One would think that judging by last night's weaker than expected CPI print (which the Fed would kill for), China is done flooding its economy with loans and various shadow debt instruments. One would be wrong.

First things first, on Tuesday China Bureau of Labor Statistics reported that March CPI fell to +0.7% yoy (vs. +1.0% consensus estimate and 1.0% in February ) and the lowest monthly increase since Sept 2021 due to a high base.

- Food CPI: +2.4% yoy in March (+5.1% mom annualized*) vs. +2.6% yoy in February, primarily due to a high base of vegetable prices from cold weather and Covid restrictions last year. Inflation in fresh vegetables fell to -11.1% yoy in March from -3.8% yoy in February, while inflation in pork prices rose to +9.6% yoy in March from +3.9% yoy in February.

- Non-food CPI: +0.3% yoy in March (+7.6% mom annualized*) vs. +0.6% yoy in February on falling crude oil prices and automobile price cuts. Specifically, fuel cost inflation fell to -6.4% yoy in March (vs. +0.5% yoy in February). Inflation in transportation equipment fell to -3.3% yoy in March (vs. -1.8% in February).

Core CPI inflation (headline CPI excluding food and energy) edged up to +0.7% yoy in March (vs. +0.6% in February), and inflation in services rose to +0.8% yoy in March (vs. +0.6% in February).

At the same time, PPI inflation fell to -2.5% Y/Y in March from -1.4% yoy in February, in line with consensus, and the lowest since June 2020 primarily on a high base of commodity prices. PPI inflation in producer goods fell to -3.4% yoy in March from -2.0% yoy in February, and PPI inflation in consumer goods edged down to +0.9% yoy in March (vs. +1.1% yoy in February). NBS commented that improved demand and accelerated infrastructure projects drove up PPIs of cement and steel sectors sequentially, but year-over-year PPI inflation fell due to a high base last year.

As Goldman summarizes, the data have continued to surprise to the downside and companies appear to be reluctant to raise prices (in order to stay competitive), and so the bank has revised down its full-year 2023 forecasts of headline CPI and PPI inflation to 1.8% yoy and -1.0% yoy, respectively vs. 2.2% and -0.5% previously. Looking ahead, the bank expects headline CPI inflation in year-over-year terms to accelerate modestly in the coming months on an economic rebound, though it should remain well below the PBOC’s 3% target. PPI deflation may continue in the coming months.

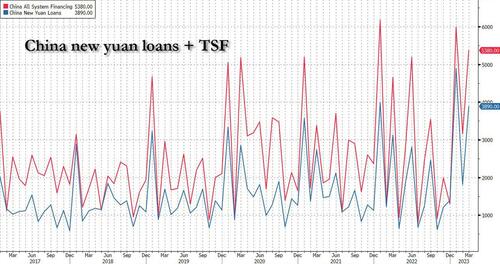

Ok so if both CPI and PPI missed and continued to slide, that's hardly the sign of an economy that is about to rebound, or one that is seeing an active credit stimulus. Maybe, but it's not for lack of trying because as China also reported overnight in March loans and Total Social Financing data came in well above expectations, a sign that the central bank’s moves to unleash more long-term liquidity into the economy and support bank lending is rapidly fueling investment activity.

Specifically, total RMB loans surprised the market to the upside mainly on stronger medium to long term loans - both households' medium to long term new borrowing (mostly mortgages) and corporates' medium to long term new borrowing improved in March. In contrast, bill financing and households' short-term loan growth slowed in March vs February.

Here are the main numbers reported by the PBOC:

- New CNY loans 3890bn yuan in March vs. Bloomberg consensus: RMB 3300 bn

- Outstanding CNY loan growth: 11.8% yoy in March up from 11.6% yoy in February

- Total social financing (TSF) 5,387bn yuan in March, vs. consensus 4565bn yuan. This was a record high TSF injection for the month of March

- TSF stock growth: 10.0% yoy in March, vs. 9.9% in February. The implied month-on-month growth of TSF stock: 14.4% in March vs. 17.8% in February.

- M2: 12.7% yoy in March vs. Bloomberg consensus: 12.7% yoy and down from February's 12.9% yoy.

New corporate mid and long-term loans — an indicator of their willingness to invest in new projects and capacities — jumped from a year ago. Government bond issuance remained robust, as local authorities have announced plans to raise spending on major construction projects by 17% this year.

While credit growth usually picks up at the end of each quarter as banks rush to meet lending targets. But lending and financing activities were also stronger than expected in the first two months of this year, as government bond issuance surged and corporate credit demand began to recover following the abandonment of Covid restrictions.

This composition of loan data suggests further improvement in credit demand in the month, although news reports suggested some signs of financial re-leveraging amid falling loan interest rates. Total social financing month-over-month annualized growth slowed from the very fast pace in February, mainly on the back of lower corporate and government bond issuance. M2 month-over-month growth accelerated in March on the back of strong credit data.

