By Ishika Mookerjee, Bloomberg Markets Live reporter and analyst

Investors are betting hard that China’s reopening will boost earnings across the globe this year, with consumer industries likely to reap the largest windfall.

Having spent three years under Covid confinement, consumers in the world’s second-largest economy now have more than $800 billion in excess savings that can be splurged on everything from shopping and dining to travel. That bodes particularly well for Asian neighbors that rely on China for trade and tourism receipts, as well as for luxury brands in Europe.

“When the mainland Chinese come out, they are going to go to Hong Kong, Thailand, Korea,” said Herald van der Linde, Hong Kong-based head of Asia Pacific equity strategy at HSBC Holdings Plc. While regional airlines and hotels have likely priced that in, mall and supermarket operators, food and beverage distributors and bank stocks in those countries aren’t yet reflecting the earnings upside, he added.

The MSCI China Index’s members have seen about 10% increase in forward earnings estimates since end-October, leading upgrades in Asia. In China, HSBC’s Van der Linde expects health care and consumer discretionary profits to grow by 61% and 40% in 2023, respectively, compared with a 6% growth for basic materials.

Earnings calls so far have struck an optimistic tone. Delta Air Lines Inc. said in its fourth-quarter earnings call that it expects to “rebuild capacity in line with demand” in China this year. Burberry Group Plc said while there is near-term uncertainty, accumulated savings and the government’s push to boost domestic consumption mean the medium-term outlook is “extremely positive”.

Consumption is focus area for China’s government too, with President Xi Jinping this week calling for enhanced efforts to boost consumption as the economy gradually recovers from Covid Zero.

There’s much less optimism over the industrial and material sectors though.

For one, China’s property slump is limiting the upside for iron ore and steel suppliers. And Beijing doesn’t seem to have the firepower, nor the willingness, to repeat the kind of blockbuster infrastructure stimulus deployed in the aftermath of the global financial crisis.

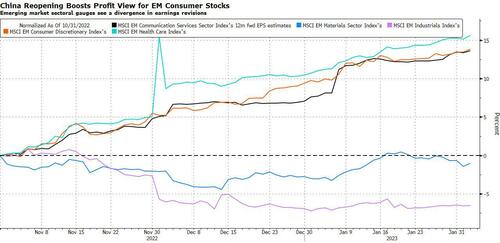

A divergence is already forming, with communications, health-care and consumer discretionary seeing among the biggest earnings upgrades in the MSCI Emerging Markets Index since end-October when China’s reopening kicked off. Estimates for materials and industrials have been steady to lower.

In Europe and the US, the impact of China’s reopening as a whole will be felt to a smaller degree than in Asia, though some sectors will benefit more.

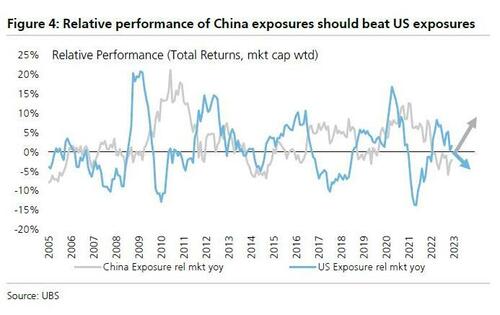

China accounts for just 4% of European sales but the contribution is bigger for certain sectors, including 18% for consumer durables and 10% for household items, according to UBS AG’s global research team. China’s growth rebound “is part of the reason consumer durables and apparel are among our preferred industry groups,” strategists including Gerry Fowler wrote in a Jan. 16 note.

The luxury sector in Europe is seen as a key beneficiary, with analysts at Exane BNP Paribas predicting the industry’s earnings to grow about 5% this year versus flat profit growth for the region as a whole.

Chinese consumers accounted for about 17% of the sector’s sales in 2022 compared with 33% pre-Covid, UBS analyst Zuzanna Pusz wrote in a note last month. Swatch Group could hit record sales this year as China rebounds from Covid restrictions, Chief Executive Officer Nick Hayek said in an interview. The watchmaker gets more than 40% of its revenue from that market, according to Citigroup.

