President Biden is calling on regulators to tighten the rules for mid-sized banks, making the political point to 'roll back Trump era rules', ensuring everyone knows - despite the fact that it is not true - that this bank failure is trump's fault (rather than the woke regulators' dismal follow-ups to red-flags)... and remember The Fed didn't stress-test for higher interest rates.

The changes include reinstating rules for banks with assets between $100 billion and $250 billion - the bucket in which SVB would have fallen - including liquidity requirements, enhanced stress testing and so-called “living wills” that show how banks that size could be wound down.

The White House also called for:

- annual stress tests for banks in that range, instead of every two years

- shortening the time to apply stress tests once banks reach $100 billion in assets

- strengthening supervisory tools to ensure banks can withstand rising interest rates.

Additionally, as Bloomberg reports, The White House called on the Federal Deposit Insurance Corp. to replenish the fund without relying on community banks.

The Bank Policy Institute made it clear how they falt about this clearly political move to avoid accountability by the regulators:

"It would be unfortunate if the response to bad management and delinquent supervision at SVB were additional regulation on all banks that would impose meaningful costs on the U.S. economy going forward.

The Fed has barely begun its promised review.

This has a strong feeling of ready, fire, aim."

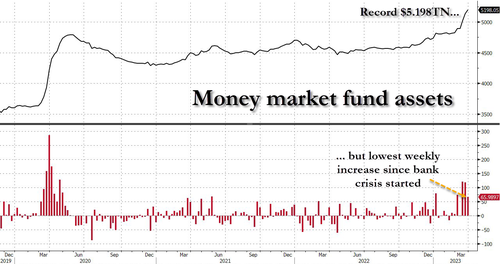

This call for tougher regulations comes as outflows from bank deposits into money markets (which hit a new fresh record highs of $5.2 trillion today - with 54.5bn of inflows last week) continue to accelerate (thanks to The Fed)...

Source: Bloomberg

The last 3 weeks (including SVB's exodus) has seen $304 billion of inflows, a record surge outside of the COVID lockdown crisis. As TD Securities strategist Gennadiy Goldberg said regarding last week's data:

"This is consistent with ongoing deposit flight from the banking system as depositors indirectly invest their cash into government securities via money funds and shun bank credit," adding that,

"This answers the question of ‘where is the money going once it leaves the banking system?"

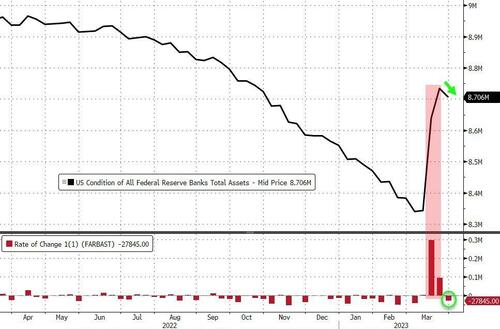

Meanwhile, the most anticipated financial update of the week, the infamous H.4.1, or the Fed's weekly balance sheet update, showed that the world's most important balance sheet actually shrank modestly last week by $27.8 billion (helped by a drop in TSY and MBS of $10bn as part of the ongoing QT)...

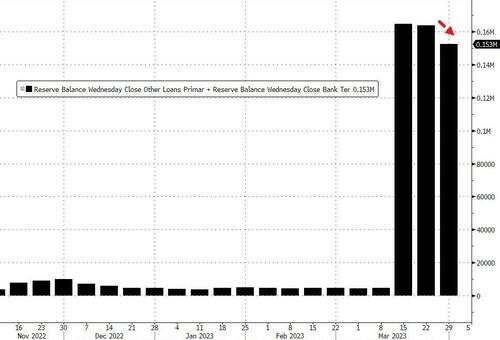

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings fell modestly from $164 billion to $153 billion (still massively higher than the $4.5 billion pre-SVB)...

Source: Bloomberg

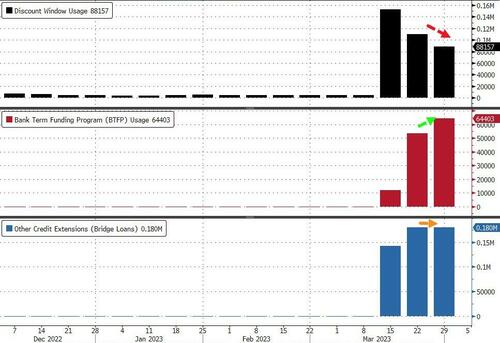

...but the composition shifted, as usage of the Discount Window dropped by $22 billion to $88 billion (upper pane below) which however was offset in part by a $10.7 billion increase in usage of the Fed's brand new Bank Term Funding Program, or BTFP, to $64.4 billion (middle pane) from $53.7BN last week. Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank - were basically flat at $180.1BN (lower pane)...

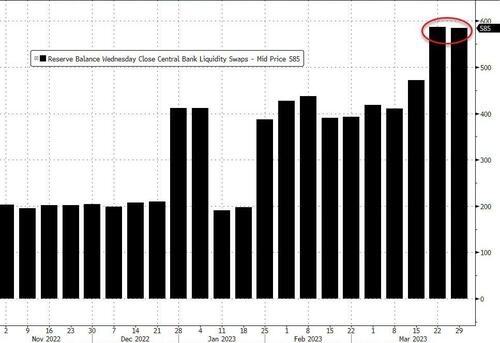

The Fed's USD liquidity swaps only remained at a paltry $585 million in the past week ($100mm to the SNB and $487.5 to ECB)...

