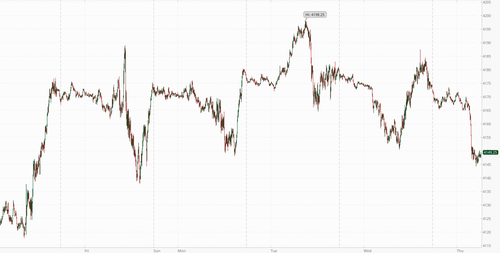

US equity futures suffered their biggest overnight drop this week as a premarket slide in Tesla shares added to uncertainties surrounding the future of US monetary policy as well as the overall quality of the first-quarter earnings season. Contracts on the S&P 500 fell 0.7% as of 7:00 a.m. in New York while Nasdaq 100 futures took a 1% hit. Elsewhere, bond yields were lower, the USD was lower, and commodities were weaker on global demand fears.

In premarket trading, Tesla slid as much as 8.5% and were down -6% at last check, after the EV maker’s first-quarter results were hit by a slew of price cuts, denting profit margins and prompting at least six analysts - including Morgan Stanley's Adam Jonas - to cut their price targets. MegaCap techs are also dragging indices lower with most names down 1%, or more. Bed Bath & Beyond shares tumbled 19% in premarket trading after Dow Jones reported that the retailer is preparing a bankruptcy filing for as early as this weekend. The stock had soared almost 100% in the three days prior. Here are some other premarket movers:

- Chip stocks decline in after Asian bellwether TSMC gave a disappointing revenue forecast for the current quarter amid a slump in demand for electronics.

- IBM rises as much as 2.2% after the IT services company reported first-quarter results that analysts say show positive growth trends.

- Las Vegas Sands rises as much as 4.8%, after the casino operator’s first-quarter earnings beat expectations and boosted hopes that a recovery in Macau and in Singapore is gaining momentum. Analysts hiked their price targets on the stock.

- Bath & Body Works drops 3.7% after Piper Sandler cuts its rating to neutral, with consensus estimates for the personal care products maker seen as “simply just too high.”

- Charles Schwab shares fall as much as 1.7% after Redburn downgraded the brokerage to sell from neutral, citing challenges from the Fed’s tightening cycle and the re-regulation of midsize banks.

- Cryptocurrency-exposed stocks fall and are poised to extend losses as Bitcoin dives further below the closely watched $30,000 level.

With better Bank earnings and a lackluster start from Tech earnings, the market seemingly remains stuck in near-term range of 3800 – 4200, with the SPX failing at 4150 level. Next week’s tech earnings will be the litmus test for bears and bulls.

Meanwhile, hawkish Fedspeak continues with some estimating 25bps – 50bps, or more, hikes remaining. Investors are seeking comfort whether policymakers will address growing recession worries, such as those flagged by the Federal Reserve’s monthly Beige Book survey which clearly noted that a credit crunch has arrived, or keep on fighting inflation as suggested by Fed Bank of New York President John Williams, who said price gains remained too high.

“We’re in a paradoxical situation,” said Alexandre Hezez, chief investment officer at Group Richelieu, a Paris-based asset manager. “If the Fed keeps on raising rates it’s not positive as it would mean we’re not done with inflation yet, but if it cuts, that would mean there are recessionary forces around.” The best path forward would be “a status quo” for the coming months, after a 25 basis-point hike in May, Hezez said, noting strong divergences on the matter among the Federal Open Market Committee.

European stocks are on course for their largest fall in almost four weeks amid tepid earnings and the prospect of additional monetary tightening. The Stoxx 600 is down 0.3% with autos, miners and tech the worst performing sectors while Renault and Nokia have fallen sharply after their respective quarterly updates. Here are the most notable European movers:

- Renault shares fall as much as 7.9% as pricing concerns offset positives from the first-quarter sales beat, with analysts questioning the sustainability of the French carmaker’s pricing

- Tryg shares rise as much as 4.7% with analysts saying the Danish insurer’s better-than-expected profit, dividend and combined operating ratio all make for a reassuring update

- Haleon shares rise as much as 3% in early trading to hit a record high. The consumer health group’s first-quarter update is strong and shows good momentum for the group, analysts say

- Bankinter jumps as much as 5%, kicking off 1Q earnings season for European banks with a strong set of numbers and analysts pointing to a net interest income beat

- Getlink shares gain as much as 2.8% after the French cross-channel transport operator reported a 1Q revenue beat and management maintained its Ebitda outlook

- Rexel shares rise as much as 3.8% after it reported a “strong beat” that should lead to consensus full-year estimates rising to the upper end of company’s guidance, Citi says

- ASML leads gains in shares of European semiconductor-equipment makers after TSMC — the industry bellwether and a major ASML customer — kept its full-year capex target unchanged

- Nordic Semiconductor shares fall as much as 17% to the lowest intraday level in more than two years after the chipmaker gave bleak 2Q guidance and scrapped a revenue outlook

- Sartorius AG falls as much as 7.8% after the German laboratory equipment group’s 1Q results, which Morgan Stanley analysts say was “significantly weaker than anticipated on all metrics”

- Stora Enso drops as much as 6.4% to lowest since August 2020 after the Finnish forestry group said operational Ebit for 2023 is now set to be “significantly lower” than in 2022

- Nokia shares fall as much as 2.9% to the lowest intraday level in more than a year, after the telecom equipment maker reported first-quarter margins well below estimates

Earlier in the session, Asian stocks edged lower as volatility across global markets remained subdued, with investors awaiting new catalysts and digesting recent corporate earnings. The MSCI Asia Pacific Index dropped as much as 0.4% before paring its loss. Most major benchmarks were up or down by less than 0.5%, with South Korea and mainland China leading the declines.

In key results Thursday, TSMC forecast worse-than-anticipated revenue for the current quarter, reflecting a persistent slump in global chip demand. Chinese EV battery maker CATL is expected to report strong revenue growth later in the day. China tech earnings so far have been in line, “could have been better but we stay more optimistic,” given positive initiatives from companies such as Alibaba, Xiaolin Chen, head of international at Kraneshares, told Bloomberg TV. “Overall you see very encouraging and constructive policies get introduced by policymakers or corporates themselves to become more market oriented.” The Kospi slipped after coming close to a bull market. The gauge is Asia’s best performer among major markets this year, climbing 19% from a September low amid frenzied gains in EV-battery related stocks and heavyweight Samsung Electronics.

