We already shared several kneejerk reactions from Wall Street's peanut gallery, now it's time for the slightly more refined and thought out takes, courtesy of some of the biggest banks such as BofA, Goldman and JPM.

We start with BofA chief economist Michael Gapen who writes that the January CPI report was in line with expectations, and notes that over the last three months core CPI has increased at a 4.6% annualized rate, accelerating slightly from the 4.3% pace in December. In Gapen's view, "there is not a lot of new information in this report. The Fed will need to see moderation in services inflation before having confidence that 2% is achievable. Today’s report did not drastically alter the risks around the policy outlook." As a result, BofA still sees risks tilted to a terminal above the bank's baseline estimate of 5.0-5.25% on account of labor markets and risks around services inflation staying sticky.

Some more details from BofA's report:

- The increase in headline CPI was largely driven by two components: energy and shelter. Together these components accounted for three-fourths of the 0.5% increase. Energy prices rose by 2.0% m/m driven by higher gas prices and shelter inflation rose by 0.7% m/m. The former was stronger than BofA expected, while the latter was roughly in line with expectations. Additionally, food prices rose by 0.5%, in-line with the revised trend in 4Q.

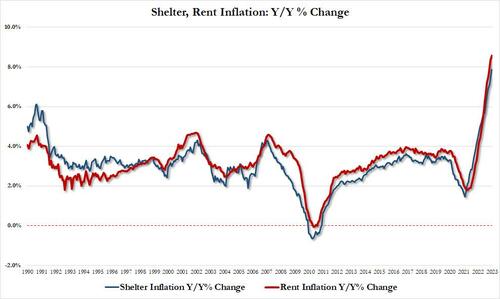

- Meanwhile, core inflation was also driven by shelter inflation, which accounted for 32bp of the 41bp increase. Within core inflation services remained sticky at 0.5% m/m. Over the last three months, core services prices have risen by 6.8% annualized, well above the pre-pandemic pace. Granted much of the increase in core services reflects the ongoing strength of shelter inflation, which increased by 0.7% m/m. Within shelter Owners’ equivalent rent (OER) and rent rose by 0.7%, in line with our expectations. However, lodging away from home surprised relative to BofA's forecasts with a 1.2% m/m increase.

- Outside of shelter. Medical care services fell by 0.7% m/m owing to a 3.6% drop in health insurance and a 0.1% decline in professional services. This was much weaker than BofA's expected 0.1% m/m decline. Meanwhile, other services generally accelerated this month with transportation services rising by 0.9% m/m, education, and communication up 0.5% m/m and recreation services up 0.7% m/m. The Fed will likely take little comfort in these readings as it looks for signs that services inflation ex-housing is moderating.

- While core services inflation was broadly in line with expectations, core goods inflation was stronger than Gapen expected, rising by 0.1% m/m. This broke a streak of three consecutive decreases in core goods prices. Used car prices did fall again (-1.9% m/m), but that streak may be coming to an end soon based on data from Manheim (Exhibit 3). Additionally, the weight of used cars was reduced in the latest update. Therefore, it should be less of a swing factor moving forward. Excluding used cars, core goods rose by 0.5% m/m and 3.5% annualized over the last three months. While this is a noticeable deceleration, it is well above the pre-pandemic pace. Additionally, it suggests that goods price deflation is not broadening outside of used cars as BofA had been anticipating.

Next, we take a look at the reaction from Goldman's Jan Hatzius, who as a reminder forecast inflation prints that were well above consensus and was therefore not wrong, and who writes that January core CPI rose 0.41%, slightly above consensus and its recent trend, and the year-on-year rate fell one tenth to 5.6%. According to the Goldman strategist, "start-of-year price increases were larger than normal in several categories including prescription drugs and private transportation services, but used car prices and airfares surprised to the downside." Meanwhile, shelter categories finally decelerated (just barely).

Some more details from the GS report:

January core CPI rose 0.41% (mom sa), slightly above consensus of 0.4% but below our forecast of 0.49%. The year-on-year rate fell another tenth to 5.6%, above consensus and in line with our forecast.

The January effect—the interaction between start-of-year price setting and pent-up cost pressures—resulted in larger than normal price increases in several categories including prescription drugs (+2.1% mom), car fees (+1.2%), and several labor-reliant categories like nursing homes (+1.4%), car repair (+1.3%), day care (+0.7%), and food away from home (+0.6%). The key exception was physician services, for which prices declined 0.1%.

Hospital services (+0.7%) and personal care services (+0.2%) were also a bit softer than our expectations.

Used car prices (-1.9%) and airfares (-2.2%) declined by more than we expected and contributed -11bps to the monthly core reading. With used car auction prices and jet fuel prices moving higher at the start of the year, we expect this weakness to partially reverse in coming months.

Shelter categories finally decelerated (rent +0.74% vs. +0.79% in December, OER +0.67% vs. +0.79%), likely reflecting weakness in the new rental market and the larger OER weight on single-family homes implemented with today’s report.

Apparel (+0.8%) and new car (+0.2%) prices were firm, in our view reflecting positive residual seasonality.

