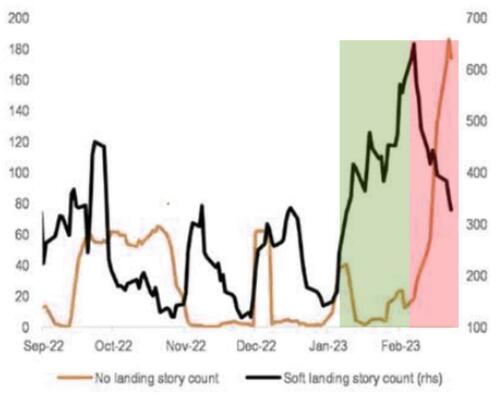

2023 so far - a tale of two narratives...from 'soft' landing to 'no' landing...

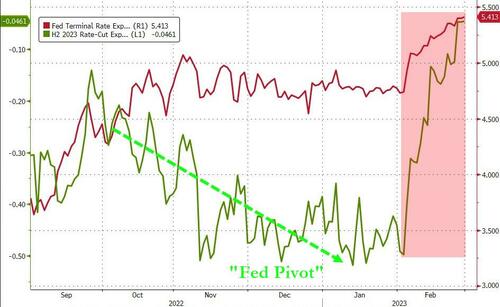

February's macro theme was the death of The Fed Pivot narrative as expectations for an H2 2023 rate-cut collapsed and the terminal rate outlook priced in rose significantly...

Source: Bloomberg

This was all sparked by the massive surge in positive macro surprise data in the US (Feb saw the biggest absolute jump in the Citi US Economic Surprise Index since July 2020)...

Source: Bloomberg

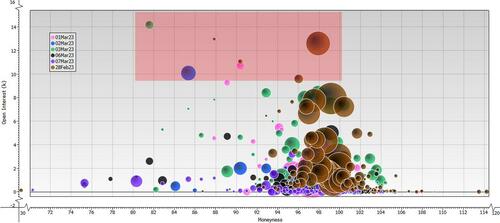

February's micro theme was the ongoing intraday dominance of 0DTE trading with SPX 0DTE options making up over 50% of volume...

For example, there are 7 major options lines with Open Interest over 10k that expire in the next few days...

Source: Bloomberg

As Goldman's traders noted, these are significant positions for a relatively quiet week with Q1 earnings mostly wrapped and no major economic data points. This is becoming the new normal.

And the impact of 0DTE is clearly seen here in the poster-child stock...

Source: Bloomberg

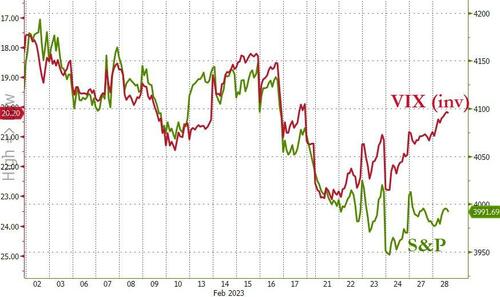

As Charlie McElligott explains, 0DTE options flows leading to an "intraday Vol only" dynamic (via market-maker Gamma hedging requirements creating "accelerant flows"... which then later see a ubiquitous "mean-reversion" from monetization of both bot 0DTE Calls and Puts), which leaves "close-to-close" volatility bleeding lower as any 'intraday' event is washed away. The latter of which helps explain why Vix and the market have decoupled in recent days...

Source: Bloomberg

Overall, February was the unwind of January's cross-asset-class trends... with Equities being the last to wake up to reality...

Source: Bloomberg

After an extremely strong January, February flopped with The Dow leading the swing lower, but all the US majors red in the month (Nasdaq briefly tagged green today for the month but could not hold it)...

This was The Dow's worst month since Sept 2022.

Today ended ugly with some dramatic selling pressure with everything closing red on the day...

...but once again it was all about the 0DTE trend-runners with early action offsetting before 0DTE traders bid puts aggressively into the market rally but as 0DTE call-owners covered, stocks rolled over and accelerated lower into a smallish MoC sell wave.

That late push drove the S&P down to test the 50DMA once again...

