By Jeran Wittenstein and Ryan Vlastelica, Bloomberg Markets live reporters and analysts

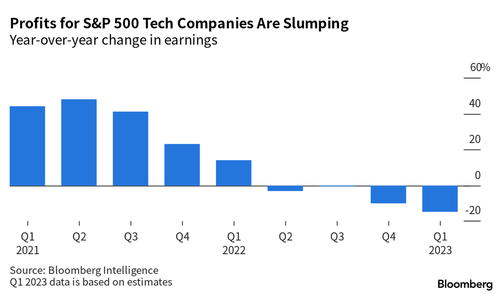

The stock market faces a major test this week when the big technology companies that have powered the S&P 500 Index’s rally this year are expected to report dismal quarterly earnings.

Profits for information technology companies in the benchmark are projected to fall 15% in the first quarter, which would be the biggest contraction year-over-year since 2009, according to data compiled by Bloomberg Intelligence. The largest tech-related companies have been the biggest contributors to the the S&P 500’s 7% advance this year, by virtue of their size and outperformance. Apple Inc., Microsoft Corp. and Nvidia Corp. alone account for nearly half of the index’s gains, according to data compiled by Bloomberg.

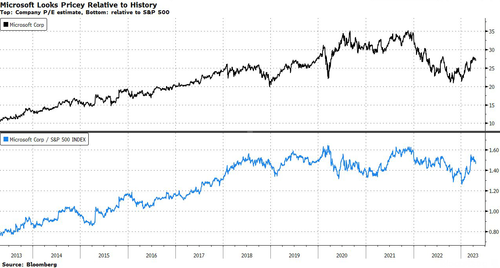

“The valuation premium for US megacap stocks could remain problematic for S&P 500 performance, as these long-duration equities appear glaringly mispriced with interest rates at current levels,” Bloomberg Intelligence strategists Gina Martin Adams and Michael Casper wrote in a research note on April 18.

Much of the gauge’s advance has been fueled by speculation that the Federal Reserve is nearing the end of its interest rate-hiking campaign and a flight to perceived safety — companies’ with strong balance sheets — amid turmoil in the banking sector. The rise has occurred as analysts continue cutting profit estimates for 2023, pushing valuations back into pricey territory.

Apple and Microsoft, for example, are priced around 27 times projected earnings over the next year. That’s near the companies’ highest price-to-earnings ratio in eight months and well above the stocks’ averages over the past decade.

Microsoft and Alphabet will kick off the megacap earnings season on Tuesday after market close. Meta Platforms and Amazon.com will follow on Wednesday and Thursday, respectively. Apple is due to report on May 4.

Any further deterioration in the outlook could spell trouble for the likes of Apple — the world’s most valuable company with a market capitalization of $2.6 trillion — and remove a major force supporting the broader stock market.

“Everyone had the same idea of going with the best-capitalized companies, with the strongest franchises,” Tim Pagliara, chairman and chief investment officer at Capwealth Advisors, said. “Given the environment we’re in, and the valuations, and the unique problems some of these companies have to address, there’s reason to be cautious.”

Early results in the sector may signal cause for concern. CDW Corp., a technology hardware and services company with a market value of $22 billion, dragged larger peers like Cisco Systems Inc. lower last week when it gave disappointing preliminary results. The company blamed a revenue shortfall on “intensifying economic uncertainty” that caused customers to pull back on spending.

International Business Machines Corp. CEO Arvind Krishna echoed that sentiment, noting the company is seeing “some softening” in customer spending.

“There’s concern about the Fed making a policy mistake, about earnings misses, tighter credit conditions, the situation with banks, and the big unknown about the debt ceiling,” said Keith Apton, managing director at UBS Wealth Management.

By Jeran Wittenstein and Ryan Vlastelica, Bloomberg Markets live reporters and analysts

The stock market faces a major test this week when the big technology companies that have powered the S&P 500 Index’s rally this year are expected to report dismal quarterly earnings.

Profits for information technology companies in the benchmark are projected to fall 15% in the first quarter, which would be the biggest contraction year-over-year since 2009, according to data compiled by Bloomberg Intelligence. The largest tech-related companies have been the biggest contributors to the the S&P 500’s 7% advance this year, by virtue of their size and outperformance. Apple Inc., Microsoft Corp. and Nvidia Corp. alone account for nearly half of the index’s gains, according to data compiled by Bloomberg.

“The valuation premium for US megacap stocks could remain problematic for S&P 500 performance, as these long-duration equities appear glaringly mispriced with interest rates at current levels,” Bloomberg Intelligence strategists Gina Martin Adams and Michael Casper wrote in a research note on April 18.

Much of the gauge’s advance has been fueled by speculation that the Federal Reserve is nearing the end of its interest rate-hiking campaign and a flight to perceived safety — companies’ with strong balance sheets — amid turmoil in the banking sector. The rise has occurred as analysts continue cutting profit estimates for 2023, pushing valuations back into pricey territory.

Apple and Microsoft, for example, are priced around 27 times projected earnings over the next year. That’s near the companies’ highest price-to-earnings ratio in eight months and well above the stocks’ averages over the past decade.

Microsoft and Alphabet will kick off the megacap earnings season on Tuesday after market close. Meta Platforms and Amazon.com will follow on Wednesday and Thursday, respectively. Apple is due to report on May 4.

Any further deterioration in the outlook could spell trouble for the likes of Apple — the world’s most valuable company with a market capitalization of $2.6 trillion — and remove a major force supporting the broader stock market.

“Everyone had the same idea of going with the best-capitalized companies, with the strongest franchises,” Tim Pagliara, chairman and chief investment officer at Capwealth Advisors, said. “Given the environment we’re in, and the valuations, and the unique problems some of these companies have to address, there’s reason to be cautious.”

Early results in the sector may signal cause for concern. CDW Corp., a technology hardware and services company with a market value of $22 billion, dragged larger peers like Cisco Systems Inc. lower last week when it gave disappointing preliminary results. The company blamed a revenue shortfall on “intensifying economic uncertainty” that caused customers to pull back on spending.

International Business Machines Corp. CEO Arvind Krishna echoed that sentiment, noting the company is seeing “some softening” in customer spending.

“There’s concern about the Fed making a policy mistake, about earnings misses, tighter credit conditions, the situation with banks, and the big unknown about the debt ceiling,” said Keith Apton, managing director at UBS Wealth Management.

Loading…