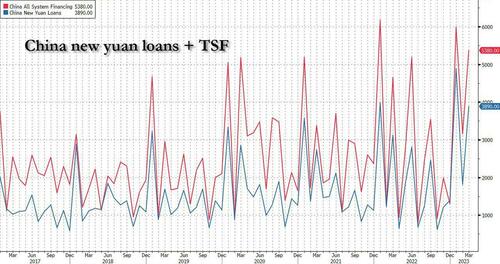

Last week, when discussing the latest record - for the month of March - Chinese credit injection which saw a massive 5.4 trillion yuan in Total Social Financing, beating estimates by almost CNY 1 trillion...

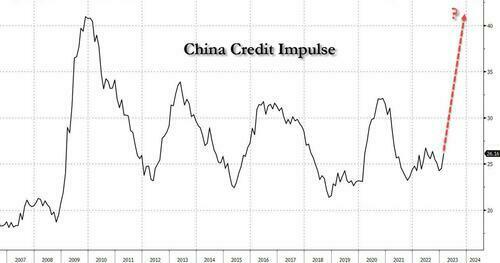

... and sparking a surge in China's all-important Credit Impulse...

... we said that China's delayed "liftoff was imminent", and that "the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is - willingly or otherwise - set to serve as the world's growth dynamo at a time when the entire developed world is about to max out at the same time. This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China's debt to over 300% of GDP."

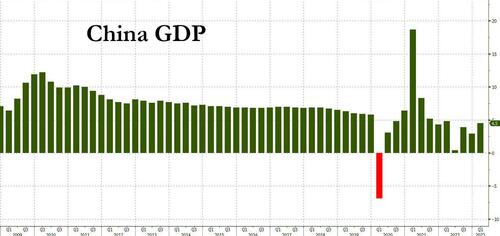

Since then, we have seen China report stellar trade data with both exports and imports sharply higher than expected, more solid real estate prints as housing prices have clearly rebounded from two years of decline, and most importantly, overnight China's Q1 GDP also surprised to the upside, rising at a 4.5% annual clip in the first quarter - the strongest quarter for the Chinese economy since Q1 2022 - as strong growth in exports and infrastructure investment as well as a rebound in retail consumption and property prices drove a recovery in the world’s second-largest economy.

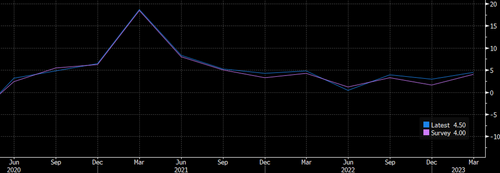

The official figure, which exceeded analyst expectations of a 4% rise and was the third consecutive beat of the median forecast...

... followed efforts by Chinese leader Xi Jinping’s government to restore business confidence damaged by pandemic controls last year and abrupt policy changes.

That said, the Q1 growth rate was just short of the government’s recently upgraded full-year target of 5%, held back by a nationwide Covid-19 outbreak at the start of this year, but economists expect it to pick up pace as the year progresses.

Xi, who formally embarked on an unprecedented third term as China’s president last month, is keen to revive economic growth following China's shocking reversal of its covid-zero policy. Last year, GDP expanded just 3%, missing the official target of 5.5% which was already the lowest in decades.

“Definitely, the recovery’s on track,” said Tao Wang, UBS chief China economist. “The momentum at the beginning of the year was stronger than expected.”

Echoing what we said last week, the FT writes that "China’s rebound is crucial to global economic growth this year as developed nations grapple with persistently high inflation, rising interest rates and sluggish expansion in the wake of the pandemic and Russia’s full-scale invasion of Ukraine."

“The national economy showed a steady recovery and made a good start,” China’s National Bureau of Statistics said. But the agency cautioned the situation was “complex and volatile, inadequate domestic demand remains prominent and the foundation for economic recovery is not solid yet”.

Curiously, while Chinese commodities markets rallied following Tuesday’s data release, equities failed to hold on to early gains. That's because the data may have snuffed out recent hopes that bad news is good news and would lead to more stimulus. As Bloomberg reports Sofia Horta e Costa writes, "It’s clear markets are setting a high bar for China’s economy. So China data beats estimates yet again, but hardly anything moves in local assets. What’s going on?"

In March I wrote about how some traders were betting on a consumption-driven recovery, and others believed more stimulus would be forthcoming. You were either in one camp or the other. The issue for markets right now is that the macro picture is falling somewhere in the middle. Yes, the data is good — in some ways much better than expected — but not good enough for bulls to make a compelling case for a reopening boom in the economy.