That has left The Dow in the red YTD, while Nasdaq 100 remains up over 10% YTD...

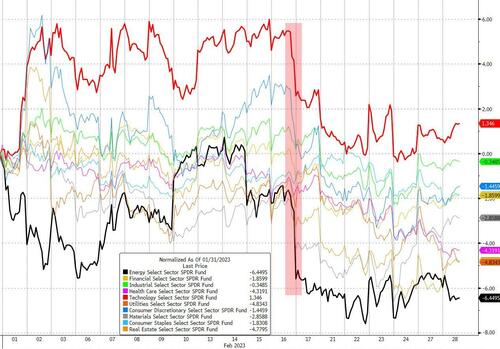

Energy stocks were the month's biggest laggard while Tech outperformed...

Source: Bloomberg

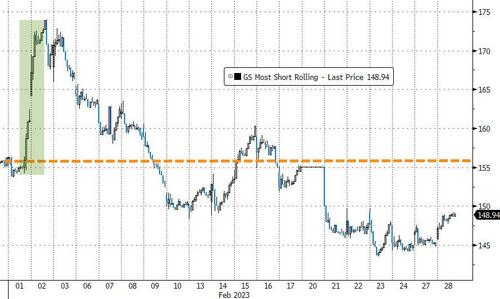

After January's biggest monthly short squeeze since Jan 2021, February saw 'most shorted' stocks actually sink

Source: Bloomberg

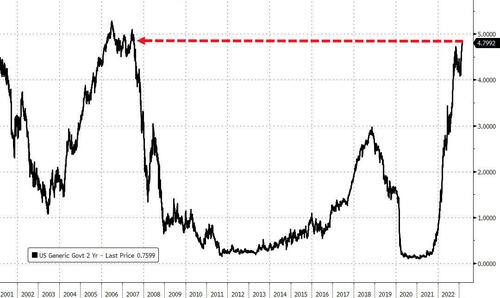

Bonds were a bloodbath in February with yields at the short-end up a stunning 60bps (while the long-end outperformed, 30Y yields were still up 30bps on the month)...

Source: Bloomberg

While the 10Y Yield pushed up towards (but did not tag) the 4.00% level, the 2Y yield broke back above its November highs to its highest yield since July 2007...

Source: Bloomberg

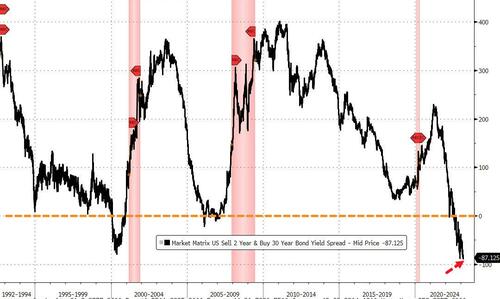

The yield curve (2s30s) has never closed in a more inverted manner than now...

Source: Bloomberg

Also, we note that inflation expectations (1Y Inflation Swap) soared back to life in February...

Source: Bloomberg

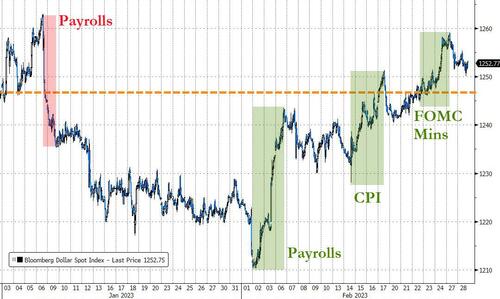

The dollar soared back into the green for the year in February, after four straight monthly declines...

Source: Bloomberg

Bitcoin & Ethereum managed modest gains in February while Ripple and Solana ended the month lower...

Source: Bloomberg

Commodities, broadly speaking, ended the month of February lower with Silver lagging and Energy the least bad (after NatGas roared back from its mid-month carnage)...

Source: Bloomberg

Gold ended the month in the red for the year, despite a decent surge higher today - but overall Feb saw 3 or 4 major selling waves...

Silver's relative clubbing (down to a $20 handle today) has lifted the Gold/Silver ratio back above 85 to its highest since early Oct 2022...

