With three out of five FAAMG stocks - which of course is now known as GAMMA ever since Facebook's ignominious rebranding to Meta (at least until the company quietly changes its name to MetAI) - having already reported solid results helping push the market back into the green for the week, investors are keenly looking to Amazon earnings after the close today to (almost) round out the picture for the resurgent market generals while could set the tone for the rest of 2023... or at least until the Fed meeting next week.

As previewed earlier, Amazon is expected to post sales of $125 billion, up 7.1% from a year earlier. According to Bloomberg, analysts and investors will be watching for insights into consumer spending patterns, both in terms of confidence in the overall economy and with regard to how much they are spending online vs. in stores. Investors will also be watching to see how Amazon’s cloud computing business and advertising business are holding up.

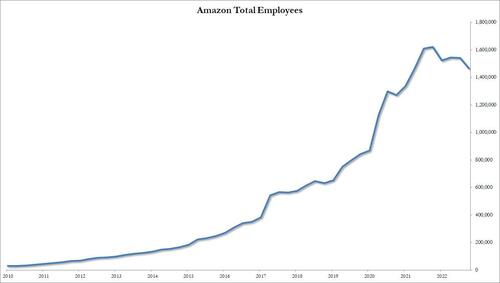

Investors will also want to see signs that CEO Andy Jassy’s cost-cutting measures - which included cutting 27,000 corporate employees - are helping to slash expenses and boost profits. Amazon had 1.5 million employees at the end of 2022, mostly blue-collar workers in its warehouses. In addition to the corporate cuts, Amazon tends to trim its warehouse workforce after the holiday shopping season.

But by far the most important variable will be Amazon Web Services, which is expected to post sales growth of 14%, the slowest since Amazon began breaking out the cloud-computing division’s performance with data going back to 2014. AWS almost always accounts for more operating income than the rest of Amazon’s businesses combined. But the unit has been hit hard as businesses pare their technology spending. Among the biggest questions for Amazon during this year of cost cutting and layoffs is how low AWS’s growth might sink.

What about Artificial Intelligence, which has been the core theme of Microsoft, Google and Meta’s earnings calls so far this week. How will Amazon play it? The company’s shown its hand, to an extent, on how generative AI will boost their business. But the focus is on AWS and targeting cloud customers (rather than Amazon’s consumer-facing arms).

Finally, while Amazon stock has badly underperformed the rest of the GAMMA names, heading into today's earnings the stock gained and was on track to notch its biggest two-day jump since February. So far this year, the shares are up about 31%.

So with all that in mind, here is what Amazon just reported for its just concluded quarter

- Q1 EPS 31c,up from a 38c loss YoY, and beating the estimate of $0.21

- Q1 Net sales $127.358 billion, +9.4% y/y, beating the estimate of $124.7 billion

- Online stores net sales $51.10 billion vs. $51.13 billion y/y, beating estimate $50.57 billion

- Physical Stores net sales $4.90 billion, +6.6% y/y, beating estimate $4.77 billion

- Third- Party Seller Services net sales $29.82 billion, +18% y/y, beating estimate $28.7 billion

- Subscription Services net sales $9.66 billion, +15% y/y, estimate $9.29 billion

- North America net sales $76.88 billion, +11% y/y, beating estimate $75.54 billion

- International net sales $29.12 billion, +1.3% y/y, beating estimate $27.65 billion

- Third-party seller services net sales excluding F/X +20% vs. +9% y/y, beating estimate +13.9%

- Subscription services net sales excluding F/X +17% vs. +13% y/y, beating estimate +11.8%

- And the most important one: AWS net sales $21.35 billion, +16% y/y, beating estimate $21.03 billion