Core services prices excluding rent and OER rose 0.36%, 0.03pp firmer than the prior 3-month average.

Headline CPI rose 0.52%, as energy prices rose 2.0% and food prices rose 0.5%.

Finally, here is JPM's Daniel Silver who writes that "the main consumer price index (CPI) aggregates were pretty close to expectations in January, with the headline rising 0.5% and the core index moving up 0.4% (0.41% to two decimals)."

This headline gain was the firmest monthly change reported for this index since last June, and the January increase in the core was the strongest monthly change in four months. Even so, we think that the broad trends for inflation are moderating even if they remain firm.

In terms of year-ago inflation rates, the headline moved down from 6.5% in December to 6.4% in January while the core eased from 5.7% to 5.6%. Thursday’s PPI report also will contain important relevant information, but for now with only the January CPI data in hand, we think that January core PCE inflation is tracking a 0.44% monthly gain. The corresponding year-ago rate is expected to come in basically unchanged between December and January after rounding, at 4.4% oya.

In terms of some of the CPI report’s main details, Silver notes that the 2.0% increase in energy prices in January and the 0.5% increase in the food price index were pretty close to, but marginally above, his forecasts. Excluding food and energy, the core index came out a little below our forecast, in part because used vehicle prices fell another 1.9% in January (Silver had looked for a modest increase as industry data show recent firming in prices). Meanwhile, apparel prices increased 0.8% in January, the firmest monthly change in about a year, and prices for medical care commodities jumped 1.1%, the biggest increase in about three years. On the whole, core goods prices rose 0.1% in January, a fairly soft monthly change, but the firmest monthly gain since last August.

Elsewhere in the CPI, JPM notes that core services prices rose 0.5% in January, with this gain in line with the average rate of inflation for this aggregate from the past few months. Shelter inflation continued to look strong in January, including a 0.74% increase for tenants’ rent and a 0.67% increase in owners’ equivalent rent. Changes to the other main components within the core services aggregate were mixed, with a 0.7% drop in medical care services prices standing out on the downside. This weakness in medical care services prices reflected another drop in health insurance prices (continuing the recent very weak trend) and also a 0.1% move down in prices for related professional services, which marked the first monthly decline for this series in almost a year.

* * *

As a result of today's data, Goldman continues to expect a 25bp rate hike at each of the next two FOMC meetings, with risks skewed towards additional hikes.

As for BofA's Gapen, he writes that "there is not a lot of new information in this report" and adds that "on net, the disinflation we are seeing remains narrow, driven by a few key core goods components, and it has yet to broaden. The Fed will need to see moderation in services inflation before having confidence that 2% is achievable." As such BofA sees risks to its terminal rate forecast of 5.0-5.25% "as being tilted to the upside on account of labor markets and risks around services inflation staying sticky."

All source reports available to pro subs.

We already shared several kneejerk reactions from Wall Street’s peanut gallery, now it’s time for the slightly more refined and thought out takes, courtesy of some of the biggest banks such as BofA, Goldman and JPM.

We start with BofA chief economist Michael Gapen who writes that the January CPI report was in line with expectations, and notes that over the last three months core CPI has increased at a 4.6% annualized rate, accelerating slightly from the 4.3% pace in December. In Gapen’s view, “there is not a lot of new information in this report. The Fed will need to see moderation in services inflation before having confidence that 2% is achievable. Today’s report did not drastically alter the risks around the policy outlook.” As a result, BofA still sees risks tilted to a terminal above the bank’s baseline estimate of 5.0-5.25% on account of labor markets and risks around services inflation staying sticky.

Some more details from BofA’s report:

- The increase in headline CPI was largely driven by two components: energy and shelter. Together these components accounted for three-fourths of the 0.5% increase. Energy prices rose by 2.0% m/m driven by higher gas prices and shelter inflation rose by 0.7% m/m. The former was stronger than BofA expected, while the latter was roughly in line with expectations. Additionally, food prices rose by 0.5%, in-line with the revised trend in 4Q.

- Meanwhile, core inflation was also driven by shelter inflation, which accounted for 32bp of the 41bp increase. Within core inflation services remained sticky at 0.5% m/m. Over the last three months, core services prices have risen by 6.8% annualized, well above the pre-pandemic pace. Granted much of the increase in core services reflects the ongoing strength of shelter inflation, which increased by 0.7% m/m. Within shelter Owners’ equivalent rent (OER) and rent rose by 0.7%, in line with our expectations. However, lodging away from home surprised relative to BofA’s forecasts with a 1.2% m/m increase.

- Outside of shelter. Medical care services fell by 0.7% m/m owing to a 3.6% drop in health insurance and a 0.1% decline in professional services. This was much weaker than BofA’s expected 0.1% m/m decline. Meanwhile, other services generally accelerated this month with transportation services rising by 0.9% m/m, education, and communication up 0.5% m/m and recreation services up 0.7% m/m. The Fed will likely take little comfort in these readings as it looks for signs that services inflation ex-housing is moderating.

