By Bailey Lipschutz, Bloomberg ECB Watch reporter

The ailing SPAC market is getting wildly volatile as speculators pour into and out of low-float companies, ripping off the strategy that brought meme-stock mania to the masses.

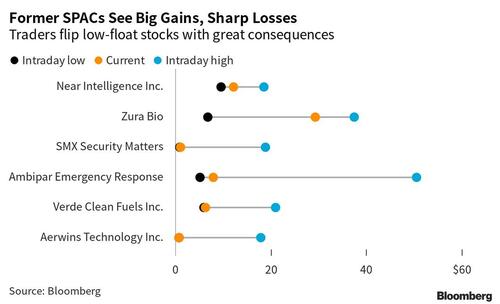

The special-purpose acquisition company that merged with Ambipar Emergency Response spiked as much as 411% after its deal won shareholder approval on Feb. 28, only for Ambipar to slump below $10 after the tie-up was completed. Lionheart III Corp. followed a similar trajectory in its merger with SMX Security Matters on March 7, while JATT Acquisition Corp. slumped before its tie-up with Zura Bio Ltd. and then soared after it.

“For the retail guy, it’s the same playbook that they have grown to know and love over the past three years: Find something that’s a low float, put it on a screener, once it starts to move tweet it out to your closest followers,” said Matthew Tuttle, CEO and CIO of Tuttle Capital Management. “Move a little bit, and all their followers will jump in.”

The volatility is being fueled by the low floats of many SPACs, with shareholders this year redeeming an average of almost 90% of their shares before any merger is completed. Holders in the two SPACs that merged with Ambipar and SMX Security cashed in more than 95% of their stock, leaving the blank-check companies with just 918,000 and 303,000 shares, respectively.

The volatility is reminiscent of meme-stock mania two years ago, where wild swings in stocks such as GameStop Corp. became commonplace. The video-game retailer’s market value rose more than 18 times in January 2021 to become larger than almost half of the companies in the S&P 500 Index — before it crashed.

Buying SPACs has become an equally profitable, and risky business. Take Intuitive Machines Inc., for example. The stock soared 1,200% in a raucous stretch early in the year to become the best performing ex-SPAC of 2023, before slumping roughly 92% from an intraday high of $136 on Feb. 22.

All told, 26 companies have gone public this year via SPAC merger, according to data compiled by Bloomberg. Of those, the median de-SPAC has shed one-third of its value, underperforming the S&P 500’s 3.6% gain.

“It’s the nature of the beast,” Tuttle said. “One day a stock can be the play, and once those guys leave, ka-boom, the stock tanks. Back in the old days when you saw a stock up big there it could be takeover speculation, there could be something real. And now you see stuff rallying based on air, and the last thing you want is to be the last guy in.”

By Bailey Lipschutz, Bloomberg ECB Watch reporter

The ailing SPAC market is getting wildly volatile as speculators pour into and out of low-float companies, ripping off the strategy that brought meme-stock mania to the masses.

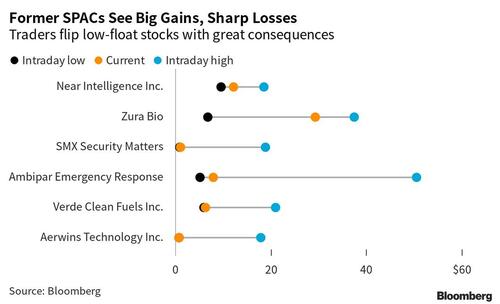

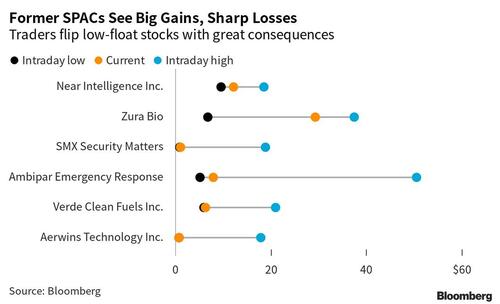

The special-purpose acquisition company that merged with Ambipar Emergency Response spiked as much as 411% after its deal won shareholder approval on Feb. 28, only for Ambipar to slump below $10 after the tie-up was completed. Lionheart III Corp. followed a similar trajectory in its merger with SMX Security Matters on March 7, while JATT Acquisition Corp. slumped before its tie-up with Zura Bio Ltd. and then soared after it.

“For the retail guy, it’s the same playbook that they have grown to know and love over the past three years: Find something that’s a low float, put it on a screener, once it starts to move tweet it out to your closest followers,” said Matthew Tuttle, CEO and CIO of Tuttle Capital Management. “Move a little bit, and all their followers will jump in.”

The volatility is being fueled by the low floats of many SPACs, with shareholders this year redeeming an average of almost 90% of their shares before any merger is completed. Holders in the two SPACs that merged with Ambipar and SMX Security cashed in more than 95% of their stock, leaving the blank-check companies with just 918,000 and 303,000 shares, respectively.

The volatility is reminiscent of meme-stock mania two years ago, where wild swings in stocks such as GameStop Corp. became commonplace. The video-game retailer’s market value rose more than 18 times in January 2021 to become larger than almost half of the companies in the S&P 500 Index — before it crashed.

Buying SPACs has become an equally profitable, and risky business. Take Intuitive Machines Inc., for example. The stock soared 1,200% in a raucous stretch early in the year to become the best performing ex-SPAC of 2023, before slumping roughly 92% from an intraday high of $136 on Feb. 22.

All told, 26 companies have gone public this year via SPAC merger, according to data compiled by Bloomberg. Of those, the median de-SPAC has shed one-third of its value, underperforming the S&P 500’s 3.6% gain.

“It’s the nature of the beast,” Tuttle said. “One day a stock can be the play, and once those guys leave, ka-boom, the stock tanks. Back in the old days when you saw a stock up big there it could be takeover speculation, there could be something real. And now you see stuff rallying based on air, and the last thing you want is to be the last guy in.”

Loading…