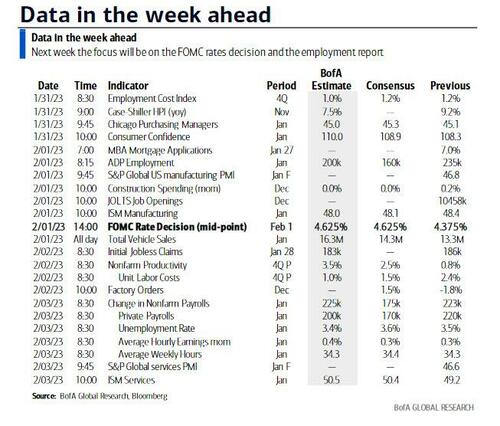

As BofA rates strategist Ralf Preusser writes in his weekly preview, "this week is one for the record book. We have not seen these three major central bank decisions (Fed, BoE, ECB); and key data releases (US ISM, payrolls, and the employment cost index, as well as Euro Area inflation, GDP, and confidence data) in the same week before. Not to mention in combination with month-end flow, which given the incidence of supply in Europe should be sizeable in both EUR and GBP."

DB's Jim Reid agrees writing that this week is set to be action packed for scheduled activity: "The main highlight is of course the FOMC conclusion (Wednesday), but the ECB and the BoE (both Thursday) will also likely hike. However, there's plenty of other events on the macro calendar, including the US jobs report on Friday, the flash CPI release from France and Germany (tomorrow), the Euro Area aggregate (Wednesday), regional and Euro Area Q4 GDP (tomorrow), global manufacturing (Wednesday) and services (Friday) PMIs/ISMs, China’s equivalents (tomorrow and Wednesday), US JOLTS (Wednesday), and US ECI (tomorrow)."

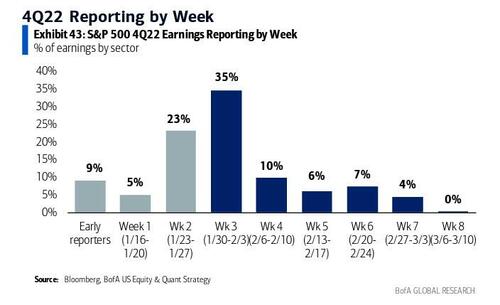

If that’s not enough, 12% of the S&P 500 by market cap report within a few moments of each other on Thursday night after the bell with Apple, Alphabet and Amazon the highlights in a busy week for earnings. Overall, a whopping 35% of S&P earnings by sector are set to report this week.

Going back to central banks, at the time of writing, the Fed is priced to deliver 26 bp, the ECB 50 bp, and the BoE 46 bp. BofA expects both the Fed and the ECB to deliver what is priced in, and sees a 25 bp hike from the BoE – marginally more likely than before after new lows in the PMIs – but risks are clearly skewed towards 50 bp.

DB's Reid adds that with a downshift to a 25bps Fed hike already priced in for Wednesday, the meeting will be all about what the Fed tone implies for further meetings. DB still think there'll be two more 25bps hikes after this one partly as the Fed won’t want to see financial conditions ease too much as a result of being too dovish.

Assuming central banks deliver on forwards, the key focus for the market will be the accompanying messages. The Fed’s message will likely be strongly influenced by critical data prints between now and Wednesday: PCE, ECI, ISM, JOLTS. And that message in turn risks looking dated already by the end of the week with ISM Services and NFP prints to come, also. Our economists remain hawkish relative to market pricing, expecting a terminal FF target range of 5.00-5.25% and the first cut not until Mar-2024, for which forwards price 100 bp more cuts than our colleagues expect.

The last big and very important data point for the Fed before their meeting will be tomorrow’s Q4 ECI release (consensus 1.1% vs. +1.2% previously). Chair Powell is very focused on the relationship between core services ex-shelter inflation and wage pressures, with ECI near the top of their dashboard. JOLTS (Wednesday) is similarly important and may get a reference in the press conference.

