Oil prices have collapsed further this morning - after bouncing last night on API-reported product inventory drawdowns - as last night's China macro data didn't suggest a strong re-opening and Europe's banking system joining the systemic crash freight train is not helping sentiment as oil stands alone for now in pricing an imminent recession.

"The energy complex appears to be connecting the dots between the recent banking issues and a possible recession," oil-consulting firm Ritterbusch and Associates told clients Tuesday.

Additionally, the EIA says global oil markets are contending with a surplus as Russian production defies predictions of a slump while fuel demand slowly picks up.

“World oil supply should comfortably exceed demand in the first half of the year,” said the agency, which advises major economies.

“Much of the supply overhang reflects ample Russian barrels racing to re-route to new destinations.”

Will we see another US crude build as API reported last night?

API

-

Crude +1.16mm (+100k exp)

-

Cushing -950k

-

Gasoline -4.59mm (-1.2mm exp)

-

Distillates -2.89mm (-600k exp)

DOE

-

Crude +1.55mm (+100k exp)

-

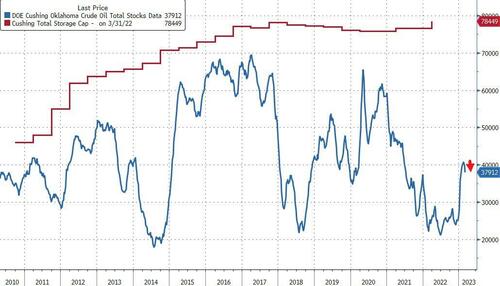

Cushing -1.916mm - biggest draw since May 2021

-

Gasoline -2.061mm (-1.2mm exp)

-

Distillates -2.527mm (-600k exp)

US Crude stocks rose last week but Products and Cushing saw considerable drawdowns...

Source: Bloomberg

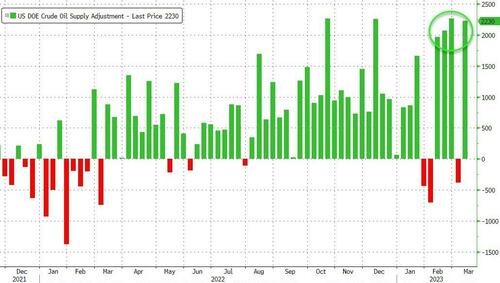

The now much-watched 'adjustment factor' on the DOE data is back near record highs...

Total crude stocks remain at highest since May 2021...

Source: Bloomberg

Inventory levels at the Cushing hub are rolling over from two year highs...

Source: Bloomberg

US crude production was flat last week as rig counts trend lower...

Source: Bloomberg

WTI was trading just below $69 ahead of the official data and rose modestly after...

Central bankers' ultimate path on interest rates could have big implications for the oil patch, said Dan Pickering, chief investment officer of Pickering Energy Partners. "Somewhere out there is an economic slowdown," Mr. Pickering said.

Oil prices have collapsed further this morning – after bouncing last night on API-reported product inventory drawdowns – as last night’s China macro data didn’t suggest a strong re-opening and Europe’s banking system joining the systemic crash freight train is not helping sentiment as oil stands alone for now in pricing an imminent recession.

“The energy complex appears to be connecting the dots between the recent banking issues and a possible recession,” oil-consulting firm Ritterbusch and Associates told clients Tuesday.

Additionally, the EIA says global oil markets are contending with a surplus as Russian production defies predictions of a slump while fuel demand slowly picks up.

“World oil supply should comfortably exceed demand in the first half of the year,” said the agency, which advises major economies.

“Much of the supply overhang reflects ample Russian barrels racing to re-route to new destinations.”

Will we see another US crude build as API reported last night?

API

-

Crude +1.16mm (+100k exp)

-

Cushing -950k

-

Gasoline -4.59mm (-1.2mm exp)

-

Distillates -2.89mm (-600k exp)

DOE

-

Crude +1.55mm (+100k exp)

-

Cushing -1.916mm – biggest draw since May 2021

-

Gasoline -2.061mm (-1.2mm exp)

-

Distillates -2.527mm (-600k exp)

US Crude stocks rose last week but Products and Cushing saw considerable drawdowns…

Source: Bloomberg

The now much-watched ‘adjustment factor’ on the DOE data is back near record highs…

Total crude stocks remain at highest since May 2021…

Source: Bloomberg

Inventory levels at the Cushing hub are rolling over from two year highs…

Source: Bloomberg

US crude production was flat last week as rig counts trend lower…

Source: Bloomberg

WTI was trading just below $69 ahead of the official data and rose modestly after…

Central bankers’ ultimate path on interest rates could have big implications for the oil patch, said Dan Pickering, chief investment officer of Pickering Energy Partners. “Somewhere out there is an economic slowdown,” Mr. Pickering said.

Loading…