Authored by Mike Shedlock via MishTalk.com,

Let's tune into a mass exodus of deposits at banks for money market mutual funds and what it means...

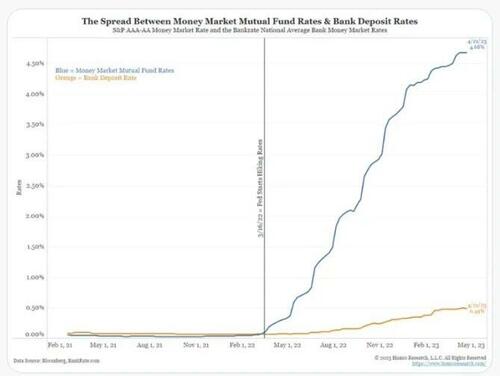

Spread between bank deposit rates and money market funds from Tweet below.

Jim Bianco has a 21-Tweet Thread on what's going on with bank deposits. I chimed in on a couple of the Tweets. Here are some of the most important ideas.

7/21

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

Why are big banks losing more deposits than small banks?

This graphic showing "too-big-too-fail" banks offering no yield has lost its appeal in a world of 120 million active mobile banking apps that can easily access money market funds averaging 4.70% and 5% T-Bills. pic.twitter.com/7q3RulM6YV

The "bank walk" becomes a "bank powerwalk" to 5%.

10/21

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

And not only is the gap above not closing anytime soon, but the Fed is also set to widen it even more when they hike rates again on May 3.

90% probability (chart)

Soon after, the avg money market fund will be above 5%.

The "bank walk" becomes a "bank powerwalk" to 5%. pic.twitter.com/zMDKaZ2Bvy

More Bank Failures?

17/21

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

I define it as a "bank walk," which is intensifying.

To be clear, a bank walk will NOT lead to another bank failure, wrong metric.

But it will kill their profitability, especially the smaller banks.

This is the market's message. Smaller banks are doing worse. pic.twitter.com/yEXmk36HhZ

"To be clear, a bank walk will NOT lead to another bank failure, wrong metric. But it will kill their profitability, especially the smaller banks."

Giant Bank Sucking Sound

“Bank Powerwalk” fitting term coined @biancoresearch to describe bigger liquidity sucking sound leaving banks after @federalreserve hikes May 3 (90% probability) pressing MMF rates north of 5%, which will (ahem) amplify awareness as to what banks are NOT paying+stock market risk. https://t.co/Poj2BSnYjH

— Danielle DiMartino Booth (@DiMartinoBooth) April 23, 2023

Question On Stopping the Run

3-Month: 5.1%

— Mike "Mish" Shedlock (@MishGEA) April 23, 2023

6-Month: 5.1%

1-yr: 4.77%

I suspect the answer is they need NEW Deposits because they already locked up existing deposits in 10-YR notes at 2.0% or so.

Offering 3% will not attract much new money with others offering 5%.

Meanwhile:https://t.co/xQfHZTul9U

Mish: "Banks need NEW Deposits because they already locked up existing deposits in 10-YR notes at 2.0% or so. Offering 3% will not attract much new money with others offering 5%."

Agreement From Bianco

Exactly correct. They locked up securities and loans that generate much lower interest rates. Somewhere around 3%. Over time they mature and get rolled into higher rates. But nort now.

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

So, they lose money by trying to compete with market rates. This explains why the bank stocks…

Bianco: "Exactly correct: They [banks] locked up securities and loans that generate much lower interest rates. Somewhere around 3%. Over time they mature and get rolled into higher rates. But not now. So, they lose money by trying to compete with market rates. This explains why the bank stocks cannot rally."

Second Question

Raising money at 5% would lose additional money if the Fed pivoted.

— Mike "Mish" Shedlock (@MishGEA) April 24, 2023

We can debate how likely that is, but the last thing banks need is more risk.

And at best it's little more than break even. So it's not an option that solves much. Takes time.

