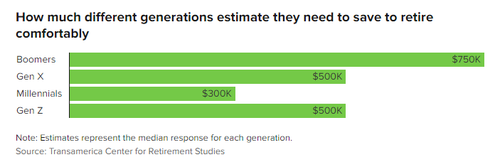

This has got to be one of the all time best forthcoming wakeup calls we've ever seen. A new survey published by Acorns last week revealed that half of millennials think they'll need just $300,000 to "retire comfortably".

As the piece notes, this is obviously a fraction of what they will actually need to retire in comfort.

Gen X and Gen Z had slightly higher estimates, guessing that they would need $500,000 to retire, while boomers have a clearer picture and understand they would need closer to $750,000 to retire.

Catherine Collinson, CEO and president of the Transamerica Institute, who conducted the study, commented: “The estimated retirement savings for all workers are on the low side. I’m concerned that they’re not thinking big enough in terms of how much somebody should save.”

Instead, as the article notes, people should be targeting about 75% of their pre-retirement income. That would mean that the average millennial earning $68,703 would need to save $1.8 million to retire comfortably by age 67.

More than 40% of respondents to the survey said they arrived at their estimates "simply by guessing".

“It’s surprising that people are not taking as much advantage as they can and should of the tools that are available,” Collinson said.

Their $750,000 estimate “is much more than they’ve actually saved in all their retirement accounts,” she said about boomers, who have an average retirement account balance of just $200,000.

This has got to be one of the all time best forthcoming wakeup calls we’ve ever seen. A new survey published by Acorns last week revealed that half of millennials think they’ll need just $300,000 to “retire comfortably”.

As the piece notes, this is obviously a fraction of what they will actually need to retire in comfort.

Gen X and Gen Z had slightly higher estimates, guessing that they would need $500,000 to retire, while boomers have a clearer picture and understand they would need closer to $750,000 to retire.

Catherine Collinson, CEO and president of the Transamerica Institute, who conducted the study, commented: “The estimated retirement savings for all workers are on the low side. I’m concerned that they’re not thinking big enough in terms of how much somebody should save.”

Instead, as the article notes, people should be targeting about 75% of their pre-retirement income. That would mean that the average millennial earning $68,703 would need to save $1.8 million to retire comfortably by age 67.

More than 40% of respondents to the survey said they arrived at their estimates “simply by guessing”.

“It’s surprising that people are not taking as much advantage as they can and should of the tools that are available,” Collinson said.

Their $750,000 estimate “is much more than they’ve actually saved in all their retirement accounts,” she said about boomers, who have an average retirement account balance of just $200,000.