Staying with labor markets, although Friday's employment report will come after the FOMC, it will as ever be a lightening rod for the market. For the headline, consensus is at +185k vs. +223K last month, and 3.6% for unemployment (DB also at 3.6%, vs. 3.5% last month). All eyes also on average hourly earnings and importantly the work week length which was soft last month hinting at a small crack in the labor market.

With regards to the ECB (Thursday), most economists expect another +50bps hike that would take the deposit rate to 2.50%. They also emphasize the importance of communicating expectations for the March meeting since core and underlying inflation remain sticky. The team sees further +50bps and +25bps hikes in March and May, respectively, and a terminal rate of 3.25%.

For the BoE decision that same day, DB economists differ with BofA and see another +50bps (vs 25bps) hike that will take the Bank Rate to 4%. That will potentially be the last 'forceful' hike in this tightening cycle. Although their view is that services and wages data warrant such a move, the risks are tilted to the downside. They continue to call for a 4.5% terminal rate as inflation pressures remain resilient.

European markets have lots of data to run through ahead of those decisions, with Eurozone Q4 GDP, inflation and labor market data all released early this week. Most of the key data will be out tomorrow, including Q4 GDP data for Germany, France, Italy and the Eurozone as well as CPI reports for Germany and France. Eurozone aggregates for the CPI and unemployment rate are released on Wednesday. DB economists expect Eurozone HICP to decline to 8.4% in January (vs 9.2% yoy in December) and continue falling to c.3.5% in Q4 this year. Core inflation is seen staying in a 5.0-5.5% range throughout first half of this year.

Finally, let's not forget about earnings, although that's impossible with a whopping 107 S&P companies reporting, including Apple, Amazon, Alphabet, Meta, Ford, AMD, Amgen, Qualcomm, Starbucks and dozens more.

Courtesy of DB, here is a day-by-day calendar of events

Monday January 30

- Data: US January Dallas Fed manufacturing activity, UK January Lloyds business barometer, Japan December jobless rate, retail sales, industrial production, Italy December PPI, Eurozone January economic, industrial and services confidence

- Central banks: ECB's Villeroy speaks

- Earnings: Sumitomo Mitsui Financial, NXP Semiconductors, Ryanair

- Other: IMF's world economic outlook update

Tuesday January 31

- Data: US Q4 employment cost index, January Conference Board consumer confidence, MNI Chicago PMI, Dallas Fed services activity, November FHFA house price index, China January PMIs, December industrial profits, UK December consumer credit, mortgage approvals, M4, Japan January consumer confidence index, December housing starts, Italy Q4 GDP, December unemployment rate, hourly wages, Germany Q4 GDP, January CPI, unemployment change, France Q4 GDP, January CPI, December PPI, consumer spending, Eurozone Q4 GDP, Canada November GDP

- Central banks: Euro Area bank lending survey

- Earnings: Samsung Electronics, Exxon Mobil, Pfizer, McDonald's, UPS, Amgen, Caterpillar, AMD, Stryker, Mondelez, UBS, Moody's, GM, MSCI, Electronic Arts, Spotify, Snap

Wednesday February 1

- Data: US January ISM manufacturing index, total vehicle sales, ADP report, December JOLTS report job openings, construction spending, China Caixin manufacturing PMI, Japan January monetary base, Italy January CPI, manufacturing PMI, new car registrations, budget balance, Eurozone January CPI, December unemployment rate, Canada January manufacturing PMI

- Central banks: Fed decision

- Earnings: SK Hynix, Novo Nordisk, Meta, Orsted, Thermo Fisher Scientific, Novartis, T-Mobile, Altria, Boston Scientific, GSK, BBVA, Peloton

Thursday February 2

- Data: US Q4 unit labor costs, nonfarm productivity, December factory orders, initial jobless claims, Germany December trade balance, France December budget balance, Canada December building permits

- Central banks: ECB, BoE decision

- Earnings: Apple, Alphabet, Amazon.com, Sony, Mitsubishi UFJ Financial, Mizuho Financial, Eli Lilly, Merck, Roche, Shell, Bristol-Myers Squibb, ConocoPhillips, QUALCOMM, Honeywell, Starbucks, Gilead Sciences, Estee Lauder, JD.com, ICE, Banco Santander, Ford, Ferrari, Infineon