Source: Bloomberg

Oil prices remain rangebound with WTI trading in a $73-83 range for the last 3 months...

US NatGas prices have collapsed since early December but while the leg higher in the bottom right of this chart doesn't look like much, it pushed Henry Hub back top almost unchanged on the month (after briefly tagging a $1 handle)...

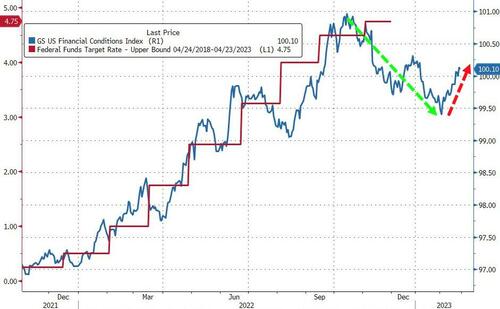

Finally, amid all the chaos of the month, financial conditions have tightened notably (now back to unchanged YTD), slowly but surely catching back up to monetary policy's tightness...

Source: Bloomberg

And as unimpressed as Powell pretended to be about this decoupling, the volume of FedSpeak uttered by his pals would argue very different.

Nomura's Charlie McElligott issued a warning though this morning for the way forward:

The onus is now on even bigger upside surprise data to substantiate ongoing FCI tightening and pricing of higher terminal rates from here....and which increasingly looks like a tall order, now that Street economists are taking-up their growth and inflation estimates again in unison, AS WELL AS the fact that we actually HAVE seen financial conditions adjust appropriately MUCH “tighter” over the past month as a data “headwind”.

Said another way, the bar is getting very high for sustained economic data "beats" which has been the catalyst for the Rates / terminal repricing in recent weeks, which then knocked-on into the FCI tightening which had hit risk-assets over the past two weeks...which likely means that "downside surprises" should be expected soon, as is the natural "mean-reversion" in economic surprise indices (“upside surprise” vs low expectations, which causes a upwards revisions to conensus estimates, which then increases frequency of “downside surprises”—the cycle continues).

And if “sustained better data = higher terminal repricing” is still part of your current Equities “bear-case” from here (after you already squeezed most of the blood from that stone over the past two weeks), you better be careful...

Sure, another big NFP could very well restart the “higher terminal / FCI tightening” spiral yet-again for markets in a week and a half... but for now, we are again “priced-to-perfection” across nearly all-assets following the multi-week positioning- and market narrative- reset.

For now, bonds are at their cheapest to stocks since the very peak in 2007...

There Is An Alternative after all...

2023 so far – a tale of two narratives…from ‘soft’ landing to ‘no’ landing…

February’s macro theme was the death of The Fed Pivot narrative as expectations for an H2 2023 rate-cut collapsed and the terminal rate outlook priced in rose significantly…

Source: Bloomberg

This was all sparked by the massive surge in positive macro surprise data in the US (Feb saw the biggest absolute jump in the Citi US Economic Surprise Index since July 2020)…

Source: Bloomberg

February’s micro theme was the ongoing intraday dominance of 0DTE trading with SPX 0DTE options making up over 50% of volume…

For example, there are 7 major options lines with Open Interest over 10k that expire in the next few days…

Source: Bloomberg

As Goldman’s traders noted, these are significant positions for a relatively quiet week with Q1 earnings mostly wrapped and no major economic data points. This is becoming the new normal.

And the impact of 0DTE is clearly seen here in the poster-child stock…

Source: Bloomberg

As Charlie McElligott explains, 0DTE options flows leading to an “intraday Vol only” dynamic (via market-maker Gamma hedging requirements creating “accelerant flows”… which then later see a ubiquitous “mean-reversion” from monetization of both bot 0DTE Calls and Puts), which leaves “close-to-close” volatility bleeding lower as any ‘intraday’ event is washed away. The latter of which helps explain why Vix and the market have decoupled in recent days…

Source: Bloomberg

Overall, February was the unwind of January’s cross-asset-class trends… with Equities being the last to wake up to reality…

Source: Bloomberg

After an extremely strong January, February flopped with The Dow leading the swing lower, but all the US majors red in the month (Nasdaq briefly tagged green today for the month but could not hold it)…

This was The Dow’s worst month since Sept 2022.

