Summary (via Newsquawk):

March Meeting

-

Several participants noted they considered whether it would be appropriate to leave rates unchanged at this meeting. However these participants noted actions taken helped calm conditions and lower near-term risks, allowing them to judge an increase as appropriate.

-

Prior to banking stresses many had seen the appropriate policy path as being somewhat higher than in December.

-

Pre-meeting data indicated slower than expected progress on inflation.

-

Participants agreed there was little evidence pointing to disinflation for core services excluding housing.

-

Participants assessed labor demand as substantially exceeding supply.

Fed Staff

-

Fed staff projected a mild recession starting later in 2023.

-

If banking and financial conditions and their effects on macroeconomic conditions were to deteriorate more than assumed in the baseline, then the risks around the baseline would be skewed to the downside for both economic activity and inflation, particularly because historical recessions related to financial market problems tend to be more severe and persistent than average recessions.

Banking

-

Banking sector developments likely to result in tighter credit conditions and weigh on activity, hiring and inflation.

-

Several participants noted regional and community banks as providing critical financial services to many communities and industries.

-

Participants agreed that the U.S. banking system remained sound and resilient.

-

Actions taken so far by Fed. US authorities and Foreign authorities, had helped calm conditions in the banking sector.

-

Participants noted that recent developments in the banking sector and the associated rise in uncertainty would likely weigh on consumer sentiment and that increased caution on the part of consumers could restrain spending.

Policy Outlook

-

Several participants emphasized the need to retain flexibility and optionality in determining the appropriate stance of monetary policy given the highly uncertain economic outlook.

-

Some participants observed that downside risks to growth and upside risks to unemployment had increased because of the risk that banking-sector developments could lead to further tightening of credit conditions and weigh on economic activity.

-

Some participants also noted that, with inflation still well above the Committee's longer-run goal and the recent economic data remaining strong, upside risks to the inflation outlook remained a key factor shaping the policy outlook, and that maintaining a restrictive policy stance until inflation is clearly on a downward path toward 2 percent would be appropriate from a risk-management perspective.

-

Several participants noted the importance of longer-term inflation expectations remaining anchored and remarked that the longer inflation remained elevated, the greater the risk of inflation expectations becoming unanchored.

-

Participants generally agreed on the importance of closely monitoring incoming information and its implications for the economic outlook, and that they were prepared to adjust their views on the appropriate stance of monetary policy in response to the incoming data and emerging risks to the economic outlook.

Has anyone told Lizzy Warren yet that the Fed admits it is now actively trying to trigger a recession?

* * *

Since the last FOMC statement on March 22nd, crypto is outperforming followed by stocks and gold while the dollar is lower and bonds around unch...

Source: Bloomberg

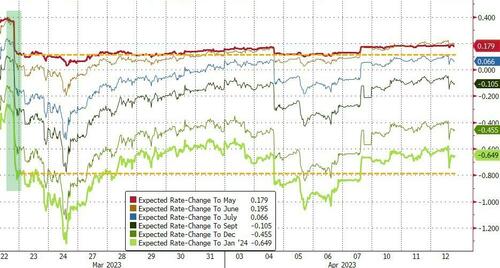

Perhaps most notably, despite some vol, rate-change expectations are just about unch from the immediate post-FOMC (dovish) shift...

Source: Bloomberg

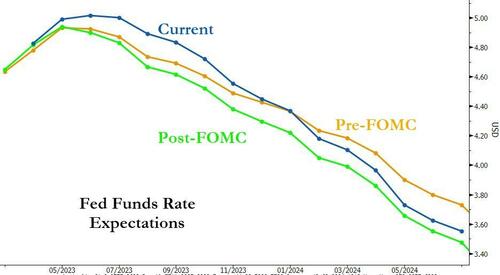

There has been a modest hawkish drift in the shorter-term, but the STIRs curve is practically unchanged since the last FOMC...

Source: Bloomberg

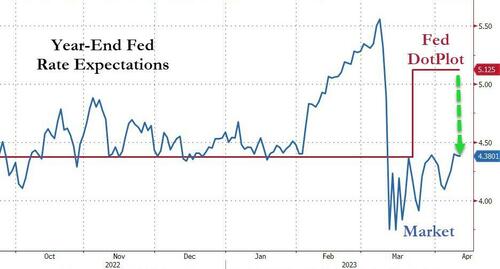

Bear in mind that the market is dramatically more dovish than The Fed's DotPlots...

