Thanks to higher interest rates, turmoil at regional banks, and slowing rent growth, sales of apartment buildings are falling at their fastest rate since the subprime-mortgage crisis, the Wall Street Journal reports.

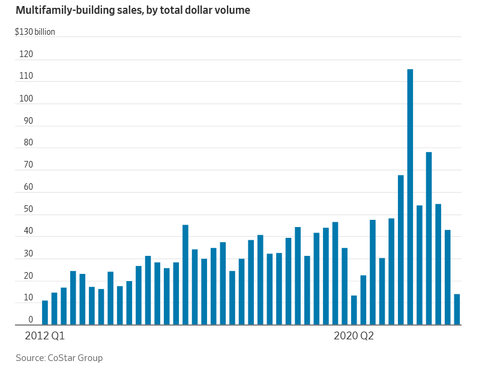

In the first quarter of this year, investors purchased approximately $14 billion of apartment buildings - a decline in sales of 74% from the same quarter last year, according to preliminary data from CoStar Group. The drop could be the largest annual sales decline for any quarter going back to a 77% drop in Q1 2009.

The $14 billion in first-quarter sales was the lowest amount for any quarter since 2012, with the exception of the second quarter of 2020 when pandemic lockdowns effectively froze the market.

The recent drop in building sales follows a stretch of record-setting transactions that peaked in late 2021, when the multifamily sector was a top performer in commercial real estate. Cash-rich investors had a strong appetite for apartment buildings. Their top choices were in Sunbelt cities such as Dallas, Phoenix and Tampa, Fla., where rental housing is largely unregulated and rents were rising 20% or more annually until last year. -WSJ

The combination of factors noted above mean that the math for buying an apartment building doesn't pencil out in many cases - as the cost to refinance purchases has jumped along with interest rates. In some major metro areas, rents are also flat or declining, after record increases.

The Journal also notes that thanks to an upheaval in banking, it's become more difficult to finance buildings, according to investors and analysts, who say banks are either pulling back on lending or only doing so at very high rates.

But there is one type of sale most everyone expects more of: forced sales. A number of investors bought buildings in recent years with short-term, floating-rate debt. Because of rising interest rates, those loans cost a lot more to pay down than they did when building owners first borrowed the money.

The remaining balance of many floating-rate loans will come due this year, and borrowers whose buildings aren’t bringing in enough cash every month might have to sell their buildings to pay off their debts. -WSJ

"Nobody wants to take a loss when they don’t have to," according to Graham Sowden, chief investment officer at RREAF Holdings, a real-estate investment firm based in Dallas.

The trend in apartment buildings follows a similar pullback in the broader residential housing market, where home prices fell year-over-year for the first time since 2012, with sales volume declining sharply as well, for the same basic reasons.

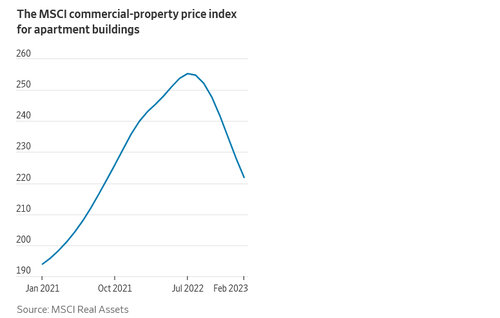

In February, the prices of multifamily buildings dropped 8.7% vs. the same month last year according to the MSCI Real Assets pricing index.

Green Street, which tracks publicly traded landlords, found a 20% drop in building values from their late 2021 highs.

Meanwhile, brokers and investors aren't expecting building sales to pick up anytime soon - in part because of a backlog of nearly 500,000 new units that are slated to be delivered this year, the most in almost 40 years.

According to Trevor Koskovich, president of multifamily at the Northmarq brokerage firm, "We're in the very early stages" of floating-rate loans coming due this year, and various things hitting various fans.

Thanks to higher interest rates, turmoil at regional banks, and slowing rent growth, sales of apartment buildings are falling at their fastest rate since the subprime-mortgage crisis, the Wall Street Journal reports.

In the first quarter of this year, investors purchased approximately $14 billion of apartment buildings – a decline in sales of 74% from the same quarter last year, according to preliminary data from CoStar Group. The drop could be the largest annual sales decline for any quarter going back to a 77% drop in Q1 2009.

The $14 billion in first-quarter sales was the lowest amount for any quarter since 2012, with the exception of the second quarter of 2020 when pandemic lockdowns effectively froze the market.

The recent drop in building sales follows a stretch of record-setting transactions that peaked in late 2021, when the multifamily sector was a top performer in commercial real estate. Cash-rich investors had a strong appetite for apartment buildings. Their top choices were in Sunbelt cities such as Dallas, Phoenix and Tampa, Fla., where rental housing is largely unregulated and rents were rising 20% or more annually until last year. -WSJ

The combination of factors noted above mean that the math for buying an apartment building doesn’t pencil out in many cases – as the cost to refinance purchases has jumped along with interest rates. In some major metro areas, rents are also flat or declining, after record increases.

The Journal also notes that thanks to an upheaval in banking, it’s become more difficult to finance buildings, according to investors and analysts, who say banks are either pulling back on lending or only doing so at very high rates.

But there is one type of sale most everyone expects more of: forced sales. A number of investors bought buildings in recent years with short-term, floating-rate debt. Because of rising interest rates, those loans cost a lot more to pay down than they did when building owners first borrowed the money.

The remaining balance of many floating-rate loans will come due this year, and borrowers whose buildings aren’t bringing in enough cash every month might have to sell their buildings to pay off their debts. -WSJ

“Nobody wants to take a loss when they don’t have to,” according to Graham Sowden, chief investment officer at RREAF Holdings, a real-estate investment firm based in Dallas.

The trend in apartment buildings follows a similar pullback in the broader residential housing market, where home prices fell year-over-year for the first time since 2012, with sales volume declining sharply as well, for the same basic reasons.

In February, the prices of multifamily buildings dropped 8.7% vs. the same month last year according to the MSCI Real Assets pricing index.

Green Street, which tracks publicly traded landlords, found a 20% drop in building values from their late 2021 highs.

Meanwhile, brokers and investors aren’t expecting building sales to pick up anytime soon – in part because of a backlog of nearly 500,000 new units that are slated to be delivered this year, the most in almost 40 years.

According to Trevor Koskovich, president of multifamily at the Northmarq brokerage firm, “We’re in the very early stages” of floating-rate loans coming due this year, and various things hitting various fans.

Loading…