By Michael Msika, Bloomberg Markets Live reporter and strategist

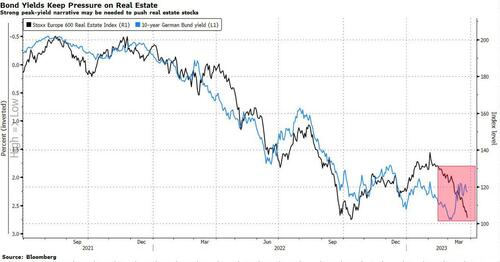

Investors are shunning the real estate sector again, as headwinds from high rates show no sign of abating.

Property stocks are back among the year’s worst performers. They have plunged 22% since early February, with the threat of recession returning to the top of worries for market participants already calculating the fallout for funding costs from Silicon Valley Bank’s collapse and preparing for rates to remain elevated for longer.

Valuations resemble those seen during past crises, like the pandemic or the post-2008 period, and Citigroup analysts led by Aaron Guy say the bad times look far from over.

“If we test historic trough valuation, real estate stocks face over 50% downside,” the Citi analysts say, citing the blow to earnings growth from hawkish central banks and a faltering economy. Further tightening in credit markets could contribute to a cut of as much as 40% in real estate values by 2024.

Commercial real estate stocks, in particular, aren’t priced for what lies ahead, according to the Citi analysts. They prefer peers with less onerous debt burdens and companies still able to increase rents. Their sell ratings include office specialists Gecina and Colonial and shopping center operator Klepierre. They have buys on residential-focused Vonovia, LEG and Grainger, self-storage provider Safestore and Aedifica in the health-care space.

Stocks in the sector have suffered a complete reversal of their strong bounce in January, when the idea that peak yields and a soft landing might be in sight took hold. As central banks stick to their rate-hiking campaigns and investors start to see the impact of these on the real economy, optimistic views on the sector have become increasingly rare.

According to the March Bank of America European fund manager survey, the proportion of investors reporting they are underweight real estate jumped to a net 45% from 20% in February, making it the region’s “most disliked sector.”

Investors are struggling to be bullish on real estate before they see a definite peak in bond yields. That could come this year, but it’s a difficult call to make with central banks still in hiking mode. In any case, property stocks failed to get a boost from the drop in yields in March as recession concerns took hold.

BofA strategists led by Sebastian Raedler have a contrarian view and are overweight real estate, given their opinion that lower bond yields are coming. This, along with forecasts of softer readings for economic expansion in Europe, support a prediction that the sector will outperform.

Even with all the gloom, analysts haven’t taken the red ink to their share price targets. Those have been stable this year, in contrast with the sharp drop in the stocks. The result is that real estate is the European sector with the greatest potential upside after banks, promising returns of 31% over the next 12 months.

“We remain underweight real estate although arguably positioning and valuations reflect a lot of pessimism already,” says Barclays strategist Emmanuel Cau. He expects high rates to pressure property prices and earnings as companies refinance debt. “As we get closer to peak rates, the risk-reward for rising-rate losers vs rising-rate winners may be more balanced going forward.”

By Michael Msika, Bloomberg Markets Live reporter and strategist

Investors are shunning the real estate sector again, as headwinds from high rates show no sign of abating.

Property stocks are back among the year’s worst performers. They have plunged 22% since early February, with the threat of recession returning to the top of worries for market participants already calculating the fallout for funding costs from Silicon Valley Bank’s collapse and preparing for rates to remain elevated for longer.

Valuations resemble those seen during past crises, like the pandemic or the post-2008 period, and Citigroup analysts led by Aaron Guy say the bad times look far from over.

“If we test historic trough valuation, real estate stocks face over 50% downside,” the Citi analysts say, citing the blow to earnings growth from hawkish central banks and a faltering economy. Further tightening in credit markets could contribute to a cut of as much as 40% in real estate values by 2024.

Commercial real estate stocks, in particular, aren’t priced for what lies ahead, according to the Citi analysts. They prefer peers with less onerous debt burdens and companies still able to increase rents. Their sell ratings include office specialists Gecina and Colonial and shopping center operator Klepierre. They have buys on residential-focused Vonovia, LEG and Grainger, self-storage provider Safestore and Aedifica in the health-care space.

Stocks in the sector have suffered a complete reversal of their strong bounce in January, when the idea that peak yields and a soft landing might be in sight took hold. As central banks stick to their rate-hiking campaigns and investors start to see the impact of these on the real economy, optimistic views on the sector have become increasingly rare.

According to the March Bank of America European fund manager survey, the proportion of investors reporting they are underweight real estate jumped to a net 45% from 20% in February, making it the region’s “most disliked sector.”

Investors are struggling to be bullish on real estate before they see a definite peak in bond yields. That could come this year, but it’s a difficult call to make with central banks still in hiking mode. In any case, property stocks failed to get a boost from the drop in yields in March as recession concerns took hold.

BofA strategists led by Sebastian Raedler have a contrarian view and are overweight real estate, given their opinion that lower bond yields are coming. This, along with forecasts of softer readings for economic expansion in Europe, support a prediction that the sector will outperform.

Even with all the gloom, analysts haven’t taken the red ink to their share price targets. Those have been stable this year, in contrast with the sharp drop in the stocks. The result is that real estate is the European sector with the greatest potential upside after banks, promising returns of 31% over the next 12 months.

“We remain underweight real estate although arguably positioning and valuations reflect a lot of pessimism already,” says Barclays strategist Emmanuel Cau. He expects high rates to pressure property prices and earnings as companies refinance debt. “As we get closer to peak rates, the risk-reward for rising-rate losers vs rising-rate winners may be more balanced going forward.”

Loading…