- While core services inflation was broadly in line with expectations, core goods inflation was stronger than Gapen expected, rising by 0.1% m/m. This broke a streak of three consecutive decreases in core goods prices. Used car prices did fall again (-1.9% m/m), but that streak may be coming to an end soon based on data from Manheim (Exhibit 3). Additionally, the weight of used cars was reduced in the latest update. Therefore, it should be less of a swing factor moving forward. Excluding used cars, core goods rose by 0.5% m/m and 3.5% annualized over the last three months. While this is a noticeable deceleration, it is well above the pre-pandemic pace. Additionally, it suggests that goods price deflation is not broadening outside of used cars as BofA had been anticipating.

Next, we take a look at the reaction from Goldman’s Jan Hatzius, who as a reminder forecast inflation prints that were well above consensus and was therefore not wrong, and who writes that January core CPI rose 0.41%, slightly above consensus and its recent trend, and the year-on-year rate fell one tenth to 5.6%. According to the Goldman strategist, “start-of-year price increases were larger than normal in several categories including prescription drugs and private transportation services, but used car prices and airfares surprised to the downside.” Meanwhile, shelter categories finally decelerated (just barely).

Some more details from the GS report:

January core CPI rose 0.41% (mom sa), slightly above consensus of 0.4% but below our forecast of 0.49%. The year-on-year rate fell another tenth to 5.6%, above consensus and in line with our forecast.

The January effect—the interaction between start-of-year price setting and pent-up cost pressures—resulted in larger than normal price increases in several categories including prescription drugs (+2.1% mom), car fees (+1.2%), and several labor-reliant categories like nursing homes (+1.4%), car repair (+1.3%), day care (+0.7%), and food away from home (+0.6%). The key exception was physician services, for which prices declined 0.1%.

Hospital services (+0.7%) and personal care services (+0.2%) were also a bit softer than our expectations.

Used car prices (-1.9%) and airfares (-2.2%) declined by more than we expected and contributed -11bps to the monthly core reading. With used car auction prices and jet fuel prices moving higher at the start of the year, we expect this weakness to partially reverse in coming months.

Shelter categories finally decelerated (rent +0.74% vs. +0.79% in December, OER +0.67% vs. +0.79%), likely reflecting weakness in the new rental market and the larger OER weight on single-family homes implemented with today’s report.

Apparel (+0.8%) and new car (+0.2%) prices were firm, in our view reflecting positive residual seasonality.

Core services prices excluding rent and OER rose 0.36%, 0.03pp firmer than the prior 3-month average.

Headline CPI rose 0.52%, as energy prices rose 2.0% and food prices rose 0.5%.

Finally, here is JPM’s Daniel Silver who writes that “the main consumer price index (CPI) aggregates were pretty close to expectations in January, with the headline rising 0.5% and the core index moving up 0.4% (0.41% to two decimals).”

This headline gain was the firmest monthly change reported for this index since last June, and the January increase in the core was the strongest monthly change in four months. Even so, we think that the broad trends for inflation are moderating even if they remain firm.

In terms of year-ago inflation rates, the headline moved down from 6.5% in December to 6.4% in January while the core eased from 5.7% to 5.6%. Thursday’s PPI report also will contain important relevant information, but for now with only the January CPI data in hand, we think that January core PCE inflation is tracking a 0.44% monthly gain. The corresponding year-ago rate is expected to come in basically unchanged between December and January after rounding, at 4.4% oya.

In terms of some of the CPI report’s main details, Silver notes that the 2.0% increase in energy prices in January and the 0.5% increase in the food price index were pretty close to, but marginally above, his forecasts. Excluding food and energy, the core index came out a little below our forecast, in part because used vehicle prices fell another 1.9% in January (Silver had looked for a modest increase as industry data show recent firming in prices). Meanwhile, apparel prices increased 0.8% in January, the firmest monthly change in about a year, and prices for medical care commodities jumped 1.1%, the biggest increase in about three years. On the whole, core goods prices rose 0.1% in January, a fairly soft monthly change, but the firmest monthly gain since last August.

Elsewhere in the CPI, JPM notes that core services prices rose 0.5% in January, with this gain in line with the average rate of inflation for this aggregate from the past few months. Shelter inflation continued to look strong in January, including a 0.74% increase for tenants’ rent and a 0.67% increase in owners’ equivalent rent. Changes to the other main components within the core services aggregate were mixed, with a 0.7% drop in medical care services prices standing out on the downside. This weakness in medical care services prices reflected another drop in health insurance prices (continuing the recent very weak trend) and also a 0.1% move down in prices for related professional services, which marked the first monthly decline for this series in almost a year.

* * *

As a result of today’s data, Goldman continues to expect a 25bp rate hike at each of the next two FOMC meetings, with risks skewed towards additional hikes.

As for BofA’s Gapen, he writes that “there is not a lot of new information in this report” and adds that “on net, the disinflation we are seeing remains narrow, driven by a few key core goods components, and it has yet to broaden. The Fed will need to see moderation in services inflation before having confidence that 2% is achievable.” As such BofA sees risks to its terminal rate forecast of 5.0-5.25% “as being tilted to the upside on account of labor markets and risks around services inflation staying sticky.”

All source reports available to pro subs.

Loading…