In the US, the Asian economy generates about 5% of revenue for companies in the Russell 1000 Index, according to Bloomberg Intelligence. Earnings estimates for the US gauge’s firms have been falling sine September as recession fears are prevalent.

Meanwhile, analysts at Citigroup Inc. said “cheaper China exposure” can now be found in Japanese stocks, which have yet to fully reflect the benefits of its neighbor’s reopening.

By Ishika Mookerjee, Bloomberg Markets Live reporter and analyst

Investors are betting hard that China’s reopening will boost earnings across the globe this year, with consumer industries likely to reap the largest windfall.

Having spent three years under Covid confinement, consumers in the world’s second-largest economy now have more than $800 billion in excess savings that can be splurged on everything from shopping and dining to travel. That bodes particularly well for Asian neighbors that rely on China for trade and tourism receipts, as well as for luxury brands in Europe.

“When the mainland Chinese come out, they are going to go to Hong Kong, Thailand, Korea,” said Herald van der Linde, Hong Kong-based head of Asia Pacific equity strategy at HSBC Holdings Plc. While regional airlines and hotels have likely priced that in, mall and supermarket operators, food and beverage distributors and bank stocks in those countries aren’t yet reflecting the earnings upside, he added.

The MSCI China Index’s members have seen about 10% increase in forward earnings estimates since end-October, leading upgrades in Asia. In China, HSBC’s Van der Linde expects health care and consumer discretionary profits to grow by 61% and 40% in 2023, respectively, compared with a 6% growth for basic materials.

Earnings calls so far have struck an optimistic tone. Delta Air Lines Inc. said in its fourth-quarter earnings call that it expects to “rebuild capacity in line with demand” in China this year. Burberry Group Plc said while there is near-term uncertainty, accumulated savings and the government’s push to boost domestic consumption mean the medium-term outlook is “extremely positive”.

Consumption is focus area for China’s government too, with President Xi Jinping this week calling for enhanced efforts to boost consumption as the economy gradually recovers from Covid Zero.

There’s much less optimism over the industrial and material sectors though.

For one, China’s property slump is limiting the upside for iron ore and steel suppliers. And Beijing doesn’t seem to have the firepower, nor the willingness, to repeat the kind of blockbuster infrastructure stimulus deployed in the aftermath of the global financial crisis.

A divergence is already forming, with communications, health-care and consumer discretionary seeing among the biggest earnings upgrades in the MSCI Emerging Markets Index since end-October when China’s reopening kicked off. Estimates for materials and industrials have been steady to lower.

In Europe and the US, the impact of China’s reopening as a whole will be felt to a smaller degree than in Asia, though some sectors will benefit more.

China accounts for just 4% of European sales but the contribution is bigger for certain sectors, including 18% for consumer durables and 10% for household items, according to UBS AG’s global research team. China’s growth rebound “is part of the reason consumer durables and apparel are among our preferred industry groups,” strategists including Gerry Fowler wrote in a Jan. 16 note.

The luxury sector in Europe is seen as a key beneficiary, with analysts at Exane BNP Paribas predicting the industry’s earnings to grow about 5% this year versus flat profit growth for the region as a whole.

Chinese consumers accounted for about 17% of the sector’s sales in 2022 compared with 33% pre-Covid, UBS analyst Zuzanna Pusz wrote in a note last month. Swatch Group could hit record sales this year as China rebounds from Covid restrictions, Chief Executive Officer Nick Hayek said in an interview. The watchmaker gets more than 40% of its revenue from that market, according to Citigroup.

In the US, the Asian economy generates about 5% of revenue for companies in the Russell 1000 Index, according to Bloomberg Intelligence. Earnings estimates for the US gauge’s firms have been falling sine September as recession fears are prevalent.

Meanwhile, analysts at Citigroup Inc. said “cheaper China exposure” can now be found in Japanese stocks, which have yet to fully reflect the benefits of its neighbor’s reopening.

Loading…