Japanese stocks were mixed in thin trading as investors eye upcoming earnings from major domestic and overseas companies. The Topix closed little changed at 2,039.73, while the Nikkei advanced 0.2% to 28,657.57. Volume on both gauges was more than 20% below the 30-day averages. Out of 2,158 stocks in the Topix, 1,203 rose and 811 fell, while 144 were unchanged. “There is a lack of news, and investors are still waiting for corporate earnings results to come out and then further on, monetary policy,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management

In Australia, the S&P/ASX 200 index was little changed to close at 7,362.20, as gains in banks were offset by broad declines in mining shares. Asian shares were broadly lower as investors parsed mixed corporate earnings and the latest assessment on the US economy. Australia’s central bank should set up an expert policy board, hold fewer meetings and give press conferences explaining its decisions, according to recommendations from an independent review that would align it with many global peers. Read: RBA Review Calls for Expert Policy Panel, Fewer Meetings (3) In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,879.68.

In FX, the Bloomberg Dollar Spot Index is flat. New Zealand dollar dropped to a month-low after data showed the nation’s inflation slowed down more than expected, spurring expectations for the central bank to ease policy tightening.

In rates, US two-year yields are lower after a five day rally, falling 3bps to 4.22% while 10-year yieldS fell as much as 5bps to 3.54%, the lowest since Monday; traders bet on 23bps of Fed tightening in May and 30bps by June, while pricing 50bps of cuts by year-end. German and UK two-year borrowing costs both fall by 1bps.

In commodities, crude futures extended their recent decline with WTI falling 1.8% to trade near $77.70. Will OPEC have to get involved again and cut production some more? Spot gold is little changed around $1,994.

Bitcoin continues to slip and has drifted more than 1% %to a fresh USD 28.56k WTD trough vs Monday's USD 30.5k best, action which has come alongside the broader dip in sentiment with specific fundamentals somewhat limited.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales for March and the Conference Board’s leading index for March. From central banks, we’ll get the ECB’s account of their March meeting, and hear from ECB President Lagarde, the ECB’s Visco, Holzmann and Schnabel, the Fed’s Waller, Mester, Bowman and Bostic, the BoE’s Tenreyro and BoC Governor Macklem. Finally, earnings releases include AT&T, Union Pacific and American Express.

Market Snapshot

- S&P 500 futures down 0.7% to 4,147.50

- STOXX Europe 600 down 0.4% to 466.47

- MXAP little changed at 162.39

- MXAPJ down 0.1% to 523.29

- Nikkei up 0.2% to 28,657.57

- Topix little changed at 2,039.73

- Hang Seng Index up 0.1% to 20,396.97

- Shanghai Composite little changed at 3,367.03

- Sensex little changed at 59,513.37

- Australia S&P/ASX 200 little changed at 7,362.19

- Kospi down 0.5% to 2,563.11

- Brent Futures down 1.5% to $81.91/bbl

- Gold spot up 0.2% to $1,997.99

- U.S. Dollar Index down 0.12% to 101.84

- German 10Y yield little changed at 2.48%

- Euro up 0.1% to $1.0970

Top Overnight News

- Today Treasury Secretary Janet L. Yellen on Thursday will call for a “constructive” and “healthy” economic relationship between the United States and China, one in which the two nations work together to confront challenges like climate change, according to excerpts from prepared remarks. NYT

- The BOJ is “warming” to the idea of tweaking its policy in a hawkish direction this year, but probably won’t take any actions at next week’s meeting. RTRS

- TSMC, the leading chipmaker for the likes of Apple and Nvidia, has warned that a weaker than expected recovery in China has hit demand for its semiconductors. The Taiwanese chipmaker cut its forecast for the semiconductor market this year, excluding memory, to a mid-single-digit percentage decline. FT

- Germany’s PPI for March dramatically undershoots the Street consensus, coming in at +7.5% Y/Y (down from +15.8% in Feb and below the Street’s +9.8% forecast). RTRS

- Brussels is preparing emergency curbs on Ukrainian grain imports to five member states close to the war-torn country, bowing to pressure from Poland and Hungary after they took unilateral action to pacify local farmers. FT

- ECB minutes will be scoured today for any additional hints on the duration of the tightening cycle. It gave no guidance on its next moves after the March meeting, though Christine Lagarde, who speaks today, indicated more tightening is coming. Governing Council hawk Klaas Knot told the Irish Times that officials may need to raise interest rates in June and July following a hike next month. BBG

- NY Fed chief John Williams said that while the banking sector has stabilized following the second-largest bank collapse in US history, the recent stress may tighten credit conditions. Chicago's Austan Goolsbee said he's still waiting to see if the fallout causes the economy to slow more than expected. Loretta Mester and Raphael Bostic are among Fed speakers today. BBG

- Uncertainty continues to linger about whether or not the US will make it through to late summer without risking a debt-ceiling-related default after figures indicating the size of the Treasury’s tax day cash influx were somewhat lackluster. The amount of money that the US government has on hand to pay its bills jumped just $108.47 billion on Tuesday. BBG

- Tesla plunged as much as 8.5% premarket after Elon Musk signaled price cuts will continue at the expense of profit margins. Profit missed and the operating margin slumped to 11.4% from 19.2% a year ago. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded rangebound with the region indecisive following the flat handover from the US where earnings were under the spotlight and early headwinds were seen after firmer-than-expected UK CPI data. ASX 200 was indecisive as participants digested output updates and with the mining sector subdued despite the fresh record Q1 iron ore shipments by Rio Tinto, while Australian Treasurer Chalmers announced recommendations from the independent RBA review which included establishing separate boards for governance and monetary policy with fewer meetings and press conferences to be conducted after policy decisions. Nikkei 225 gradually pared opening losses following mixed trade data including better-than-expected exports growth and after a recent report that the BoJ is said to be wary of tweaking yield control this month. Hang Seng and Shanghai Comp were mixed following the lack of surprises by the PBoC which maintained its benchmark lending rates for the 8th consecutive month and as frictions lingered after the US Commerce Department imposed a USD 300mln civil penalty on Seagate for supplying hard disk drives to Huawei in violation of export controls.

