After last week saw The Fed's balance sheet continue is decline back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening to see if things have continued to 'improve' or re-worsened amid regional bank shares re-testing post-SVB amid earnings disappointments.

Following the unexpected OUTFLOW the previous week, this week saw money market funds resume their trend with a $53.8 billion INFLOW...

Source: Bloomberg

The breakdown was $48.9 billion from Institutional funds and $4.98 billion from retail funds.

That pushed assets back up near their $5.277 trillion record high and suggests last week's deposit OUTFLOWS may be about to re-accelerate - not good news for banks?

Source: Bloomberg

On top of the news from First Republic this week, one could argue that Round 2 of the banking crisis (bank superwalk as Jim Bianco has put it) is just beginning.

Bear in mind though that it's tax-time and their are some odd seasonal impacts to the data.

Though not wanting to piss all over those hopeful fireworks, we note that reverse repo continues to rise...

Source: Bloomberg

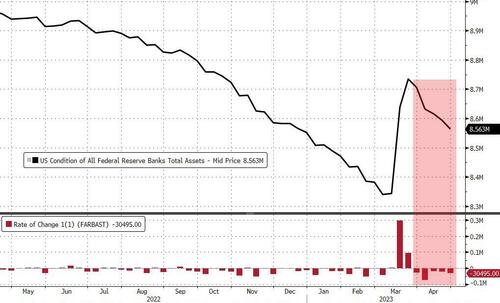

However, the most anticipated financial update of the week - the infamous H.4.1. showed the world's most important balance sheet shrank for the 5th straight week last week, by $30.5 billion, notably more than last week's tumble (helped by a $16.6bn QT)...

Source: Bloomberg

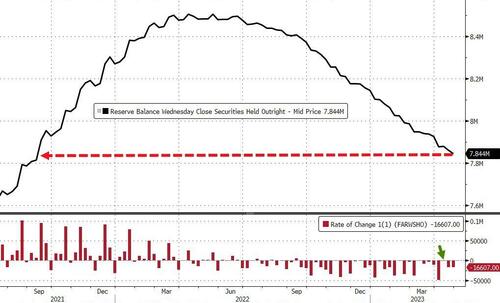

The Total Securities held outright on The Fed balance sheet fell to $7.84 trillion, the lowest since Sept 2021...

Source: Bloomberg

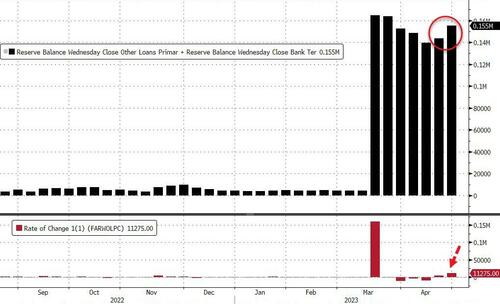

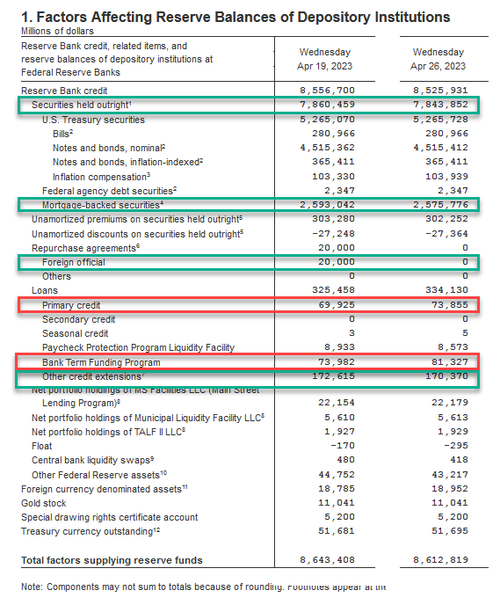

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings ROSE AGAIN last week from $144 billion to $155.2 billion (still massively higher than the $4.5 billion pre-SVB)...

Source: Bloomberg

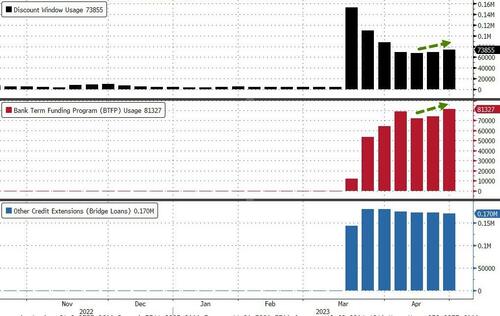

...but the composition shifted, as usage of the Discount Window rose by $4 billion to $73.8 billion (upper pane below) along with an $8 billion increase in usage of the Fed's brand new Bank Term Funding Program, or BTFP, to $81.3 billion (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank were relatively unchanged at around $170BN (lower pane)...

Source: Bloomberg

Scanning down the H.4.1, we note that Foreign repo down another $20 billion back to $0 finally and Other Fed Assets (loans to FDIC etc) rose $2.3 billion to $170.4 billion...

Of course we get to see the actual deposit outflows (or inflows) tomorrow after the bell, but it appears the hopeful bounce was nothing more than the tax-related seasonal we warned about last week.

After last week saw The Fed’s balance sheet continue is decline back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening to see if things have continued to ‘improve’ or re-worsened amid regional bank shares re-testing post-SVB amid earnings disappointments.

Following the unexpected OUTFLOW the previous week, this week saw money market funds resume their trend with a $53.8 billion INFLOW…

Source: Bloomberg

The breakdown was $48.9 billion from Institutional funds and $4.98 billion from retail funds.

That pushed assets back up near their $5.277 trillion record high and suggests last week’s deposit OUTFLOWS may be about to re-accelerate – not good news for banks?

Source: Bloomberg

On top of the news from First Republic this week, one could argue that Round 2 of the banking crisis (bank superwalk as Jim Bianco has put it) is just beginning.

Bear in mind though that it’s tax-time and their are some odd seasonal impacts to the data.

Though not wanting to piss all over those hopeful fireworks, we note that reverse repo continues to rise…

Source: Bloomberg

However, the most anticipated financial update of the week – the infamous H.4.1. showed the world’s most important balance sheet shrank for the 5th straight week last week, by $30.5 billion, notably more than last week’s tumble (helped by a $16.6bn QT)…

Source: Bloomberg

The Total Securities held outright on The Fed balance sheet fell to $7.84 trillion, the lowest since Sept 2021…

Source: Bloomberg

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings ROSE AGAIN last week from $144 billion to $155.2 billion (still massively higher than the $4.5 billion pre-SVB)…

Source: Bloomberg

…but the composition shifted, as usage of the Discount Window rose by $4 billion to $73.8 billion (upper pane below) along with an $8 billion increase in usage of the Fed’s brand new Bank Term Funding Program, or BTFP, to $81.3 billion (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions – consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank were relatively unchanged at around $170BN (lower pane)…

Source: Bloomberg

Scanning down the H.4.1, we note that Foreign repo down another $20 billion back to $0 finally and Other Fed Assets (loans to FDIC etc) rose $2.3 billion to $170.4 billion…

Of course we get to see the actual deposit outflows (or inflows) tomorrow after the bell, but it appears the hopeful bounce was nothing more than the tax-related seasonal we warned about last week.

Loading…