- Amazon Web Services net sales excluding F/X +16% vs. +37% y/y, estimate +13.8%

- Operating income $4.77 billion, +30% y/y, beating the estimate $3 billion

- Operating margin 3.7% vs. 3.2% y/y, beating the estimate 2.38%

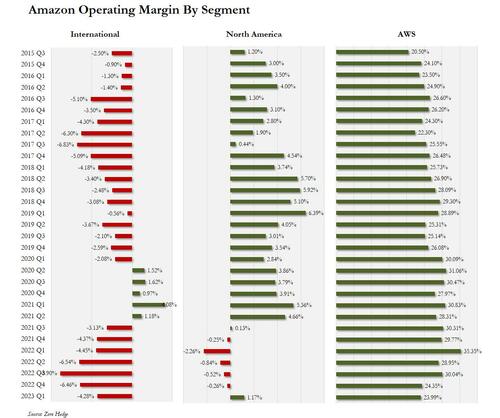

- North America operating margin +1.2% vs. -2.3% y/y, beating the estimate +0.34%

- International operating margin -4.3% vs. -4.5% y/y, beating estimate -8.49%

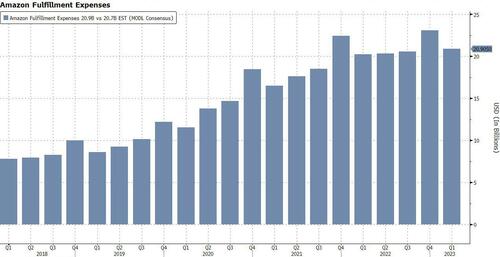

- Fulfillment expense $20.91 billion, +3.1% y/y, beating estimate $20.72 billion

- Seller unit mix 59% vs. 55% y/y, estimate 56.8%

Of note, FX headwinds were a factor in the quarter with AMZN booking $2.4 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter. Excluding that impact, net sales increased 11% in 1Q compared with first quarter of 2022.

It's also notable that a big positive for Amazon was its continued revenue mix shift to providing services and advertising to independent merchants as opposed to selling goods directly to shoppers as a retailer. This is a more profitable business model for Amazon with less risk on inventory. Advertising revenue grew by more than 21% and seller services by 18%. Meanwhile, fulfillment expenses grew by just 3% and shipping costs by just 2%. Amazon is making more money off of its e-commerce and logistics operation while keeping expenses in check.

Bottom line here, Amazon beats expectations for Q1 across the board, and most importantly AWS came in well above expectations on both revenue growth and profit margin basis, which is why AMZN stock is seeing a buying frenzy after hours pushing it more than 10% higher.

There is another reason for the surge: the company's Q2 guidance was stellar:

- Sees net sales $127.0 billion to $133.0 billion, in line with the sellside estimate $130.1 billion; this represents growth between 5% and 10% compared with Q2 2022 and "anticipates an unfavorable impact of approximately 30 basis points from foreign exchange rates.”

- Sees operating income $2 to $5.5 billion, estimate $4.74 billion

The Q2 outlook, with sales of up to $133 billion and operating income of up to $5.5 billion, indicates it expects the positive momentum to continue.

In short, solid earnings beating expectations across the board, while guidance came generally in line with Wall Street expectations.

Commenting on the quarter, CEO Andy Jassy said that "we like the fundamentals we’re seeing in AWS, and believe there’s much growth ahead." He added that "our Advertising business continues to deliver robust growth, largely due to our ongoing machine learning investments that help customers see relevant information when they engage with us, which in turn delivers unusually strong results for brands."

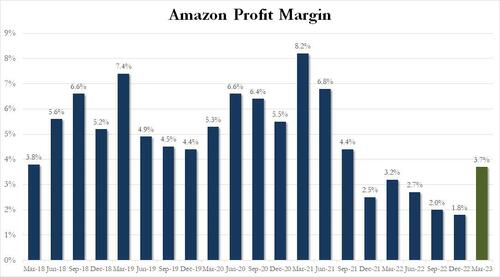

Digging into the numbers we find that operating margins soared, more than doubling form 1.8% last quarter which was the lowest in at least five years, to 3.7%, smashing the consensus est of 2.38%.