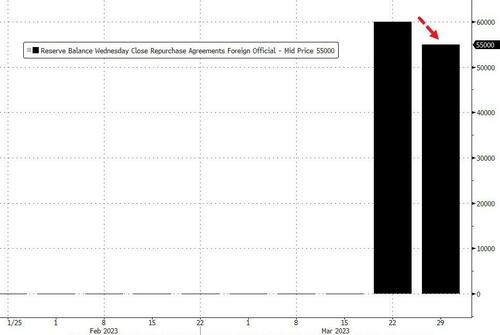

But just like last week, this is meaningless since at least one bank parked a whopping $55BN in the Fed's foreign repo facility. The bad news: the dollar shortage continues; the good news: at least it's less than last week's record $60BN.

And finally, bear in mind what we detailed earlier, that according to Barclays, a second, slower-burning but even more powerful, bank run wave has now begun as "price sensitive" depositors are no longer dormant, but are not actively looking for the best place to park their money. Which is also why contrary to the narrative that the banking crisis is now over, because the S&P is back above pre-SVB levels, banks continue to plumb lows.

1/2

— Jim Bianco biancoresearch.eth (@biancoresearch) March 30, 2023

Narrative building that the banking crisis is now over because the S&P 500 has just about retraced all its losses.

Someone tell the bank stocks as they are unable to rally ... pic.twitter.com/2oBMuuSrNF

Still, there was some some good news: While we noted above that money market funds rose to a new record high, the weekly increase was down almost 50% from $117.4BN last week to "only" $66BN and the slowest since the bank crisis started.

Bottom line: for now at least, the deposit run is slowing.

President Biden is calling on regulators to tighten the rules for mid-sized banks, making the political point to ‘roll back Trump era rules’, ensuring everyone knows – despite the fact that it is not true – that this bank failure is trump’s fault (rather than the woke regulators’ dismal follow-ups to red-flags)… and remember The Fed didn’t stress-test for higher interest rates.

The changes include reinstating rules for banks with assets between $100 billion and $250 billion – the bucket in which SVB would have fallen – including liquidity requirements, enhanced stress testing and so-called “living wills” that show how banks that size could be wound down.

The White House also called for:

- annual stress tests for banks in that range, instead of every two years

- shortening the time to apply stress tests once banks reach $100 billion in assets

- strengthening supervisory tools to ensure banks can withstand rising interest rates.

Additionally, as Bloomberg reports, The White House called on the Federal Deposit Insurance Corp. to replenish the fund without relying on community banks.

The Bank Policy Institute made it clear how they falt about this clearly political move to avoid accountability by the regulators:

“It would be unfortunate if the response to bad management and delinquent supervision at SVB were additional regulation on all banks that would impose meaningful costs on the U.S. economy going forward.

The Fed has barely begun its promised review.

This has a strong feeling of ready, fire, aim.“

This call for tougher regulations comes as outflows from bank deposits into money markets (which hit a new fresh record highs of $5.2 trillion today – with 54.5bn of inflows last week) continue to accelerate (thanks to The Fed)…

Source: Bloomberg

The last 3 weeks (including SVB’s exodus) has seen $304 billion of inflows, a record surge outside of the COVID lockdown crisis. As TD Securities strategist Gennadiy Goldberg said regarding last week’s data:

“This is consistent with ongoing deposit flight from the banking system as depositors indirectly invest their cash into government securities via money funds and shun bank credit,” adding that,

“This answers the question of ‘where is the money going once it leaves the banking system?”

Meanwhile, the most anticipated financial update of the week, the infamous H.4.1, or the Fed’s weekly balance sheet update, showed that the world’s most important balance sheet actually shrank modestly last week by $27.8 billion (helped by a drop in TSY and MBS of $10bn as part of the ongoing QT)…

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings fell modestly from $164 billion to $153 billion (still massively higher than the $4.5 billion pre-SVB)…

Source: Bloomberg

…but the composition shifted, as usage of the Discount Window dropped by $22 billion to $88 billion (upper pane below) which however was offset in part by a $10.7 billion increase in usage of the Fed’s brand new Bank Term Funding Program, or BTFP, to $64.4 billion (middle pane) from $53.7BN last week. Meanwhile, other credit extensions – consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank – were basically flat at $180.1BN (lower pane)…

The Fed’s USD liquidity swaps only remained at a paltry $585 million in the past week ($100mm to the SNB and $487.5 to ECB)…

But just like last week, this is meaningless since at least one bank parked a whopping $55BN in the Fed’s foreign repo facility. The bad news: the dollar shortage continues; the good news: at least it’s less than last week’s record $60BN.

And finally, bear in mind what we detailed earlier, that according to Barclays, a second, slower-burning but even more powerful, bank run wave has now begun as “price sensitive” depositors are no longer dormant, but are not actively looking for the best place to park their money. Which is also why contrary to the narrative that the banking crisis is now over, because the S&P is back above pre-SVB levels, banks continue to plumb lows.

1/2

Narrative building that the banking crisis is now over because the S&P 500 has just about retraced all its losses.

Someone tell the bank stocks as they are unable to rally … pic.twitter.com/2oBMuuSrNF

— Jim Bianco biancoresearch.eth (@biancoresearch) March 30, 2023

Still, there was some some good news: While we noted above that money market funds rose to a new record high, the weekly increase was down almost 50% from $117.4BN last week to “only” $66BN and the slowest since the bank crisis started.

Bottom line: for now at least, the deposit run is slowing.

Loading…