After repeated laments by the likes of Bill Ackman, who most recently said that "I continue to believe that the best course of action is a temporary @FDICgov deposit guarantee until an updated insurance regime is introduced" (and who just flip-flopped on his "Fed must hike with shock and awe" call from 2022 and is now urging for a Fed hiking pause), and following a Bloomberg weekend report that US mid-sized banks demanded a two-year total deposit insurance scheme from the FDIC, and warned if it doesn't arrive, there may lots more shotgun weddings (or shotguns), moments ago Bloomberg reported that "US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis." Guess our March 12 tweet was ahead of its time yet again.

FDIC unveils new sign pic.twitter.com/PbYESPaji5

— zerohedge (@zerohedge) March 12, 2023

The BBG report explains that "Treasury Department staff are reviewing whether federal regulators have enough emergency authority to temporarily insure deposits greater than the current $250,000 cap on most accounts" without formal consent from a deeply divided Congress, and goes on to note that "authorities don’t yet view such a move as necessary, especially after regulators took steps this month to help banks keep up with any demands for withdrawals" which is an important caveat, and is the same one that hawks are using to justify why a Fed pause would be self-defeating ("why is the Fed blowing up their last bit of inflation-fighting credibility; what do they know that we don't): the same question can be applied to the Treasury: "what does the Treasury know that we don't."

Most likely nothing - after all bank crises are non-linear, but as Bloomberg notes, "still, they are developing a strategy out of due diligence in case the situation worsens."

“We will use the tools we have to support community banks,” White House spokesman Michael Kikukawa said, without directly addressing whether the measure is being studied. “Since our administration and the regulators took decisive action last weekend, we have seen deposits stabilize at regional banks throughout the country and, in some cases, outflows have modestly reversed.”

Still, the report notes, the behind-the-scenes deliberations show there are concerns in Washington’s corridors of power as midsize banks call for broader government intervention after three lenders collapsed this month when uninsured depositors pulled their money, and as a fourth firm strives to avoid a similar fate. Shares of that one, First Republic Bank, tumbled an additional 47% on Monday as industry leaders tried to find a way to bolster the company’s finances.

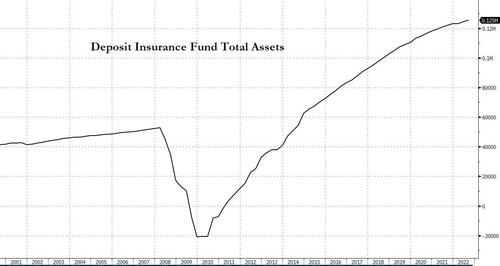

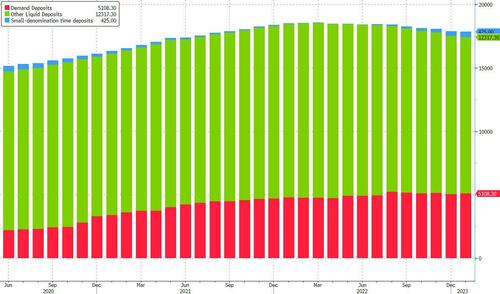

Ok, that's the theory. What about the practice? After all, as regular readers know there are $18 trillion in total deposits, all of which will have to be insured...

... and just $125 billion in the FDIC's Deposit Insurance Fund, which makes an outright guarantee of all deposits just a small mathematical impossibility.

Well, there's always printing. According to Bloomberg, one legal framework under discussion for expanding FDIC insurance would use the Treasury Department’s authority to take emergency action and lean on the Exchange Stabilization Fund. The same magical Exchange Stabilization Fund which the Treasury is already using to backstop its latest bank bailout facility, the Bank Term Funding Program, or BTFP.

Here too there is a small problem: that ESF pot of money is used to buy or sell currencies and to provide financing to foreign governments. A bigger problem: the ESF only has $25 billion currently in it as parts of its BTFP backstop.... but it has to do, as it is the only pot of money under the full authority of Janet Yellen, with other spending and financing under the jurisdiction of Congress.

Any mechanism using the ESF as a bailout mechanism uses the cash from the fund as a first-loss equity tranche to which the Fed then applies leverage. LOTS of leverage, because if authorities plan on backstopping the $18 trillion in total US deposits, the Fed will need to cover the difference... of some $17.975 trillion (unless Congress reaches a bipartisan deal to infuse more capital in the ESF, the same way the ESF was expanded to $500BN during the covid crisis

Meanwhile, in keeping with the tradition of saying the polar opposite of what it is doing, a Treasury spokeswoman said in a statement that “due to decisive recent actions, the situation has stabilized, deposit flows are improving and Americans can have confidence in the safety of their deposits”

Which of course explains why First Republic is about to join the collapse contagion and why Treasury is planning a full deposit backstop.

Finally, such a program will likely have to also be the result of an executive order since it has little hope of passing in Congress where members of both the left and right will be vehemently against it.

“Any universal guarantee on all bank deposits, whether implicit or explicit, enshrines a dangerous precedent that simply encourages future irresponsible behavior to be paid for by those not involved who followed the rules,” the House Freedom Caucus said in a statement, and we are confident most of the progressive wing will not be too excited about bailing out billionaires and corporations with orders of magnitude more in the bank than the FDIC limit.