Source: Bloomberg

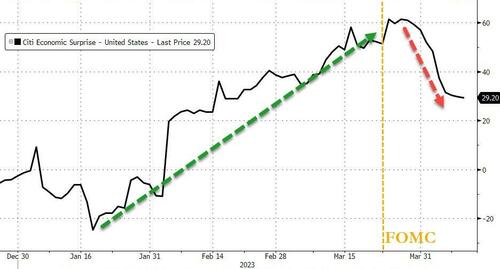

One last thing of note, since the last FOMC meeting, US macro data has surprised to the downside (especially labor market signals), after three months of upside surprises...

Source: Bloomberg

So the big question from the Minutes is whether there is real sentiment for that hawkish median dot-plot (sticky inflation) or are Fed members leaning more to pause and hold (systemic threats and slowing inflation)?

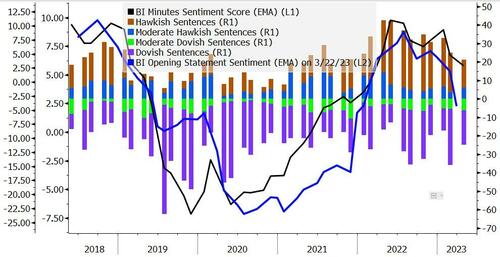

Bloomberg Intelligence Chief US Interest Rate Strategist Ira Jersey says BI’s natural language processing model shows the minutes were more dovish than January’s, but not as dramatic as Powell’s opening remarks.

“In particular the model shows less dovish sentences compared with January, but also some less hawkish ones as well.”

On banking system stress impact - uncertainty:

“Many participants noted that the likely effects of recent banking-sector developments on economic activity and inflation had led them to lower their assessments of the federal funds rate target range that would be sufficiently restrictive.”

On banking system stress impact - tighter credit:

"Participants... commented that recent developments in the banking sector were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. Participants agreed that the extent of these effects was uncertain."

On banking system stress impact - consumer sentiment:

"Participants noted that recent developments in the banking sector and the associated rise in uncertainty would likely weigh on consumer sentiment and that increased caution on the part of consumers could restrain spending. A couple of participants observed that high-frequency measures of consumer sentiment had not yet shown a significant change following the recent developments in the banking sector, although they also acknowledged that the situation was fluid. "

On banking system stress impact - don't worry:

“Participants agreed that the US banking system remained sound and resilient. .."

“Recession” is only mentioned three times, versus four in the previous meeting.

“The staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

On the rate-hike trajectory:

"Several participants noted that, in their policy deliberations, they considered whether it would be appropriate to hold the target range steady at this meeting...

They noted that doing so would allow more time to assess the financial and economic effects of recent banking-sector developments and of the cumulative tightening of monetary policy.

However, these participants also observed that the actions taken by the Federal Reserve in coordination with other government agencies helped calm conditions in the banking sector and lessen the near-term risks to economic activity and inflation.

Consequently, these participants judged it appropriate to increase the target range 25 basis points because of elevated inflation, the strength of the recent economic data, and their commitment to bring inflation down to the Committee’s 2 percent longer-run goal."

On the lagged effect of policy...

"In determining the extent of future increases in the target range, participants judged that it would be appropriate to take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

Finally, we note that “Inflation” mentions increased to 108 from 91; “disinflation” mentions increased to 5 from 0.

Read the full Minutes below:

Summary (via Newsquawk):

March Meeting

-

Several participants noted they considered whether it would be appropriate to leave rates unchanged at this meeting. However these participants noted actions taken helped calm conditions and lower near-term risks, allowing them to judge an increase as appropriate.

-

Prior to banking stresses many had seen the appropriate policy path as being somewhat higher than in December.

-

Pre-meeting data indicated slower than expected progress on inflation.

-

Participants agreed there was little evidence pointing to disinflation for core services excluding housing.

-

Participants assessed labor demand as substantially exceeding supply.

Fed Staff

-

Fed staff projected a mild recession starting later in 2023.

-

If banking and financial conditions and their effects on macroeconomic conditions were to deteriorate more than assumed in the baseline, then the risks around the baseline would be skewed to the downside for both economic activity and inflation, particularly because historical recessions related to financial market problems tend to be more severe and persistent than average recessions.

Banking

-

Banking sector developments likely to result in tighter credit conditions and weigh on activity, hiring and inflation.

-

Several participants noted regional and community banks as providing critical financial services to many communities and industries.

