Authored by Ven Ram, Bloomberg cross-asset strategist,

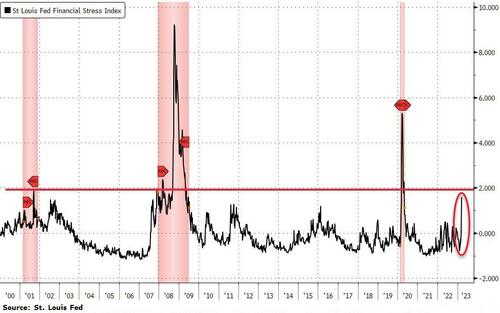

It’s not just the credit markets that are sending out a signal of distress. A key barometer that the Fed watches, the St. Louis Fed Financial Stress Index, is telegraphing a similar message about the state of the US economy.

While the spread between high-yield and investment grade debt captures one major variable, the Fed’s gauge comprises a host of yield spreads, interest rates and other indicators, making it a veritable one-stop-shop.

The average value of the index is intentionally meant to be zero, capturing a moment in time when the financial markets are in a “normal” state, with values above indicative of heightened stress.

The markets have been relatively calm these past couple of days after immense volatility earlier this month. But the key question confronting the Fed is what the combination of widening credit spreads and a re-steepening of the Treasury curve tells us about damage already inflicted on the economy.

As far as interest-rate traders are concerned, the damage merits rate cuts down the line.

While Fed Chair Jerome Powell already poured cold water on the idea that the Fed would consider rate cuts this year, we heard overnight from James Bullard, who has espoused the separation principle in walking the fine balance between financial and price stability.

For now, though, policymakers’ best hope will be that the current calm will prevail long enough to keep the economy from falling off a cliff.

Authored by Ven Ram, Bloomberg cross-asset strategist,

It’s not just the credit markets that are sending out a signal of distress. A key barometer that the Fed watches, the St. Louis Fed Financial Stress Index, is telegraphing a similar message about the state of the US economy.

While the spread between high-yield and investment grade debt captures one major variable, the Fed’s gauge comprises a host of yield spreads, interest rates and other indicators, making it a veritable one-stop-shop.

The average value of the index is intentionally meant to be zero, capturing a moment in time when the financial markets are in a “normal” state, with values above indicative of heightened stress.

The markets have been relatively calm these past couple of days after immense volatility earlier this month. But the key question confronting the Fed is what the combination of widening credit spreads and a re-steepening of the Treasury curve tells us about damage already inflicted on the economy.

As far as interest-rate traders are concerned, the damage merits rate cuts down the line.

While Fed Chair Jerome Powell already poured cold water on the idea that the Fed would consider rate cuts this year, we heard overnight from James Bullard, who has espoused the separation principle in walking the fine balance between financial and price stability.

For now, though, policymakers’ best hope will be that the current calm will prevail long enough to keep the economy from falling off a cliff.

Loading…