Top Asian News

- PBoC 1-Year Loan Prime Rate (Apr) 3.65% vs Exp. 3.65% (Prev. 3.65%); 5-Year Loan Prime Rate (Apr) 4.30% vs Exp. 4.30% (Prev. 4.30%)

- PBoC official expects consumer inflation to pick up later this year; the impact on the Yuan from volatility in major currencies is limited, expects it to be basically stable with two-way swings.

- US Trade Representative Tai said they have seen supply chain fragility and that US trade restrictions on China are narrowly targeted, while she added the US doesn't intend to decouple and intends a level trade playing field with China.

- US Commerce Department imposed a USD 300mln civil penalty on Seagate (STX) and said the Co. sold 7.4mln hard disk drives to Huawei between August 2020-September 2021 in violation of export controls, according to Reuters.

- RBA independent review recommended that the RBA should have dual objectives of price stability and full employment, while it should retain a flexible inflation target of 2%-3% and aim at the mid-point. It was also recommended that the government form a monetary policy board of experts which would comprise of the RBA Governor, Deputy Governor, Treasury Secretary and 6 external members with the Governor as Chair in which the policy board would conduct 8 meetings a year with a press conference after each meeting, while the government should establish a governance board with an external chair and legislate changes to commence from July 2024. Furthermore, the RBA should retain independence and the power of government to override decisions should be repealed.

- BoJ is reportedly open to tweaking Yield Curve Control (YCC) this year if wage momentum holds, according to Reuters sources; may engage is more lively debate in the June and July meetings; no current consensus on how soon to phase YCC out, July wage tally key.

European bourses are lower across the board, Euro Stoxx 50 -0.3%, as pressure emerged without a clear catalyst after a relatively contained open. Sectors are largely in the red, with Autos underperforming amid downside in Renault post-earnings and with attention on Tesla; elsewhere, Nokia slumps and L'Oreal trims upside after their latest updates. Stateside, futures are pressured to a larger extent than their European peers with downside occurring in tandem with the above move and exacerbated by marked pressure in Tesla, NQ -1.1%. TSMC (2330 TT/TSM) Q1 (TWD): Net Profit 206.9bln (exp. 192.8bln), Sales 508.6bln (exp. 517.9bln), Gross Profit 286.5bln (prev. 273.2bln). EPS 7.98 (exp. 7.41), Gross Margin 56.3% (exp. 54.5%). Q2 Guidance (USD): Revenue 15.2-16.0bn (exp. 17.3bln), Gross Margin 52-54% (exp. 52.5%), Operating Margin 39.5-41.5% (exp. 40%). TSM +0.4% in pre-market trade. Tesla (TSLA) - Q1 2023 (USD): Adj. EPS 0.85 (exp. 0.85), Revenue 23.33bln (exp. 23.29bln). Still sees FY production 1.80mln vehicles (exp. 1.84mln). Tesla did not release its automotive margins, but continues to believe that its operating margin will remain among the highest in the industry. CEO Musk has taken a view that pushing for higher volumes and a larger fleet is the right choice here vs lower volume and higher margins. -7.5% in pre-market trade.

Top European News

- Turkey Gas Field Launch Sets Up Pre-Election Giveaway

- European Gas Prices Swing With Signs of Weak Industrial Demand

- Melrose Spinoff Dowlais Slips in Rare London Trading Debut

- Nokia Misses Estimates as Clients Reduce Spending on 5G Gear

FX

- Kiwi deflated as NZ CPI metrics miss consensus, NZD/USD sub-0.6200 and AUD/NZD eyeing 1.0900.

- DXY drifting within 102.040-101.780 range after failing to close above the 21 DMA again.

- Aussie and Euro underpinned by option expiries between 0.6700-0.6695 and at 1.0925 vs the Buck.

- Franc firm and retesting 0.9850 vs Greenback as Treasury yields ease; Yen, Pound and Loonie rangy.

- PBoC set USD/CNY mid-point at 6.8987 vs exp. 6.8979 (prev. 6.8732)

Fixed Income

- Core benchmarks have pared back initial recovery momentum and are now in close proximity to the neutral mark on the session, though currently retain an incremental positive bias.

- Given the above, bonds are yet to mark new troughs though the waning momentum is notable but worth caveating with the particularly hefty upcoming US agenda.

- Specifically, the action has seen Bunds, Gilts and USTs move closer to their 133.42, 99.94 and 114-07 intraday lows vs initial recovery highs; stateside yields are lower, with curve action again most pronounced at the short-end.

Commodities

- Crude benchmarks remain under pressure, with specific fundamentals limited and the complex printing new multi-week lows. Though, the magnitude of today's action has thus far been much less pronounced than the losses seen earlier in the week.

- Specifically, WTI and Brent June futures are under USD 78/bbl (vs high 79.07/bbl) and USD 82/bbl (vs high 82.92/bbl) respective highs.

- Spot gold has attempted to reclaim the USD 2k/oz mark but is yet to convincingly surmount the figure despite the softer USD and equity landscape, base metals are lower in fitting with the mentioned tone though the downside is perhaps capped as the Dollar dips.

- Pakistan's first order for Russian discount oil has been placed, via Pakistan's petroleum minister; intends to import 100k BPD of Russian oil.

Geopolitics

- China Hainan Maritime Bureau said it will ban passage during military drills in nearby waters in South China Sea amid military drills from Friday to Sunday, according to Kyodo.

- Iran says its navy has forced a US submarine to surface as it enters the Gulf, via State TV.

US Event Calendar

- 08:30: April Initial Jobless Claims, est. 240,000, prior 239,000

- 08:30: April Continuing Claims, est. 1.83m, prior 1.81m

- 08:30: April Philadelphia Fed Business Outl, est. -19.3, prior -23.2

- 10:00: March Existing Home Sales MoM, est. -1.8%, prior 14.5%

- 10:00: March Home Resales with Condos, est. 4.5m, prior 4.58m

- 10:00: March Leading Index, est. -0.7%, prior -0.3%

DB's Jim Reid concludes the overnight wrap

Markets have struggled a bit over the last 24 hours, with bonds and equities selling off thanks to strong inflation data and a mixed batch of earnings releases. However by the close of business both Euro and US equities had broadly clawed their way back to flat (S&P -0.01%) but with yields on 10yr Treasuries (+1.5bps) ending just a shade under their one-month highs at of 3.59% and Bund yields at their highest close since March 9th.

