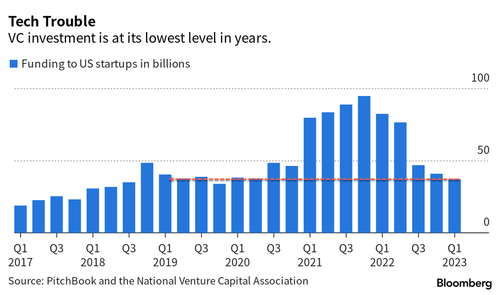

An extinction event that kills a large swath of early-stage startups could be in the cards as venture capital funding collapsed by more than half in the first quarter.

According to Bloomberg, new data from research firm PitchBook and the National Venture Capital Association show startups raised only $37 billion from VCs in the first quarter, the lowest in three years.

The first quarter marked the lowest number of deals in five years as VCs reduced the size of their checks to startups.

"The whole market is taking much more caution toward investment," said Kyle Stanford, a VC analyst at PitchBook. He warned, "It's not going to be easy for companies to raise capital even if they're growing at a pace they set in their last round."

Before the collapse of Silicon Valley Bank, early and mid-stage startups faced a heightened risk of running into cash crunches due to the Federal Reserve's aggressive interest rate hiking cycle. The demise of SVB led to even more funding pipelines being severed for startups.

For months, we've outlined VC funding was sliding and the coming hell startups would face as a result:

- Fundraising By Venture-Capital Firms Tumbles To Near Decade Low Amid' Tech-Wreck'

- VC Funds See "Mass Extinction Event" For Startups In 2023: "It Will Make The Financial Crisis Look Quaint"

Even Substack faced funding woes and turned to its users:

PitchBook's Stanford warned the sharp slowdown in VC funding could soon hit later-stage startups and mature companies in the second half of this year, and even the ones who've been reducing headcount and cutting costs.

"Companies are trying to lengthen their runways," he said, adding VCs might not be able to support all the early-stage startups that burn cash.

This suggests that a wave of startups is on the brink of closing up shop. Andrea Lamari, the general partner at Manhattan Venture Partners, said, "There has not been this level of uncertainty in nearly a decade surrounding what the macro environment impact will be on startups." She warned, "It's as if everyone's waiting for the next shoe to drop."

An extinction event that kills a large swath of early-stage startups could be in the cards as venture capital funding collapsed by more than half in the first quarter.

According to Bloomberg, new data from research firm PitchBook and the National Venture Capital Association show startups raised only $37 billion from VCs in the first quarter, the lowest in three years.

The first quarter marked the lowest number of deals in five years as VCs reduced the size of their checks to startups.

“The whole market is taking much more caution toward investment,” said Kyle Stanford, a VC analyst at PitchBook. He warned, “It’s not going to be easy for companies to raise capital even if they’re growing at a pace they set in their last round.”

Before the collapse of Silicon Valley Bank, early and mid-stage startups faced a heightened risk of running into cash crunches due to the Federal Reserve’s aggressive interest rate hiking cycle. The demise of SVB led to even more funding pipelines being severed for startups.

For months, we’ve outlined VC funding was sliding and the coming hell startups would face as a result:

Even Substack faced funding woes and turned to its users:

PitchBook’s Stanford warned the sharp slowdown in VC funding could soon hit later-stage startups and mature companies in the second half of this year, and even the ones who’ve been reducing headcount and cutting costs.

“Companies are trying to lengthen their runways,” he said, adding VCs might not be able to support all the early-stage startups that burn cash.

This suggests that a wave of startups is on the brink of closing up shop. Andrea Lamari, the general partner at Manhattan Venture Partners, said, “There has not been this level of uncertainty in nearly a decade surrounding what the macro environment impact will be on startups.” She warned, “It’s as if everyone’s waiting for the next shoe to drop.”

Loading…