By Scott Skyrm of Curvature

The stars might be aligned on Friday to create a unique situation in the Repo market.

Friday is quarter-end and Japanese year-end, which has the most market distortions for a quarter-end next to year-end. At the same time, there's still some crisis in the market, so we expect this Friday to be more volatile and have more bank window dressing than normal.

Could be a unique situation in the REPO market on Quarter-End. If O/N rates are above 5.00%, Primary Dealers might go to the SRF and borrow cash from the Fed at 5.00% at the same time Money Market Funds give cash to the Fed at 4.80% in RRP. Both programs used on the same day!

— Scott Skyrm (@ScottSkyrm) March 30, 2023

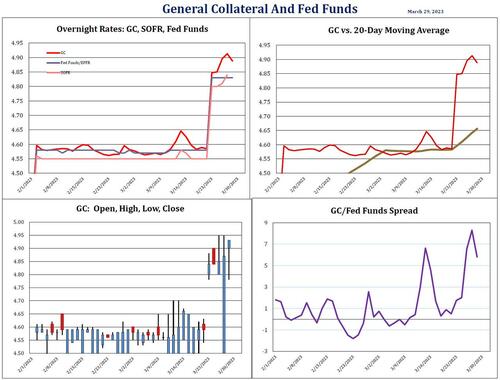

As of now, Repo GC (General Collateral) traded between 4.88% and 5.00% for Friday and the market is now at 4.98%/4.95%. GC is effectively trading near the top of the fed funds target range for the first time in three years. And that presents an interesting possibility!

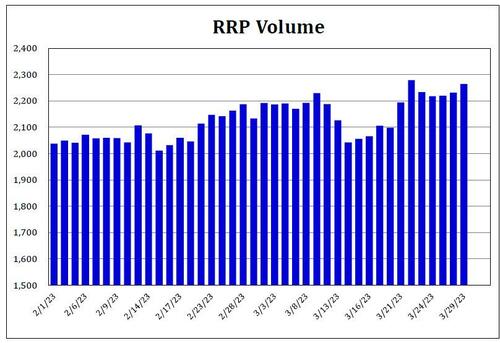

There is still $2.2 trillion in the Fed's RRP earning just 4.80%. Those investors are giving up 5 to 7 basis points each day going to the Fed instead of the market. In fact, on Friday, GC rates could be above 5.00%, so at some point RRP investors will be giving up 15 to 20 basis points. There's supposed to be a natural market mechanism that pulls cash out of the RRP and into the general market when Repo rates are higher than the RRP rate.

However, due to the market crisis and quarter-end, we expect RRP volume to actually increase on Friday.

At the other end of the target range, the Standing Repo Facility (SRF) has not yet been used by the market because Repo rates have been at the bottom of the fed funds target range since the program was initiated.

This crates the unique situation. If overnight rates are above 5.00%, Primary Dealers might go to the SRF and borrow cash from the Fed at 5.00% at the same time Money Market Funds are giving cash to the Fed at 4.80%. Both programs could be used on the same day!

By Scott Skyrm of Curvature

The stars might be aligned on Friday to create a unique situation in the Repo market.

Friday is quarter-end and Japanese year-end, which has the most market distortions for a quarter-end next to year-end. At the same time, there’s still some crisis in the market, so we expect this Friday to be more volatile and have more bank window dressing than normal.

Could be a unique situation in the REPO market on Quarter-End. If O/N rates are above 5.00%, Primary Dealers might go to the SRF and borrow cash from the Fed at 5.00% at the same time Money Market Funds give cash to the Fed at 4.80% in RRP. Both programs used on the same day!

— Scott Skyrm (@ScottSkyrm) March 30, 2023

As of now, Repo GC (General Collateral) traded between 4.88% and 5.00% for Friday and the market is now at 4.98%/4.95%. GC is effectively trading near the top of the fed funds target range for the first time in three years. And that presents an interesting possibility!

There is still $2.2 trillion in the Fed’s RRP earning just 4.80%. Those investors are giving up 5 to 7 basis points each day going to the Fed instead of the market. In fact, on Friday, GC rates could be above 5.00%, so at some point RRP investors will be giving up 15 to 20 basis points. There’s supposed to be a natural market mechanism that pulls cash out of the RRP and into the general market when Repo rates are higher than the RRP rate.

However, due to the market crisis and quarter-end, we expect RRP volume to actually increase on Friday.

At the other end of the target range, the Standing Repo Facility (SRF) has not yet been used by the market because Repo rates have been at the bottom of the fed funds target range since the program was initiated.

This crates the unique situation. If overnight rates are above 5.00%, Primary Dealers might go to the SRF and borrow cash from the Fed at 5.00% at the same time Money Market Funds are giving cash to the Fed at 4.80%. Both programs could be used on the same day!

Loading…