While we all sit back and wait for the housing market to wreck, likely led by commercial real estate, trust fund millennials and those who haven't blown through all of their pandemic stimmy money yet are still out in the market, taking their shots at housing.

And a new study by Construction Coverage published this week has looked at where millennials are purchasing the most expensive homes relative to other homebuyers.

As the study notes: "The COVID-19 pandemic transformed how Americans work, popularizing remote work by necessity. This pivot to a work-from-anywhere mentality also created a shift in where Americans live, causing more and more people to move away from dense cities like New York, Los Angeles, and the Bay Area to smaller and more affordable cities, suburbs, and rural areas across the U.S."

It found that existing home prices have risen 45% over pre-pandemic levels as a result. Since the millennial generation has finally reached peak age for homeownership, and working from home continues to be a growing trend, it's fair to assume millennials could help drive the home buying boom for years to come.

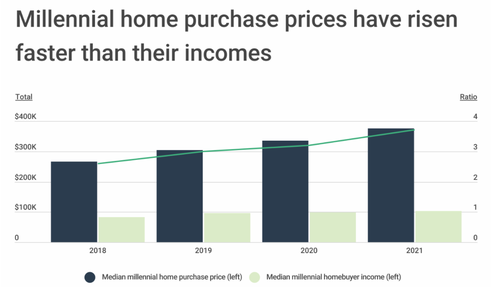

"The millennial homebuyer price-to-income ratio, or the ratio between what millennials are spending on homes versus what they make in a year, has increased significantly from pre-pandemic levels, deepening the divide between what millennials must pay to own and what they actually make," the report found.

"In 2018 and 2019, the millennial homebuyer price-to-income ratio was 2.6 and 3.0, respectively. By 2021, the millennial homebuyer price-to-income ratio increased to a striking 3.7, highlighting the mounting financial barriers for millennials when it comes to homeownership. While median millennial homebuyer income increased 24% from 2018 to 2021, it failed to keep pace with the median millennial home purchase price, which increased roughly 42% in the same time period."

The report continued:

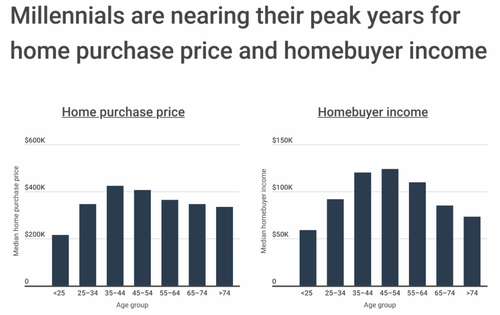

"In spite of the growing gap between millennial home prices and millennial incomes, millennials are entering their prime earning years, making it a pivotal time to buy a home. The median income for homebuyers between 35 and 44 was $120,000 in 2021, which is 30% more than the median income for homebuyers between 25 and 34 ($92,000), and 103% more than that for homebuyers under 25 ($59,000). Gen X was the only age group earning more than millennials, with a median homebuyer income of $124,000—which also means that millennials can expect some remaining growth in purchasing power in the years ahead.

This additional income will likely come in handy, because despite millennials earning less than Gen X, they have been spending more on home purchases than any other generation. The median home purchase price for individuals ages 35 to 44 was $425,000. That’s 23% higher than the median home purchase price of individuals ages 25 to 34, and approximately 5% more than individuals ages 45 to 54."

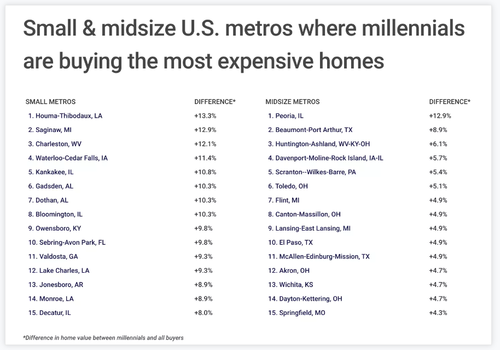

Millennials are spending the most on homes than is typical of other buyers in states like Iowa, North Dakota, and Illinois, the study found. Meanwhile, the most expensive homes by price are being snapped up by millennials in states like California, Hawaii, Washington, and Massachusetts.

Here are the large U.S. metropolitan areas where millennials are buying the most expensive homes relative to other buyers.

The full report includes a table with data on more than 350 metros and all 50 states and can be found here.

While we all sit back and wait for the housing market to wreck, likely led by commercial real estate, trust fund millennials and those who haven’t blown through all of their pandemic stimmy money yet are still out in the market, taking their shots at housing.

And a new study by Construction Coverage published this week has looked at where millennials are purchasing the most expensive homes relative to other homebuyers.

As the study notes: “The COVID-19 pandemic transformed how Americans work, popularizing remote work by necessity. This pivot to a work-from-anywhere mentality also created a shift in where Americans live, causing more and more people to move away from dense cities like New York, Los Angeles, and the Bay Area to smaller and more affordable cities, suburbs, and rural areas across the U.S.”

It found that existing home prices have risen 45% over pre-pandemic levels as a result. Since the millennial generation has finally reached peak age for homeownership, and working from home continues to be a growing trend, it’s fair to assume millennials could help drive the home buying boom for years to come.

“The millennial homebuyer price-to-income ratio, or the ratio between what millennials are spending on homes versus what they make in a year, has increased significantly from pre-pandemic levels, deepening the divide between what millennials must pay to own and what they actually make,” the report found.

“In 2018 and 2019, the millennial homebuyer price-to-income ratio was 2.6 and 3.0, respectively. By 2021, the millennial homebuyer price-to-income ratio increased to a striking 3.7, highlighting the mounting financial barriers for millennials when it comes to homeownership. While median millennial homebuyer income increased 24% from 2018 to 2021, it failed to keep pace with the median millennial home purchase price, which increased roughly 42% in the same time period.”

The report continued:

“In spite of the growing gap between millennial home prices and millennial incomes, millennials are entering their prime earning years, making it a pivotal time to buy a home. The median income for homebuyers between 35 and 44 was $120,000 in 2021, which is 30% more than the median income for homebuyers between 25 and 34 ($92,000), and 103% more than that for homebuyers under 25 ($59,000). Gen X was the only age group earning more than millennials, with a median homebuyer income of $124,000—which also means that millennials can expect some remaining growth in purchasing power in the years ahead.

This additional income will likely come in handy, because despite millennials earning less than Gen X, they have been spending more on home purchases than any other generation. The median home purchase price for individuals ages 35 to 44 was $425,000. That’s 23% higher than the median home purchase price of individuals ages 25 to 34, and approximately 5% more than individuals ages 45 to 54.”

Millennials are spending the most on homes than is typical of other buyers in states like Iowa, North Dakota, and Illinois, the study found. Meanwhile, the most expensive homes by price are being snapped up by millennials in states like California, Hawaii, Washington, and Massachusetts.

Here are the large U.S. metropolitan areas where millennials are buying the most expensive homes relative to other buyers.

The full report includes a table with data on more than 350 metros and all 50 states and can be found here.

Loading…