"sheesh... that escalated quickly..."

In October 2022, Chinese government researchers proposed a digital currency based on a basket of Asian currencies.

In late March, China and Brazil agreed to transact solely in their national currencies, cutting out the greenback completely.

Also, in late March, a Russian state official spoke of a new currency for the BRICS alliance, as reported by Cointelegraph. It would be another effort to distance itself from the dollar, incorporating the burgeoning economies of Brazil, Russia, India, China and South Africa.

On April 4, South China Morning Post Columnist Alex Lo opined additional reasons for dollar distancing could exist.

And now, as The Epoch Times' Andrew Moran reports below, Malaysia has joined the group of several Asian nations trying to detach itself from dollar dependence.

Malaysia no longer believes it is necessary to depend on the U.S. dollar, Prime Minister Anwar Ibrahim said during an address to the nation’s parliament.

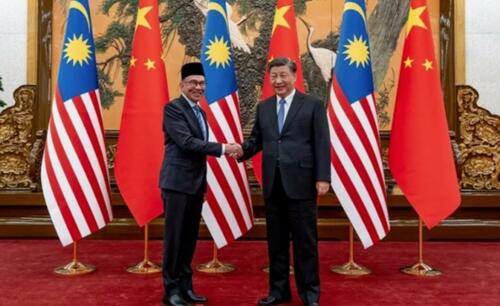

Following last week’s state visit to China, the Malaysian prime minister revealed that Beijing is open to deliberations with Kuala Lumpur to establish an Asian Monetary Fund.

“When I had a meeting with President Xi Jinping, he immediately said, ‘I refer to Anwar’s proposal on the Asian Monetary Fund,’ and he welcomed discussions,” Anwar told lawmakers on Tuesday.

“There is no reason for Malaysia to continue depending on the dollar.”

The concept of an Asian Monetary Fund (AMF) was first proposed in 1997 by the Japanese government during the regional financial crisis. The objective would be that Asian countries fund the organization and ensure ample liquidity levels to weather economic storm clouds. However, the group was never formed due to U.S. and Chinese opposition.

Now that several economies have strengthened considerably since then, such as China and Japan, Anwar thinks now is the time to “discuss this.”

Anwar, who also serves as the finance minister, further confirmed that the two countries negotiated bilateral trade in yuan and ringgit after the Chinese government invested $39 billion into the Malaysian economy.

Many Asian countries, particularly net food importers, have been negatively affected by the greenback’s strength over the last eight years.

Since 2015, the U.S. Dollar Index (DXY), a gauge of the greenback against a basket of currencies, has mostly remained above 90.00. After the U.S. Federal Reserve began raising interest rates in March 2022, the dollar accelerated to its best level since the early 2000s. This was a headache for Asian currencies, including the Malaysian ringgit. The U.S. dollar had soared as much as 9 percent against the ringgit in October, before paring some of these gains.

China Grows Yuan’s Influence

Last summer, China created a yuan-pooling program with the Bank for International Settlements (BIS), an institution for central banks. The Renminbi Liquidity Arrangement (RLA) would provide liquidity to countries in the Asia-Pacific Region during economic turmoil and market volatility.

Chinese yuan and U.S. dollar banknotes, on Feb. 10, 2020. (Dado Ruvic/Illustration/Reuters)

The scheme includes the People’s Bank of China (PBC), the Central Bank of Chile, the Hong Kong Monetary Authority, the Bank of Indonesia, and the Central Bank of Malaysia.

Experts note this is part of the Chinese government’s broader objective to internationalize the yuan. In recent years, China has signed dozens of bilateral currency-swap agreements, including with Western central banks, such as the Bank of England and the European Central Bank (ECB).

The Chinese yuan’s presence in foreign exchange reserves rose 0.81 percent quarter over quarter, to $298.44 billion to close out 2022, according to the International Monetary Fund’s (IMF) Currency Composition of Official Foreign Exchange Reserves (COFER) statistics. But the yuan’s share of global forex reserves was down 11.51 percent year over year in the fourth quarter.

While the de-dollarization campaign has generated significant momentum over the last 12 months, critics have asserted that global financial markets will take a long time to accept and trust the yuan.

However, while speaking at a financial forum on April 4, PBC governor Yi Gang noted that China would install safeguards and employ measures to protect the yuan and maintain financial stability.

In addition, the open market could play a crucial role in keeping the currency in check and preventing policymakers from currency manipulation. The CME Group launched options trading for yuan futures on Monday. This trading mechanism allows investors to bet or hedge against moves in the Chinese currency.

But the growing prominence of the yuan and the broader de-dollarization campaign could be bad news for the international community, says U.S. senator Marco Rubio (R-Fla.).

Rubio warned that U.S. sanctions would become worthless over the next five years as more countries aligning with China will utilize currencies other than the dollar.

“Just today, Brazil … the largest country in the Western hemisphere, south of us, cut a trade deal with China,” Rubio said in an interview with Sean Hannity on Fox News.

“They’re going to … trade in their own currencies to get right around the dollar.”

Brazil and China signed an agreement on March 29 to settle trade and financial transactions in yuan and reals, effectively abandoning the U.S. dollar.

“They are creating a secondary economy in the world totally independent of the United States,” Rubio added.