-

Participants agreed that the U.S. banking system remained sound and resilient.

-

Actions taken so far by Fed. US authorities and Foreign authorities, had helped calm conditions in the banking sector.

-

Participants noted that recent developments in the banking sector and the associated rise in uncertainty would likely weigh on consumer sentiment and that increased caution on the part of consumers could restrain spending.

Policy Outlook

-

Several participants emphasized the need to retain flexibility and optionality in determining the appropriate stance of monetary policy given the highly uncertain economic outlook.

-

Some participants observed that downside risks to growth and upside risks to unemployment had increased because of the risk that banking-sector developments could lead to further tightening of credit conditions and weigh on economic activity.

-

Some participants also noted that, with inflation still well above the Committee’s longer-run goal and the recent economic data remaining strong, upside risks to the inflation outlook remained a key factor shaping the policy outlook, and that maintaining a restrictive policy stance until inflation is clearly on a downward path toward 2 percent would be appropriate from a risk-management perspective.

-

Several participants noted the importance of longer-term inflation expectations remaining anchored and remarked that the longer inflation remained elevated, the greater the risk of inflation expectations becoming unanchored.

-

Participants generally agreed on the importance of closely monitoring incoming information and its implications for the economic outlook, and that they were prepared to adjust their views on the appropriate stance of monetary policy in response to the incoming data and emerging risks to the economic outlook.

Has anyone told Lizzy Warren yet that the Fed admits it is now actively trying to trigger a recession?

* * *

Since the last FOMC statement on March 22nd, crypto is outperforming followed by stocks and gold while the dollar is lower and bonds around unch…

Source: Bloomberg

Perhaps most notably, despite some vol, rate-change expectations are just about unch from the immediate post-FOMC (dovish) shift…

Source: Bloomberg

There has been a modest hawkish drift in the shorter-term, but the STIRs curve is practically unchanged since the last FOMC…

Source: Bloomberg

Bear in mind that the market is dramatically more dovish than The Fed’s DotPlots…

Source: Bloomberg

One last thing of note, since the last FOMC meeting, US macro data has surprised to the downside (especially labor market signals), after three months of upside surprises…

Source: Bloomberg

So the big question from the Minutes is whether there is real sentiment for that hawkish median dot-plot (sticky inflation) or are Fed members leaning more to pause and hold (systemic threats and slowing inflation)?

Bloomberg Intelligence Chief US Interest Rate Strategist Ira Jersey says BI’s natural language processing model shows the minutes were more dovish than January’s, but not as dramatic as Powell’s opening remarks.

“In particular the model shows less dovish sentences compared with January, but also some less hawkish ones as well.”

On banking system stress impact – uncertainty:

“Many participants noted that the likely effects of recent banking-sector developments on economic activity and inflation had led them to lower their assessments of the federal funds rate target range that would be sufficiently restrictive.”

On banking system stress impact – tighter credit:

“Participants… commented that recent developments in the banking sector were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. Participants agreed that the extent of these effects was uncertain.”

On banking system stress impact – consumer sentiment:

“Participants noted that recent developments in the banking sector and the associated rise in uncertainty would likely weigh on consumer sentiment and that increased caution on the part of consumers could restrain spending. A couple of participants observed that high-frequency measures of consumer sentiment had not yet shown a significant change following the recent developments in the banking sector, although they also acknowledged that the situation was fluid. “

On banking system stress impact – don’t worry:

“Participants agreed that the US banking system remained sound and resilient. ..”

“Recession” is only mentioned three times, versus four in the previous meeting.

“The staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

On the rate-hike trajectory:

“Several participants noted that, in their policy deliberations, they considered whether it would be appropriate to hold the target range steady at this meeting…

They noted that doing so would allow more time to assess the financial and economic effects of recent banking-sector developments and of the cumulative tightening of monetary policy.

However, these participants also observed that the actions taken by the Federal Reserve in coordination with other government agencies helped calm conditions in the banking sector and lessen the near-term risks to economic activity and inflation.

Consequently, these participants judged it appropriate to increase the target range 25 basis points because of elevated inflation, the strength of the recent economic data, and their commitment to bring inflation down to the Committee’s 2 percent longer-run goal.”

On the lagged effect of policy…

“In determining the extent of future increases in the target range, participants judged that it would be appropriate to take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Finally, we note that “Inflation” mentions increased to 108 from 91; “disinflation” mentions increased to 5 from 0.

Read the full Minutes below:

Loading…