Friday February 3

- Data: US January jobs report, change in nonfarm payrolls, unemployment rate, labor force participation rate, average hourly earnings, ISM services, China Caixin services PMI, UK January official reserves changes, Italy January services PMI, France December manufacturing and industrial production, Eurozone December PPI

- Central banks: ECB Survey of Professional Forecasters

- Earnings: Sanofi, Regeneron, Intesa Sanpaolo

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the employment cost index on Tuesday, JOLTS job openings and ISM manufacturing on Wednesday, and the employment situation report on Friday. The February FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, January 30

- 10:30 AM Dallas Fed manufacturing index, January (consensus -15.5, last -18.8)

Tuesday, January 31

- 08:30 AM Employment cost index, Q4 (GS +1.1%, consensus +1.1%, prior +1.2%): We estimate that the employment cost index (ECI) rose 1.1% in Q4 (qoq sa), which would boost the year-on-year rate by one tenth to 5.1%. Our forecast reflects sequential slowing in the private wages ex-incentives category following net softer readings of production and nonsupervisory average hourly earnings and the Atlanta Fed wage tracker. However, we expect another strong reading for the benefits category as firms expand health insurance and supplemental pay programs in order to attract and retain talent.

- 09:00 AM FHFA house price index, November (consensus -0.5%, last flat)

- 09:00 AM S&P/Case-Shiller 20-city home price index, November (GS -0.6%, consensus -0.7%, last -0.5%): We estimate that the S&P/Case-Shiller 20-city home price index declined 0.6% in November, following a 0.5% decline in October.

- 09:45 AM Chicago PMI, January (GS 45.1, consensus 45.3, last 45.1): We estimate that the Chicago PMI was unchanged at 45.1 in January, reflecting weaker industrial activity in the US and a continued drag from the covid wave in China.

- 10:00 AM Conference Board consumer confidence, January (GS 109.5, consensus 109.0, last 108.3): We estimate that the Conference Board consumer confidence index increased to 109.5 in January.

Wednesday, February 1

- 08:15 AM ADP employment report, January (GS +190k, consensus +170k, last +235k): We estimate a 190k rise in ADP payroll employment in January, reflecting strength in Big Data indicators.

- 09:45 AM S&P Global US manufacturing PMI, January final (consensus 46.8, last 46.8)

- 10:00 AM Construction spending, December (GS +0.2%, consensus flat, last +0.2%): We estimate construction spending increased 0.2% in December.

- 10:00 AM ISM manufacturing index, January (GS 48.0, consensus 48.0, last 48.4): We estimate that the ISM manufacturing index declined 0.4pt to 48.0 in January, reflecting weaker industrial activity in the US and a continued drag from the covid wave in China. Our GS manufacturing tracker declined 1.3pt to 47.0.

- 10:00 AM JOLTS job openings, December (GS 10,350k, consensus 10,300k, last 10,458k): We estimate that JOLTS job openings declined to 10,350k in December.

- 02:00 PM FOMC statement, January 31 – February 1 meeting: The key question for the February meeting is what the FOMC will signal about further hikes this year. As discussed on our FOMC preview, we expect two additional 25bp hikes in March and May, but fewer might be needed if weak business confidence depresses hiring and investment, or more might be needed if the economy reaccelerates as the impact of past policy tightening fades. Fed officials appear to also expect about two more hikes and will likely tone down the reference to “ongoing” hikes being appropriate in the FOMC statement.

- 05:00 PM Lightweight motor vehicle sales, January (GS 15.8mn, consensus 14.4mn, last 13.3mn)

Thursday, February 2

- 08:30 AM Nonfarm productivity, Q4 preliminary (GS +2.5%, consensus +2.4%, last +0.8%); Unit labor costs, Q4 preliminary (GS +1.5%, consensus +1.5%, last +2.4%): We estimate nonfarm productivity growth of +2.5% in Q4 (qoq saar) and unit labor cost—compensation per hour divided by output per hour—growth of +1.5%.