The initial catalyst for the bond and equity weakness yesterday came from the UK inflation release shortly after we went to press yesterday. It showed CPI inflation had only fallen to +10.1% in March (vs. +9.8% expected), and core inflation was above expectations as well at +6.2% (vs. +6.0% expected), which disappointed hopes that we’d be in the midst of a broader trend lower by this point. At the same time, the print was also on the upside of the BoE’s own staff forecasts in February, which had looked for a +9.2% number yesterday. So with the previous day’s wage data surprising on the upside too, the picture is one of stronger inflationary pressures than previously thought.

With another inflation report surprising on the upside, that spurred a broader selloff among sovereign bonds, and investors continued to dial back the chances of rate cuts from central banks this year. UK gilts were at the forefront of that, with the 10yr yield up by +10.9bps, and investors moved to fully price in a 25bp rate hike from the BoE in May for the first time since late February. Our own UK economist at DB has also adjusted his expectations for the BoE (link here), and now sees them taking Bank Rate up by 25bps in both May and June. If realised, that would leave the terminal rate at 4.75%, and he argues the risks are now skewed to the upside of that as well.

Those moves in the UK were echoed in other countries, and investors priced in a growing chance that the ECB would deliver another 50bp hike in two weeks’ time. That led to a rise in yields across the continent, with those on 10yr bunds (+3.8bps), OATs (+3.7bps) and BTPs (+6.2bps) all moving higher on the day. Likewise in the US, the 10yr yield rose +1.5bps to 3.591%, which came as investors further downplayed the chance of rate cuts this year. What’s interesting is that investors are now increasingly considering whether the Fed will pursue further rate hikes after the next decision in May, and the odds of a 25bp hike in June hit a post-SVB high of 29.4% yesterday. That’s partly because of the inflation data of late, but they’ve also been propelled by the persistent easing of financial conditions over recent days, with Bloomberg’s index now at its most accommodative level since the SVB collapse. Whilst that might be welcome news after the recent turmoil, one consequence of easier financial conditions is it puts more of the onus on the Fed to tighten policy to get inflation back to target, rather than relying on tighter financial conditions.

On that topic, yesterday was the first Fed Beige Book since the SVB episode. The Beige Book is released two weeks prior to FOMC meetings and publishes anecdotal data/comments from the various districts. On credit conditions, five districts mentioned tighter conditions with a respondent from New York mentioning that “Credit standards tightened noticeably for all loan types, and loan spreads continued to narrow. Deposit rates moved higher.” A respondent from California, the epicentre for stress last month, said that “following recent volatility in deposit levels at regional and community banks, outflows have reportedly stabilized since late March." Not all regions saw large disruptions with a respondent in Chicago saying there was “some movement in deposits but little change in credit availability following the collapse of Silicon Valley Bank". Attention will turn to the senior loan officer survey early next month. It’s always been a huge favourite lead indicator of ours but the whole financial world will be watching this time around.

For equities, as discussed at the top, the main news came after the close as we heard from Tesla, which dropped more than -6% in after-market trading before recovering its losses. The EV-maker missed profit estimates with EPS coming in at $0.85 ($0.86 estimated) as margins were tighter than expected. The company also expects there to be “ongoing cost reduction” of their vehicles.IBM (+1.73% in after-market trading) rose after beating earning expectations and increased sales guidance for 2023.

Also after the close we learned that the US Treasury took in $129bn across corporate and individual income taxes, which means that the Treasury General Account is now up to $252bn, up from $144bn on Monday. Today is another big day to watch as it will capture a portion of Tuesday’s deadline day tax flows, yet to be reported. The overall total was softer than some initial assumptions and leaves an x-date of midsummer as the most likely. Also on the debt ceiling, House Speaker McCarthy released a plan yesterday to raise the debt ceiling by $1.5tr, which would push the “x-date” out into March 2024. The GOP hope to vote on the bill in the coming days as an opening salvo in talks with the White House. Moderate members of both parties also pushed forward an idea that would suspend the debt ceiling until December 31 and then possibly February 2025 if certain conditions were met. The plan is likely dead-on-arrival given the slim GOP majority and the weakened position of Speaker McCarthy, who would have to put the bill up to a vote.

Prior to this, and as mentioned at the top, the S&P 500 had another quiet day, ending just -0.01% lower and remaining in the very narrow band seen over recent sessions. There was a decent amount of dispersion once again though with rate-proxies such as utilities (+0.78%) and real estate (+0.55%) rising, while cyclicals fell back led by communications (-0.72%), materials (-0.31%), and energy (-0.25%). The VIX index of volatility declined a further -0.4pts to 16.4pts, which marked its lowest closing level since November 2021. Elsewhere the NASDAQ (0.03%) was similarly unchanged with the Dow Jones (-0.23%) seeing a marginal loss. In Europe there were modest declines as well, leaving the STOXX 600 down -0.10%.

Asian equity markets are broadly trading lower this morning following a tepid performance of US equities on Wall Street. As I type, the Chinese stocks are leading losses across the region with the Shanghai Composite (-0.69%) and the CSI (-0.63%) edging lower while the Hang Seng (+0.19%) is just above flat. Elsewhere, the KOSPI (-0.28%) is trading in negative territory while the Nikkei (+0.09%) held on to its minor gains. Outside of Asia, US stock futures tied to the S&P 500 (-0.18%) and NASDAQ 100 (-0.33%) are modestly lower as risk appetite remains downbeat following the latest batch of earnings.

In early morning data, exports in Japan rose +4.3% y/y in March (v/s +2.4% expected), down from growth of +6.5% in February mainly due to a drop in China-bound shipments. Imports outpaced exports, increasing 7.3% in the year to March (v/s a +11.6% expected increase), the smallest advance in two years and coming after the prior month's 8.3% gain. Meanwhile, the nation’s trade deficit narrowed for the second consecutive month, contracting to 754.5 billion yen ($5.6 billion) from an upwardly revised deficit of 898.1 billion yen in February,

When it comes to the Bank of Japan’s decision next week, Bloomberg reported yesterday that officials were wary of adjusting their yield curve control policy this soon after last month’s market turmoil. The meeting isn’t until a week on Friday, but will be the first for new Governor Ueda, so will likely get more attention than usual anyway.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales for March and the Conference Board’s leading index for March. From central banks, we’ll get the ECB’s account of their March meeting, and hear from ECB President Lagarde, the ECB’s Visco, Holzmann and Schnabel, the Fed’s Waller, Mester, Bowman and Bostic, the BoE’s Tenreyro and BoC Governor Macklem. Finally, earnings releases include AT&T, Union Pacific and American Express.

