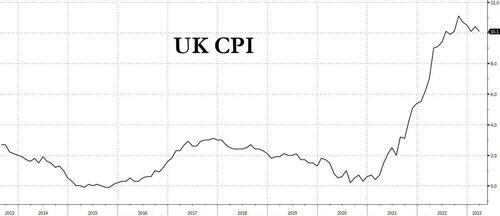

Futures are trading near session lows, weighted down by the latest inflation data out of the UK where early this morning, we learned that March inflation remained in the double digits with annual price rises of 10.1%, coming in hotter than expected for the second straight month, and making it more likely that the Bank of England will increase interest rates next month.

February's CPI was 10.4% and was expected to drop to 9.8% last month, and although petrol and diesel prices fell in the month, fresh sharp rises in the costs of food, recreation and culture — a broad category which includes theater, concerts and sporting events — kept the index in double digits.

The drop in headline inflation was almost entirely caused by motor fuels where the average price of a liter of petrol fell from just over £1.60 in March 2022 to just under £1.47 last month. Across components, the largest downward contributions to the moderation in headline inflation came from transport and housing. Offsetting this and keeping the headline rate high were soaring food prices, especially of bread and cereals, with prices rising 19.1% in the year to March.

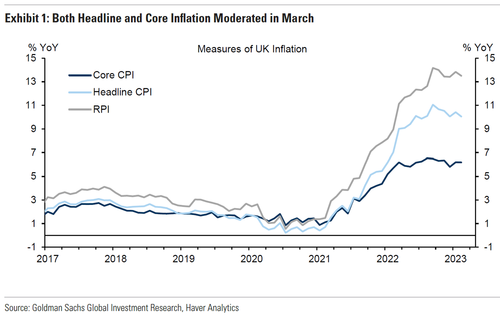

Following the uptick in sequential pressures last month, today’s print showed a slowing in the seasonally adjusted MoM pace but the slowing was less than expected and the sequential pace for core inflation remains above that observed in Q4, reflecting continued strength in core goods in particular.

Here are the key numbers:

- CPI (Mar): +10.1%; GS: +9.9%; Cons: +9.8%; Previous (Feb): +10.4%, all%yoy.

- Core CPI (Mar): +6.2%; Cons: +6.0%; Previous (Feb): +6.2%

- RPI (Mar): +13.5%; Cons: +13.3%; Previous (Feb): +13.8%

Following today’s release, Goldman said that it mechanically updated its UK inflation forecast and now expects headline and core inflation to be 3.9%yoy and 4.3%yoy, respectively, in December 2023. Also, given today’s upside surprise, the bank continues to expect the MPC to hike by 25bp at its upcoming May meeting.

And speaking of the BOE, the FT notes that the central bank had been watching these figures very closely as they were the last significant data release before its next meeting in early May and while officials had hoped that there would be the first signs of a significant drop in inflationary pressure, core inflation, excluding food and energy prices, remained unchanged at 6.2%, which remains too high to give them comfort.

The BoE’s Monetary Policy Committee has been looking for signs that underlying inflationary pressure is moderating and that declines in the headline rate are not caused solely by large energy price increases last year beginning to drop out of the annual comparisons.

The members will not be reassured by both services inflation remaining at 6.6 per cent and core inflation failing to fall, instead sticking at 6.2 per cent. The MPC has said that it will raise interest rates again from the current 4.25 per cent level, “if there were to be evidence of more persistent pressures”.

Grant Fitzner, chief economist of the ONS, said that inflation remained at a “high level”. Falling motor fuel prices “were partially offset by the cost of food, which is still climbing steeply, with bread and cereal price inflation at a record high."

Kitty Ussher, chief economist at the Institute of Directors, said that the failure to see any drop in core inflation would require the bank to take action and raise rates again on May 4. “Taken together with yesterday’s strong labour market data, it is now clear that there is more demand in the economy than the Bank of England had expected in the first quarter,” she said.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the fall in the headline rate had been “too modest for the MPC to stop raising rates”.

Capital Economics, the consultancy, said that the stubbornness of high inflation raised the possibility that a rise in interest rates to 4.5% at the May meeting may not be the last.

UK inflation has not been falling as quickly as comparable indicators in many European countries which saw lower energy prices reflected in the March data, but headline rates for the UK are expected to drop significantly next month.

With gas and electricity prices for April already known, the annual increase in this component will fall from 96 per cent to 27 per cent, although consumers will not feel better off as the energy price cap will stay at the same level. These prices are expected to start falling in the summer.