- 08:30 AM Initial jobless claims, week ended January 28 (GS 190k, consensus 200k, last 186k); Continuing jobless claims, week ended January 21 (consensus 1,684k, last 1,675k): We estimate initial jobless claims increased to 190k in the week ended January 28.

- 10:00 AM Factory orders, December (GS +2.5%, consensus +2.4%, last -1.8%); Durable goods orders, December final (last +5.6%); Durable goods orders ex-transportation, December final (last -0.8%); Core capital goods orders, December final (last -0.2%); Core capital goods shipments, December final (last -0.4%): We estimate that factory orders increased 2.5% in December following a 1.8% decrease in November. Durable goods orders increased 5.6% in the December advance report, reflecting a $15.5bn increase in nondefense aircraft orders, while core capital goods orders decreased 0.2%.

Friday, February 3

- 08:30 AM Nonfarm payroll employment, January (GS +300k, consensus +185k, last +223k); Private payroll employment, January (GS +250k, consensus +185k, last +220k); Average hourly earnings (mom), January (GS +0.4%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), January (GS +4.4%, consensus +4.3%, last +4.6%); Unemployment rate, January (GS 3.5%, consensus 3.6%, last 3.5%); Labor force participation rate, January (GS 62.3%, consensus 62.3%, last 62.3%): We estimate nonfarm payrolls rose by 300k in January (mom sa). Our well-above-consensus forecast reflects the elevated level of labor demand, the strong recent payroll trend, a 36k boost from the return of striking education workers, strength in Big Data employment indicators, and a boost from favorable seasonal factors that are spuriously fitting to last winter’s Omicron wave. Jobless claims remain extremely low, and while corporate layoff announcements have increased in recent months, only 15% of California layoff filings since December had been implemented by the January payroll period. We estimate the unemployment rate was unchanged at 3.5%, reflecting a rise in household employment offset by flat-to-up labor force participation rate (we estimate unchanged on a rounded basis at 62.3%). We estimate a 0.4% increase in average hourly earnings (mom sa), reflecting a 0.05pp boost from start-of-year wage hikes and neutral calendar effects.

- 09:45 AM S&P Global US services PMI, January final (consensus n.a., last 46.2)

- 10:00 AM ISM services index, January (GS 51.0, consensus 50.5, last 49.2): We estimate that the ISM services index rebounded by 1.8pt to 51.0 in January, reflecting the rise in our survey tracker (+1.0pt to 51.1).

Source: DB, Goldman, BofA

As BofA rates strategist Ralf Preusser writes in his weekly preview, “this week is one for the record book. We have not seen these three major central bank decisions (Fed, BoE, ECB); and key data releases (US ISM, payrolls, and the employment cost index, as well as Euro Area inflation, GDP, and confidence data) in the same week before. Not to mention in combination with month-end flow, which given the incidence of supply in Europe should be sizeable in both EUR and GBP.”

DB’s Jim Reid agrees writing that this week is set to be action packed for scheduled activity: “The main highlight is of course the FOMC conclusion (Wednesday), but the ECB and the BoE (both Thursday) will also likely hike. However, there’s plenty of other events on the macro calendar, including the US jobs report on Friday, the flash CPI release from France and Germany (tomorrow), the Euro Area aggregate (Wednesday), regional and Euro Area Q4 GDP (tomorrow), global manufacturing (Wednesday) and services (Friday) PMIs/ISMs, China’s equivalents (tomorrow and Wednesday), US JOLTS (Wednesday), and US ECI (tomorrow).”

If that’s not enough, 12% of the S&P 500 by market cap report within a few moments of each other on Thursday night after the bell with Apple, Alphabet and Amazon the highlights in a busy week for earnings. Overall, a whopping 35% of S&P earnings by sector are set to report this week.

