In a day seeing relentless economic data barrage, moments ago the UMich delivered a second hawkish punch (the first being Waller's hawkish remarks earlier in the day) when it unexpectedly showed that 1-year inflation expectations soared by 1% from 3.6% in March - the lowest print since April 2021 - to 4.6% in April, the highest since November 22. This was the biggest jump in 1-Year inflation expectations since May 2021, and a number which quickly caught the market's attention as it confirms Waller's view that near-term inflation expectations - really a proxy for gas prices - are about to take off again (courtesy of OPEC).

According to UMich, these expectations "have been seesawing for four consecutive months, alternating between increases and decreases" as uncertainty over short-run inflation expectations continues to be notably elevated, indicating that the recent volatility in expected year-ahead inflation is likely to continue.

That said, the bumpiness in inflation expectations is limited to the short run as long-run inflation expectations remained remarkably stable: they came in at 2.9% for the fifth consecutive month and have stayed within the narrow 2.9-3.1% range for 20 of the last 21 months.

Curiously, while one would expect a spike in near-term inflation expectations to result in a drop in sentiment, that was clearly not the case because according to the latest goalseeked numbers, in April UMich consumer sentiment not only rose across the board but beat all expectations!

- Sentiment 63.5, beating exp. 62.1, Last 62.0

- Current Conditions 68.6, beating exp. 66.0, Last 66.3

- Expectations 60.3, beating exp. 58.5, Last 59.2

“These patterns reveal that consumers are fully aware that inflation has softened from its peak, but that high prices continue to make them feel less financially secure,” Joanne Hsu, director of the survey, said in a statement.

Consumer sentiment has been generally subdued as inflation ebbs only slowly, and higher interest rates have made buying both everyday items and bigger purchases much harder. Data out earlier Friday showed US retail sales fell for a second month in March.

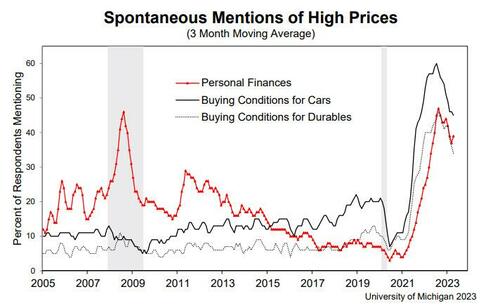

Paradoxically, buying conditions for durable goods also improved as consumers noted some disinflation for car . Still, about 42% of respondents blamed high prices for eroding their personal finances, the most since December.

And something else curious: despite the alleged spike in inflation expectations, the number of spontaneous mentions of high prices dropped again, confirming that there is something quite inconsistent within the entire report.

What is most remarkable however, and consistent with the March readings, the bank crisis appears to have little impact on sentiment - as confidence levels were similar whether or not consumers mentioned the failures, the report said - something which casts doubt on the validity and credibility of the entire UMich survey which like most other economic indicators appears to have been subsumed to some political agenda.

In a day seeing relentless economic data barrage, moments ago the UMich delivered a second hawkish punch (the first being Waller’s hawkish remarks earlier in the day) when it unexpectedly showed that 1-year inflation expectations soared by 1% from 3.6% in March – the lowest print since April 2021 – to 4.6% in April, the highest since November 22. This was the biggest jump in 1-Year inflation expectations since May 2021, and a number which quickly caught the market’s attention as it confirms Waller’s view that near-term inflation expectations – really a proxy for gas prices – are about to take off again (courtesy of OPEC).

According to UMich, these expectations “have been seesawing for four consecutive months, alternating between increases and decreases” as uncertainty over short-run inflation expectations continues to be notably elevated, indicating that the recent volatility in expected year-ahead inflation is likely to continue.

That said, the bumpiness in inflation expectations is limited to the short run as long-run inflation expectations remained remarkably stable: they came in at 2.9% for the fifth consecutive month and have stayed within the narrow 2.9-3.1% range for 20 of the last 21 months.

Curiously, while one would expect a spike in near-term inflation expectations to result in a drop in sentiment, that was clearly not the case because according to the latest goalseeked numbers, in April UMich consumer sentiment not only rose across the board but beat all expectations!

- Sentiment 63.5, beating exp. 62.1, Last 62.0

- Current Conditions 68.6, beating exp. 66.0, Last 66.3

- Expectations 60.3, beating exp. 58.5, Last 59.2

“These patterns reveal that consumers are fully aware that inflation has softened from its peak, but that high prices continue to make them feel less financially secure,” Joanne Hsu, director of the survey, said in a statement.

Consumer sentiment has been generally subdued as inflation ebbs only slowly, and higher interest rates have made buying both everyday items and bigger purchases much harder. Data out earlier Friday showed US retail sales fell for a second month in March.

Paradoxically, buying conditions for durable goods also improved as consumers noted some disinflation for car . Still, about 42% of respondents blamed high prices for eroding their personal finances, the most since December.

And something else curious: despite the alleged spike in inflation expectations, the number of spontaneous mentions of high prices dropped again, confirming that there is something quite inconsistent within the entire report.

What is most remarkable however, and consistent with the March readings, the bank crisis appears to have little impact on sentiment – as confidence levels were similar whether or not consumers mentioned the failures, the report said – something which casts doubt on the validity and credibility of the entire UMich survey which like most other economic indicators appears to have been subsumed to some political agenda.

Loading…