Headline inflation is still on course to halve by the end of the year, meeting the government’s target. In a statement, Jeremy Hunt, chancellor, said: “These figures reaffirm exactly why we must continue with our efforts to drive down inflation so we can ease pressure on families and businesses”.

In kneejerk response, sterling strengthened against the dollar, with the pound up 0.3% against the dollar at $1.24 in early trading but it has since faded back to unchanged as the dollar rose amid a broad-based pullback in risk.

Futures are trading near session lows, weighted down by the latest inflation data out of the UK where early this morning, we learned that March inflation remained in the double digits with annual price rises of 10.1%, coming in hotter than expected for the second straight month, and making it more likely that the Bank of England will increase interest rates next month.

February’s CPI was 10.4% and was expected to drop to 9.8% last month, and although petrol and diesel prices fell in the month, fresh sharp rises in the costs of food, recreation and culture — a broad category which includes theater, concerts and sporting events — kept the index in double digits.

The drop in headline inflation was almost entirely caused by motor fuels where the average price of a liter of petrol fell from just over £1.60 in March 2022 to just under £1.47 last month. Across components, the largest downward contributions to the moderation in headline inflation came from transport and housing. Offsetting this and keeping the headline rate high were soaring food prices, especially of bread and cereals, with prices rising 19.1% in the year to March.

Following the uptick in sequential pressures last month, today’s print showed a slowing in the seasonally adjusted MoM pace but the slowing was less than expected and the sequential pace for core inflation remains above that observed in Q4, reflecting continued strength in core goods in particular.

Here are the key numbers:

- CPI (Mar): +10.1%; GS: +9.9%; Cons: +9.8%; Previous (Feb): +10.4%, all%yoy.

- Core CPI (Mar): +6.2%; Cons: +6.0%; Previous (Feb): +6.2%

- RPI (Mar): +13.5%; Cons: +13.3%; Previous (Feb): +13.8%

Following today’s release, Goldman said that it mechanically updated its UK inflation forecast and now expects headline and core inflation to be 3.9%yoy and 4.3%yoy, respectively, in December 2023. Also, given today’s upside surprise, the bank continues to expect the MPC to hike by 25bp at its upcoming May meeting.

And speaking of the BOE, the FT notes that the central bank had been watching these figures very closely as they were the last significant data release before its next meeting in early May and while officials had hoped that there would be the first signs of a significant drop in inflationary pressure, core inflation, excluding food and energy prices, remained unchanged at 6.2%, which remains too high to give them comfort.

The BoE’s Monetary Policy Committee has been looking for signs that underlying inflationary pressure is moderating and that declines in the headline rate are not caused solely by large energy price increases last year beginning to drop out of the annual comparisons.

The members will not be reassured by both services inflation remaining at 6.6 per cent and core inflation failing to fall, instead sticking at 6.2 per cent. The MPC has said that it will raise interest rates again from the current 4.25 per cent level, “if there were to be evidence of more persistent pressures”.

Grant Fitzner, chief economist of the ONS, said that inflation remained at a “high level”. Falling motor fuel prices “were partially offset by the cost of food, which is still climbing steeply, with bread and cereal price inflation at a record high.”

Kitty Ussher, chief economist at the Institute of Directors, said that the failure to see any drop in core inflation would require the bank to take action and raise rates again on May 4. “Taken together with yesterday’s strong labour market data, it is now clear that there is more demand in the economy than the Bank of England had expected in the first quarter,” she said.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the fall in the headline rate had been “too modest for the MPC to stop raising rates”.

Capital Economics, the consultancy, said that the stubbornness of high inflation raised the possibility that a rise in interest rates to 4.5% at the May meeting may not be the last.

UK inflation has not been falling as quickly as comparable indicators in many European countries which saw lower energy prices reflected in the March data, but headline rates for the UK are expected to drop significantly next month.

With gas and electricity prices for April already known, the annual increase in this component will fall from 96 per cent to 27 per cent, although consumers will not feel better off as the energy price cap will stay at the same level. These prices are expected to start falling in the summer.

Headline inflation is still on course to halve by the end of the year, meeting the government’s target. In a statement, Jeremy Hunt, chancellor, said: “These figures reaffirm exactly why we must continue with our efforts to drive down inflation so we can ease pressure on families and businesses”.

In kneejerk response, sterling strengthened against the dollar, with the pound up 0.3% against the dollar at $1.24 in early trading but it has since faded back to unchanged as the dollar rose amid a broad-based pullback in risk.

Loading…