Going back to central banks, at the time of writing, the Fed is priced to deliver 26 bp, the ECB 50 bp, and the BoE 46 bp. BofA expects both the Fed and the ECB to deliver what is priced in, and sees a 25 bp hike from the BoE – marginally more likely than before after new lows in the PMIs – but risks are clearly skewed towards 50 bp.

DB’s Reid adds that with a downshift to a 25bps Fed hike already priced in for Wednesday, the meeting will be all about what the Fed tone implies for further meetings. DB still think there’ll be two more 25bps hikes after this one partly as the Fed won’t want to see financial conditions ease too much as a result of being too dovish.

Assuming central banks deliver on forwards, the key focus for the market will be the accompanying messages. The Fed’s message will likely be strongly influenced by critical data prints between now and Wednesday: PCE, ECI, ISM, JOLTS. And that message in turn risks looking dated already by the end of the week with ISM Services and NFP prints to come, also. Our economists remain hawkish relative to market pricing, expecting a terminal FF target range of 5.00-5.25% and the first cut not until Mar-2024, for which forwards price 100 bp more cuts than our colleagues expect.

The last big and very important data point for the Fed before their meeting will be tomorrow’s Q4 ECI release (consensus 1.1% vs. +1.2% previously). Chair Powell is very focused on the relationship between core services ex-shelter inflation and wage pressures, with ECI near the top of their dashboard. JOLTS (Wednesday) is similarly important and may get a reference in the press conference.

Staying with labor markets, although Friday’s employment report will come after the FOMC, it will as ever be a lightening rod for the market. For the headline, consensus is at +185k vs. +223K last month, and 3.6% for unemployment (DB also at 3.6%, vs. 3.5% last month). All eyes also on average hourly earnings and importantly the work week length which was soft last month hinting at a small crack in the labor market.

With regards to the ECB (Thursday), most economists expect another +50bps hike that would take the deposit rate to 2.50%. They also emphasize the importance of communicating expectations for the March meeting since core and underlying inflation remain sticky. The team sees further +50bps and +25bps hikes in March and May, respectively, and a terminal rate of 3.25%.

For the BoE decision that same day, DB economists differ with BofA and see another +50bps (vs 25bps) hike that will take the Bank Rate to 4%. That will potentially be the last ‘forceful’ hike in this tightening cycle. Although their view is that services and wages data warrant such a move, the risks are tilted to the downside. They continue to call for a 4.5% terminal rate as inflation pressures remain resilient.

European markets have lots of data to run through ahead of those decisions, with Eurozone Q4 GDP, inflation and labor market data all released early this week. Most of the key data will be out tomorrow, including Q4 GDP data for Germany, France, Italy and the Eurozone as well as CPI reports for Germany and France. Eurozone aggregates for the CPI and unemployment rate are released on Wednesday. DB economists expect Eurozone HICP to decline to 8.4% in January (vs 9.2% yoy in December) and continue falling to c.3.5% in Q4 this year. Core inflation is seen staying in a 5.0-5.5% range throughout first half of this year.

Finally, let’s not forget about earnings, although that’s impossible with a whopping 107 S&P companies reporting, including Apple, Amazon, Alphabet, Meta, Ford, AMD, Amgen, Qualcomm, Starbucks and dozens more.

Courtesy of DB, here is a day-by-day calendar of events

Monday January 30

- Data: US January Dallas Fed manufacturing activity, UK January Lloyds business barometer, Japan December jobless rate, retail sales, industrial production, Italy December PPI, Eurozone January economic, industrial and services confidence

- Central banks: ECB’s Villeroy speaks

- Earnings: Sumitomo Mitsui Financial, NXP Semiconductors, Ryanair

- Other: IMF’s world economic outlook update

Tuesday January 31

- Data: US Q4 employment cost index, January Conference Board consumer confidence, MNI Chicago PMI, Dallas Fed services activity, November FHFA house price index, China January PMIs, December industrial profits, UK December consumer credit, mortgage approvals, M4, Japan January consumer confidence index, December housing starts, Italy Q4 GDP, December unemployment rate, hourly wages, Germany Q4 GDP, January CPI, unemployment change, France Q4 GDP, January CPI, December PPI, consumer spending, Eurozone Q4 GDP, Canada November GDP