US equity futures suffered their biggest overnight drop this week as a premarket slide in Tesla shares added to uncertainties surrounding the future of US monetary policy as well as the overall quality of the first-quarter earnings season. Contracts on the S&P 500 fell 0.7% as of 7:00 a.m. in New York while Nasdaq 100 futures took a 1% hit. Elsewhere, bond yields were lower, the USD was lower, and commodities were weaker on global demand fears.

In premarket trading, Tesla slid as much as 8.5% and were down -6% at last check, after the EV maker’s first-quarter results were hit by a slew of price cuts, denting profit margins and prompting at least six analysts – including Morgan Stanley’s Adam Jonas – to cut their price targets. MegaCap techs are also dragging indices lower with most names down 1%, or more. Bed Bath & Beyond shares tumbled 19% in premarket trading after Dow Jones reported that the retailer is preparing a bankruptcy filing for as early as this weekend. The stock had soared almost 100% in the three days prior. Here are some other premarket movers:

- Chip stocks decline in after Asian bellwether TSMC gave a disappointing revenue forecast for the current quarter amid a slump in demand for electronics.

- IBM rises as much as 2.2% after the IT services company reported first-quarter results that analysts say show positive growth trends.

- Las Vegas Sands rises as much as 4.8%, after the casino operator’s first-quarter earnings beat expectations and boosted hopes that a recovery in Macau and in Singapore is gaining momentum. Analysts hiked their price targets on the stock.

- Bath & Body Works drops 3.7% after Piper Sandler cuts its rating to neutral, with consensus estimates for the personal care products maker seen as “simply just too high.”

- Charles Schwab shares fall as much as 1.7% after Redburn downgraded the brokerage to sell from neutral, citing challenges from the Fed’s tightening cycle and the re-regulation of midsize banks.

- Cryptocurrency-exposed stocks fall and are poised to extend losses as Bitcoin dives further below the closely watched $30,000 level.

With better Bank earnings and a lackluster start from Tech earnings, the market seemingly remains stuck in near-term range of 3800 – 4200, with the SPX failing at 4150 level. Next week’s tech earnings will be the litmus test for bears and bulls.

Meanwhile, hawkish Fedspeak continues with some estimating 25bps – 50bps, or more, hikes remaining. Investors are seeking comfort whether policymakers will address growing recession worries, such as those flagged by the Federal Reserve’s monthly Beige Book survey which clearly noted that a credit crunch has arrived, or keep on fighting inflation as suggested by Fed Bank of New York President John Williams, who said price gains remained too high.

“We’re in a paradoxical situation,” said Alexandre Hezez, chief investment officer at Group Richelieu, a Paris-based asset manager. “If the Fed keeps on raising rates it’s not positive as it would mean we’re not done with inflation yet, but if it cuts, that would mean there are recessionary forces around.” The best path forward would be “a status quo” for the coming months, after a 25 basis-point hike in May, Hezez said, noting strong divergences on the matter among the Federal Open Market Committee.

European stocks are on course for their largest fall in almost four weeks amid tepid earnings and the prospect of additional monetary tightening. The Stoxx 600 is down 0.3% with autos, miners and tech the worst performing sectors while Renault and Nokia have fallen sharply after their respective quarterly updates. Here are the most notable European movers:

- Renault shares fall as much as 7.9% as pricing concerns offset positives from the first-quarter sales beat, with analysts questioning the sustainability of the French carmaker’s pricing

- Tryg shares rise as much as 4.7% with analysts saying the Danish insurer’s better-than-expected profit, dividend and combined operating ratio all make for a reassuring update

- Haleon shares rise as much as 3% in early trading to hit a record high. The consumer health group’s first-quarter update is strong and shows good momentum for the group, analysts say

- Bankinter jumps as much as 5%, kicking off 1Q earnings season for European banks with a strong set of numbers and analysts pointing to a net interest income beat

- Getlink shares gain as much as 2.8% after the French cross-channel transport operator reported a 1Q revenue beat and management maintained its Ebitda outlook

- Rexel shares rise as much as 3.8% after it reported a “strong beat” that should lead to consensus full-year estimates rising to the upper end of company’s guidance, Citi says

- ASML leads gains in shares of European semiconductor-equipment makers after TSMC — the industry bellwether and a major ASML customer — kept its full-year capex target unchanged

- Nordic Semiconductor shares fall as much as 17% to the lowest intraday level in more than two years after the chipmaker gave bleak 2Q guidance and scrapped a revenue outlook

- Sartorius AG falls as much as 7.8% after the German laboratory equipment group’s 1Q results, which Morgan Stanley analysts say was “significantly weaker than anticipated on all metrics”

- Stora Enso drops as much as 6.4% to lowest since August 2020 after the Finnish forestry group said operational Ebit for 2023 is now set to be “significantly lower” than in 2022

- Nokia shares fall as much as 2.9% to the lowest intraday level in more than a year, after the telecom equipment maker reported first-quarter margins well below estimates

Earlier in the session, Asian stocks edged lower as volatility across global markets remained subdued, with investors awaiting new catalysts and digesting recent corporate earnings. The MSCI Asia Pacific Index dropped as much as 0.4% before paring its loss. Most major benchmarks were up or down by less than 0.5%, with South Korea and mainland China leading the declines.

In key results Thursday, TSMC forecast worse-than-anticipated revenue for the current quarter, reflecting a persistent slump in global chip demand. Chinese EV battery maker CATL is expected to report strong revenue growth later in the day. China tech earnings so far have been in line, “could have been better but we stay more optimistic,” given positive initiatives from companies such as Alibaba, Xiaolin Chen, head of international at Kraneshares, told Bloomberg TV. “Overall you see very encouraging and constructive policies get introduced by policymakers or corporates themselves to become more market oriented.” The Kospi slipped after coming close to a bull market. The gauge is Asia’s best performer among major markets this year, climbing 19% from a September low amid frenzied gains in EV-battery related stocks and heavyweight Samsung Electronics.

