The shorts are being squeezed once again this morning, with 'most shorted' stocks up 4% from yesterday's lows (but we note they are at a key resistance level (post-SVB) once again...

And that is lifting all the majors, especially Small Caps...

But, the question is - can this last?

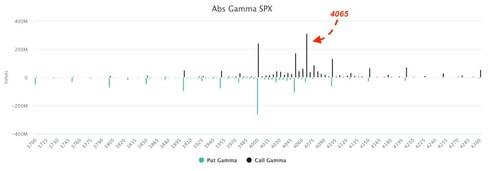

As SpotGamma explained in a note this morning, what's clear from the data is that the quarter end sessions either seem to be flat or down (last 8 q ends)...

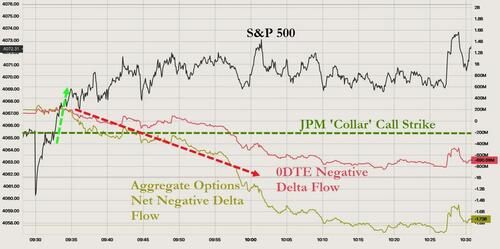

However, today's JPM roll may have a strong impact to markets, as somewhere mid-morning we are likely to see the initial roll placed (3-5% OTM call vs ~5% OTM put spread).

That spread likely prints with some type of deep ITM 0DTE call, and all of this is followed up by a late day spread adjustment (the flip the original spread to the final strikes, adjusting for any intraday market movement).

This trade is obviously heavily watched, and the implementation is likely adjusted to mitigate signals & impact.

Simply said: it’s hard to draw any conclusion/edge of the trades impact. Clouding this, too, are quarter end flows.

However, the JPM Collar Call Strike at 2065 is large...

And already this morning we have seen decisive trade action by options traders, aggressively fading the rally above that 2065 level...

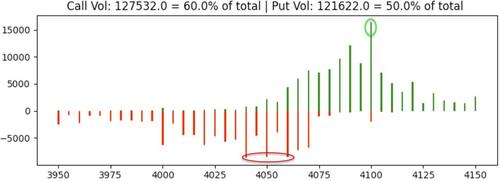

We also note that 0DTE flow is concentrating around 4,100 to the upside (acting as resistance as day continues) with puts (downside) dominated at around 4040-4070...

So will 0DTE (and agg options flows) be the pressure for the historical 'flat to lower q end' come to pass by day's end? 2065 remains the key level to watch.

However, through the options lens, for any extended upside the market needs to have some “real buyers” to carry us higher, vs the post-bank-crisis options short covering (negative gamma/vanna hedging).

The shorts are being squeezed once again this morning, with ‘most shorted’ stocks up 4% from yesterday’s lows (but we note they are at a key resistance level (post-SVB) once again…

And that is lifting all the majors, especially Small Caps…

But, the question is – can this last?

As SpotGamma explained in a note this morning, what’s clear from the data is that the quarter end sessions either seem to be flat or down (last 8 q ends)…

However, today’s JPM roll may have a strong impact to markets, as somewhere mid-morning we are likely to see the initial roll placed (3-5% OTM call vs ~5% OTM put spread).

That spread likely prints with some type of deep ITM 0DTE call, and all of this is followed up by a late day spread adjustment (the flip the original spread to the final strikes, adjusting for any intraday market movement).

This trade is obviously heavily watched, and the implementation is likely adjusted to mitigate signals & impact.

Simply said: it’s hard to draw any conclusion/edge of the trades impact. Clouding this, too, are quarter end flows.

However, the JPM Collar Call Strike at 2065 is large…

And already this morning we have seen decisive trade action by options traders, aggressively fading the rally above that 2065 level…

We also note that 0DTE flow is concentrating around 4,100 to the upside (acting as resistance as day continues) with puts (downside) dominated at around 4040-4070…

So will 0DTE (and agg options flows) be the pressure for the historical ‘flat to lower q end’ come to pass by day’s end? 2065 remains the key level to watch.

However, through the options lens, for any extended upside the market needs to have some “real buyers” to carry us higher, vs the post-bank-crisis options short covering (negative gamma/vanna hedging).

Loading…