A much hotter than expected Core PCE print has sparked a dramatic hawkish response across markets.

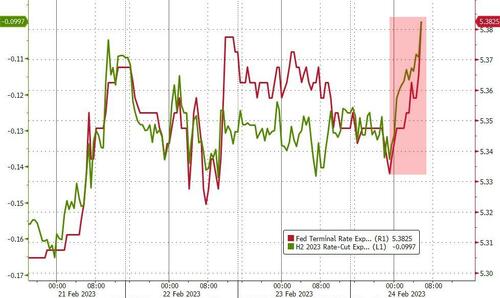

Expectations for The Fed's terminal rate has spiked to 5.39% and H2 2023 rate-cut expectations have dwindled to single-digits (just 9bps priced in)...

Source: Bloomberg

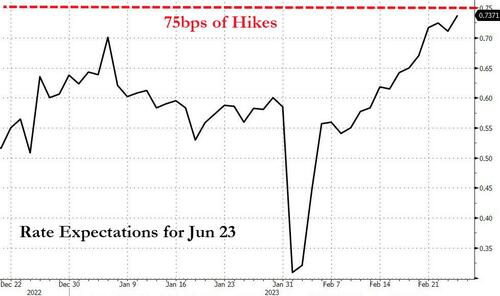

The market is now fully pricing in 3 x 25bps rate-hikes at the next three FOMC meetings...

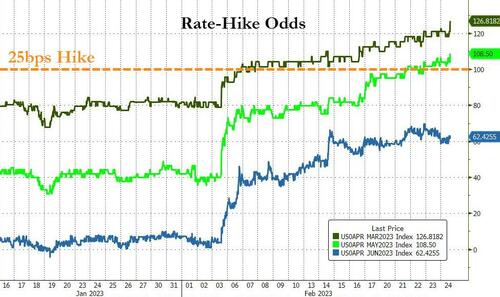

With the odds of a 50bps hike in March now up at around 25% (and a 25bps hike fully priced-in for

All of which sent stocks reeling, below yesterday's lows...

And Treasury yields soaring higher at the short-end while the long-end has rallied (yields slower post-PCE)...

The dollar is surging higher, erasing all of the losses since the January Payrolls slump...

Will the 0DTE gamers BTFD in stocks again?

A much hotter than expected Core PCE print has sparked a dramatic hawkish response across markets.

Expectations for The Fed’s terminal rate has spiked to 5.39% and H2 2023 rate-cut expectations have dwindled to single-digits (just 9bps priced in)…

Source: Bloomberg

The market is now fully pricing in 3 x 25bps rate-hikes at the next three FOMC meetings…

With the odds of a 50bps hike in March now up at around 25% (and a 25bps hike fully priced-in for

All of which sent stocks reeling, below yesterday’s lows…

And Treasury yields soaring higher at the short-end while the long-end has rallied (yields slower post-PCE)…

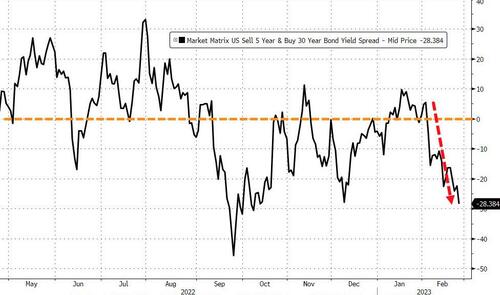

The yield curve (5s10s) is inverting deeper and deeper (pricing in recession/Fed policy error)…

With 2Y yields pushing to fresh cycle highs (highest since July 2007)…

The dollar is surging higher, erasing all of the losses since the January Payrolls slump…

Will the 0DTE gamers BTFD in stocks again?

Loading…