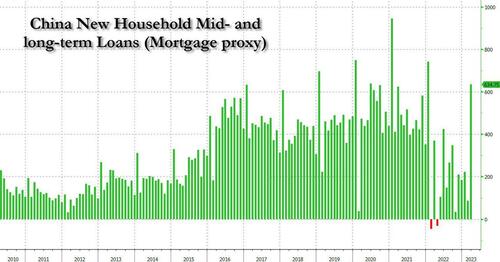

As noted above, in a sign of recovering housing demand across the country, new household mid- and long-term loans, a proxy for mortgages, picked up strongly to the highest level since January 2022.

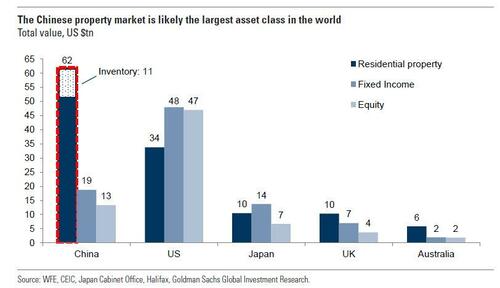

That's right, China is quietly reflating the world's biggest asset class bubble.

While this continuous injection of massive amounts of credit into the economy has failed to manifest itself in faster growth and higher prices so far, it's only a matter of time now: after all, it is now clear that Beijing wants a full-blown economic liftoff and it is willing to risk reflating another credit bubble to get there.

Indeed, the PBOC has stepped up cash injections to help banks cope with tighter liquidity. It unleashed 500 billion yuan of long-term cash into the banking system by cutting the reserve requirement ratio last month, according to estimates by Bloomberg Economics. The central bank also added the most cash in over two years through its monthly medium-term loans operation in March.

“If the trend in credit growth extends into April and May, it would translate into significant support for the economy’s recovery through investment financing,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group, quoted by Bloomberg.

“The figures show firms are making greater use of the government’s loan supports. They also show a recovery in household demand for mortgages — another sign that the property market slump is starting to ease. We see credit growth continuing to climb in 2Q, albeit gradually, supported by a looser policy stance and a broader recovery in demand” said Bloomberg economist Eric Zhu.

As if RRR cuts and injecting record loans into the economy was not enough, some economists, including Bloomberg Economics’ David Qu, forecast continue easing by Beijing and forecast a cut in the policy interest rate in the second quarter. Policy easing expectations continued to grow Tuesday after authorities reported weak inflation data, with bonds rallying as the yield on 10-year government notes booked the biggest one-day drop since the middle of December.

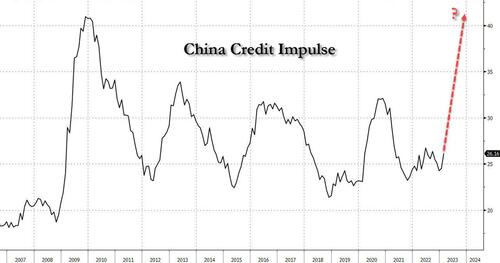

Bottom line: the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is - willingly or otherwise - set to serve as the world's growth dynamo at a time when the entire developed world is about to max out at the same time. This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China's debt to over 300% of GDP.

What happens next? Keep an eye on China's credit impulse - this most leading indicator of the global reflationary cycle - which is about to rise above its two year highs after which it will again be on its way to new all time highs.

One would think that judging by last night’s weaker than expected CPI print (which the Fed would kill for), China is done flooding its economy with loans and various shadow debt instruments. One would be wrong.

First things first, on Tuesday China Bureau of Labor Statistics reported that March CPI fell to +0.7% yoy (vs. +1.0% consensus estimate and 1.0% in February ) and the lowest monthly increase since Sept 2021 due to a high base.

- Food CPI: +2.4% yoy in March (+5.1% mom annualized*) vs. +2.6% yoy in February, primarily due to a high base of vegetable prices from cold weather and Covid restrictions last year. Inflation in fresh vegetables fell to -11.1% yoy in March from -3.8% yoy in February, while inflation in pork prices rose to +9.6% yoy in March from +3.9% yoy in February.

- Non-food CPI: +0.3% yoy in March (+7.6% mom annualized*) vs. +0.6% yoy in February on falling crude oil prices and automobile price cuts. Specifically, fuel cost inflation fell to -6.4% yoy in March (vs. +0.5% yoy in February). Inflation in transportation equipment fell to -3.3% yoy in March (vs. -1.8% in February).

Core CPI inflation (headline CPI excluding food and energy) edged up to +0.7% yoy in March (vs. +0.6% in February), and inflation in services rose to +0.8% yoy in March (vs. +0.6% in February).