As The Chicago Fed wrote in a paper in 1986 - after the deposit runs at Penn Square National Bank and Continental Illinois Bank - uninsured deposits are a source of market discipline for banks. Herbert Baer and Elijah Brewer go further, warning that doing away with insured deposits (i.e. by insuring every deposit as is being considered currently) would actually increase risk in the banking system.

"While such proposals might reduce the likelihood of bank runs, they would at the same time reduce banks' incentives to control risk."

Will US bank regulators learn from the mistakes of the past?

After repeated laments by the likes of Bill Ackman, who most recently said that “I continue to believe that the best course of action is a temporary @FDICgov deposit guarantee until an updated insurance regime is introduced” (and who just flip-flopped on his “Fed must hike with shock and awe“ call from 2022 and is now urging for a Fed hiking pause), and following a Bloomberg weekend report that US mid-sized banks demanded a two-year total deposit insurance scheme from the FDIC, and warned if it doesn’t arrive, there may lots more shotgun weddings (or shotguns), moments ago Bloomberg reported that “US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.” Guess our March 12 tweet was ahead of its time yet again.

FDIC unveils new sign pic.twitter.com/PbYESPaji5

— zerohedge (@zerohedge) March 12, 2023

The BBG report explains that “Treasury Department staff are reviewing whether federal regulators have enough emergency authority to temporarily insure deposits greater than the current $250,000 cap on most accounts” without formal consent from a deeply divided Congress, and goes on to note that “authorities don’t yet view such a move as necessary, especially after regulators took steps this month to help banks keep up with any demands for withdrawals” which is an important caveat, and is the same one that hawks are using to justify why a Fed pause would be self-defeating (“why is the Fed blowing up their last bit of inflation-fighting credibility; what do they know that we don’t): the same question can be applied to the Treasury: “what does the Treasury know that we don’t.”

Most likely nothing – after all bank crises are non-linear, but as Bloomberg notes, “still, they are developing a strategy out of due diligence in case the situation worsens.”

“We will use the tools we have to support community banks,” White House spokesman Michael Kikukawa said, without directly addressing whether the measure is being studied. “Since our administration and the regulators took decisive action last weekend, we have seen deposits stabilize at regional banks throughout the country and, in some cases, outflows have modestly reversed.”

Still, the report notes, the behind-the-scenes deliberations show there are concerns in Washington’s corridors of power as midsize banks call for broader government intervention after three lenders collapsed this month when uninsured depositors pulled their money, and as a fourth firm strives to avoid a similar fate. Shares of that one, First Republic Bank, tumbled an additional 47% on Monday as industry leaders tried to find a way to bolster the company’s finances.

Ok, that’s the theory. What about the practice? After all, as regular readers know there are $18 trillion in total deposits, all of which will have to be insured…

… and just $125 billion in the FDIC’s Deposit Insurance Fund, which makes an outright guarantee of all deposits just a small mathematical impossibility.

Well, there’s always printing. According to Bloomberg, one legal framework under discussion for expanding FDIC insurance would use the Treasury Department’s authority to take emergency action and lean on the Exchange Stabilization Fund. The same magical Exchange Stabilization Fund which the Treasury is already using to backstop its latest bank bailout facility, the Bank Term Funding Program, or BTFP.

Here too there is a small problem: that ESF pot of money is used to buy or sell currencies and to provide financing to foreign governments. A bigger problem: the ESF only has $25 billion currently in it as parts of its BTFP backstop…. but it has to do, as it is the only pot of money under the full authority of Janet Yellen, with other spending and financing under the jurisdiction of Congress.

Any mechanism using the ESF as a bailout mechanism uses the cash from the fund as a first-loss equity tranche to which the Fed then applies leverage. LOTS of leverage, because if authorities plan on backstopping the $18 trillion in total US deposits, the Fed will need to cover the difference… of some $17.975 trillion (unless Congress reaches a bipartisan deal to infuse more capital in the ESF, the same way the ESF was expanded to $500BN during the covid crisis

Meanwhile, in keeping with the tradition of saying the polar opposite of what it is doing, a Treasury spokeswoman said in a statement that “due to decisive recent actions, the situation has stabilized, deposit flows are improving and Americans can have confidence in the safety of their deposits”

Which of course explains why First Republic is about to join the collapse contagion and why Treasury is planning a full deposit backstop.

Finally, such a program will likely have to also be the result of an executive order since it has little hope of passing in Congress where members of both the left and right will be vehemently against it.

“Any universal guarantee on all bank deposits, whether implicit or explicit, enshrines a dangerous precedent that simply encourages future irresponsible behavior to be paid for by those not involved who followed the rules,” the House Freedom Caucus said in a statement, and we are confident most of the progressive wing will not be too excited about bailing out billionaires and corporations with orders of magnitude more in the bank than the FDIC limit.

As The Chicago Fed wrote in a paper in 1986 – after the deposit runs at Penn Square National Bank and Continental Illinois Bank – uninsured deposits are a source of market discipline for banks. Herbert Baer and Elijah Brewer go further, warning that doing away with insured deposits (i.e. by insuring every deposit as is being considered currently) would actually increase risk in the banking system.

“While such proposals might reduce the likelihood of bank runs, they would at the same time reduce banks’ incentives to control risk.”

Will US bank regulators learn from the mistakes of the past?

Loading…