Japanese stocks were mixed in thin trading as investors eye upcoming earnings from major domestic and overseas companies. The Topix closed little changed at 2,039.73, while the Nikkei advanced 0.2% to 28,657.57. Volume on both gauges was more than 20% below the 30-day averages. Out of 2,158 stocks in the Topix, 1,203 rose and 811 fell, while 144 were unchanged. “There is a lack of news, and investors are still waiting for corporate earnings results to come out and then further on, monetary policy,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management

In Australia, the S&P/ASX 200 index was little changed to close at 7,362.20, as gains in banks were offset by broad declines in mining shares. Asian shares were broadly lower as investors parsed mixed corporate earnings and the latest assessment on the US economy. Australia’s central bank should set up an expert policy board, hold fewer meetings and give press conferences explaining its decisions, according to recommendations from an independent review that would align it with many global peers. Read: RBA Review Calls for Expert Policy Panel, Fewer Meetings (3) In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,879.68.

In FX, the Bloomberg Dollar Spot Index is flat. New Zealand dollar dropped to a month-low after data showed the nation’s inflation slowed down more than expected, spurring expectations for the central bank to ease policy tightening.

In rates, US two-year yields are lower after a five day rally, falling 3bps to 4.22% while 10-year yieldS fell as much as 5bps to 3.54%, the lowest since Monday; traders bet on 23bps of Fed tightening in May and 30bps by June, while pricing 50bps of cuts by year-end. German and UK two-year borrowing costs both fall by 1bps.

In commodities, crude futures extended their recent decline with WTI falling 1.8% to trade near $77.70. Will OPEC have to get involved again and cut production some more? Spot gold is little changed around $1,994.

Bitcoin continues to slip and has drifted more than 1% %to a fresh USD 28.56k WTD trough vs Monday’s USD 30.5k best, action which has come alongside the broader dip in sentiment with specific fundamentals somewhat limited.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales for March and the Conference Board’s leading index for March. From central banks, we’ll get the ECB’s account of their March meeting, and hear from ECB President Lagarde, the ECB’s Visco, Holzmann and Schnabel, the Fed’s Waller, Mester, Bowman and Bostic, the BoE’s Tenreyro and BoC Governor Macklem. Finally, earnings releases include AT&T, Union Pacific and American Express.

Market Snapshot

- S&P 500 futures down 0.7% to 4,147.50

- STOXX Europe 600 down 0.4% to 466.47

- MXAP little changed at 162.39

- MXAPJ down 0.1% to 523.29

- Nikkei up 0.2% to 28,657.57

- Topix little changed at 2,039.73

- Hang Seng Index up 0.1% to 20,396.97

- Shanghai Composite little changed at 3,367.03

- Sensex little changed at 59,513.37

- Australia S&P/ASX 200 little changed at 7,362.19

- Kospi down 0.5% to 2,563.11

- Brent Futures down 1.5% to $81.91/bbl

- Gold spot up 0.2% to $1,997.99

- U.S. Dollar Index down 0.12% to 101.84

- German 10Y yield little changed at 2.48%

- Euro up 0.1% to $1.0970

Top Overnight News

- Today Treasury Secretary Janet L. Yellen on Thursday will call for a “constructive” and “healthy” economic relationship between the United States and China, one in which the two nations work together to confront challenges like climate change, according to excerpts from prepared remarks. NYT

- The BOJ is “warming” to the idea of tweaking its policy in a hawkish direction this year, but probably won’t take any actions at next week’s meeting. RTRS

- TSMC, the leading chipmaker for the likes of Apple and Nvidia, has warned that a weaker than expected recovery in China has hit demand for its semiconductors. The Taiwanese chipmaker cut its forecast for the semiconductor market this year, excluding memory, to a mid-single-digit percentage decline. FT

- Germany’s PPI for March dramatically undershoots the Street consensus, coming in at +7.5% Y/Y (down from +15.8% in Feb and below the Street’s +9.8% forecast). RTRS

- Brussels is preparing emergency curbs on Ukrainian grain imports to five member states close to the war-torn country, bowing to pressure from Poland and Hungary after they took unilateral action to pacify local farmers. FT

- ECB minutes will be scoured today for any additional hints on the duration of the tightening cycle. It gave no guidance on its next moves after the March meeting, though Christine Lagarde, who speaks today, indicated more tightening is coming. Governing Council hawk Klaas Knot told the Irish Times that officials may need to raise interest rates in June and July following a hike next month. BBG

- NY Fed chief John Williams said that while the banking sector has stabilized following the second-largest bank collapse in US history, the recent stress may tighten credit conditions. Chicago’s Austan Goolsbee said he’s still waiting to see if the fallout causes the economy to slow more than expected. Loretta Mester and Raphael Bostic are among Fed speakers today. BBG

- Uncertainty continues to linger about whether or not the US will make it through to late summer without risking a debt-ceiling-related default after figures indicating the size of the Treasury’s tax day cash influx were somewhat lackluster. The amount of money that the US government has on hand to pay its bills jumped just $108.47 billion on Tuesday. BBG

- Tesla plunged as much as 8.5% premarket after Elon Musk signaled price cuts will continue at the expense of profit margins. Profit missed and the operating margin slumped to 11.4% from 19.2% a year ago. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded rangebound with the region indecisive following the flat handover from the US where earnings were under the spotlight and early headwinds were seen after firmer-than-expected UK CPI data. ASX 200 was indecisive as participants digested output updates and with the mining sector subdued despite the fresh record Q1 iron ore shipments by Rio Tinto, while Australian Treasurer Chalmers announced recommendations from the independent RBA review which included establishing separate boards for governance and monetary policy with fewer meetings and press conferences to be conducted after policy decisions. Nikkei 225 gradually pared opening losses following mixed trade data including better-than-expected exports growth and after a recent report that the BoJ is said to be wary of tweaking yield control this month. Hang Seng and Shanghai Comp were mixed following the lack of surprises by the PBoC which maintained its benchmark lending rates for the 8th consecutive month and as frictions lingered after the US Commerce Department imposed a USD 300mln civil penalty on Seagate for supplying hard disk drives to Huawei in violation of export controls.

Top Asian News

- PBoC 1-Year Loan Prime Rate (Apr) 3.65% vs Exp. 3.65% (Prev. 3.65%); 5-Year Loan Prime Rate (Apr) 4.30% vs Exp. 4.30% (Prev. 4.30%)

- PBoC official expects consumer inflation to pick up later this year; the impact on the Yuan from volatility in major currencies is limited, expects it to be basically stable with two-way swings.