- Central banks: Euro Area bank lending survey

- Earnings: Samsung Electronics, Exxon Mobil, Pfizer, McDonald’s, UPS, Amgen, Caterpillar, AMD, Stryker, Mondelez, UBS, Moody’s, GM, MSCI, Electronic Arts, Spotify, Snap

Wednesday February 1

- Data: US January ISM manufacturing index, total vehicle sales, ADP report, December JOLTS report job openings, construction spending, China Caixin manufacturing PMI, Japan January monetary base, Italy January CPI, manufacturing PMI, new car registrations, budget balance, Eurozone January CPI, December unemployment rate, Canada January manufacturing PMI

- Central banks: Fed decision

- Earnings: SK Hynix, Novo Nordisk, Meta, Orsted, Thermo Fisher Scientific, Novartis, T-Mobile, Altria, Boston Scientific, GSK, BBVA, Peloton

Thursday February 2

- Data: US Q4 unit labor costs, nonfarm productivity, December factory orders, initial jobless claims, Germany December trade balance, France December budget balance, Canada December building permits

- Central banks: ECB, BoE decision

- Earnings: Apple, Alphabet, Amazon.com, Sony, Mitsubishi UFJ Financial, Mizuho Financial, Eli Lilly, Merck, Roche, Shell, Bristol-Myers Squibb, ConocoPhillips, QUALCOMM, Honeywell, Starbucks, Gilead Sciences, Estee Lauder, JD.com, ICE, Banco Santander, Ford, Ferrari, Infineon

Friday February 3

- Data: US January jobs report, change in nonfarm payrolls, unemployment rate, labor force participation rate, average hourly earnings, ISM services, China Caixin services PMI, UK January official reserves changes, Italy January services PMI, France December manufacturing and industrial production, Eurozone December PPI

- Central banks: ECB Survey of Professional Forecasters

- Earnings: Sanofi, Regeneron, Intesa Sanpaolo

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the employment cost index on Tuesday, JOLTS job openings and ISM manufacturing on Wednesday, and the employment situation report on Friday. The February FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, January 30

- 10:30 AM Dallas Fed manufacturing index, January (consensus -15.5, last -18.8)

Tuesday, January 31

- 08:30 AM Employment cost index, Q4 (GS +1.1%, consensus +1.1%, prior +1.2%): We estimate that the employment cost index (ECI) rose 1.1% in Q4 (qoq sa), which would boost the year-on-year rate by one tenth to 5.1%. Our forecast reflects sequential slowing in the private wages ex-incentives category following net softer readings of production and nonsupervisory average hourly earnings and the Atlanta Fed wage tracker. However, we expect another strong reading for the benefits category as firms expand health insurance and supplemental pay programs in order to attract and retain talent.

- 09:00 AM FHFA house price index, November (consensus -0.5%, last flat)

- 09:00 AM S&P/Case-Shiller 20-city home price index, November (GS -0.6%, consensus -0.7%, last -0.5%): We estimate that the S&P/Case-Shiller 20-city home price index declined 0.6% in November, following a 0.5% decline in October.

- 09:45 AM Chicago PMI, January (GS 45.1, consensus 45.3, last 45.1): We estimate that the Chicago PMI was unchanged at 45.1 in January, reflecting weaker industrial activity in the US and a continued drag from the covid wave in China.

- 10:00 AM Conference Board consumer confidence, January (GS 109.5, consensus 109.0, last 108.3): We estimate that the Conference Board consumer confidence index increased to 109.5 in January.

Wednesday, February 1

- 08:15 AM ADP employment report, January (GS +190k, consensus +170k, last +235k): We estimate a 190k rise in ADP payroll employment in January, reflecting strength in Big Data indicators.

- 09:45 AM S&P Global US manufacturing PMI, January final (consensus 46.8, last 46.8)

- 10:00 AM Construction spending, December (GS +0.2%, consensus flat, last +0.2%): We estimate construction spending increased 0.2% in December.

