Authored by Simon White, Bloomberg macro strategist,

Subdued equity volatility is poised to rise soon as the US economy becomes more recession-like.

Oscar Wilde once said the only thing worse than being talked about is not being talked about. It’s a fate that’s befallen the VIX in recent months as its limelight has been stolen by the increasing focus on options with zero days to expiry.

But that’s likely to change soon as it and other measures of longer-dated volatility rise as the economy enters the recession event horizon: the transitory state between a slowdown and an inescapable contraction.

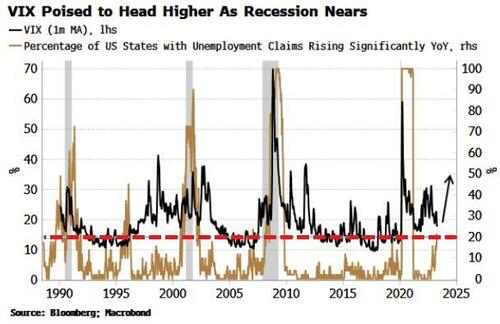

We can see this most clearly in the rapid deterioration in unemployment claims across the US.

When the percentage of states with claims rising sharply reaches around 20% (where it is now), it typically shoots much higher, with a recession often following soon after.

Almost 50% of trading volume has shifted to options with zero days to expiry, subduing the VIX and depressing it relative to other yardsticks. But now it is rising versus realized volatility as well as against at-the-money volatility.

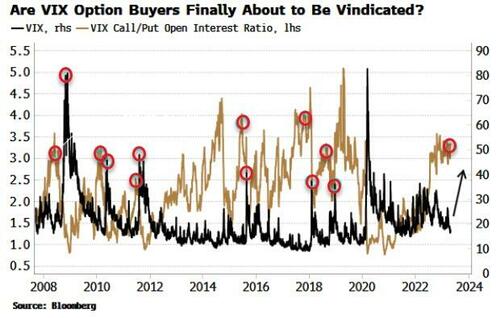

Furthermore, trading in VIX options continues to favor calls over puts. As the chart below shows, this often leads to a rise in the index. The lag in the relationship here has extended, but the rise in the VIX that option traders are gunning for may be about to come into view.

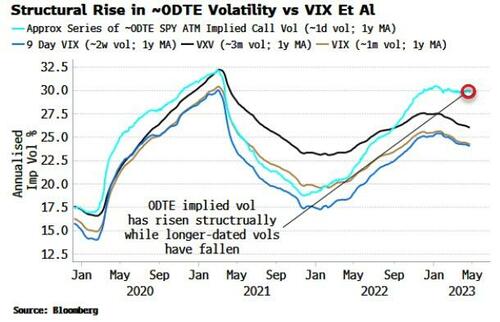

The CBOE is due to introduce the one-day VIX today. As the chart below shows (using my estimate for a zero-day VIX), zero-day vol has been rising relative to longer-date vol measures.

An oncoming recession could close that gap quickly as the VIX rises - and finally, be talked about again.

Authored by Simon White, Bloomberg macro strategist,

Subdued equity volatility is poised to rise soon as the US economy becomes more recession-like.

Oscar Wilde once said the only thing worse than being talked about is not being talked about. It’s a fate that’s befallen the VIX in recent months as its limelight has been stolen by the increasing focus on options with zero days to expiry.

But that’s likely to change soon as it and other measures of longer-dated volatility rise as the economy enters the recession event horizon: the transitory state between a slowdown and an inescapable contraction.

We can see this most clearly in the rapid deterioration in unemployment claims across the US.

When the percentage of states with claims rising sharply reaches around 20% (where it is now), it typically shoots much higher, with a recession often following soon after.

Almost 50% of trading volume has shifted to options with zero days to expiry, subduing the VIX and depressing it relative to other yardsticks. But now it is rising versus realized volatility as well as against at-the-money volatility.

Furthermore, trading in VIX options continues to favor calls over puts. As the chart below shows, this often leads to a rise in the index. The lag in the relationship here has extended, but the rise in the VIX that option traders are gunning for may be about to come into view.

The CBOE is due to introduce the one-day VIX today. As the chart below shows (using my estimate for a zero-day VIX), zero-day vol has been rising relative to longer-date vol measures.

An oncoming recession could close that gap quickly as the VIX rises – and finally, be talked about again.

Loading…