- US Trade Representative Tai said they have seen supply chain fragility and that US trade restrictions on China are narrowly targeted, while she added the US doesn’t intend to decouple and intends a level trade playing field with China.

- US Commerce Department imposed a USD 300mln civil penalty on Seagate (STX) and said the Co. sold 7.4mln hard disk drives to Huawei between August 2020-September 2021 in violation of export controls, according to Reuters.

- RBA independent review recommended that the RBA should have dual objectives of price stability and full employment, while it should retain a flexible inflation target of 2%-3% and aim at the mid-point. It was also recommended that the government form a monetary policy board of experts which would comprise of the RBA Governor, Deputy Governor, Treasury Secretary and 6 external members with the Governor as Chair in which the policy board would conduct 8 meetings a year with a press conference after each meeting, while the government should establish a governance board with an external chair and legislate changes to commence from July 2024. Furthermore, the RBA should retain independence and the power of government to override decisions should be repealed.

- BoJ is reportedly open to tweaking Yield Curve Control (YCC) this year if wage momentum holds, according to Reuters sources; may engage is more lively debate in the June and July meetings; no current consensus on how soon to phase YCC out, July wage tally key.

European bourses are lower across the board, Euro Stoxx 50 -0.3%, as pressure emerged without a clear catalyst after a relatively contained open. Sectors are largely in the red, with Autos underperforming amid downside in Renault post-earnings and with attention on Tesla; elsewhere, Nokia slumps and L’Oreal trims upside after their latest updates. Stateside, futures are pressured to a larger extent than their European peers with downside occurring in tandem with the above move and exacerbated by marked pressure in Tesla, NQ -1.1%. TSMC (2330 TT/TSM) Q1 (TWD): Net Profit 206.9bln (exp. 192.8bln), Sales 508.6bln (exp. 517.9bln), Gross Profit 286.5bln (prev. 273.2bln). EPS 7.98 (exp. 7.41), Gross Margin 56.3% (exp. 54.5%). Q2 Guidance (USD): Revenue 15.2-16.0bn (exp. 17.3bln), Gross Margin 52-54% (exp. 52.5%), Operating Margin 39.5-41.5% (exp. 40%). TSM +0.4% in pre-market trade. Tesla (TSLA) – Q1 2023 (USD): Adj. EPS 0.85 (exp. 0.85), Revenue 23.33bln (exp. 23.29bln). Still sees FY production 1.80mln vehicles (exp. 1.84mln). Tesla did not release its automotive margins, but continues to believe that its operating margin will remain among the highest in the industry. CEO Musk has taken a view that pushing for higher volumes and a larger fleet is the right choice here vs lower volume and higher margins. -7.5% in pre-market trade.

Top European News

- Turkey Gas Field Launch Sets Up Pre-Election Giveaway

- European Gas Prices Swing With Signs of Weak Industrial Demand

- Melrose Spinoff Dowlais Slips in Rare London Trading Debut

- Nokia Misses Estimates as Clients Reduce Spending on 5G Gear

FX

- Kiwi deflated as NZ CPI metrics miss consensus, NZD/USD sub-0.6200 and AUD/NZD eyeing 1.0900.

- DXY drifting within 102.040-101.780 range after failing to close above the 21 DMA again.

- Aussie and Euro underpinned by option expiries between 0.6700-0.6695 and at 1.0925 vs the Buck.

- Franc firm and retesting 0.9850 vs Greenback as Treasury yields ease; Yen, Pound and Loonie rangy.

- PBoC set USD/CNY mid-point at 6.8987 vs exp. 6.8979 (prev. 6.8732)

Fixed Income

- Core benchmarks have pared back initial recovery momentum and are now in close proximity to the neutral mark on the session, though currently retain an incremental positive bias.

- Given the above, bonds are yet to mark new troughs though the waning momentum is notable but worth caveating with the particularly hefty upcoming US agenda.

- Specifically, the action has seen Bunds, Gilts and USTs move closer to their 133.42, 99.94 and 114-07 intraday lows vs initial recovery highs; stateside yields are lower, with curve action again most pronounced at the short-end.

Commodities

- Crude benchmarks remain under pressure, with specific fundamentals limited and the complex printing new multi-week lows. Though, the magnitude of today’s action has thus far been much less pronounced than the losses seen earlier in the week.

- Specifically, WTI and Brent June futures are under USD 78/bbl (vs high 79.07/bbl) and USD 82/bbl (vs high 82.92/bbl) respective highs.

- Spot gold has attempted to reclaim the USD 2k/oz mark but is yet to convincingly surmount the figure despite the softer USD and equity landscape, base metals are lower in fitting with the mentioned tone though the downside is perhaps capped as the Dollar dips.

- Pakistan’s first order for Russian discount oil has been placed, via Pakistan’s petroleum minister; intends to import 100k BPD of Russian oil.

Geopolitics

- China Hainan Maritime Bureau said it will ban passage during military drills in nearby waters in South China Sea amid military drills from Friday to Sunday, according to Kyodo.

- Iran says its navy has forced a US submarine to surface as it enters the Gulf, via State TV.

US Event Calendar

- 08:30: April Initial Jobless Claims, est. 240,000, prior 239,000

- 08:30: April Continuing Claims, est. 1.83m, prior 1.81m

- 08:30: April Philadelphia Fed Business Outl, est. -19.3, prior -23.2

- 10:00: March Existing Home Sales MoM, est. -1.8%, prior 14.5%

- 10:00: March Home Resales with Condos, est. 4.5m, prior 4.58m

- 10:00: March Leading Index, est. -0.7%, prior -0.3%

DB’s Jim Reid concludes the overnight wrap

Markets have struggled a bit over the last 24 hours, with bonds and equities selling off thanks to strong inflation data and a mixed batch of earnings releases. However by the close of business both Euro and US equities had broadly clawed their way back to flat (S&P -0.01%) but with yields on 10yr Treasuries (+1.5bps) ending just a shade under their one-month highs at of 3.59% and Bund yields at their highest close since March 9th.

The initial catalyst for the bond and equity weakness yesterday came from the UK inflation release shortly after we went to press yesterday. It showed CPI inflation had only fallen to +10.1% in March (vs. +9.8% expected), and core inflation was above expectations as well at +6.2% (vs. +6.0% expected), which disappointed hopes that we’d be in the midst of a broader trend lower by this point. At the same time, the print was also on the upside of the BoE’s own staff forecasts in February, which had looked for a +9.2% number yesterday. So with the previous day’s wage data surprising on the upside too, the picture is one of stronger inflationary pressures than previously thought.