At the same time, PPI inflation fell to -2.5% Y/Y in March from -1.4% yoy in February, in line with consensus, and the lowest since June 2020 primarily on a high base of commodity prices. PPI inflation in producer goods fell to -3.4% yoy in March from -2.0% yoy in February, and PPI inflation in consumer goods edged down to +0.9% yoy in March (vs. +1.1% yoy in February). NBS commented that improved demand and accelerated infrastructure projects drove up PPIs of cement and steel sectors sequentially, but year-over-year PPI inflation fell due to a high base last year.

As Goldman summarizes, the data have continued to surprise to the downside and companies appear to be reluctant to raise prices (in order to stay competitive), and so the bank has revised down its full-year 2023 forecasts of headline CPI and PPI inflation to 1.8% yoy and -1.0% yoy, respectively vs. 2.2% and -0.5% previously. Looking ahead, the bank expects headline CPI inflation in year-over-year terms to accelerate modestly in the coming months on an economic rebound, though it should remain well below the PBOC’s 3% target. PPI deflation may continue in the coming months.

Ok so if both CPI and PPI missed and continued to slide, that’s hardly the sign of an economy that is about to rebound, or one that is seeing an active credit stimulus. Maybe, but it’s not for lack of trying because as China also reported overnight in March loans and Total Social Financing data came in well above expectations, a sign that the central bank’s moves to unleash more long-term liquidity into the economy and support bank lending is rapidly fueling investment activity.

Specifically, total RMB loans surprised the market to the upside mainly on stronger medium to long term loans – both households’ medium to long term new borrowing (mostly mortgages) and corporates’ medium to long term new borrowing improved in March. In contrast, bill financing and households’ short-term loan growth slowed in March vs February.

Here are the main numbers reported by the PBOC:

- New CNY loans 3890bn yuan in March vs. Bloomberg consensus: RMB 3300 bn

- Outstanding CNY loan growth: 11.8% yoy in March up from 11.6% yoy in February

- Total social financing (TSF) 5,387bn yuan in March, vs. consensus 4565bn yuan. This was a record high TSF injection for the month of March

- TSF stock growth: 10.0% yoy in March, vs. 9.9% in February. The implied month-on-month growth of TSF stock: 14.4% in March vs. 17.8% in February.

- M2: 12.7% yoy in March vs. Bloomberg consensus: 12.7% yoy and down from February’s 12.9% yoy.

New corporate mid and long-term loans — an indicator of their willingness to invest in new projects and capacities — jumped from a year ago. Government bond issuance remained robust, as local authorities have announced plans to raise spending on major construction projects by 17% this year.

While credit growth usually picks up at the end of each quarter as banks rush to meet lending targets. But lending and financing activities were also stronger than expected in the first two months of this year, as government bond issuance surged and corporate credit demand began to recover following the abandonment of Covid restrictions.

This composition of loan data suggests further improvement in credit demand in the month, although news reports suggested some signs of financial re-leveraging amid falling loan interest rates. Total social financing month-over-month annualized growth slowed from the very fast pace in February, mainly on the back of lower corporate and government bond issuance. M2 month-over-month growth accelerated in March on the back of strong credit data.

As noted above, in a sign of recovering housing demand across the country, new household mid- and long-term loans, a proxy for mortgages, picked up strongly to the highest level since January 2022.

That’s right, China is quietly reflating the world’s biggest asset class bubble.

While this continuous injection of massive amounts of credit into the economy has failed to manifest itself in faster growth and higher prices so far, it’s only a matter of time now: after all, it is now clear that Beijing wants a full-blown economic liftoff and it is willing to risk reflating another credit bubble to get there.

Indeed, the PBOC has stepped up cash injections to help banks cope with tighter liquidity. It unleashed 500 billion yuan of long-term cash into the banking system by cutting the reserve requirement ratio last month, according to estimates by Bloomberg Economics. The central bank also added the most cash in over two years through its monthly medium-term loans operation in March.

“If the trend in credit growth extends into April and May, it would translate into significant support for the economy’s recovery through investment financing,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group, quoted by Bloomberg.

“The figures show firms are making greater use of the government’s loan supports. They also show a recovery in household demand for mortgages — another sign that the property market slump is starting to ease. We see credit growth continuing to climb in 2Q, albeit gradually, supported by a looser policy stance and a broader recovery in demand” said Bloomberg economist Eric Zhu.

As if RRR cuts and injecting record loans into the economy was not enough, some economists, including Bloomberg Economics’ David Qu, forecast continue easing by Beijing and forecast a cut in the policy interest rate in the second quarter. Policy easing expectations continued to grow Tuesday after authorities reported weak inflation data, with bonds rallying as the yield on 10-year government notes booked the biggest one-day drop since the middle of December.

Bottom line: the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is – willingly or otherwise – set to serve as the world’s growth dynamo at a time when the entire developed world is about to max out at the same time. This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China’s debt to over 300% of GDP.

What happens next? Keep an eye on China’s credit impulse – this most leading indicator of the global reflationary cycle – which is about to rise above its two year highs after which it will again be on its way to new all time highs.

Loading…