“We won’t have to talk about sanctions in five years because there will be so many countries transacting in currencies other than the dollar that we won’t have the ability to sanction them.”

New data compiled by Bloomberg highlighted that the Chinese yuan surpassed the U.S. dollar as the most traded currency in Russia.

“sheesh… that escalated quickly…”

In October 2022, Chinese government researchers proposed a digital currency based on a basket of Asian currencies.

In late March, China and Brazil agreed to transact solely in their national currencies, cutting out the greenback completely.

Also, in late March, a Russian state official spoke of a new currency for the BRICS alliance, as reported by Cointelegraph. It would be another effort to distance itself from the dollar, incorporating the burgeoning economies of Brazil, Russia, India, China and South Africa.

On April 4, South China Morning Post Columnist Alex Lo opined additional reasons for dollar distancing could exist.

And now, as The Epoch Times’ Andrew Moran reports below, Malaysia has joined the group of several Asian nations trying to detach itself from dollar dependence.

Malaysia no longer believes it is necessary to depend on the U.S. dollar, Prime Minister Anwar Ibrahim said during an address to the nation’s parliament.

Following last week’s state visit to China, the Malaysian prime minister revealed that Beijing is open to deliberations with Kuala Lumpur to establish an Asian Monetary Fund.

“When I had a meeting with President Xi Jinping, he immediately said, ‘I refer to Anwar’s proposal on the Asian Monetary Fund,’ and he welcomed discussions,” Anwar told lawmakers on Tuesday.

“There is no reason for Malaysia to continue depending on the dollar.”

The concept of an Asian Monetary Fund (AMF) was first proposed in 1997 by the Japanese government during the regional financial crisis. The objective would be that Asian countries fund the organization and ensure ample liquidity levels to weather economic storm clouds. However, the group was never formed due to U.S. and Chinese opposition.

Now that several economies have strengthened considerably since then, such as China and Japan, Anwar thinks now is the time to “discuss this.”

Anwar, who also serves as the finance minister, further confirmed that the two countries negotiated bilateral trade in yuan and ringgit after the Chinese government invested $39 billion into the Malaysian economy.

Many Asian countries, particularly net food importers, have been negatively affected by the greenback’s strength over the last eight years.

Since 2015, the U.S. Dollar Index (DXY), a gauge of the greenback against a basket of currencies, has mostly remained above 90.00. After the U.S. Federal Reserve began raising interest rates in March 2022, the dollar accelerated to its best level since the early 2000s. This was a headache for Asian currencies, including the Malaysian ringgit. The U.S. dollar had soared as much as 9 percent against the ringgit in October, before paring some of these gains.

China Grows Yuan’s Influence

Last summer, China created a yuan-pooling program with the Bank for International Settlements (BIS), an institution for central banks. The Renminbi Liquidity Arrangement (RLA) would provide liquidity to countries in the Asia-Pacific Region during economic turmoil and market volatility.

Chinese yuan and U.S. dollar banknotes, on Feb. 10, 2020. (Dado Ruvic/Illustration/Reuters)

The scheme includes the People’s Bank of China (PBC), the Central Bank of Chile, the Hong Kong Monetary Authority, the Bank of Indonesia, and the Central Bank of Malaysia.

Experts note this is part of the Chinese government’s broader objective to internationalize the yuan. In recent years, China has signed dozens of bilateral currency-swap agreements, including with Western central banks, such as the Bank of England and the European Central Bank (ECB).

The Chinese yuan’s presence in foreign exchange reserves rose 0.81 percent quarter over quarter, to $298.44 billion to close out 2022, according to the International Monetary Fund’s (IMF) Currency Composition of Official Foreign Exchange Reserves (COFER) statistics. But the yuan’s share of global forex reserves was down 11.51 percent year over year in the fourth quarter.

While the de-dollarization campaign has generated significant momentum over the last 12 months, critics have asserted that global financial markets will take a long time to accept and trust the yuan.

However, while speaking at a financial forum on April 4, PBC governor Yi Gang noted that China would install safeguards and employ measures to protect the yuan and maintain financial stability.

In addition, the open market could play a crucial role in keeping the currency in check and preventing policymakers from currency manipulation. The CME Group launched options trading for yuan futures on Monday. This trading mechanism allows investors to bet or hedge against moves in the Chinese currency.

But the growing prominence of the yuan and the broader de-dollarization campaign could be bad news for the international community, says U.S. senator Marco Rubio (R-Fla.).

Rubio warned that U.S. sanctions would become worthless over the next five years as more countries aligning with China will utilize currencies other than the dollar.

“Just today, Brazil … the largest country in the Western hemisphere, south of us, cut a trade deal with China,” Rubio said in an interview with Sean Hannity on Fox News.

“They’re going to … trade in their own currencies to get right around the dollar.”

Brazil and China signed an agreement on March 29 to settle trade and financial transactions in yuan and reals, effectively abandoning the U.S. dollar.

“They are creating a secondary economy in the world totally independent of the United States,” Rubio added.

“We won’t have to talk about sanctions in five years because there will be so many countries transacting in currencies other than the dollar that we won’t have the ability to sanction them.”

New data compiled by Bloomberg highlighted that the Chinese yuan surpassed the U.S. dollar as the most traded currency in Russia.

Loading…