Another day, another cold shower for long-suffering investors in what was once upon a time a greatly respected chip company.

On Wednesday morning, Intel Corp., the biggest maker of computer processors whose stock price has been eviscerated in the past two years, slashed its dividend payment to preserve cash for investment.

The company will reduce it’s quarterly payout to investors by 66% to 12.5 cents a share for holders payable June 1 - the lowest quarterly dividend since 2011 - the chipmaker said in a statement on Wednesday. Intel’s current quarterly dividend is 36.5 cents and was projected to cost more than $6 billion in 2023.

Intel also reaffirmed its adjusted revenue forecast for the first quarter, which as noted below, is hardly something to be proud of. The company also reiterated that...

- Still sees adjusted revenue $10.5 billion to $11.5 billion, estimate $11.08 billion

- Still sees adjusted loss per share 15c, estimate loss/shr 15c

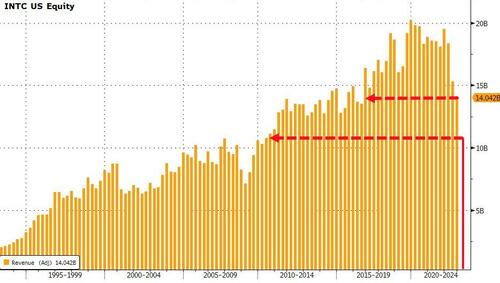

As reported last month, in its latest catastrophic earnings report Intel forecast one of the worst quarters in its history projecting revenue that would be the smallest since 2010, as a slowdown in personal-computer sales ravages the semiconductor industry.

Commenting on the dividend cut, Bloomberg Intelligence says that the move was not a surprise and had been widely expected. It notes that the cut “reflects the company’s challenge to improve cash flow despite its announced $3 billion in operational cost cuts”, and the problem is that Intel’s capex intensity leaves “little room to generate positive free cash flow for at least the next two years”

Wells Fargo also chimed in, saying that because this had been widely expected, “this announcement, while negative, will not materially change investor sentiment.”

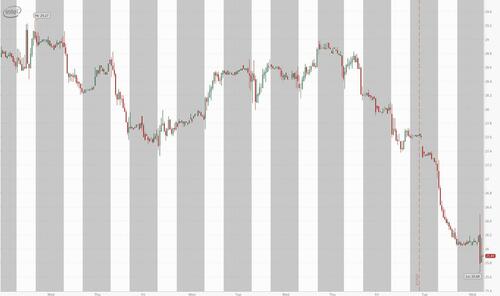

While the dividend cut may have been expected, INTC stock still dropped, sliding to the lowest level since the end of 2022.

Another day, another cold shower for long-suffering investors in what was once upon a time a greatly respected chip company.

On Wednesday morning, Intel Corp., the biggest maker of computer processors whose stock price has been eviscerated in the past two years, slashed its dividend payment to preserve cash for investment.

The company will reduce it’s quarterly payout to investors by 66% to 12.5 cents a share for holders payable June 1 – the lowest quarterly dividend since 2011 – the chipmaker said in a statement on Wednesday. Intel’s current quarterly dividend is 36.5 cents and was projected to cost more than $6 billion in 2023.

Intel also reaffirmed its adjusted revenue forecast for the first quarter, which as noted below, is hardly something to be proud of. The company also reiterated that…

- Still sees adjusted revenue $10.5 billion to $11.5 billion, estimate $11.08 billion

- Still sees adjusted loss per share 15c, estimate loss/shr 15c

As reported last month, in its latest catastrophic earnings report Intel forecast one of the worst quarters in its history projecting revenue that would be the smallest since 2010, as a slowdown in personal-computer sales ravages the semiconductor industry.

Commenting on the dividend cut, Bloomberg Intelligence says that the move was not a surprise and had been widely expected. It notes that the cut “reflects the company’s challenge to improve cash flow despite its announced $3 billion in operational cost cuts”, and the problem is that Intel’s capex intensity leaves “little room to generate positive free cash flow for at least the next two years”

Wells Fargo also chimed in, saying that because this had been widely expected, “this announcement, while negative, will not materially change investor sentiment.”

While the dividend cut may have been expected, INTC stock still dropped, sliding to the lowest level since the end of 2022.

Loading…