Oil prices will soar to $140 by the end of this year, hedge fund manager Pierre Andurand said at the FT Commodities Global Summit on Tuesday, adding that the recent slump was speculative on the back of the banking sector troubles. Echoing a popular thesis espoused by Goldman - namely that shrinking supply and capex spending can not keep up with rising demand - Andurand said adding that even when oil demand peaks around the end of this decade (an aggressive hypothesis), it will not head for a fast decline.

"Even when we peak, oil demand won't fall down so fast. We will reach peak demand towards 110 million barrels per day and then a slow decline from there," the hedge fund manager said at the summit, cited by Reuters.

Andurand's forecast is a repeat of what he said earlier this year, when he predicted that oil could rise above $140 per barrel this year if China's economy fully reopens.

Joining the French commodity trader in the bullish corner in the FT Commodities Global Summit today, was Amrita Sen, Director of Research at Energy Aspects, who also expressed a bullish view on oil demand for the second half of 2023. Sen said that demand in China is very consumer-driven after the reopening, adding that gasoline and jet fuel demand are set to rebound.

"Jet is going to be the big story this year," Sen added, just as the Shanghai International Airport announced that Shanghai’s Hongqiao airport will resume international flights from March 26, boosting jet fuel demand substantially.

The plunge in crude also represents a threat to supply, said Sen: "About 200,000 to 300,000 barrels a day of US production is at risk at current prices, while demand could get a 200,000 barrels a day boost."

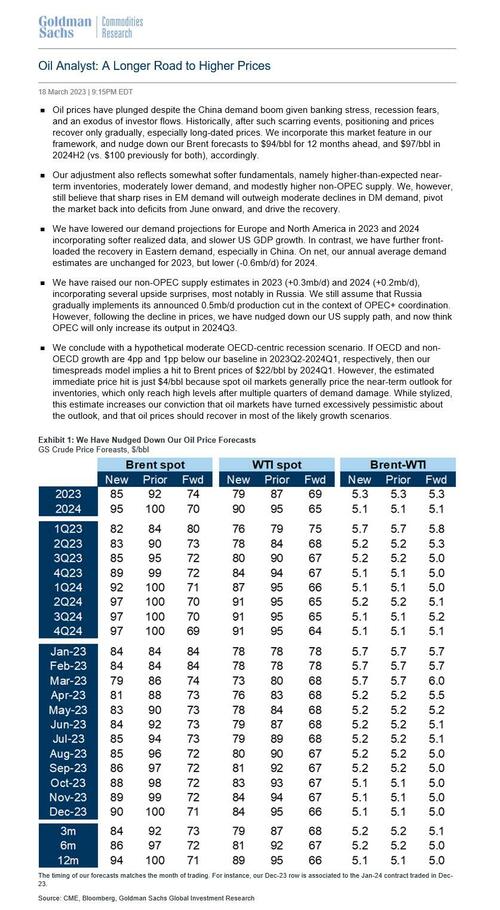

Elsewhere, Goldman's notoriously bullish commodities team - still smarting from its recent 12-month Brent price target cut from $100 to $94/bbl - refuses to turn bearish, and said that the banking crisis will eventually be bullish for oil prices because it will hit supply harder than demand.

Also speaking at the FT Commodities Global Summit in Lausanne, Switzerland, Goldman's head of commodity research Jeff Currie said that there’s no sign yet that contagion is weakening physical demand for raw materials, and noted that the greatest impact from a crisis that’s focused on regional US banks could be to limit the capital available to shale drillers, which would ultimately curb oil supply.

And leaving no bases uncovered, Currie said that if the US Federal Reserve pauses its interest rate hikes on Wednesday in response to the banking crisis, which is now Goldman’s base case, that would also be bullish for oil.

“The problem is in regional banks in the United States” which are reducing their lending, Currie said. “What kind of lending gets hit? It’s what’s going to go to the shale patch. So it’s more of a supply hit when we think about it further out than it’s likely to be a demand hit.”

As we noted over the weekend, Goldman - which has long been one of the most bullish banks on oil - nudged its forecasts lower this week as worries over the banking sector and the potential for recession outweigh a surge in demand from China.

However, Currie said his conviction that there will be a commodities supercycle is stronger than before the current crisis. He sees the oil market slipping into deficit in June, which would draw investors back into the sector.

Oil prices slumped by $10 per barrel in one week as the markets were roiled by the collapse of two banks in the United States and the near-collapse of Credit Suisse, which was forcibly takenunder by domestic rival, and now banking supergiant, UBS.

Oil prices will soar to $140 by the end of this year, hedge fund manager Pierre Andurand said at the FT Commodities Global Summit on Tuesday, adding that the recent slump was speculative on the back of the banking sector troubles. Echoing a popular thesis espoused by Goldman – namely that shrinking supply and capex spending can not keep up with rising demand – Andurand said adding that even when oil demand peaks around the end of this decade (an aggressive hypothesis), it will not head for a fast decline.

“Even when we peak, oil demand won’t fall down so fast. We will reach peak demand towards 110 million barrels per day and then a slow decline from there,” the hedge fund manager said at the summit, cited by Reuters.

Andurand’s forecast is a repeat of what he said earlier this year, when he predicted that oil could rise above $140 per barrel this year if China’s economy fully reopens.

Joining the French commodity trader in the bullish corner in the FT Commodities Global Summit today, was Amrita Sen, Director of Research at Energy Aspects, who also expressed a bullish view on oil demand for the second half of 2023. Sen said that demand in China is very consumer-driven after the reopening, adding that gasoline and jet fuel demand are set to rebound.

“Jet is going to be the big story this year,” Sen added, just as the Shanghai International Airport announced that Shanghai’s Hongqiao airport will resume international flights from March 26, boosting jet fuel demand substantially.

The plunge in crude also represents a threat to supply, said Sen: “About 200,000 to 300,000 barrels a day of US production is at risk at current prices, while demand could get a 200,000 barrels a day boost.“

Elsewhere, Goldman’s notoriously bullish commodities team – still smarting from its recent 12-month Brent price target cut from $100 to $94/bbl – refuses to turn bearish, and said that the banking crisis will eventually be bullish for oil prices because it will hit supply harder than demand.

Also speaking at the FT Commodities Global Summit in Lausanne, Switzerland, Goldman’s head of commodity research Jeff Currie said that there’s no sign yet that contagion is weakening physical demand for raw materials, and noted that the greatest impact from a crisis that’s focused on regional US banks could be to limit the capital available to shale drillers, which would ultimately curb oil supply.

And leaving no bases uncovered, Currie said that if the US Federal Reserve pauses its interest rate hikes on Wednesday in response to the banking crisis, which is now Goldman’s base case, that would also be bullish for oil.

“The problem is in regional banks in the United States” which are reducing their lending, Currie said. “What kind of lending gets hit? It’s what’s going to go to the shale patch. So it’s more of a supply hit when we think about it further out than it’s likely to be a demand hit.”

As we noted over the weekend, Goldman – which has long been one of the most bullish banks on oil – nudged its forecasts lower this week as worries over the banking sector and the potential for recession outweigh a surge in demand from China.

However, Currie said his conviction that there will be a commodities supercycle is stronger than before the current crisis. He sees the oil market slipping into deficit in June, which would draw investors back into the sector.

Oil prices slumped by $10 per barrel in one week as the markets were roiled by the collapse of two banks in the United States and the near-collapse of Credit Suisse, which was forcibly takenunder by domestic rival, and now banking supergiant, UBS.

Loading…