The rebound is fragile, with pockets of weakness including the property market and factories. It’s also uneven: consumers may be spending more but they’re mainly focused on restaurants and jewelry. And the central bank is erring on the cautious side of stimulus. The bar is increasingly getting higher for any meaningful market reaction. We either need a blowout set of data across the board or more action from Beijing.

Indeed, while the Chinese data has been strong so far, it is certainly not blowout, at least not yet.

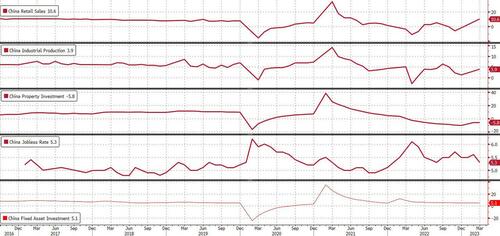

China abandoned zero-Covid restrictions in December amid popular opposition to the rolling lockdowns that paralyzed cities across the country for most of the year. The easing unleashed pent-up demand in the retail sector, where sales rose 5.8% year on year in the first quarter and 10.6% in March, both coming in well above expectations. But the base of comparison with last year was low, given that Shanghai started a months-long lockdown in late February 2022.

Premier Li Qiang, Xi’s new number two, signalled at China’s rubber-stamp parliament last month that the government would relax a crackdown on business that has wiped billions of dollars from property developers and internet platforms.

Elsewhere, manufacturing investment rose 7% year on year in the first quarter and industrial output gained 3%. Exports showed strong growth, up 8.4% in the first quarter, and state-led infrastructure investment climbed 8.8%, while overall fixed asset investment rose 5.1%, a modest miss to expectations. Private investment was weak, up just 0.6 %, suggesting a decline in March. The jobless rate fell to 5.3% in March from 5.6% in February, but youth unemployment hit the second-highest mark on record, at 19.6%.

At the same time, while home prices may be rising, housing sector woes persisted: the property sector’s woes continued, with new housing starts tumbling 19.2% year on year in the first quarter. Home sales by area declined 1.8% but sales by value rose 4.1%, pointing to a nascent recovery in prices. Indeed, in March, new home prices rose at their fastest pace in 21 months.

Following the news, Citigroup economists upgraded their forecast for 2023 GDP growth to 6.1% from 5.7% previously after strong data Tuesday. “Consumption recovery continued to be divergent across sectors, with services outperforming,” economists led by Xiangrong Yu wrote in a Tuesday research note. “Normalization in savings and improvement in employment” has provided “potential upside”

The property sector also improved steadily in March compared to the first two months of the year, especially for sales. The growth pickup “perhaps further lowers the necessity of stimulus,” the economists wrote, adding that they “don’t expect anything major” in the upcoming April Politburo meeting. This year could be a “window of opportunities for policymakers to address structural issues, such as weak private confidence, youth unemployment and local government debt.”

Other economists also said momentum would pick up in the second quarter, helped by the low base effect, but warned that consumption and property might struggle to maintain strong growth, while exports could be threatened by weaker developed markets.

Xi’s administration also remained hamstrung by a lack of credibility after hobbling the private sector, experts said.

Keyu Jin, a professor at the London School of Economics and author of The New China Playbook, said the biggest obstacle was the gap in private sector demand, both in consumption and investment.

“It will take time for confidence to come back to the Chinese economy,” she said, although what she really meant is that it would take a lot of new debt and credit. And as we showed last week, Beijing is already injecting record amounts of it as it prepares to become the world's growth pillar now that the US is set to slide into recession.

Last week, when discussing the latest record – for the month of March – Chinese credit injection which saw a massive 5.4 trillion yuan in Total Social Financing, beating estimates by almost CNY 1 trillion…

… and sparking a surge in China’s all-important Credit Impulse…

… we said that China’s delayed “liftoff was imminent”, and that “the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is – willingly or otherwise – set to serve as the world’s growth dynamo at a time when the entire developed world is about to max out at the same time. This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China’s debt to over 300% of GDP.”

Since then, we have seen China report stellar trade data with both exports and imports sharply higher than expected, more solid real estate prints as housing prices have clearly rebounded from two years of decline, and most importantly, overnight China’s Q1 GDP also surprised to the upside, rising at a 4.5% annual clip in the first quarter – the strongest quarter for the Chinese economy since Q1 2022 – as strong growth in exports and infrastructure investment as well as a rebound in retail consumption and property prices drove a recovery in the world’s second-largest economy.

The official figure, which exceeded analyst expectations of a 4% rise and was the third consecutive beat of the median forecast…

… followed efforts by Chinese leader Xi Jinping’s government to restore business confidence damaged by pandemic controls last year and abrupt policy changes.

That said, the Q1 growth rate was just short of the government’s recently upgraded full-year target of 5%, held back by a nationwide Covid-19 outbreak at the start of this year, but economists expect it to pick up pace as the year progresses.