Bianco Conclusion

21/21

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

Conclusion

The current economy, inflation, and Fed thinking are irrelevant. What is coming next matters, as is always the case.

The answer will be the "bank walk's" cumulative impact on markets, the economy, and lending.

It will be a significant drag later this year.

The "bank walk's" cumulative impact on markets, the economy, and lending. It will be a significant drag later this year.

Moody's Downgrades 11 Regional Banks

Please note Moody’s Downgrades 11 Regional Banks, Including Zions, U.S. Bank, Western Alliance.

Regional banks, Moody’s said, are more exposed to hard-hit commercial real estate. U.S. banks hold about half of total CRE debt outstanding, and some are concentrated in construction, office, or land development.

U.S. Bank has a “relatively low capitalization” as well as unrealized losses on its securities, Moody’s said. Zions has “significant” unrealized losses on its securities portfolio and its capital has deteriorated, Moody’s said.

Downgraded Banks

-

U.S. Bancorp USB, with $682 billion in assets

-

Zions Bancorp ZION with $89 billion in assets.

-

Bank of Hawaii Corp., BOH with $24 billion in assets.

-

Western Alliance Bancorp WAL, received a two-notch downgrade.

-

First Republic Bank, which faced a run last month, had its preferred-stock rating cut.

-

Six More: Associated Banc-Corp., Comerica Inc., First Hawaiian Inc., Intrust Financial Corp, Washington Federal Inc., UMB Financial Corp.

Banks will not be taking any extra risks. Nor will larger banks that also face the "powerwalk". This will pressure bank lending across the board.

Like it or not, the Fed is purposely angling for recession to cure inflation.

And the Fed does not have an inflation ally in the White House. Biden is doing everything possible to fuel inflation with inept Green policies.

Biden's Trillion Dollar Clean Energy Grab Bag in Pictures and Quotes

For discussion of the drastically misnamed Inflation Reduction Act, please see Biden's Trillion Dollar Clean Energy Grab Bag in Pictures and Quotes

Strangest Yield Curve in History

For discussion of how the debt ceiling has impacted the yield curve, please see The Strangest US Treasury Yield Curve in History, What's Going On?

Finally, please recall Fed Minutes Now Predict a Recession This Year Along With Higher Unemployment

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Authored by Mike Shedlock via MishTalk.com,

Let’s tune into a mass exodus of deposits at banks for money market mutual funds and what it means…

Spread between bank deposit rates and money market funds from Tweet below.

Jim Bianco has a 21-Tweet Thread on what’s going on with bank deposits. I chimed in on a couple of the Tweets. Here are some of the most important ideas.

7/21

Why are big banks losing more deposits than small banks?

This graphic showing “too-big-too-fail” banks offering no yield has lost its appeal in a world of 120 million active mobile banking apps that can easily access money market funds averaging 4.70% and 5% T-Bills. pic.twitter.com/7q3RulM6YV

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

The “bank walk” becomes a “bank powerwalk” to 5%.

10/21

And not only is the gap above not closing anytime soon, but the Fed is also set to widen it even more when they hike rates again on May 3.

90% probability (chart)

Soon after, the avg money market fund will be above 5%.

The “bank walk” becomes a “bank powerwalk” to 5%. pic.twitter.com/zMDKaZ2Bvy

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

More Bank Failures?

17/21

I define it as a “bank walk,” which is intensifying.

To be clear, a bank walk will NOT lead to another bank failure, wrong metric.

But it will kill their profitability, especially the smaller banks.

This is the market’s message. Smaller banks are doing worse. pic.twitter.com/yEXmk36HhZ

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

“To be clear, a bank walk will NOT lead to another bank failure, wrong metric. But it will kill their profitability, especially the smaller banks.“

Giant Bank Sucking Sound

“Bank Powerwalk” fitting term coined @biancoresearch to describe bigger liquidity sucking sound leaving banks after @federalreserve hikes May 3 (90% probability) pressing MMF rates north of 5%, which will (ahem) amplify awareness as to what banks are NOT paying+stock market risk. https://t.co/Poj2BSnYjH

— Danielle DiMartino Booth (@DiMartinoBooth) April 23, 2023

Question On Stopping the Run

3-Month: 5.1%

6-Month: 5.1%

1-yr: 4.77%I suspect the answer is they need NEW Deposits because they already locked up existing deposits in 10-YR notes at 2.0% or so.