Today ended ugly with some dramatic selling pressure with everything closing red on the day…

…but once again it was all about the 0DTE trend-runners with early action offsetting before 0DTE traders bid puts aggressively into the market rally but as 0DTE call-owners covered, stocks rolled over and accelerated lower into a smallish MoC sell wave.

That late push drove the S&P down to test the 50DMA once again…

That has left The Dow in the red YTD, while Nasdaq 100 remains up over 10% YTD…

Energy stocks were the month’s biggest laggard while Tech outperformed…

Source: Bloomberg

After January’s biggest monthly short squeeze since Jan 2021, February saw ‘most shorted’ stocks actually sink

Source: Bloomberg

Bonds were a bloodbath in February with yields at the short-end up a stunning 60bps (while the long-end outperformed, 30Y yields were still up 30bps on the month)…

Source: Bloomberg

While the 10Y Yield pushed up towards (but did not tag) the 4.00% level, the 2Y yield broke back above its November highs to its highest yield since July 2007…

Source: Bloomberg

The yield curve (2s30s) has never closed in a more inverted manner than now…

Source: Bloomberg

Also, we note that inflation expectations (1Y Inflation Swap) soared back to life in February…

Source: Bloomberg

The dollar soared back into the green for the year in February, after four straight monthly declines…

Source: Bloomberg

Bitcoin & Ethereum managed modest gains in February while Ripple and Solana ended the month lower…

Source: Bloomberg

Commodities, broadly speaking, ended the month of February lower with Silver lagging and Energy the least bad (after NatGas roared back from its mid-month carnage)…

Source: Bloomberg

Gold ended the month in the red for the year, despite a decent surge higher today – but overall Feb saw 3 or 4 major selling waves…

Silver’s relative clubbing (down to a $20 handle today) has lifted the Gold/Silver ratio back above 85 to its highest since early Oct 2022…

Source: Bloomberg

Oil prices remain rangebound with WTI trading in a $73-83 range for the last 3 months…

US NatGas prices have collapsed since early December but while the leg higher in the bottom right of this chart doesn’t look like much, it pushed Henry Hub back top almost unchanged on the month (after briefly tagging a $1 handle)…

Finally, amid all the chaos of the month, financial conditions have tightened notably (now back to unchanged YTD), slowly but surely catching back up to monetary policy’s tightness…

Source: Bloomberg

And as unimpressed as Powell pretended to be about this decoupling, the volume of FedSpeak uttered by his pals would argue very different.

Nomura’s Charlie McElligott issued a warning though this morning for the way forward:

The onus is now on even bigger upside surprise data to substantiate ongoing FCI tightening and pricing of higher terminal rates from here….and which increasingly looks like a tall order, now that Street economists are taking-up their growth and inflation estimates again in unison, AS WELL AS the fact that we actually HAVE seen financial conditions adjust appropriately MUCH “tighter” over the past month as a data “headwind”.

Said another way, the bar is getting very high for sustained economic data “beats” which has been the catalyst for the Rates / terminal repricing in recent weeks, which then knocked-on into the FCI tightening which had hit risk-assets over the past two weeks…which likely means that “downside surprises” should be expected soon, as is the natural “mean-reversion” in economic surprise indices (“upside surprise” vs low expectations, which causes a upwards revisions to conensus estimates, which then increases frequency of “downside surprises”—the cycle continues).

And if “sustained better data = higher terminal repricing” is still part of your current Equities “bear-case” from here (after you already squeezed most of the blood from that stone over the past two weeks), you better be careful…

Sure, another big NFP could very well restart the “higher terminal / FCI tightening” spiral yet-again for markets in a week and a half… but for now, we are again “priced-to-perfection” across nearly all-assets following the multi-week positioning- and market narrative- reset.

For now, bonds are at their cheapest to stocks since the very peak in 2007…

There Is An Alternative after all…

Loading…