Xi, who formally embarked on an unprecedented third term as China’s president last month, is keen to revive economic growth following China’s shocking reversal of its covid-zero policy. Last year, GDP expanded just 3%, missing the official target of 5.5% which was already the lowest in decades.

“Definitely, the recovery’s on track,” said Tao Wang, UBS chief China economist. “The momentum at the beginning of the year was stronger than expected.”

Echoing what we said last week, the FT writes that “China’s rebound is crucial to global economic growth this year as developed nations grapple with persistently high inflation, rising interest rates and sluggish expansion in the wake of the pandemic and Russia’s full-scale invasion of Ukraine.”

“The national economy showed a steady recovery and made a good start,” China’s National Bureau of Statistics said. But the agency cautioned the situation was “complex and volatile, inadequate domestic demand remains prominent and the foundation for economic recovery is not solid yet”.

Curiously, while Chinese commodities markets rallied following Tuesday’s data release, equities failed to hold on to early gains. That’s because the data may have snuffed out recent hopes that bad news is good news and would lead to more stimulus. As Bloomberg reports Sofia Horta e Costa writes, “It’s clear markets are setting a high bar for China’s economy. So China data beats estimates yet again, but hardly anything moves in local assets. What’s going on?”

In March I wrote about how some traders were betting on a consumption-driven recovery, and others believed more stimulus would be forthcoming. You were either in one camp or the other. The issue for markets right now is that the macro picture is falling somewhere in the middle. Yes, the data is good — in some ways much better than expected — but not good enough for bulls to make a compelling case for a reopening boom in the economy.

The rebound is fragile, with pockets of weakness including the property market and factories. It’s also uneven: consumers may be spending more but they’re mainly focused on restaurants and jewelry. And the central bank is erring on the cautious side of stimulus. The bar is increasingly getting higher for any meaningful market reaction. We either need a blowout set of data across the board or more action from Beijing.

Indeed, while the Chinese data has been strong so far, it is certainly not blowout, at least not yet.

China abandoned zero-Covid restrictions in December amid popular opposition to the rolling lockdowns that paralyzed cities across the country for most of the year. The easing unleashed pent-up demand in the retail sector, where sales rose 5.8% year on year in the first quarter and 10.6% in March, both coming in well above expectations. But the base of comparison with last year was low, given that Shanghai started a months-long lockdown in late February 2022.

Premier Li Qiang, Xi’s new number two, signalled at China’s rubber-stamp parliament last month that the government would relax a crackdown on business that has wiped billions of dollars from property developers and internet platforms.

Elsewhere, manufacturing investment rose 7% year on year in the first quarter and industrial output gained 3%. Exports showed strong growth, up 8.4% in the first quarter, and state-led infrastructure investment climbed 8.8%, while overall fixed asset investment rose 5.1%, a modest miss to expectations. Private investment was weak, up just 0.6 %, suggesting a decline in March. The jobless rate fell to 5.3% in March from 5.6% in February, but youth unemployment hit the second-highest mark on record, at 19.6%.

At the same time, while home prices may be rising, housing sector woes persisted: the property sector’s woes continued, with new housing starts tumbling 19.2% year on year in the first quarter. Home sales by area declined 1.8% but sales by value rose 4.1%, pointing to a nascent recovery in prices. Indeed, in March, new home prices rose at their fastest pace in 21 months.

Following the news, Citigroup economists upgraded their forecast for 2023 GDP growth to 6.1% from 5.7% previously after strong data Tuesday. “Consumption recovery continued to be divergent across sectors, with services outperforming,” economists led by Xiangrong Yu wrote in a Tuesday research note. “Normalization in savings and improvement in employment” has provided “potential upside”

The property sector also improved steadily in March compared to the first two months of the year, especially for sales. The growth pickup “perhaps further lowers the necessity of stimulus,” the economists wrote, adding that they “don’t expect anything major” in the upcoming April Politburo meeting. This year could be a “window of opportunities for policymakers to address structural issues, such as weak private confidence, youth unemployment and local government debt.”

Other economists also said momentum would pick up in the second quarter, helped by the low base effect, but warned that consumption and property might struggle to maintain strong growth, while exports could be threatened by weaker developed markets.

Xi’s administration also remained hamstrung by a lack of credibility after hobbling the private sector, experts said.

Keyu Jin, a professor at the London School of Economics and author of The New China Playbook, said the biggest obstacle was the gap in private sector demand, both in consumption and investment.

“It will take time for confidence to come back to the Chinese economy,” she said, although what she really meant is that it would take a lot of new debt and credit. And as we showed last week, Beijing is already injecting record amounts of it as it prepares to become the world’s growth pillar now that the US is set to slide into recession.

Loading…