Earlier this week, we wrote an article in which we said that the great fear - one also shared by Jamie Dimon - is that the ongoing bank run and near death experience of countless regional banks will force small and mid-size banks to further tighten lending standards as they enter survival mode and hunker down, effectively grinding all new loan issuance to a halt and sending the US economy into a tailspin (as a reminder, 70% of US GDP comes from consumption, the bulk of which derives from new credit creation).

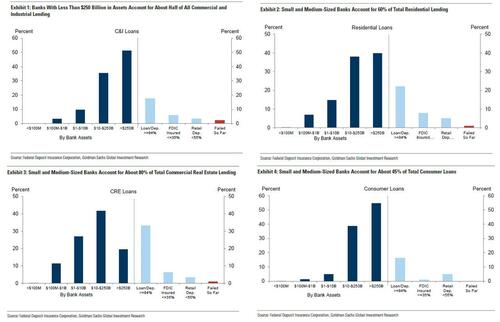

That's a problem because as we also discussed previously, banks with less than $250bn in assets are responsible for roughly 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending. And with key segments of the economy locked out of critical lines of funding, GDP will crater and the US will spiral into a recession, just as the "inflation-fighting" Fed ordered.

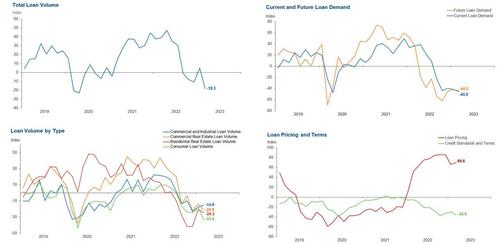

Unfortunately for the Fed, the central bank won't know until early May, or one month from now when the next Senior Loan Officer Opinion Survey on Bank Lending Practices is published, what the impact of the bank failures has been on loan issuance. What we do know, as we first reported it two months ago, is that already back in February loan demand was plunging while bank lending standards were approaching the tightest levels on record.

The good news is that as we also first reported on Tuesday, we were given an early glimpse into the loan demand and supply big picture as of late March - after the bank crisis and credit crunch had started - courtesy of the Dallas Fed's latest Banking Conditions Survey which had the following ominous conclusion:

Loan demand declined for the fifth period in a row as bankers in the March survey reported worsening business activity. Loan volumes fell, driven largely by a sharp contraction in consumer loans.... Credit standards and terms continued to tighten sharply, and marked rises in loan pricing were also noted over the reporting period. Banking outlooks continued to deteriorate, with contacts expecting a contraction in loan demand and business activity and an increase in nonperforming loans over the next six months. Some contacts cited waning consumer confidence from recent financial instability as a concern."

And since the survey took place after the bulk of the bank failures in March and around the peak of the bank crisis...

"Data were collected March 21–29, and 71 financial institutions responded to the survey."

... it best captures the current lending zeitgeist, and is a credible preview of the bloodbath that will be revealed in the the next SLOOs report.

Fast forward to today when we got another confirmation that a painful credit crunch is coming when the Fed took advantage of the Good Friday holiday to report the latest consumer credit data. It was ugly.

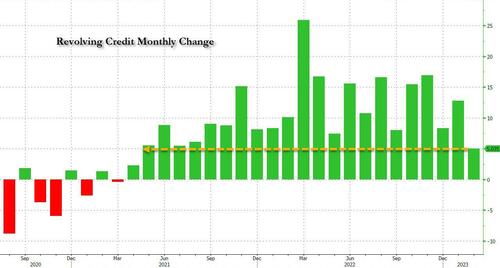

What it showed is that as of February, or the month before the worst credit crisis since Lehman slammed the banking sector, revolving credit (i.e., credit card debt) rose by just $5 billion, down sharply from the $12.8 billion in January, the $13.7 billion LTM average, and the lowest single increase since April 2021.

While it is unclear if credit card usage rose at the slowest pace in two years due to weak demand or a sudden squeeze in supply - obviously we will have more information in one month when the next SLOOS hits - the implication is clear: one of the most powerful economic lifelines is grinding to a halt.

