year to meet its refining demand. In addition, we believe the US will also need to increase crude imports this year to fill the void left by the cessation of SPR releases and as the US refining system bounces back from the cold related outages.

By Ryan Fitzmaurice of Marex

As many traders would agree, sometimes it’s not the data that is important but rather the price reaction to the data. We believe this is the case with oil prices recently. Looking at US inventory statistics, crude oil stocks have built by an incredible +27mb over the past two reports, yet oil prices have rallied more than 10% over the same timeframe in a classic case of sell the rumor, buy the fact. As for the sharp rise in US crude inventories, it’s not as if oil fundamentals have shifted on a dime, but rather it’s the result of the extreme cold weather that ravaged the US energy corridor in late December. The cold forced several major US refineries to shut down due to operational issues related to the freezing temperatures. Additionally, end of year tax on inventory in Texas and Louisiana caused oil imports to come onshore in early January.

So, despite what seems to be very bearish data points, the oil market appears focused on China’s abrupt reopening plans and the improving macro backdrop as opposed to backward looking inventory that was impacted by weather. In fact, the spot Brent contract is now trading in the mid to high $80s and above many moving averages. The oil rally has also coincided with a notable increase in futures open interest and managed money buying. The combined aggregate futures open interest for ICE Brent and Nymex WTI has climbed by +440mb since the start of the year while the net managed money position has increased by +68mb since last Tuesday, the latest reporting period for the CFTC positioning data. Also, about half of the net buying has come from “short”covering due to the big shift in momentum the past two weeks.

Mixed Signals

Last week we discussed momentum traders, and how their herd-like behavior can impact oil prices at times. Today we want to expand on that topic while discussing the impact the war in Ukraine has had on the momentum factor. To reiterate our point from last week, momentum is a very simple and straight forward trading strategy, buying commodities or assets with positive returns and selling those with negative returns over a pre-defined timeframe. For example, the one-year momentum signal tends to be a popular long-term indicator that measures the roll-adjusted return of the past year. Given we are dealing with historical prices, it is possible to look at the price development of the prior year to formulate a roadmap of how this key hurdle will change with time. It is worth noting that roll-adjustments will alter the momentum indicator somewhat, with contango increasing the signal threshold over time while backwardation decreases it.

With that in mind, we are all aware of how erratic oil prices were last year, and particularly in the early stages of the Russian invasion of Ukraine in late February. In fact, spot Brent prices spiked from below $80 at the start of 2022 to more than $135 by early March. This is important to remember because the huge spike in oil prices is going to make for an increasingly higher bar with respect to the one-year momentum signal as we approach the anniversary of the start of the war. Importantly, the forward curves shifted into a strong state of backwardation for several months after the price spike, which has worked to lower this key hurdle, but the current contango could work to offset that in the coming months should it hold. On the flip side, the weak price action more recently could make for a low bar with respect to shorter-term signals. As a result, mixed oil momentum signals are likely to persist until the impact from the war fades.

Thinking Ahead

Oil prices are now higher on the year after a very sharp decline the first week of January and despite some sizable US inventory builds. Notably, open interest has also increased alongside prices as new money enters the fray. So far, there has been little in the way of commodity index inflows this year, however, one would assume “long-only” investor dollars are likely to be chasing oil prices given the past two years of stellar returns. This group of institutional investors should gain more influence as the war-inspired volatility begins to filter out of risk models, allowing for increased position sizes. This dynamic should become more apparent in 2H23 though.

Fundamentally, all eyes remain on the Chinese reopening and its potential demand implications for this year. As we have been highlighting recently, Chinese crude imports already climbed to more than 11mb/d in November and December, even before the abrupt pandemic policy reversal took place. This supports the notion that China will likely need record oil imports this year to meet its refining demand. In addition, we believe the US will also need to increase crude imports this year to fill the void left by the cessation of SPR releases and as the US refining system bounces back from the cold related outages.

Loading…