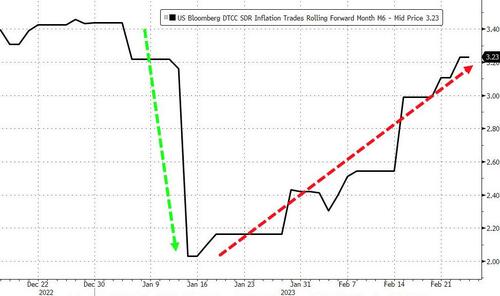

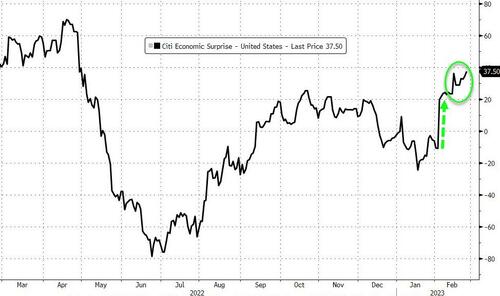

A week of hotter than expected data (especially in stickier-than-expected inflation-related data)...

Source: Bloomberg

...has driven inflation expectations roaring back to cycle highs as the 'Fed Pivot' narrative collapses...

Source: Bloomberg

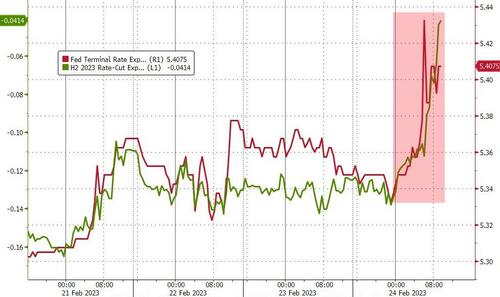

...and that has sent terminal-rate expectations spiking to cycle highs (and the expectations for any imminent rate-cuts evaporated)...

Source: Bloomberg

Goldman's Chris Hussey summarizes the flip-flop perfectly:

As we went through January, evidence mounted that inflation was indeed receding in the US and perhaps the coast was clearing for monetary policy, a soft landing of the economy, and perhaps even a reacceleration of activity with a boost from Europe and China.

But two reports in successive weeks here in February have called that narrative into question...

...led Goldman's economists to add an additional 25bp rate hike from the Fed, and pushed up yields on 10-year Treasuries by 60bp to 3.95% - nearing the top-end range we have seen in this cycle (yields peaked at 4.23% in October).

Today's higher than expected PCE inflation reading seems to confirm what we saw in last week's high PPI wholesale inflation report - that is that prices are continuing to rise in the US and that the rate of increase may not be receding as fast as it had been last fall (if the rate is receding at all)...

...policymakers - notably central bankers - have indicated that they are for the most part data dependent, providing further support to the view that we are in a higher-for-longer rate environment.

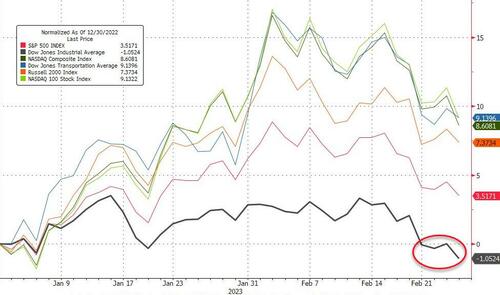

And while we had already seen Bonds, the dollar, and gold all reverse their trends from January, it wasn't until this week that we saw stocks actually begin to catch down to that more hawkish reality...

Source: Bloomberg

All the US Majors ended the holiday-shortened week in the red (Dow's worst week since September), down around 3%...

The Dow ended the week in the red for 2023...

Source: Bloomberg

The S&P 500 closed below its 50DMA, trapped in a range just above its 200DMA...

The Nasdaq found support at its 200DMA for the last two days...

Consumer Discretionary and Real Estate sectors were the ugliest horse in this week's glue factory and Energy stocks the best, eking out a tiny gain for the week...

Source: Bloomberg

In a replay of yesterday, 0DTE players went on offense to start the day, buying calls with both hands and feet but that surge was unable to ignite enough momentum to spark a squeeze higher and so calls were dumped...

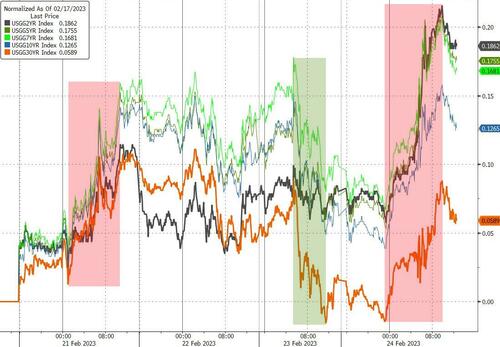

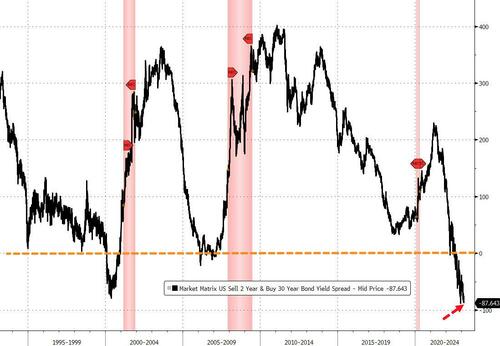

Treasury yields were higher across the curve this week with the short-end underperforming. 30Y yields actually dipped lower on the week at one point but today's carnage following the hot PCE print dragged everything higher (in yield)...