Offering 3% will not attract much new money with others offering 5%.

Meanwhile:https://t.co/xQfHZTul9U

— Mike “Mish” Shedlock (@MishGEA) April 23, 2023

Mish: “Banks need NEW Deposits because they already locked up existing deposits in 10-YR notes at 2.0% or so. Offering 3% will not attract much new money with others offering 5%.“

Agreement From Bianco

Exactly correct. They locked up securities and loans that generate much lower interest rates. Somewhere around 3%. Over time they mature and get rolled into higher rates. But nort now.

So, they lose money by trying to compete with market rates. This explains why the bank stocks…

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

Bianco: “Exactly correct: They [banks] locked up securities and loans that generate much lower interest rates. Somewhere around 3%. Over time they mature and get rolled into higher rates. But not now. So, they lose money by trying to compete with market rates. This explains why the bank stocks cannot rally.“

Second Question

Raising money at 5% would lose additional money if the Fed pivoted.

We can debate how likely that is, but the last thing banks need is more risk.

And at best it’s little more than break even. So it’s not an option that solves much. Takes time.

— Mike “Mish” Shedlock (@MishGEA) April 24, 2023

Bianco Conclusion

21/21

Conclusion

The current economy, inflation, and Fed thinking are irrelevant. What is coming next matters, as is always the case.

The answer will be the “bank walk’s” cumulative impact on markets, the economy, and lending.

It will be a significant drag later this year.

— Jim Bianco biancoresearch.eth (@biancoresearch) April 23, 2023

The “bank walk’s” cumulative impact on markets, the economy, and lending. It will be a significant drag later this year.

Moody’s Downgrades 11 Regional Banks

Please note Moody’s Downgrades 11 Regional Banks, Including Zions, U.S. Bank, Western Alliance.

Regional banks, Moody’s said, are more exposed to hard-hit commercial real estate. U.S. banks hold about half of total CRE debt outstanding, and some are concentrated in construction, office, or land development.

U.S. Bank has a “relatively low capitalization” as well as unrealized losses on its securities, Moody’s said. Zions has “significant” unrealized losses on its securities portfolio and its capital has deteriorated, Moody’s said.

Downgraded Banks

-

U.S. Bancorp USB, with $682 billion in assets

-

Zions Bancorp ZION with $89 billion in assets.

-

Bank of Hawaii Corp., BOH with $24 billion in assets.

-

Western Alliance Bancorp WAL, received a two-notch downgrade.

-

First Republic Bank, which faced a run last month, had its preferred-stock rating cut.

-

Six More: Associated Banc-Corp., Comerica Inc., First Hawaiian Inc., Intrust Financial Corp, Washington Federal Inc., UMB Financial Corp.

Banks will not be taking any extra risks. Nor will larger banks that also face the “powerwalk”. This will pressure bank lending across the board.

Like it or not, the Fed is purposely angling for recession to cure inflation.

And the Fed does not have an inflation ally in the White House. Biden is doing everything possible to fuel inflation with inept Green policies.

Biden’s Trillion Dollar Clean Energy Grab Bag in Pictures and Quotes

For discussion of the drastically misnamed Inflation Reduction Act, please see Biden’s Trillion Dollar Clean Energy Grab Bag in Pictures and Quotes

Strangest Yield Curve in History

For discussion of how the debt ceiling has impacted the yield curve, please see The Strangest US Treasury Yield Curve in History, What’s Going On?

Finally, please recall Fed Minutes Now Predict a Recession This Year Along With Higher Unemployment

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Loading…