While the market was clearly happy with the overall profit margin, it also appeared happy with the profit margin breakdown where the AWS profit margin dipped to the lowest since 2017. At the same time, international operating margin remained negative, with US online sales still just barely turned green, generating a 1.2% profit margin.

Maybe the AWS profit margin could have been better (which would be difficult when competitors are now aggressively cutting prices to capture market share), the silver lining was that revenue growth of 16% Y/Y to $21.354 billion, was better than the expected $21.03 billion.

Jassy had said in his annual shareholder letter a couple of weeks ago that AWS was facing some short-term headwinds. That idea is carried through into the earnings statement, where he says:

“While our AWS business navigates companies spending more cautiously in this macro environment, we continue to prioritize building long-term customer relationships both by helping customers save money and enabling them to more easily leverage technologies like Large Language Models and Generative AI with our uniquely cost-effective machine learning chips (‘Trainium’ and ‘Inferentia’), managed Large Language Models (‘Bedrock’), and AI code companion CodeWhisperer. We like the fundamentals we’re seeing in AWS, and believe there’s much growth ahead.”

And while AWS sales growth came in strong, the sales growth for Advertising Services came in even stronger at 23% YoY, a 35.5% beat relative to consensus.

On the expense side, we already know that AMZN has joined other companies in laying workers off, but a bigger question is whether its employees have plateaued and whether it will start replacing them with robots. Well, in Q1, employment dropped 10% to 1.47 million, well beyond the 27,000 corporate layoffs; furthermore Amazon is shedding blue collar warehouse workers as well, which is typical in the first quarter.

Elsewhere, fulfillment expenses, the cost of packing and shipping goods, were also close to expectations, indicating spending is under control.

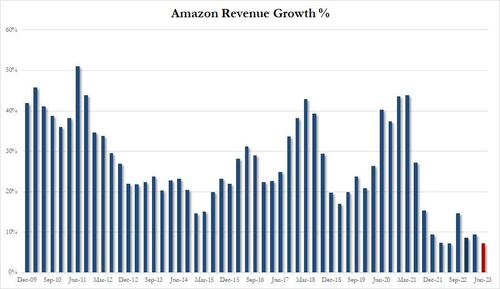

The market was also focused the company's revenue growth forecast which is in a range of $127-$133BN (midline at $130BN), which was on top of the $130.1BN expected. The problem is that at just 7.2%, this would be tied for the lowest annual growth in company history (just Q2 2022 would be comparable).

Finally for those asking, Amazon has clearly also jumped on the AI bandwagon, mentioning the phrase "AI" 8 times in the earnings release, and the full phrase “artificial intelligence” twice.

Responding to the results, Bloomberg Intelligence analyst Poonam Goyal said that “Amazon did much better than expected, especially in the face of inflation and thoughts from other company leaders who have said consumer spending has slowed recently. It’s quite promising that Amazon is still able to deliver. We don’t think it is promotions. We think it is demand, and consumers are flocking to Amazon for day-to-day needs.”

The market agreed, and its reaction was euphoric at least initially, with the stock spiking as much as 12% higher in kneejerk before dipping modestly, but still solidly in the green on the day.

With three out of five FAAMG stocks – which of course is now known as GAMMA ever since Facebook’s ignominious rebranding to Meta (at least until the company quietly changes its name to MetAI) – having already reported solid results helping push the market back into the green for the week, investors are keenly looking to Amazon earnings after the close today to (almost) round out the picture for the resurgent market generals while could set the tone for the rest of 2023… or at least until the Fed meeting next week.

As previewed earlier, Amazon is expected to post sales of $125 billion, up 7.1% from a year earlier. According to Bloomberg, analysts and investors will be watching for insights into consumer spending patterns, both in terms of confidence in the overall economy and with regard to how much they are spending online vs. in stores. Investors will also be watching to see how Amazon’s cloud computing business and advertising business are holding up.

