Authored by Simon White, Bloomberg macro strategist,

Credit spreads are looking increasingly detached to rising leverage, tight global liquidity and recession risk...

Since peaking out in October, spreads have been tightening, but this is increasingly at odds with many other indicators.

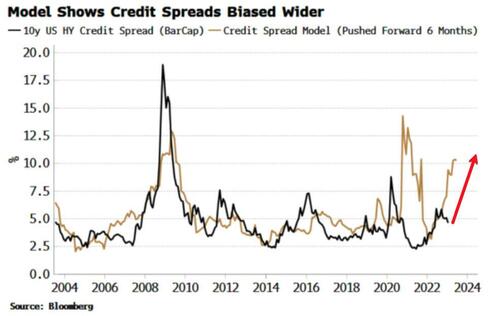

The global liquidity environment remains very tight, which pressures spreads wider. Similarly, personal savings have been rising, which at the margin is bad for companies as income is diverted away from them.

My model for credit spreads, which uses these and other inputs, shows they should move wider in the coming months.

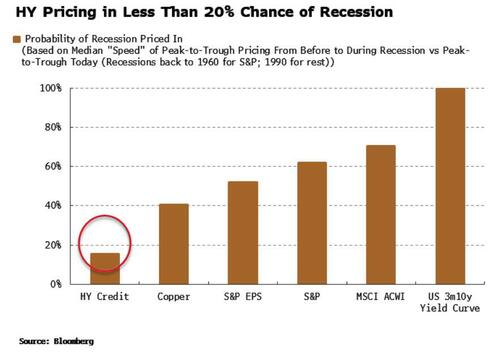

Credit markets are also complacent on the risk of a recession. We can look at how various assets have behaved in previous ones and compare it to how they have performed in this cycle to infer an implied probability of a recession.

While the yield curve is “certain” a recession is on the way, and even rose-tinted equities see a slump occurring as better than evens, credit spreads are implying only a one-in-six chance of a downturn. But the likelihood of a recession from multiple angles suggests the risk is much higher.

Another warning is that bank-lending standards continue to tighten even as credit spreads come in.

Often banks take their cues of credit conditions from spreads as they are a daily gauge of the credit situation. But the Fed’s Senior Loan Officer Survey, with the latest quarter’s data released yesterday, showed banks continued to tighten loan standards despite tighter spreads.

On the positive side of the ledger is a fall in firms’ debt-servicing costs as inflation has improved nominal incomes. Also, the corporate financing gap is negative, showing that companies’ internal funds are on aggregate sufficient to cover capital expenditures, reducing the need for financing. And companies were able to refinance amid robust demand for credit. But these are unlikely to be enough to counter poor liquidity and heightened recession risk.

One explanation for credit markets’ optimistic outlook comes from fevered speculation in equity option markets, with the explosive rise in 0DTE (zero days to expiry) trading a potential aggravating factor.

There has been a recent burst in activity in lending markets, with even the famed CLO behemoth, Japanese farmers’ bank Norinchukin, ready to return to the fray. But with credit looking one of the most mispriced assets, such renewed speculation is fated to end with crushing disappointment.

Authored by Simon White, Bloomberg macro strategist,

Credit spreads are looking increasingly detached to rising leverage, tight global liquidity and recession risk…

Since peaking out in October, spreads have been tightening, but this is increasingly at odds with many other indicators.

The global liquidity environment remains very tight, which pressures spreads wider. Similarly, personal savings have been rising, which at the margin is bad for companies as income is diverted away from them.

My model for credit spreads, which uses these and other inputs, shows they should move wider in the coming months.

Credit markets are also complacent on the risk of a recession. We can look at how various assets have behaved in previous ones and compare it to how they have performed in this cycle to infer an implied probability of a recession.

While the yield curve is “certain” a recession is on the way, and even rose-tinted equities see a slump occurring as better than evens, credit spreads are implying only a one-in-six chance of a downturn. But the likelihood of a recession from multiple angles suggests the risk is much higher.

Another warning is that bank-lending standards continue to tighten even as credit spreads come in.

Often banks take their cues of credit conditions from spreads as they are a daily gauge of the credit situation. But the Fed’s Senior Loan Officer Survey, with the latest quarter’s data released yesterday, showed banks continued to tighten loan standards despite tighter spreads.

On the positive side of the ledger is a fall in firms’ debt-servicing costs as inflation has improved nominal incomes. Also, the corporate financing gap is negative, showing that companies’ internal funds are on aggregate sufficient to cover capital expenditures, reducing the need for financing. And companies were able to refinance amid robust demand for credit. But these are unlikely to be enough to counter poor liquidity and heightened recession risk.

One explanation for credit markets’ optimistic outlook comes from fevered speculation in equity option markets, with the explosive rise in 0DTE (zero days to expiry) trading a potential aggravating factor.

There has been a recent burst in activity in lending markets, with even the famed CLO behemoth, Japanese farmers’ bank Norinchukin, ready to return to the fray. But with credit looking one of the most mispriced assets, such renewed speculation is fated to end with crushing disappointment.

Loading…