Here come the vacancies...

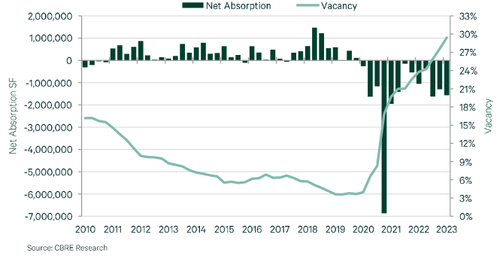

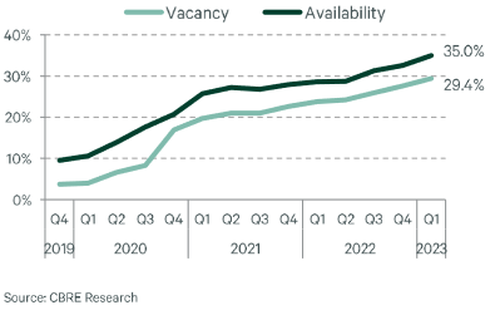

A sobering report from Coldwell Banker (available to pro subs in the usual place) reveals that San Francisco's office vacancy rate hit a record high of 29.4%, as net absorption (total new square footage leased minus the total square footage of vacated space) registered -1.56 million sq. ft.

To wit, software giant Salesforce has put the last of its San Francisco office space up for sublease as part of its January plan to lay off approximately 7,000 employees and reduce office space, SF Gate reports.

According to the report, six floors at 350 Mission St. (Salesforce East) - the top four floors and the fifth and sixth floors - which encompass more than 104,000 square feet, are now up for sublease, according to real estate giant Cushman and Wakefield. The space comes with amenities such as a "fully functional coffee bar," board rooms, and "high-end" presentation floors.

Salesforce’s intention to cut back on its San Francisco real estate footprint has been evident since even before the dramatic January announcement. Within the past year, the company — San Francisco’s largest private employer — has listed half of its space at Salesforce West at 350 Fremont St. for sublease and six floors at Salesforce Tower, in addition to the Slack headquarters move. In 2021, Salesforce listed half of its footprint in Salesforce East. -SF Gate

"Over the past two years, we have continued to re-imagine our real estate strategy," said CFO Amy Weaver, adding that the company's reassessment of their real estate footprint is ongoing. "That is not only to optimize for scale but also continue hybrid work environment and how people are working and how they’re using their space."

The move is in-line with current industry trends, as big tech firms cut workers and office space - despite CEOs such as Salesforce's Marc Benioff pushing post-pandemic return-to-office policies.

According to the CBRE report, "Businesses are challenged with macroeconomic headwinds, including tech industry layoffs, rising interest rates, banking industry uncertainty, and recession risk."

Prior to the COVID-19 pandemic, San Francisco had a near 100% occupation rate throughout the city due to the latest tech boom, as the vacancy rate in 2019 grew from 5.4% in the fourth quarter of 2019 to 24.1% at the end of 2022.

Here come the vacancies…

A sobering report from Coldwell Banker (available to pro subs in the usual place) reveals that San Francisco’s office vacancy rate hit a record high of 29.4%, as net absorption (total new square footage leased minus the total square footage of vacated space) registered -1.56 million sq. ft.

To that end, software giant Salesforce has put the last of its San Francisco office space up for sublease as part of its January plan to lay off approximately 7,000 employees and reduce office space, SF Gate reports.

According to the report, six floors at 350 Mission St. (Salesforce East) – the top four floors and the fifth and sixth floors – which encompass more than 104,000 square feet, are now up for sublease, according to real estate giant Cushman and Wakefield. The space comes with amenities such as a “fully functional coffee bar,” board rooms, and “high-end” presentation floors.

Salesforce’s intention to cut back on its San Francisco real estate footprint has been evident since even before the dramatic January announcement. Within the past year, the company — San Francisco’s largest private employer — has listed half of its space at Salesforce West at 350 Fremont St. for sublease and six floors at Salesforce Tower, in addition to the Slack headquarters move. In 2021, Salesforce listed half of its footprint in Salesforce East. -SF Gate

“Over the past two years, we have continued to re-imagine our real estate strategy,” said CFO Amy Weaver, adding that the company’s reassessment of their real estate footprint is ongoing. “That is not only to optimize for scale but also continue hybrid work environment and how people are working and how they’re using their space.”

The move is in-line with current industry trends, as big tech firms cut workers and office space – despite CEOs such as Salesforce’s Marc Benioff pushing post-pandemic return-to-office policies.

According to the CBRE report, “Businesses are challenged with macroeconomic headwinds, including tech industry layoffs, rising interest rates, banking industry uncertainty, and recession risk.”

Prior to the COVID-19 pandemic, San Francisco had a near 100% occupation rate throughout the city due to the latest tech boom, as the vacancy rate in 2019 grew from 5.4% in the fourth quarter of 2019 to 24.1% at the end of 2022.

Loading…