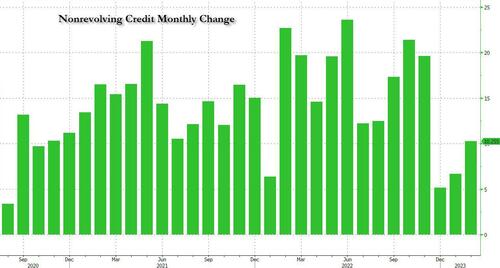

There was a silver lining: while nonrevolving credit had unexpectedly collapsed in early 2023, driven by a sharp slowdown in auto loans (courtesy of record high interest rates), in March, this category saw a modest rebound, rising from last month's $6.7 billion, if 40% below the LTM average of $16.8 billion.

It gets worse: on Thursday, the American Bankers Association index of credit conditions fell to the lowest level since the onset of the pandemic, indicating bank economists see credit conditions weakening sharply over the next six months. As a result, banks are likely to become even more cautious about extending credit.

The bottom line is that while the consumer credit data is backward looking, the trend is clear and the March events will only lead to an even sharper credit crunch, as revolving credit - due to a reduction in both supply and demand - turns negative, to be followed promptly by a contraction in GDP and - subsequently - a recession, and another panicked stimulus package.

Earlier this week, we wrote an article in which we said that the great fear – one also shared by Jamie Dimon – is that the ongoing bank run and near death experience of countless regional banks will force small and mid-size banks to further tighten lending standards as they enter survival mode and hunker down, effectively grinding all new loan issuance to a halt and sending the US economy into a tailspin (as a reminder, 70% of US GDP comes from consumption, the bulk of which derives from new credit creation).

That’s a problem because as we also discussed previously, banks with less than $250bn in assets are responsible for roughly 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending. And with key segments of the economy locked out of critical lines of funding, GDP will crater and the US will spiral into a recession, just as the “inflation-fighting” Fed ordered.

Unfortunately for the Fed, the central bank won’t know until early May, or one month from now when the next Senior Loan Officer Opinion Survey on Bank Lending Practices is published, what the impact of the bank failures has been on loan issuance. What we do know, as we first reported it two months ago, is that already back in February loan demand was plunging while bank lending standards were approaching the tightest levels on record.

The good news is that as we also first reported on Tuesday, we were given an early glimpse into the loan demand and supply big picture as of late March – after the bank crisis and credit crunch had started – courtesy of the Dallas Fed’s latest Banking Conditions Survey which had the following ominous conclusion:

Loan demand declined for the fifth period in a row as bankers in the March survey reported worsening business activity. Loan volumes fell, driven largely by a sharp contraction in consumer loans…. Credit standards and terms continued to tighten sharply, and marked rises in loan pricing were also noted over the reporting period. Banking outlooks continued to deteriorate, with contacts expecting a contraction in loan demand and business activity and an increase in nonperforming loans over the next six months. Some contacts cited waning consumer confidence from recent financial instability as a concern.”

And since the survey took place after the bulk of the bank failures in March and around the peak of the bank crisis…

“Data were collected March 21–29, and 71 financial institutions responded to the survey.”

… it best captures the current lending zeitgeist, and is a credible preview of the bloodbath that will be revealed in the the next SLOOs report.

Fast forward to today when we got another confirmation that a painful credit crunch is coming when the Fed took advantage of the Good Friday holiday to report the latest consumer credit data. It was ugly.

What it showed is that as of February, or the month before the worst credit crisis since Lehman slammed the banking sector, revolving credit (i.e., credit card debt) rose by just $5 billion, down sharply from the $12.8 billion in January, the $13.7 billion LTM average, and the lowest single increase since April 2021.

While it is unclear if credit card usage rose at the slowest pace in two years due to weak demand or a sudden squeeze in supply – obviously we will have more information in one month when the next SLOOS hits – the implication is clear: one of the most powerful economic lifelines is grinding to a halt.

There was a silver lining: while nonrevolving credit had unexpectedly collapsed in early 2023, driven by a sharp slowdown in auto loans (courtesy of record high interest rates), in March, this category saw a modest rebound, rising from last month’s $6.7 billion, if 40% below the LTM average of $16.8 billion.

It gets worse: on Thursday, the American Bankers Association index of credit conditions fell to the lowest level since the onset of the pandemic, indicating bank economists see credit conditions weakening sharply over the next six months. As a result, banks are likely to become even more cautious about extending credit.

The bottom line is that while the consumer credit data is backward looking, the trend is clear and the March events will only lead to an even sharper credit crunch, as revolving credit – due to a reduction in both supply and demand – turns negative, to be followed promptly by a contraction in GDP and – subsequently – a recession, and another panicked stimulus package.

Loading…