With another inflation report surprising on the upside, that spurred a broader selloff among sovereign bonds, and investors continued to dial back the chances of rate cuts from central banks this year. UK gilts were at the forefront of that, with the 10yr yield up by +10.9bps, and investors moved to fully price in a 25bp rate hike from the BoE in May for the first time since late February. Our own UK economist at DB has also adjusted his expectations for the BoE (link here), and now sees them taking Bank Rate up by 25bps in both May and June. If realised, that would leave the terminal rate at 4.75%, and he argues the risks are now skewed to the upside of that as well.

Those moves in the UK were echoed in other countries, and investors priced in a growing chance that the ECB would deliver another 50bp hike in two weeks’ time. That led to a rise in yields across the continent, with those on 10yr bunds (+3.8bps), OATs (+3.7bps) and BTPs (+6.2bps) all moving higher on the day. Likewise in the US, the 10yr yield rose +1.5bps to 3.591%, which came as investors further downplayed the chance of rate cuts this year. What’s interesting is that investors are now increasingly considering whether the Fed will pursue further rate hikes after the next decision in May, and the odds of a 25bp hike in June hit a post-SVB high of 29.4% yesterday. That’s partly because of the inflation data of late, but they’ve also been propelled by the persistent easing of financial conditions over recent days, with Bloomberg’s index now at its most accommodative level since the SVB collapse. Whilst that might be welcome news after the recent turmoil, one consequence of easier financial conditions is it puts more of the onus on the Fed to tighten policy to get inflation back to target, rather than relying on tighter financial conditions.

On that topic, yesterday was the first Fed Beige Book since the SVB episode. The Beige Book is released two weeks prior to FOMC meetings and publishes anecdotal data/comments from the various districts. On credit conditions, five districts mentioned tighter conditions with a respondent from New York mentioning that “Credit standards tightened noticeably for all loan types, and loan spreads continued to narrow. Deposit rates moved higher.” A respondent from California, the epicentre for stress last month, said that “following recent volatility in deposit levels at regional and community banks, outflows have reportedly stabilized since late March.” Not all regions saw large disruptions with a respondent in Chicago saying there was “some movement in deposits but little change in credit availability following the collapse of Silicon Valley Bank”. Attention will turn to the senior loan officer survey early next month. It’s always been a huge favourite lead indicator of ours but the whole financial world will be watching this time around.

For equities, as discussed at the top, the main news came after the close as we heard from Tesla, which dropped more than -6% in after-market trading before recovering its losses. The EV-maker missed profit estimates with EPS coming in at $0.85 ($0.86 estimated) as margins were tighter than expected. The company also expects there to be “ongoing cost reduction” of their vehicles.IBM (+1.73% in after-market trading) rose after beating earning expectations and increased sales guidance for 2023.

Also after the close we learned that the US Treasury took in $129bn across corporate and individual income taxes, which means that the Treasury General Account is now up to $252bn, up from $144bn on Monday. Today is another big day to watch as it will capture a portion of Tuesday’s deadline day tax flows, yet to be reported. The overall total was softer than some initial assumptions and leaves an x-date of midsummer as the most likely. Also on the debt ceiling, House Speaker McCarthy released a plan yesterday to raise the debt ceiling by $1.5tr, which would push the “x-date” out into March 2024. The GOP hope to vote on the bill in the coming days as an opening salvo in talks with the White House. Moderate members of both parties also pushed forward an idea that would suspend the debt ceiling until December 31 and then possibly February 2025 if certain conditions were met. The plan is likely dead-on-arrival given the slim GOP majority and the weakened position of Speaker McCarthy, who would have to put the bill up to a vote.

Prior to this, and as mentioned at the top, the S&P 500 had another quiet day, ending just -0.01% lower and remaining in the very narrow band seen over recent sessions. There was a decent amount of dispersion once again though with rate-proxies such as utilities (+0.78%) and real estate (+0.55%) rising, while cyclicals fell back led by communications (-0.72%), materials (-0.31%), and energy (-0.25%). The VIX index of volatility declined a further -0.4pts to 16.4pts, which marked its lowest closing level since November 2021. Elsewhere the NASDAQ (0.03%) was similarly unchanged with the Dow Jones (-0.23%) seeing a marginal loss. In Europe there were modest declines as well, leaving the STOXX 600 down -0.10%.

Asian equity markets are broadly trading lower this morning following a tepid performance of US equities on Wall Street. As I type, the Chinese stocks are leading losses across the region with the Shanghai Composite (-0.69%) and the CSI (-0.63%) edging lower while the Hang Seng (+0.19%) is just above flat. Elsewhere, the KOSPI (-0.28%) is trading in negative territory while the Nikkei (+0.09%) held on to its minor gains. Outside of Asia, US stock futures tied to the S&P 500 (-0.18%) and NASDAQ 100 (-0.33%) are modestly lower as risk appetite remains downbeat following the latest batch of earnings.

In early morning data, exports in Japan rose +4.3% y/y in March (v/s +2.4% expected), down from growth of +6.5% in February mainly due to a drop in China-bound shipments. Imports outpaced exports, increasing 7.3% in the year to March (v/s a +11.6% expected increase), the smallest advance in two years and coming after the prior month’s 8.3% gain. Meanwhile, the nation’s trade deficit narrowed for the second consecutive month, contracting to 754.5 billion yen ($5.6 billion) from an upwardly revised deficit of 898.1 billion yen in February,

When it comes to the Bank of Japan’s decision next week, Bloomberg reported yesterday that officials were wary of adjusting their yield curve control policy this soon after last month’s market turmoil. The meeting isn’t until a week on Friday, but will be the first for new Governor Ueda, so will likely get more attention than usual anyway.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales for March and the Conference Board’s leading index for March. From central banks, we’ll get the ECB’s account of their March meeting, and hear from ECB President Lagarde, the ECB’s Visco, Holzmann and Schnabel, the Fed’s Waller, Mester, Bowman and Bostic, the BoE’s Tenreyro and BoC Governor Macklem. Finally, earnings releases include AT&T, Union Pacific and American Express.

Loading…