Source: Bloomberg

Which sent the yield curve (2s30s) to fresh cycle lows

Source: Bloomberg

Rate-hike odds for March, May, and June all surged hawkishly this week with March now pricing in a 20-25% chance of a 50bps hike (and May fully pricing in a 25bps hike)...

Source: Bloomberg

Which means the market is fully pricing in 75bps of hikes in the next 3 FOMC meetings...

Source: Bloomberg

The dollar ripped higher this week, erasing all the losses since the January payrolls plunge...

Source: Bloomberg

Bitcoin battled away around $23k again but ended with the worst week since November...

Source: Bloomberg

Gold was down for the 5th straight week, but held above $1800 for now...

Oil prices ended the week unchanged (after a big dip mid-week and another puke today)...

After falling for 9 of the 10 weeks, US NatGas prices soared higher this week (after first hitting a $1 handle) - the biggest weekly rise for Henry Hub since Thanksgiving...

Finally, in the year since the start of the war in Ukraine, the Russian Ruble has strengthened 11% against the USDollar, Brent Crude is down 16% and EU NatGas has crashed 55%...

Source: Bloomberg

Not sure many would have bet on that series of outcomes a year ago.

A week of hotter than expected data (especially in stickier-than-expected inflation-related data)…

Source: Bloomberg

…has driven inflation expectations roaring back to cycle highs as the ‘Fed Pivot’ narrative collapses…

Source: Bloomberg

…and that has sent terminal-rate expectations spiking to cycle highs (and the expectations for any imminent rate-cuts evaporated)…

Source: Bloomberg

Goldman’s Chris Hussey summarizes the flip-flop perfectly:

As we went through January, evidence mounted that inflation was indeed receding in the US and perhaps the coast was clearing for monetary policy, a soft landing of the economy, and perhaps even a reacceleration of activity with a boost from Europe and China.

But two reports in successive weeks here in February have called that narrative into question…

…led Goldman’s economists to add an additional 25bp rate hike from the Fed, and pushed up yields on 10-year Treasuries by 60bp to 3.95% – nearing the top-end range we have seen in this cycle (yields peaked at 4.23% in October).

Today’s higher than expected PCE inflation reading seems to confirm what we saw in last week’s high PPI wholesale inflation report – that is that prices are continuing to rise in the US and that the rate of increase may not be receding as fast as it had been last fall (if the rate is receding at all)…

…policymakers – notably central bankers – have indicated that they are for the most part data dependent, providing further support to the view that we are in a higher-for-longer rate environment.

And while we had already seen Bonds, the dollar, and gold all reverse their trends from January, it wasn’t until this week that we saw stocks actually begin to catch down to that more hawkish reality…

Source: Bloomberg

All the US Majors ended the holiday-shortened week in the red (Dow’s worst week since September), down around 3%…

The Dow ended the week in the red for 2023…

Source: Bloomberg

The S&P 500 closed below its 50DMA, trapped in a range just above its 200DMA…

The Nasdaq found support at its 200DMA for the last two days…

Consumer Discretionary and Real Estate sectors were the ugliest horse in this week’s glue factory and Energy stocks the best, eking out a tiny gain for the week…

Source: Bloomberg

In a replay of yesterday, 0DTE players went on offense to start the day, buying calls with both hands and feet but that surge was unable to ignite enough momentum to spark a squeeze higher and so calls were dumped…

Treasury yields were higher across the curve this week with the short-end underperforming. 30Y yields actually dipped lower on the week at one point but today’s carnage following the hot PCE print dragged everything higher (in yield)…

Source: Bloomberg

Which sent the yield curve (2s30s) to fresh cycle lows

Source: Bloomberg

Rate-hike odds for March, May, and June all surged hawkishly this week with March now pricing in a 20-25% chance of a 50bps hike (and May fully pricing in a 25bps hike)…

Source: Bloomberg

Which means the market is fully pricing in 75bps of hikes in the next 3 FOMC meetings…

Source: Bloomberg

The dollar ripped higher this week, erasing all the losses since the January payrolls plunge…

Source: Bloomberg

Bitcoin battled away around $23k again but ended with the worst week since November…

Source: Bloomberg

Gold was down for the 5th straight week, but held above $1800 for now…

Oil prices ended the week unchanged (after a big dip mid-week and another puke today)…

After falling for 9 of the 10 weeks, US NatGas prices soared higher this week (after first hitting a $1 handle) – the biggest weekly rise for Henry Hub since Thanksgiving…

Finally, in the year since the start of the war in Ukraine, the Russian Ruble has strengthened 11% against the USDollar, Brent Crude is down 16% and EU NatGas has crashed 55%…

Source: Bloomberg

Not sure many would have bet on that series of outcomes a year ago.

Loading…