Investors will also want to see signs that CEO Andy Jassy’s cost-cutting measures – which included cutting 27,000 corporate employees – are helping to slash expenses and boost profits. Amazon had 1.5 million employees at the end of 2022, mostly blue-collar workers in its warehouses. In addition to the corporate cuts, Amazon tends to trim its warehouse workforce after the holiday shopping season.

But by far the most important variable will be Amazon Web Services, which is expected to post sales growth of 14%, the slowest since Amazon began breaking out the cloud-computing division’s performance with data going back to 2014. AWS almost always accounts for more operating income than the rest of Amazon’s businesses combined. But the unit has been hit hard as businesses pare their technology spending. Among the biggest questions for Amazon during this year of cost cutting and layoffs is how low AWS’s growth might sink.

What about Artificial Intelligence, which has been the core theme of Microsoft, Google and Meta’s earnings calls so far this week. How will Amazon play it? The company’s shown its hand, to an extent, on how generative AI will boost their business. But the focus is on AWS and targeting cloud customers (rather than Amazon’s consumer-facing arms).

Finally, while Amazon stock has badly underperformed the rest of the GAMMA names, heading into today’s earnings the stock gained and was on track to notch its biggest two-day jump since February. So far this year, the shares are up about 31%.

So with all that in mind, here is what Amazon just reported for its just concluded quarter

- Q1 EPS 31c,up from a 38c loss YoY, and beating the estimate of $0.21

- Q1 Net sales $127.358 billion, +9.4% y/y, beating the estimate of $124.7 billion

- Online stores net sales $51.10 billion vs. $51.13 billion y/y, beating estimate $50.57 billion

- Physical Stores net sales $4.90 billion, +6.6% y/y, beating estimate $4.77 billion

- Third- Party Seller Services net sales $29.82 billion, +18% y/y, beating estimate $28.7 billion

- Subscription Services net sales $9.66 billion, +15% y/y, estimate $9.29 billion

- North America net sales $76.88 billion, +11% y/y, beating estimate $75.54 billion

- International net sales $29.12 billion, +1.3% y/y, beating estimate $27.65 billion

- Third-party seller services net sales excluding F/X +20% vs. +9% y/y, beating estimate +13.9%

- Subscription services net sales excluding F/X +17% vs. +13% y/y, beating estimate +11.8%

- And the most important one: AWS net sales $21.35 billion, +16% y/y, beating estimate $21.03 billion

- Amazon Web Services net sales excluding F/X +16% vs. +37% y/y, estimate +13.8%

- Operating income $4.77 billion, +30% y/y, beating the estimate $3 billion

- Operating margin 3.7% vs. 3.2% y/y, beating the estimate 2.38%

- North America operating margin +1.2% vs. -2.3% y/y, beating the estimate +0.34%

- International operating margin -4.3% vs. -4.5% y/y, beating estimate -8.49%

- Fulfillment expense $20.91 billion, +3.1% y/y, beating estimate $20.72 billion

- Seller unit mix 59% vs. 55% y/y, estimate 56.8%

Of note, FX headwinds were a factor in the quarter with AMZN booking $2.4 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter. Excluding that impact, net sales increased 11% in 1Q compared with first quarter of 2022.

It’s also notable that a big positive for Amazon was its continued revenue mix shift to providing services and advertising to independent merchants as opposed to selling goods directly to shoppers as a retailer. This is a more profitable business model for Amazon with less risk on inventory. Advertising revenue grew by more than 21% and seller services by 18%. Meanwhile, fulfillment expenses grew by just 3% and shipping costs by just 2%. Amazon is making more money off of its e-commerce and logistics operation while keeping expenses in check.

Bottom line here, Amazon beats expectations for Q1 across the board, and most importantly AWS came in well above expectations on both revenue growth and profit margin basis, which is why AMZN stock is seeing a buying frenzy after hours pushing it more than 10% higher.