- 10:00 AM ISM manufacturing index, January (GS 48.0, consensus 48.0, last 48.4): We estimate that the ISM manufacturing index declined 0.4pt to 48.0 in January, reflecting weaker industrial activity in the US and a continued drag from the covid wave in China. Our GS manufacturing tracker declined 1.3pt to 47.0.

- 10:00 AM JOLTS job openings, December (GS 10,350k, consensus 10,300k, last 10,458k): We estimate that JOLTS job openings declined to 10,350k in December.

- 02:00 PM FOMC statement, January 31 – February 1 meeting: The key question for the February meeting is what the FOMC will signal about further hikes this year. As discussed on our FOMC preview, we expect two additional 25bp hikes in March and May, but fewer might be needed if weak business confidence depresses hiring and investment, or more might be needed if the economy reaccelerates as the impact of past policy tightening fades. Fed officials appear to also expect about two more hikes and will likely tone down the reference to “ongoing” hikes being appropriate in the FOMC statement.

- 05:00 PM Lightweight motor vehicle sales, January (GS 15.8mn, consensus 14.4mn, last 13.3mn)

Thursday, February 2

- 08:30 AM Nonfarm productivity, Q4 preliminary (GS +2.5%, consensus +2.4%, last +0.8%); Unit labor costs, Q4 preliminary (GS +1.5%, consensus +1.5%, last +2.4%): We estimate nonfarm productivity growth of +2.5% in Q4 (qoq saar) and unit labor cost—compensation per hour divided by output per hour—growth of +1.5%.

- 08:30 AM Initial jobless claims, week ended January 28 (GS 190k, consensus 200k, last 186k); Continuing jobless claims, week ended January 21 (consensus 1,684k, last 1,675k): We estimate initial jobless claims increased to 190k in the week ended January 28.

- 10:00 AM Factory orders, December (GS +2.5%, consensus +2.4%, last -1.8%); Durable goods orders, December final (last +5.6%); Durable goods orders ex-transportation, December final (last -0.8%); Core capital goods orders, December final (last -0.2%); Core capital goods shipments, December final (last -0.4%): We estimate that factory orders increased 2.5% in December following a 1.8% decrease in November. Durable goods orders increased 5.6% in the December advance report, reflecting a $15.5bn increase in nondefense aircraft orders, while core capital goods orders decreased 0.2%.

Friday, February 3

- 08:30 AM Nonfarm payroll employment, January (GS +300k, consensus +185k, last +223k); Private payroll employment, January (GS +250k, consensus +185k, last +220k); Average hourly earnings (mom), January (GS +0.4%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), January (GS +4.4%, consensus +4.3%, last +4.6%); Unemployment rate, January (GS 3.5%, consensus 3.6%, last 3.5%); Labor force participation rate, January (GS 62.3%, consensus 62.3%, last 62.3%): We estimate nonfarm payrolls rose by 300k in January (mom sa). Our well-above-consensus forecast reflects the elevated level of labor demand, the strong recent payroll trend, a 36k boost from the return of striking education workers, strength in Big Data employment indicators, and a boost from favorable seasonal factors that are spuriously fitting to last winter’s Omicron wave. Jobless claims remain extremely low, and while corporate layoff announcements have increased in recent months, only 15% of California layoff filings since December had been implemented by the January payroll period. We estimate the unemployment rate was unchanged at 3.5%, reflecting a rise in household employment offset by flat-to-up labor force participation rate (we estimate unchanged on a rounded basis at 62.3%). We estimate a 0.4% increase in average hourly earnings (mom sa), reflecting a 0.05pp boost from start-of-year wage hikes and neutral calendar effects.

- 09:45 AM S&P Global US services PMI, January final (consensus n.a., last 46.2)

- 10:00 AM ISM services index, January (GS 51.0, consensus 50.5, last 49.2): We estimate that the ISM services index rebounded by 1.8pt to 51.0 in January, reflecting the rise in our survey tracker (+1.0pt to 51.1).

Source: DB, Goldman, BofA

Loading…