There is another reason for the surge: the company’s Q2 guidance was stellar:

- Sees net sales $127.0 billion to $133.0 billion, in line with the sellside estimate $130.1 billion; this represents growth between 5% and 10% compared with Q2 2022 and “anticipates an unfavorable impact of approximately 30 basis points from foreign exchange rates.”

- Sees operating income $2 to $5.5 billion, estimate $4.74 billion

The Q2 outlook, with sales of up to $133 billion and operating income of up to $5.5 billion, indicates it expects the positive momentum to continue.

In short, solid earnings beating expectations across the board, while guidance came generally in line with Wall Street expectations.

Commenting on the quarter, CEO Andy Jassy said that “we like the fundamentals we’re seeing in AWS, and believe there’s much growth ahead.” He added that “our Advertising business continues to deliver robust growth, largely due to our ongoing machine learning investments that help customers see relevant information when they engage with us, which in turn delivers unusually strong results for brands.”

Digging into the numbers we find that operating margins soared, more than doubling form 1.8% last quarter which was the lowest in at least five years, to 3.7%, smashing the consensus est of 2.38%.

While the market was clearly happy with the overall profit margin, it also appeared happy with the profit margin breakdown where the AWS profit margin dipped to the lowest since 2017. At the same time, international operating margin remained negative, with US online sales still just barely turned green, generating a 1.2% profit margin.

Maybe the AWS profit margin could have been better (which would be difficult when competitors are now aggressively cutting prices to capture market share), the silver lining was that revenue growth of 16% Y/Y to $21.354 billion, was better than the expected $21.03 billion.

Jassy had said in his annual shareholder letter a couple of weeks ago that AWS was facing some short-term headwinds. That idea is carried through into the earnings statement, where he says:

“While our AWS business navigates companies spending more cautiously in this macro environment, we continue to prioritize building long-term customer relationships both by helping customers save money and enabling them to more easily leverage technologies like Large Language Models and Generative AI with our uniquely cost-effective machine learning chips (‘Trainium’ and ‘Inferentia’), managed Large Language Models (‘Bedrock’), and AI code companion CodeWhisperer. We like the fundamentals we’re seeing in AWS, and believe there’s much growth ahead.”

And while AWS sales growth came in strong, the sales growth for Advertising Services came in even stronger at 23% YoY, a 35.5% beat relative to consensus.

On the expense side, we already know that AMZN has joined other companies in laying workers off, but a bigger question is whether its employees have plateaued and whether it will start replacing them with robots. Well, in Q1, employment dropped 10% to 1.47 million, well beyond the 27,000 corporate layoffs; furthermore Amazon is shedding blue collar warehouse workers as well, which is typical in the first quarter.

Elsewhere, fulfillment expenses, the cost of packing and shipping goods, were also close to expectations, indicating spending is under control.

The market was also focused the company’s revenue growth forecast which is in a range of $127-$133BN (midline at $130BN), which was on top of the $130.1BN expected. The problem is that at just 7.2%, this would be tied for the lowest annual growth in company history (just Q2 2022 would be comparable).

Finally for those asking, Amazon has clearly also jumped on the AI bandwagon, mentioning the phrase “AI” 6 times in the earnings release, and the full phrase “artificial intelligence” twice.

Responding to the results, Bloomberg Intelligence analyst Poonam Goyal said that “Amazon did much better than expected, especially in the face of inflation and thoughts from other company leaders who have said consumer spending has slowed recently. It’s quite promising that Amazon is still able to deliver. We don’t think it is promotions. We think it is demand, and consumers are flocking to Amazon for day-to-day needs.”

The market agreed, and its reaction was euphoric at least initially, with the stock spiking as much as 12% higher in kneejerk before dipping modestly, but still solidly in the green on the day.

Loading…